One of the numbers that has been tossed around for months by the Biden administration is its plan to deploy “500,000 EV charging stations.” And now that the Senate’s version of the Biden Infrastructure Bill is close to passing, a potential estimated $10 billion could fund grants for building out EV charging infrastructure in the US.

But how many charging “stations” (e.g., chargers, ports, individual charging connections) will whatever the final number is in front of the word “billion” actually fund?

First, why did I say $10 billion? The Senate bill allocates $7.5 billion toward not just EV charging infrastructure, but also “hydrogen fueling infrastructure, propane fueling infrastructure, and natural gas fueling infrastructure.”

“… a grant program to strategically deploy publicly accessible electric vehicle charging infrastructure, hydrogen fueling infrastructure, propane fueling infrastructure, and natural gas fueling infrastructure along designated alternative fuel corridors or in certain other locations that will be accessible to all drivers of electric vehicles, hydrogen vehicles, propane vehicles, and natural gas vehicles.”

I have yet to hear how these costs might be allocated toward the different types of fueling infrastructure, but my best guess is that perhaps $5 billion of the $7.5 billion may go to EV charging infrastructure. Secondly, according to analysis from Jeff Davis at the Eno Center for Transportation, there is an additional $5 billion earmarked for EV charging infrastructure in the USDOT Appropriations grants that would be disbursed through state and local governments.

So with that out of the way, let’s get back to the question of “How many electric vehicle charging stations will $10 billion buy for America?”

The short answer is: “It depends,” because the cost to deploy EV charging stations has multiple variables. These include:

- The mix of type of EV charging equipment – Level 1, Level 2, and DC fast charging.

- The mix of equipment types – networked versus “dumb”/non-networked; and charging power such as 100 kW versus 250 kW DC fast charging hardware.

- Where in the US they are deployed. For example, labor costs in states like California or Hawaii, may be much higher than in Alabama or Oklahoma. Secondly, many states or localities may have more onerous regulations and permitting processes than other localities adding time and cost.

- Union versus non-union electricians and contractors.

- Number of chargers deployed per location (more chargers lowers the per charger cost). Because non-hardware costs can reach as high as 80% of a project, the more chargers installed per site, the lower the cost is per charger.

What Does It Cost to Deploy DC Fast Chargers?

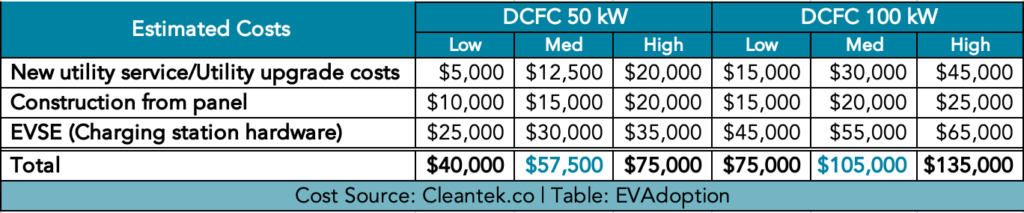

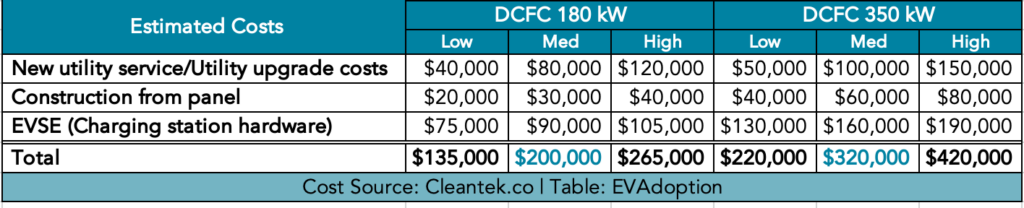

I reached out to Carl Pancutt, CEO of high-power EV charging deployment company Cleantek, for help in fleshing out costs to deploy DC fast chargers.

As you can see from the cost examples below, the actual hardware costs are often a bit more than 50% of total project costs. The other costs include:

- Bringing additional power/utility service and upgrade costs to the site. Especially with DC fast chargers, a host site likely will not have enough power available and the local utility will have to bring more power to the site.

