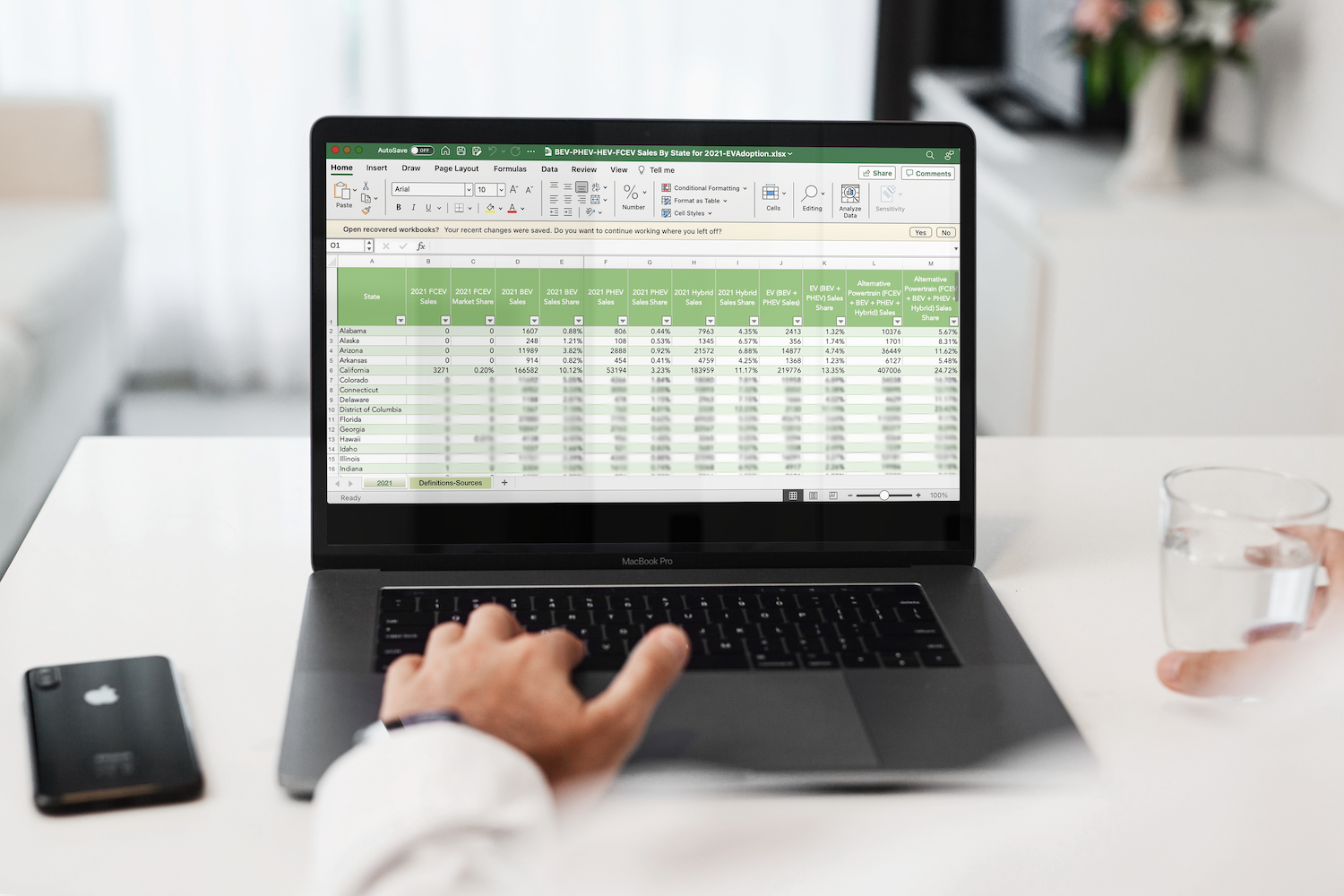

EV Sales & Market Share By US Red vs. Blue State & Multiple Factors

| State: Red or Blue (1) | EV Sales Share (2) | ZEV / ZEV Mandate State (3) | EV Rebate/Tax Credit (4) | Gas Price / Gallon (5) | % Light Trucks Purchased (6) | Household Median Income (7) | "Green Score" (8) |

