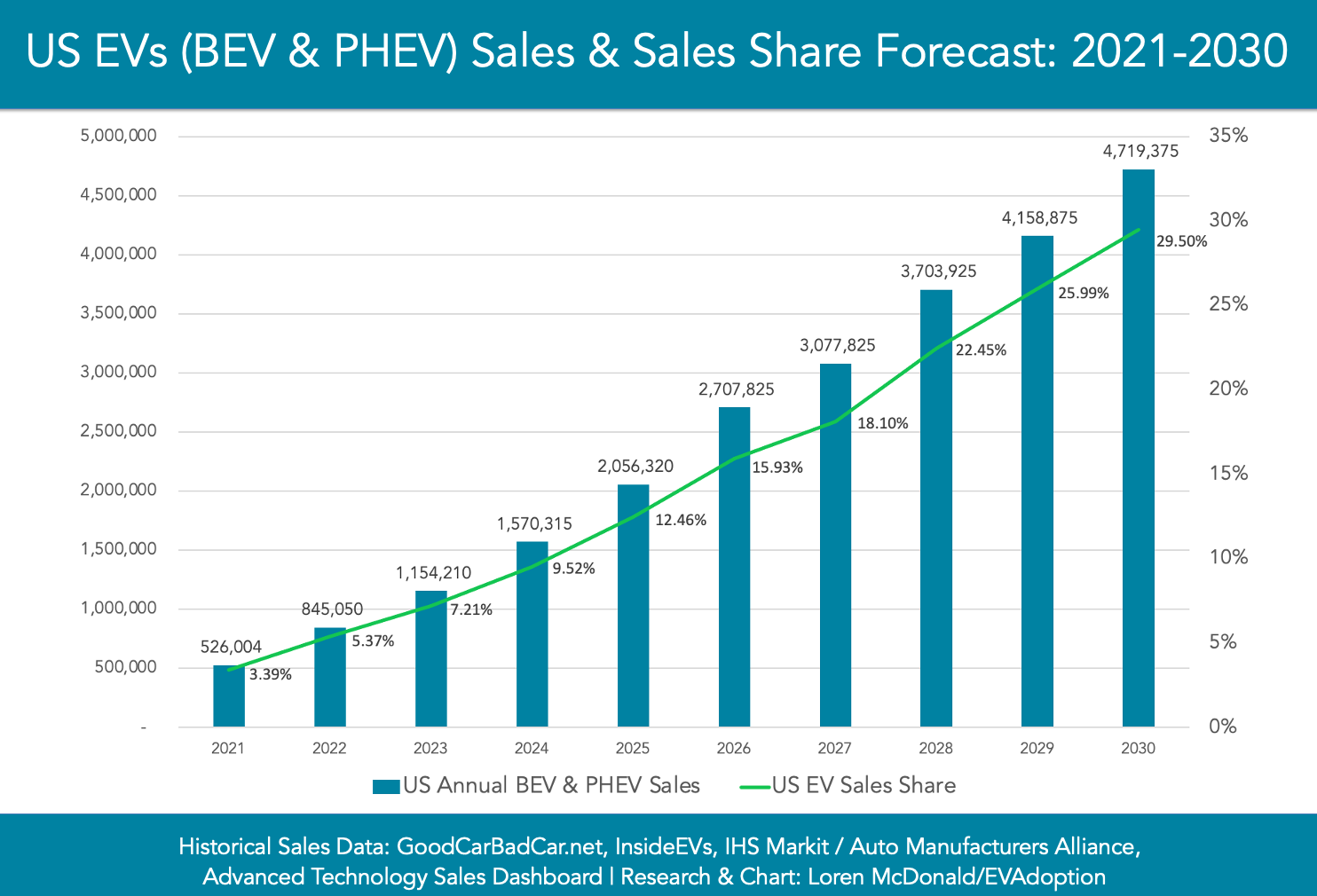

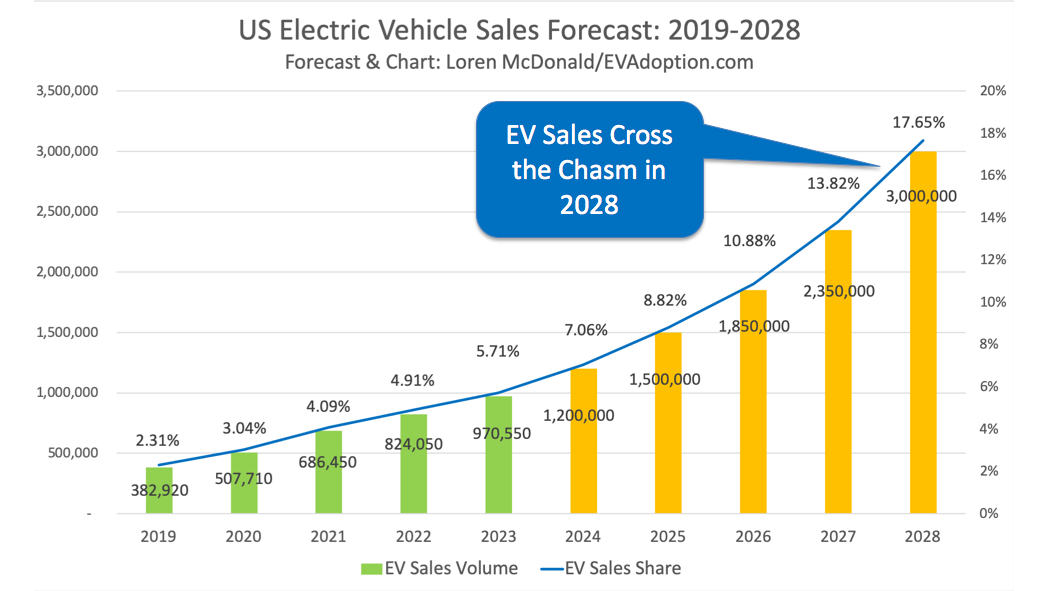

Below is our latest long-term forecast for new electric vehicle (BEV and PHEV) sales in the US through 2030. EV sales should grow to reach approximately 29.5% of all new car sales in 2030 from an expect roughly 3.4% in 2021.

This would also see sales increase to 4.7 million from a little more than 500,000 in 2021.