- Construction includes the underground preparation, electrical infrastructure, and concrete pads needed to support multiple DC fast chargers. This also includes the permitting and approvals process.

Add up all of those costs and you are looking at a cost of from $40,000 for a 50 kW DC fast charger to more than $400,000 for a 350 kW DC fast charger. These are the costs per charger. The more DC fast chargers installed per site, the lower the per charger cost due to the high cost of additional power and construction.

Don’t believe these costs are accurate? In a recent Wall Street Journal article, Cathy Zoi, CEO of the charging network EVgo, was quoted that it cost the company an estimated $110,000 to deploy a DC fast charger. And hence, costs to deploy a charging location with four charging units costs approaches half a million, or one with 8 chargers, nearly one million dollars.

“Construction and the charging units for each parking stall cost about $110,000. When we’re talking about building a station, we’re talking about a half a million to a million dollars in capital.” – Cathy Zoi, CEO – EVgo

Following are a few more recent examples I pulled from Twitter conversations.

In the North Carolina example above the cost was $100,000 for a single 50 kW charger and in the Baltimore example, $137,500 for deploying two 50 kW chargers. The $61,612 for two 50 kW DC fast chargers is consistent with the mid-priced cost provided by Carl Pancutt of Cleantek.

Level 1 and Level 2 Charger Deployment Costs

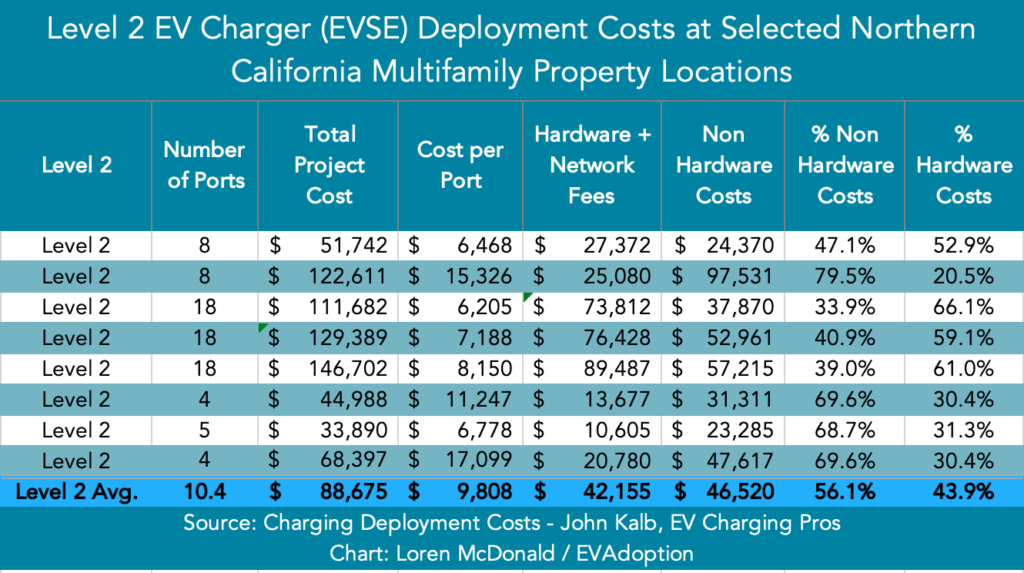

For average cost to deploy Level 1 and Level 2 charging stations I reached out to John Kalb of EV Charging Pros, one of the foremost experts on deploying EV charging at multifamily properties. John has been involved in the deployment of 100s of Level 1 and Level 2 EV charging projects and has a wealth of project data.

Just like installing DC fast chargers, the costs to deploy Level 1 and Level 2 charging stations can include the installation of additional electrical panels, pulling conduit, for Level 2 often additional power from the utility, permitting and the charging hardware.

Below is a sampling of 8 Level 2 deployments at Northern California multifamily properties. Cost per port ranged from a low of $6,205 to a high of $17,099 and averaged $9,808. The percentage of project costs attributed to non-hardware aspects ranged widely, but averaged 56.1% of total project costs.

