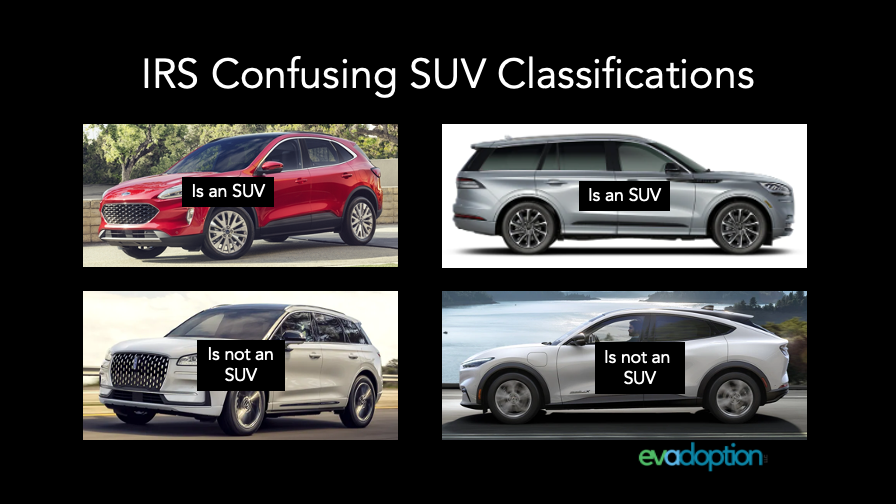

The Clean Vehicle Credit Is A Confusing Mess

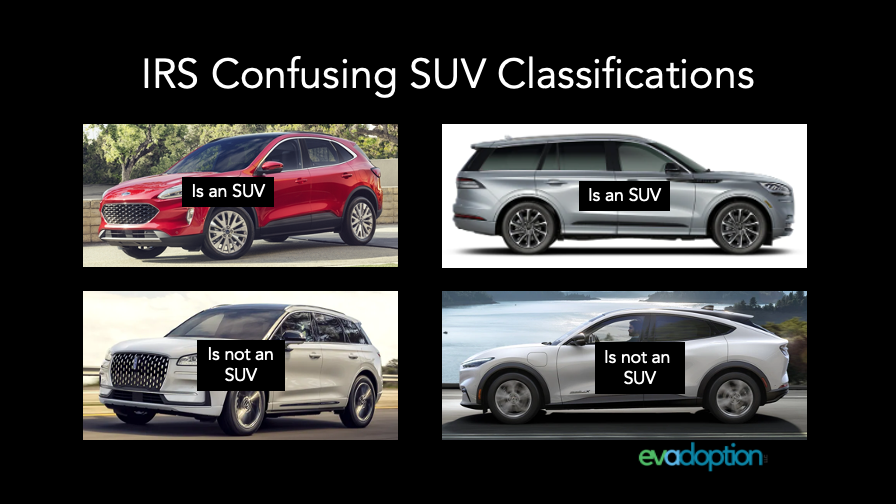

Hailed as a huge win for auto manufacturers, car dealers, and consumers, the Clean Vehicle Credit (CVC) which is part of Inflation Reduction Act (IRA),

Hailed as a huge win for auto manufacturers, car dealers, and consumers, the Clean Vehicle Credit (CVC) which is part of Inflation Reduction Act (IRA),

