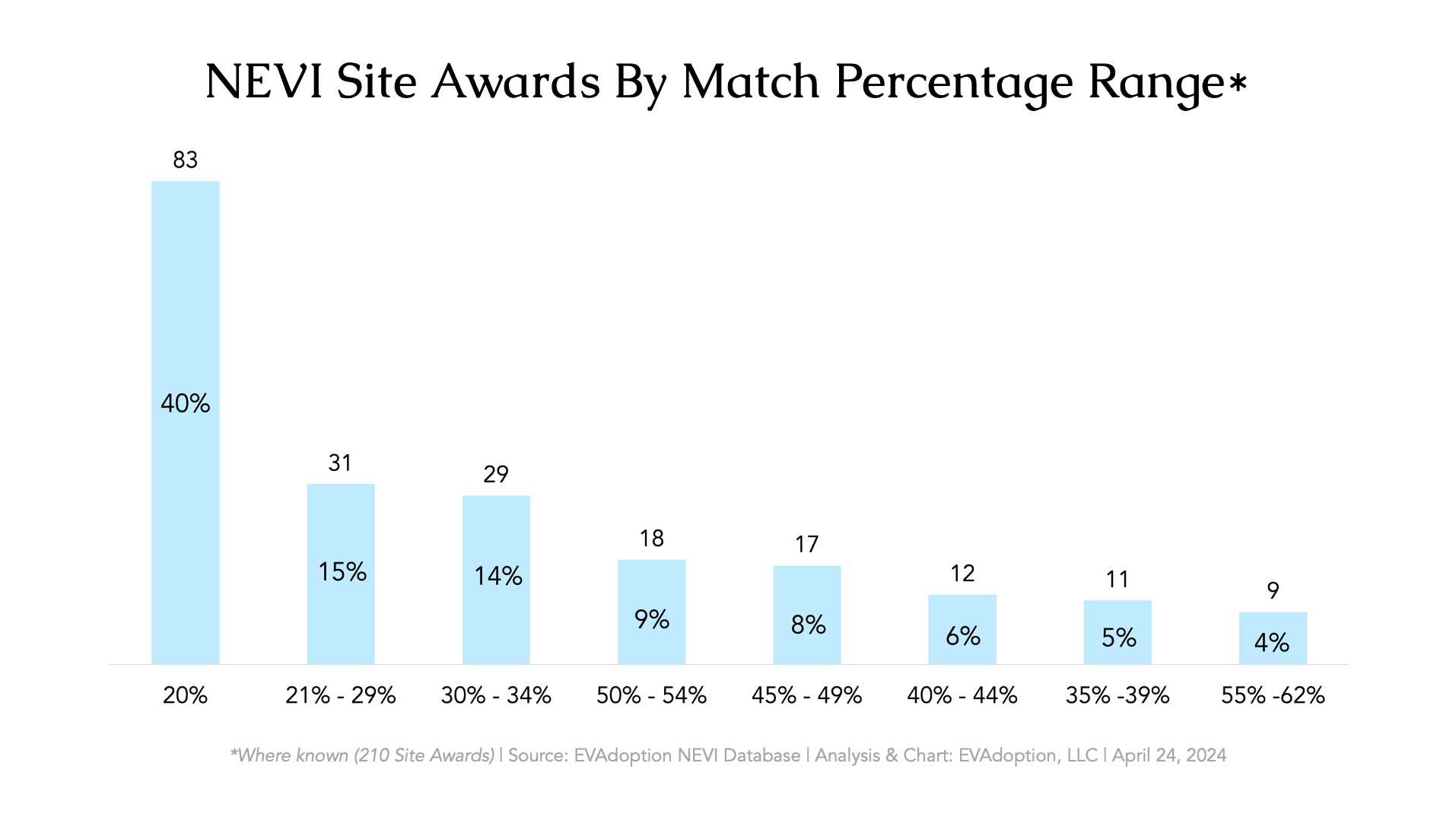