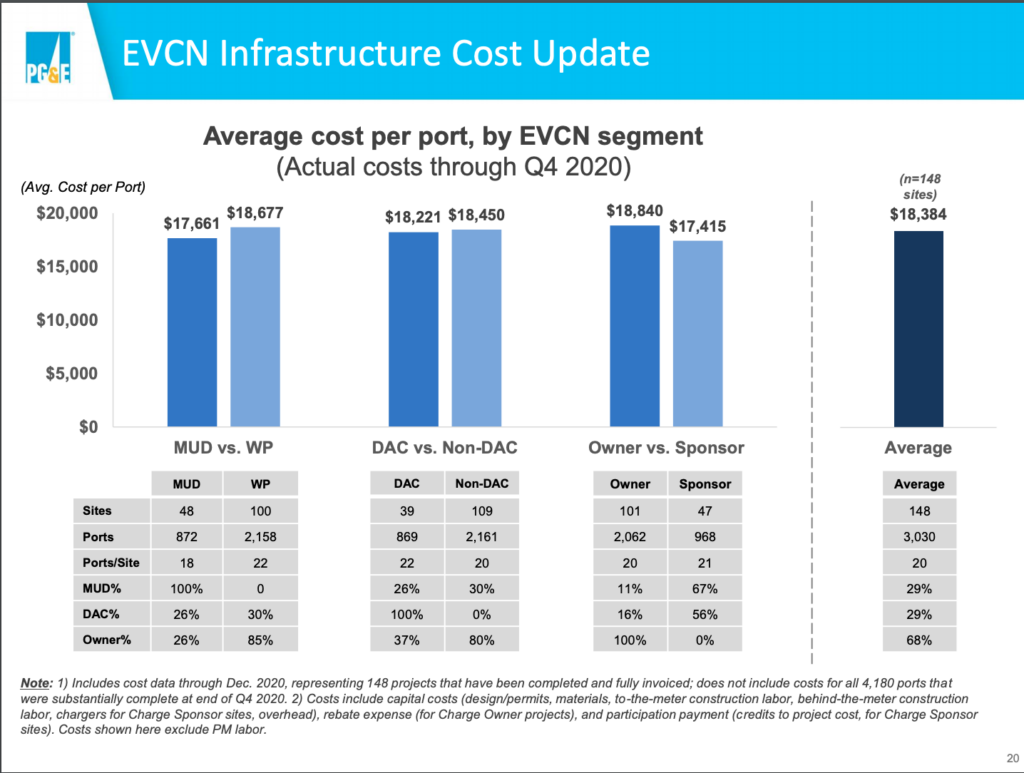

Interestingly, PG&E, the Northern California-based utility, has published cost data showing an average of $17,661 for MUD (multifamily unit development) Level 2 deployment per port and $18,384 across MUD and workplace deployments.

One challenge with apartment properties is that in some markets the majority of the properties may have been built between 1950 and the 1980s and the power supply and electrical panels cannot support charging multiple EVs with Level 2 chargers. And the projects themselves then trigger requirements to bring electrical infrastructure on these properties up to current code, adding yet additional costs to the project.

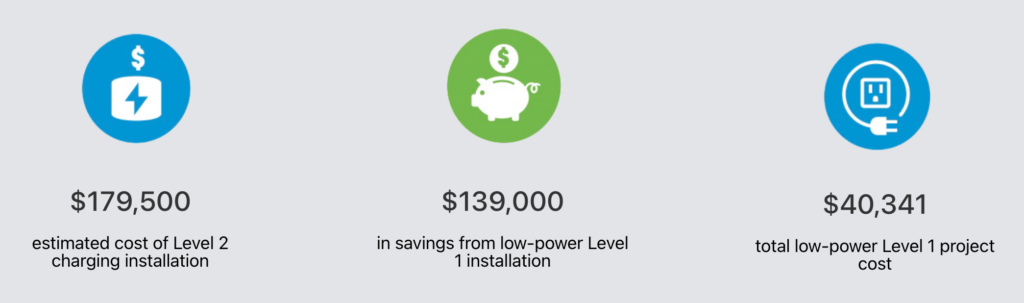

Cost is a key reason that some consultants and utilities are recommending that multifamily property owners deploy Level 1 “smart outlets” instead of Level 2. Peninsula Clean Energy recently published a case study comparing the costs to deploy a Level 1 smart outlet solution versus networked Level 2 and found (see image) that a Level 2 deployment cost 4.5 times that of using Level 1 smart outlets.