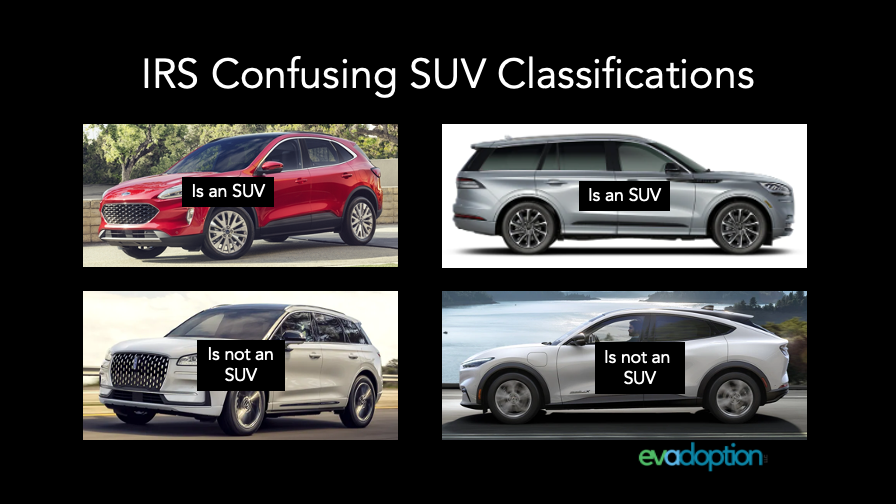

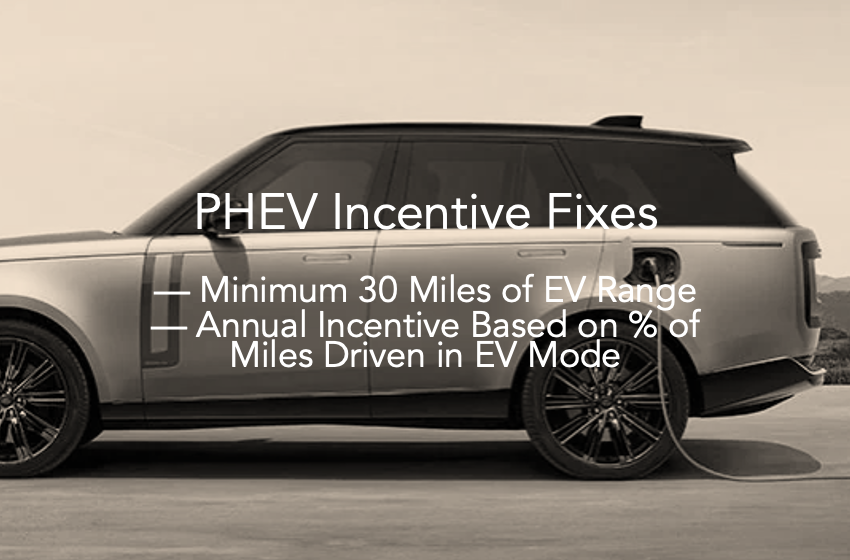

PHEVs are either loved and seen as part of the solution in the transition to vehicles with zero tailpipe emissions, or derided by BEV purists. But PHEVs are a great solution for many, the problem with them in the US is hour are EV incentives are structured. This article outlines some potential fixes.

As we wait for Congress to fully return from their recess and vote on various legislation, I continue to be extremely concerned about how as