|---|---|---|---|---|---|---|---|

| Alabama | 0.41% | N/A | NO | $3.47 | 63.40% | 51,113 | 39.99 |

| Alaska | 0.59% | N/A | NO | $2.46 | 78.80% | 72,231 | 49.41 |

| Arizona | 1.84% | N/A | NO | $2.52 | 63.00% | 61,125 | 54.33 |

| Arkansas | 0.35% | N/A | NO | $3.15 | 70.80% | 48,829 | 40.09 |

| California | 7.84% | ZEV + Mandate | YES | $4.05 | 50.70% | 69,759 | 69.4 |

| Colorado | 2.61% | N/A | YES | $2.85 | 72.90% | 74,172 | 59.57 |

| Connecticut | 2.02% | ZEV + Mandate | YES | $2.99 | 64.30% | 72,780 | 73.89 |

| Delaware | 1.27% | ZEV | YES | $2.94 | 62.90% | 62,318 | 63.19 |

| District of Columbia | 3.34% | ZEV | NO | $2.65 | 49.50% | 83,382 | N/A |

| Florida | 1.03% | N/A | NO | $2.65 | 56.30% | 53,681 | 50.15 |

| Georgia | 1.18% | N/A | NO | $2.65 | 60.10% | 57,016 | 53.89 |

| Hawaii | 2.59% | N/A | NO | $3.65 | 59.90% | 73,575 | 62.4 |

| Idaho | 0.77% | N/A | NO | $2.67 | 77.20% | 60,208 | 58.48 |

| Illinois | 1.20% | N/A | NO | $3.20 | 64.50% | 64,609 | 59.51 |

| Indiana | 0.82% | N/A | NO | $2.99 | 68.60% | 58,873 | 49.18 |

| Iowa | 0.70% | N/A | NO | $2.88 | 74.80% | 63,481 | 52.88 |

| Kansas | 0.96% | N/A | NO | $2.60 | 68.40% | 57,872 | 50.36 |

| Kentucky | 0.53% | N/A | NO | $2.68 | 66.30% | 51,348 | 32.23 |

| Louisiana | 0.28% | N/A | YES | $2.47 | 66.80% | 43,903 | 23.96 |

| Maine | 1.13% | ZEV + Mandate | NO | $2.85 | 73.80% | 51,664 | 66.73 |

| Maryland | 1.91% | ZEV + Mandate | YES | $2.76 | 60.00% | 81,084 | 66.6 |

| Massachusetts | 2.53% | ZEV + Mandate | YES | $2.81 | 66.10% | 73,227 | 72.53 |

| Michigan | 0.59% | N/A | NO | $2.89 | 76.90% | 57,700 | 63.65 |

| Minnesota | 1.14% | N/A | NO | $2.72 | 73.00% | 71,920 | 73.13 |

| Mississippi | 0.22% | N/A | NO | $2.55 | 63.00% | 43,441 | 42.69 |

| Missouri | 0.73% | N/A | NO | $2.47 | 67.60% | 56,885 | 57.94 |

| Montana | 0.47% | N/A | NO | $2.87 | 77.50% | 59,087 | 52.44 |

| Nebraska | 0.73% | N/A | NO | $2.64 | 73.00% | 59,619 | 50.53 |

| Nevada | 1.62% | N/A | NO | $2.77 | 59.00% | 56,550 | 65.63 |

| New Hampshire | 1.16% | N/A | NO | $2.74 | 69.60% | 74,801 | 67.79 |

| New Jersey | 1.59% | ZEV + Mandate | NO | $2.74 | 60.70% | 72,997 | 65.25 |

| New Mexico | 0.81% | ZEV | NO | $2.90 | 64.70% | 47,855 | 51.18 |

| New York | 1.56% | ZEV + Mandate | YES | $2.73 | 65.60% | 62,447 | 75.49 |

| North Carolina | 1.02% | N/A | NO | $3.49 | 62.50% | 50,343 | 60.32 |

| North Dakota | 0.24% | N/A | NO | $2.96 | 81.20% | 59,886 | 37.9 |

| Ohio | 0.74% | N/A | NO | $2.77 | 64.90% | 59,768 | 50.87 |

| Oklahoma | 0.35% | N/A | NO | $2.57 | 59.30% | 55,006 | 42.8 |

| Oregon | 3.41% | ZEV + Mandate | YES | $3.43 | 68.60% | 64,610 | 75.24 |

| Pennsylvania | 0.92% | N/A | YES | $3.01 | 66.40% | 63,173 | 58.08 |

| Rhode Island | 1.26% | ZEV + Mandate | YES | $2.86 | 63.10% | 66,390 | 69 |

| South Carolina | 0.53% | N/A | NO | $2.47 | 64.10% | 54,971 | 57.39 |

| South Dakota | 0.35% | N/A | NO | $2.79 | 79.30% | 56,894 | 68.45 |

| Tennessee | 0.73% | N/A | NO | $2.55 | 63.60% | 55,240 | 54.71 |

| Texas | 0.78% | N/A | YES * | $2.58 | 65.50% | 59,295 | 46.67 |

| Utah | 1.60% | N/A | NO | $3.20 | 69.40% | 71,319 | 53.27 |

| Vermont | 1.92% | ZEV + Mandate | NO | $2.59 | 72.40% | 63,805 | 76.35 |

| Virginia | 1.67% | N/A | NO | $2.81 | 60.40% | 71,293 | 55.22 |

| Washington | 4.28% | ZEV | NO | $3.54 | 65.70% | 75,418 | 65.77 |

| West Virginia | 0.27% | N/A | NO | $2.84 | 74.30% | 45,392 | 28.77 |

| Wisconsin | 0.79% | N/A | NO | $2.76 | 72.60% | 63,451 | 67.79 |

| Wyoming | 0.35% | N/A | NO | $2.80 | 82.40% | 57,837 | 36.91 |