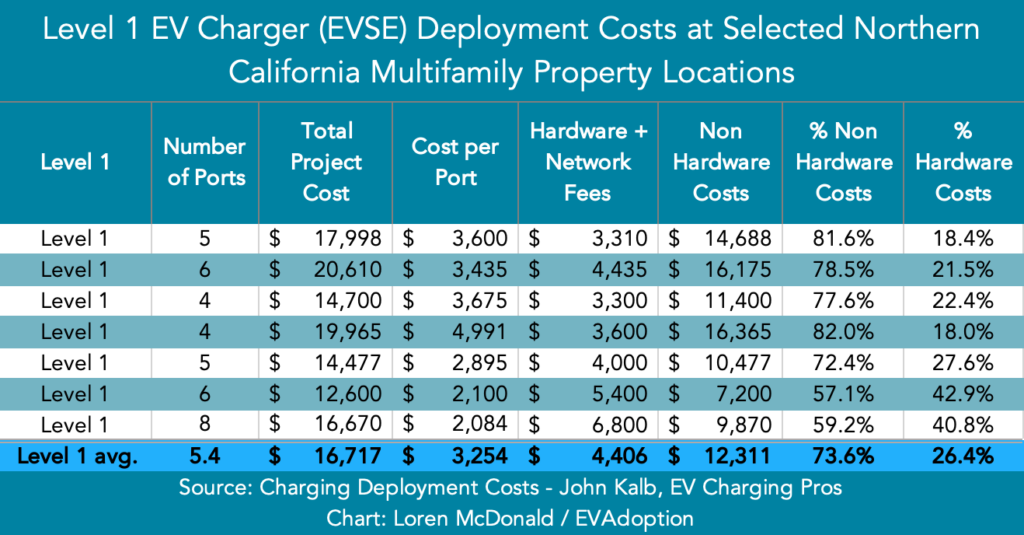

Below is a sampling of 7 Level 1 smart outlet deployments at Northern California multifamily properties. Cost per port ranged from a low of $2,084 to a high of $4,991 and averaged $3,254. In these samplings, the average cost per port for Level 1 is exactly one-third the cost per Level 2 port. The percentage of project costs attributed to non-hardware aspects ranged widely, but averaged 73.6% of total project costs.

Breaking it Down By Mix Of Charging Stations

Now that we’ve mapped out the range of average deployment costs for each level of EV charging hardware, let’s look at how many chargers $10 billion will buy across each level and by various mixes.

In the chart below I’ve modeled the number of 50 kW, 100 kW, 180 kW, and 350 kW DC fast chargers that can be deployed with from $1 billion to $10 billion. As you can see the number ranges from a high of nearly 175,000 for 50 kW chargers with $10 billion, to a low of 3,125 for 350 kW chargers with $1 billion.

If you used a cost of $105,000 to deploy 100 kW chargers, $10 billion could cover the cost of roughly 95,000 DC fast chargers.

That is nowhere near the 500,000 number frequently touted by the Biden administration. And if instead of 100 kW chargers, you went with 200 kW at $200,000 the $10 billion would only cover 50,000 chargers. And 350 kW high-power chargers at an average cost of $320,000 would result in 31,250 installed chargers.

Now, one important investment factor to note. With the Biden Infrastructure Bill, the US government’s grants are capped at $15 million per grant and 80% of the project cost. So the above investment dollars include the 20% or more that would be contributed by the grant recipient. So if you are looking at just how much the government dollars would cover, the number of chargers deployed would be slightly higher. However, it is also likely that these grants will themselves inflate charger deployment costs which would raise the project cost, keeping this numbers still relatively accurate.