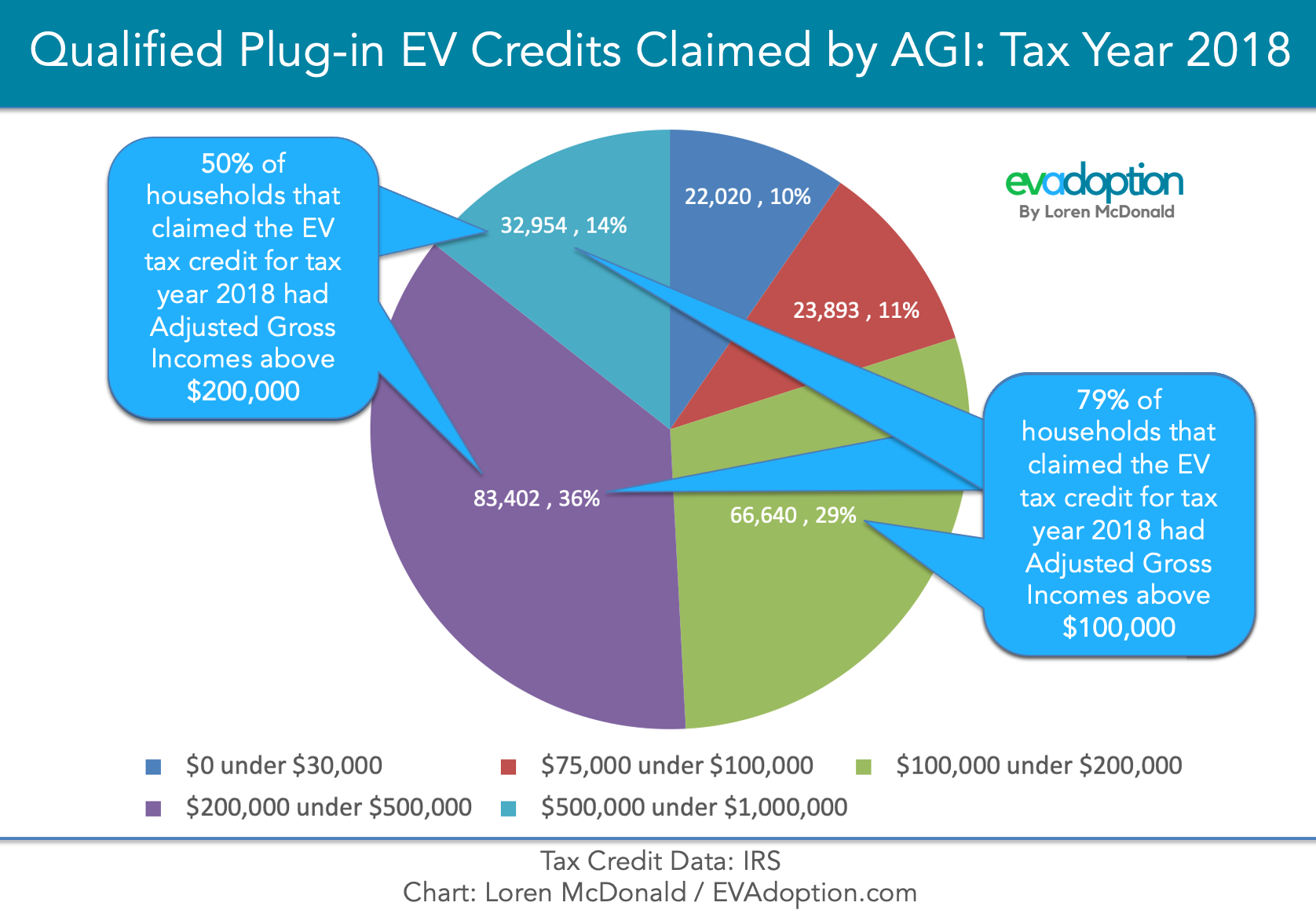

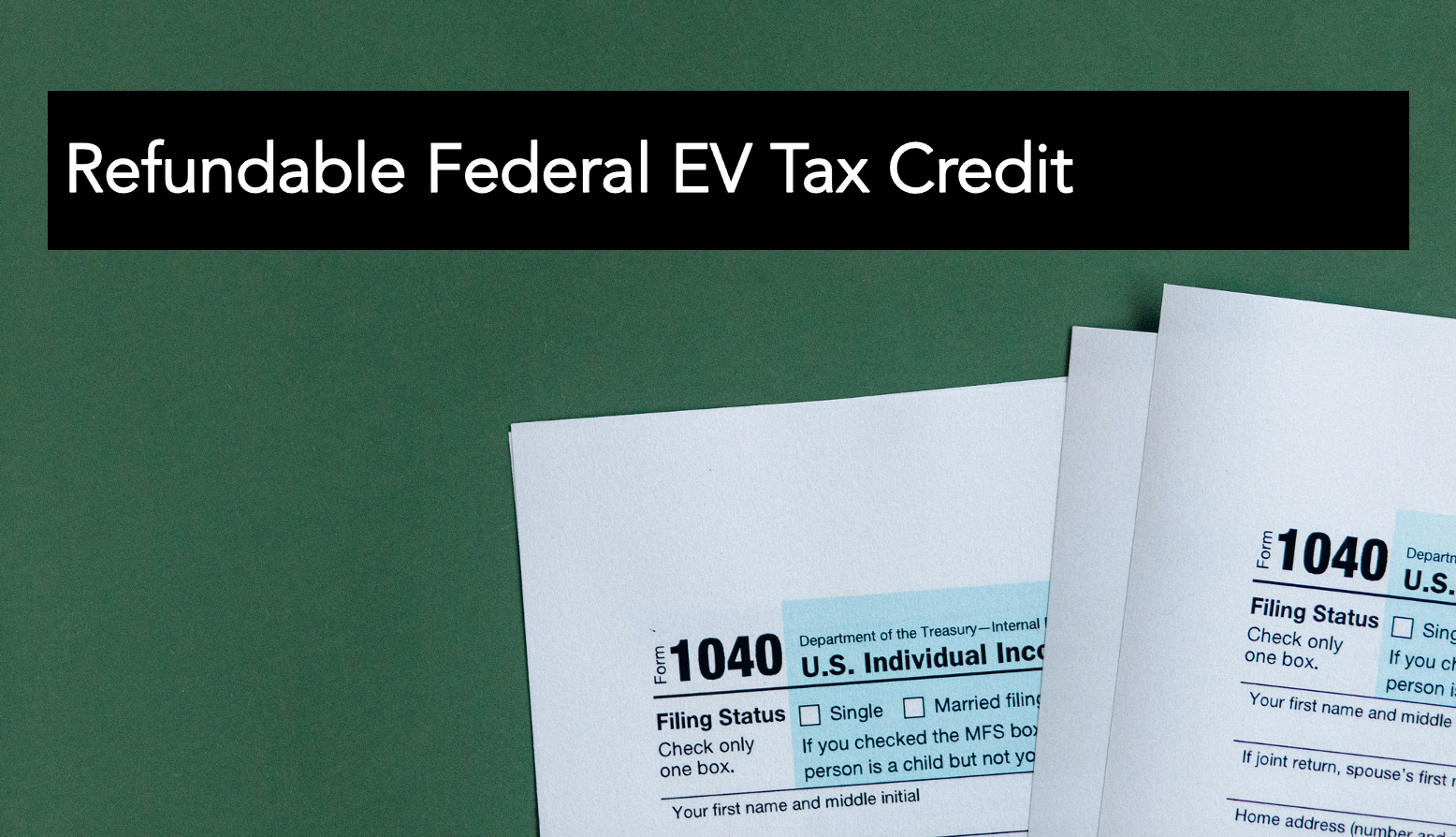

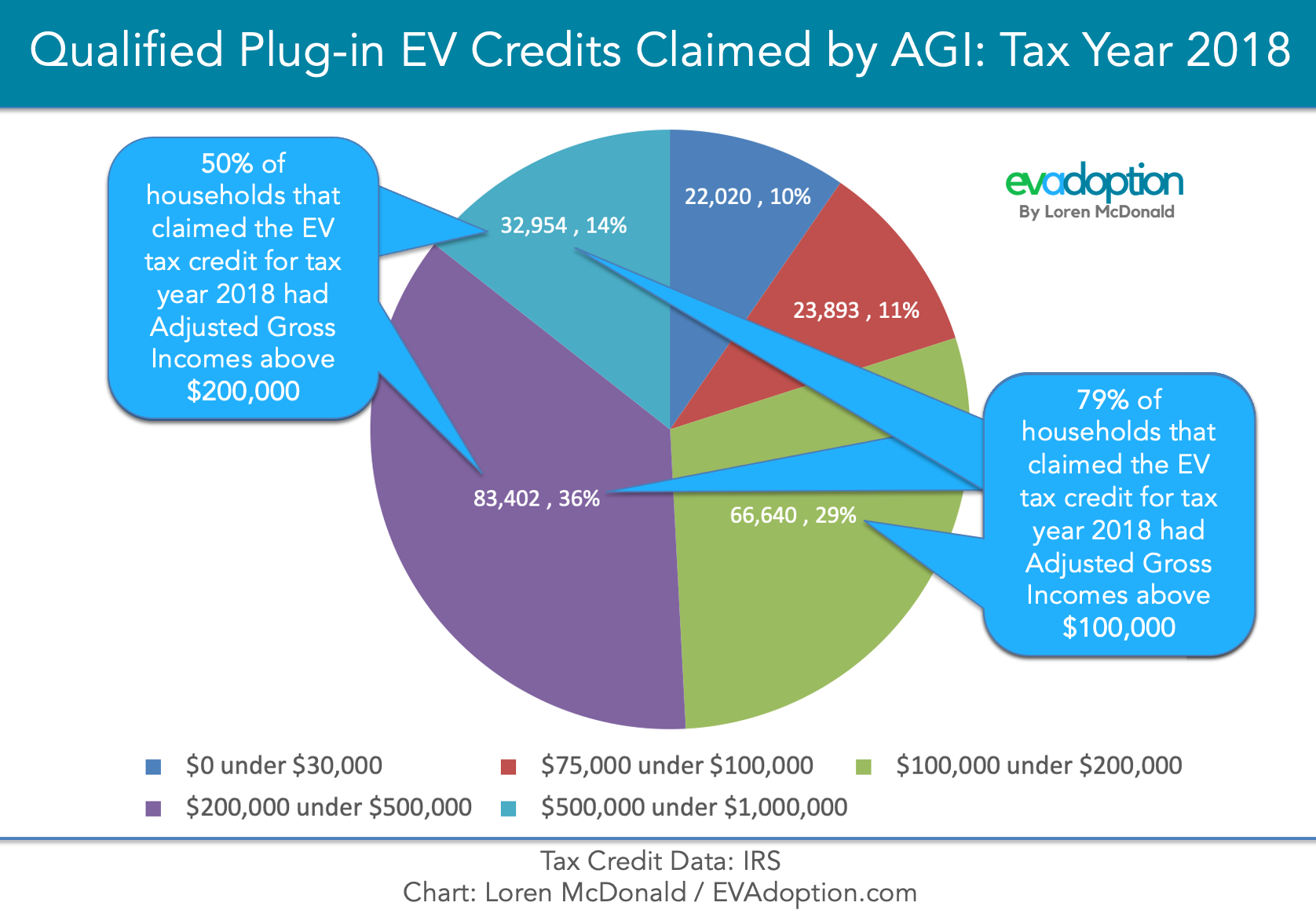

One of the biggest complaints about the federal electric vehicle (EV) tax credit (IRC 30D) is that its structure of using a non-refundable tax credit is clearly more beneficial to higher-income households. But Congress may actually get something right (well mostly) as among the nine key proposed changes to the tax credit contained in the Clean Energy for America Act (CEAA) is changing the current non-refundable credit into one that is refundable.

A provision in the Clean Energy for America Act requires that a new qualified electric vehicle purchased by the taxpayer has a manufacturer’s suggested retail price (MSRP) of $80,000 or less. What would this change mean for automakers and EV buyers?

With an estimated $10 billion in US government grants earmarked for the deployment of electric vehicle (EV) charging stations, who many chargers would this actually buy America?

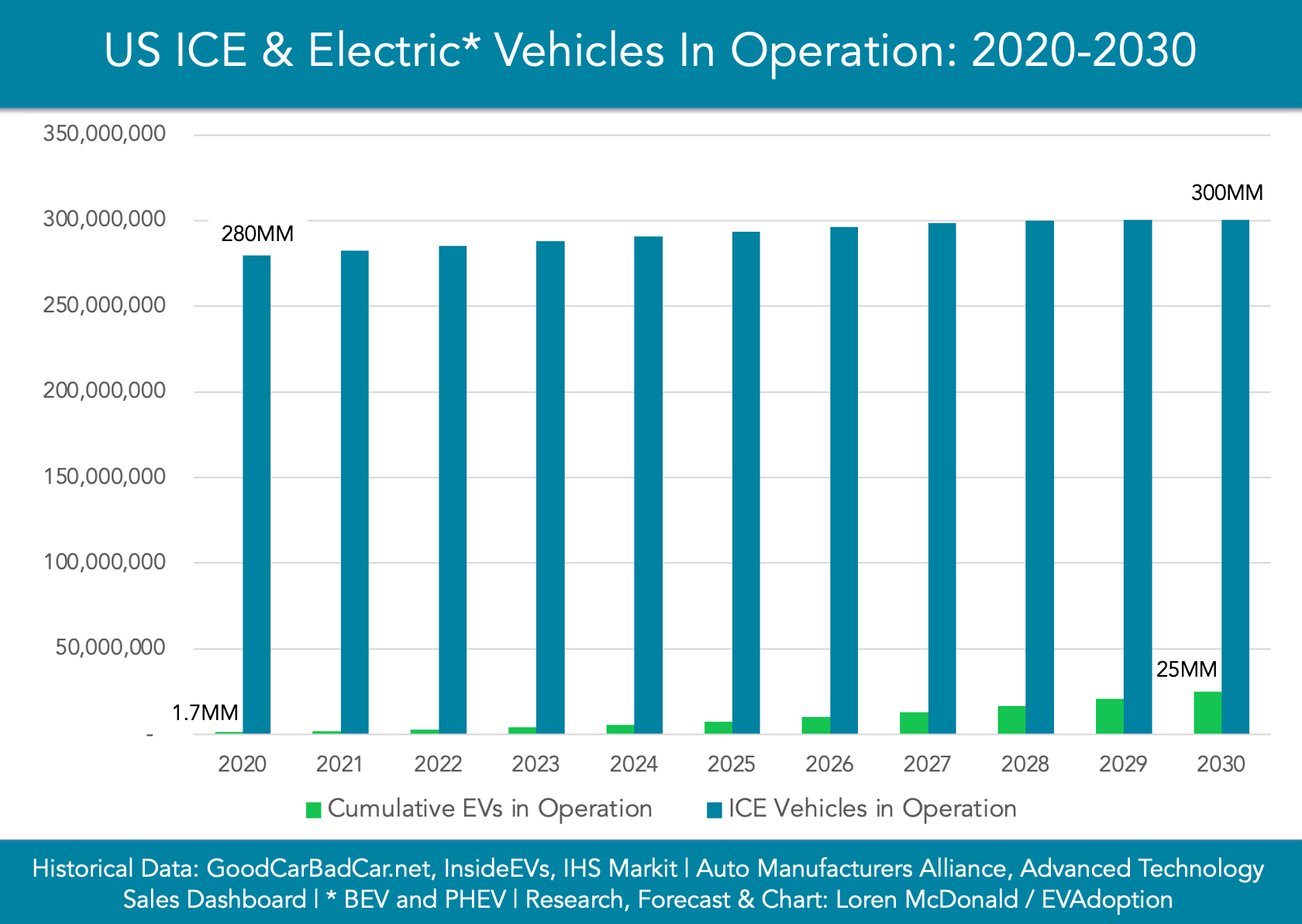

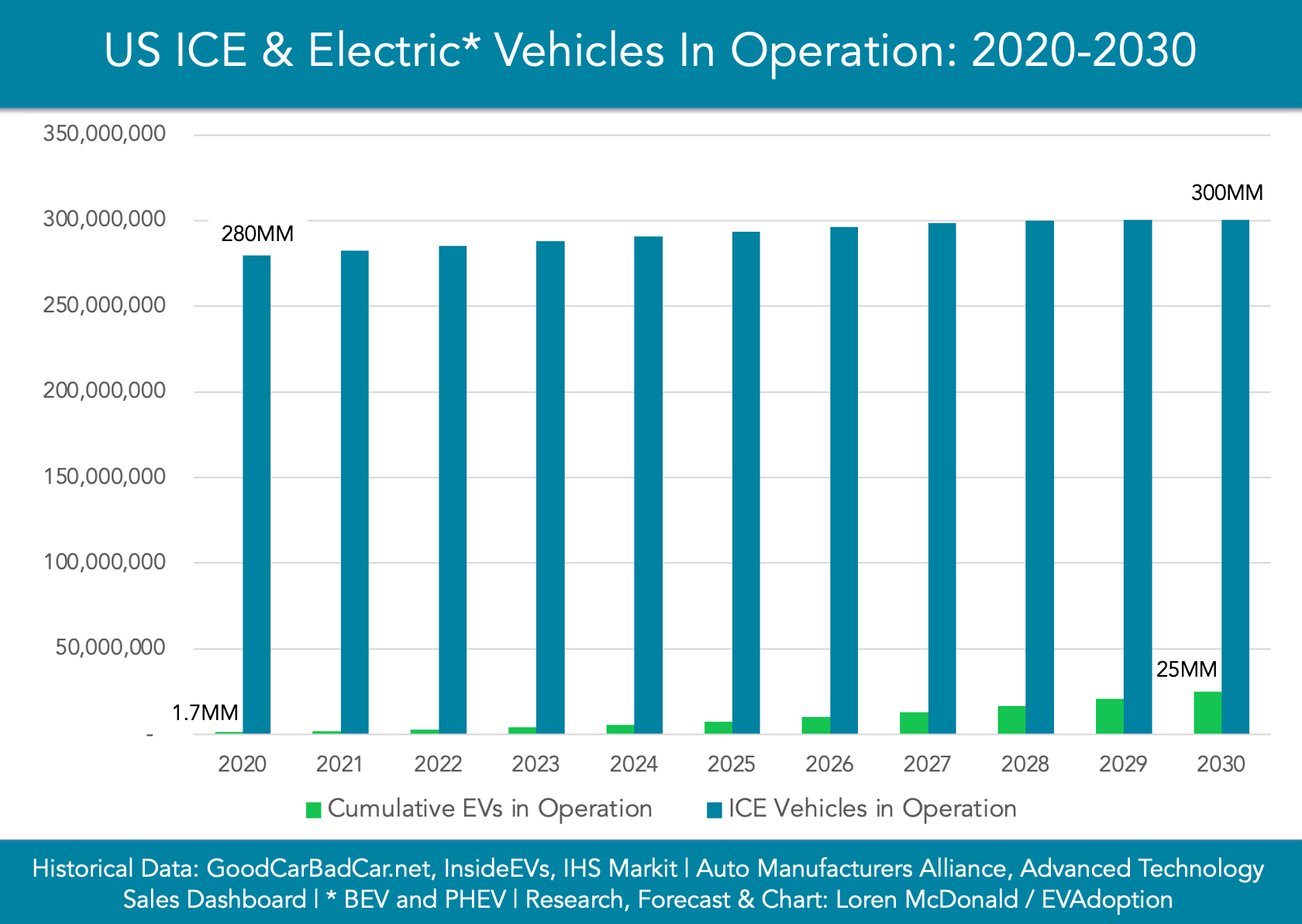

US sales of electric vehicles are expected to increase significantly this decade, however, by the end of 2030 EVs will still comprise only a tiny

The federal EV tax credit has a number of flaws, but one of the biggest is the poorly-designed formula that determines the amount of the tax credit available for each BEV and PHEV sold in the US. The formula, which is based on the size of an EV’s battery pack, rewards OEMs (and their buying consumers) for using larger batteries with no consideration to efficiency (EPA range/kWh) and price.

Proposed reform to the Federal EV tax credit extends to automakers who already reached the current phaseout level of 200,000 EVs sold with another 400,000 vehicles, but with a reduction to $7,000 from the current maximum $7,500 credit.

Here are the electric vehicle-related programs that we can expect the Biden administration to pursue.

Hailed as a huge win for auto manufacturers, car dealers, and consumers, the Clean Vehicle Credit (CVC) which is part of Inflation Reduction Act (IRA),

PHEVs are either loved and seen as part of the solution in the transition to vehicles with zero tailpipe emissions, or derided by BEV purists. But PHEVs are a great solution for many, the problem with them in the US is hour are EV incentives are structured. This article outlines some potential fixes.

As we wait for Congress to fully return from their recess and vote on various legislation, I continue to be extremely concerned about how as