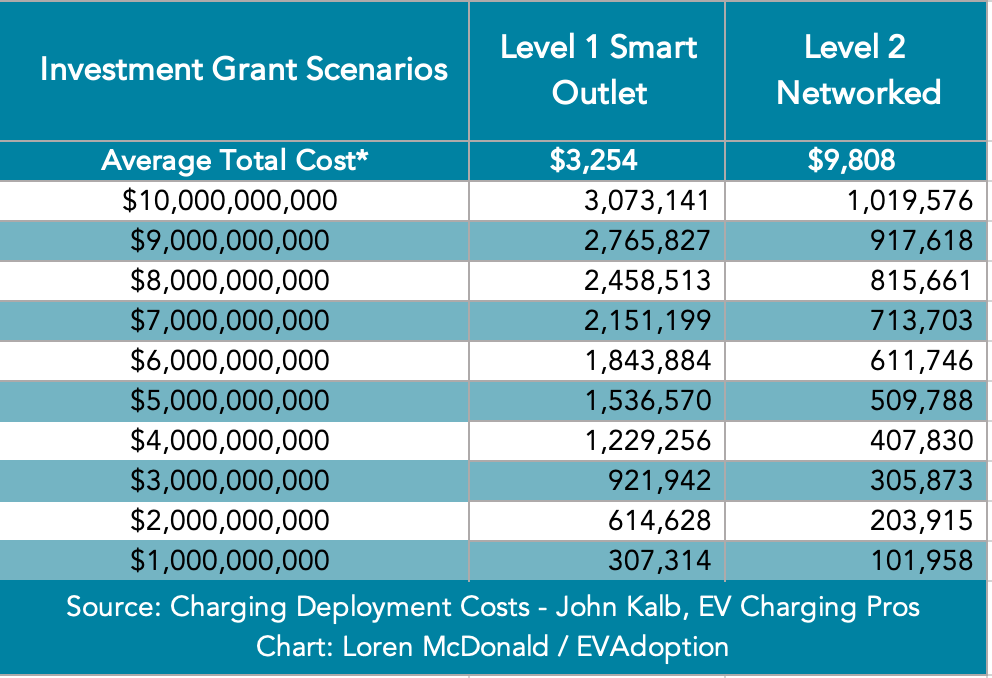

Now let’s look at Level 1 and Level 2 costs using the same model and approach as above for DC fast chargers. Using the average costs from above, $10 billion will fund more than 3 million Level 1 smart outlets or a bit more than 1 million Level 2 charging stations.

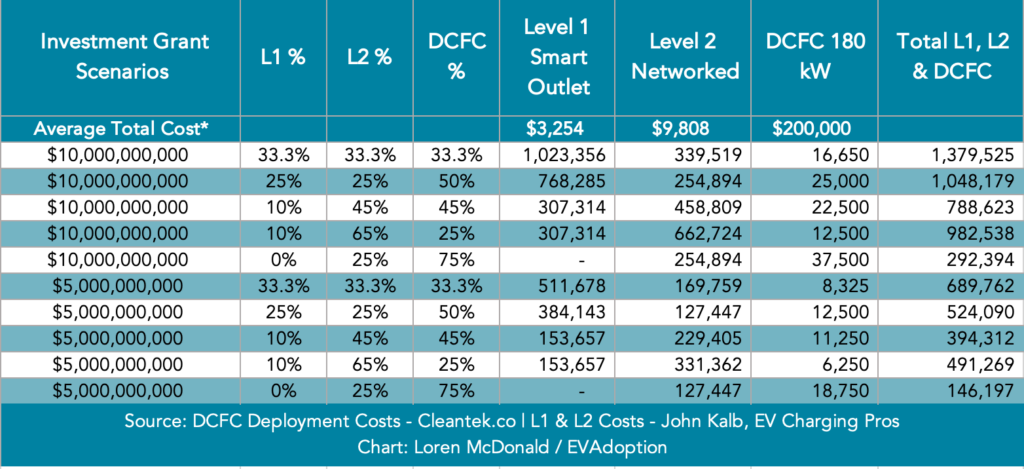

Pulling all three charging types together, let’s see what a couple of sample scenarios and combinations might look like when spending either $10 billion or $5 billion? Depending on the mix of chargers by level/power it could be as few as about 150,000 to nearly 1.4 million and everything in between.

The point of this article is not to suggest what the mix should be — I’ll save that for a future article — but rather to do the math and show what is actually possible.

But one thing that is abundantly clear, if the Biden administration wants to add 500,000 additional charging stations — the majority of them will need to be Level 2 and assuming they fund them (which is unlikely), also Level 1 chargers.

One Response