One of the biggest complaints about the federal electric vehicle (EV) tax credit (IRC 30D) is that its structure of using a non-refundable tax credit is clearly more beneficial to higher-income households. But Congress may actually get something right (well mostly) as among the nine key proposed changes to the tax credit contained in the Clean Energy for America Act (CEAA) is changing the current non-refundable credit into one that is refundable.

A provision in the Clean Energy for America Act requires that a new qualified electric vehicle purchased by the taxpayer has a manufacturer’s suggested retail price (MSRP) of $80,000 or less. What would this change mean for automakers and EV buyers?

With an estimated $10 billion in US government grants earmarked for the deployment of electric vehicle (EV) charging stations, who many chargers would this actually buy America?

US sales of electric vehicles are expected to increase significantly this decade, however, by the end of 2030 EVs will still comprise only a tiny

The federal EV tax credit has a number of flaws, but one of the biggest is the poorly-designed formula that determines the amount of the tax credit available for each BEV and PHEV sold in the US. The formula, which is based on the size of an EV’s battery pack, rewards OEMs (and their buying consumers) for using larger batteries with no consideration to efficiency (EPA range/kWh) and price.

Proposed reform to the Federal EV tax credit extends to automakers who already reached the current phaseout level of 200,000 EVs sold with another 400,000 vehicles, but with a reduction to $7,000 from the current maximum $7,500 credit.

Here are the electric vehicle-related programs that we can expect the Biden administration to pursue.

© 2024 EVAdoption, LLC | All Rights Reserved.