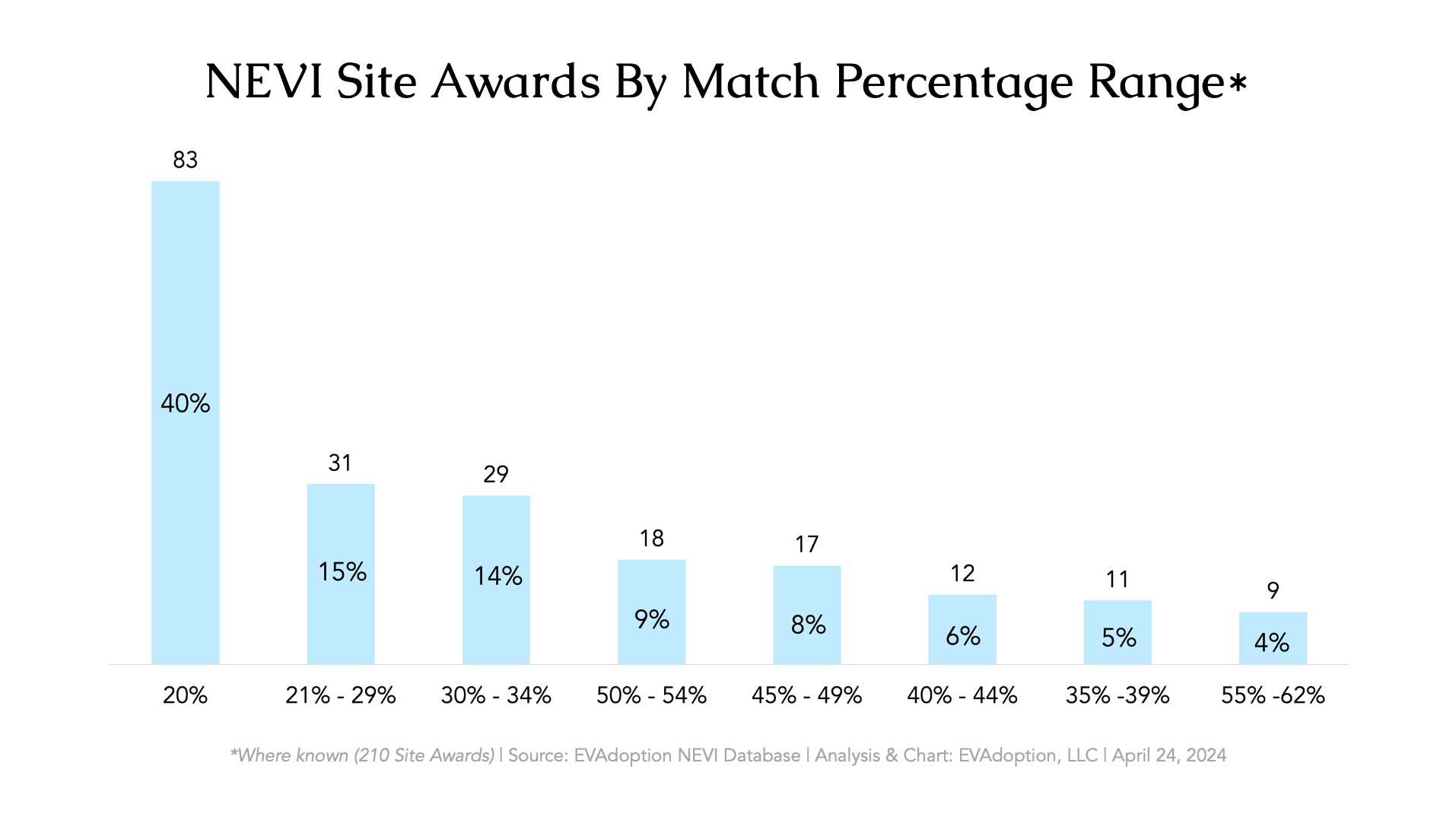

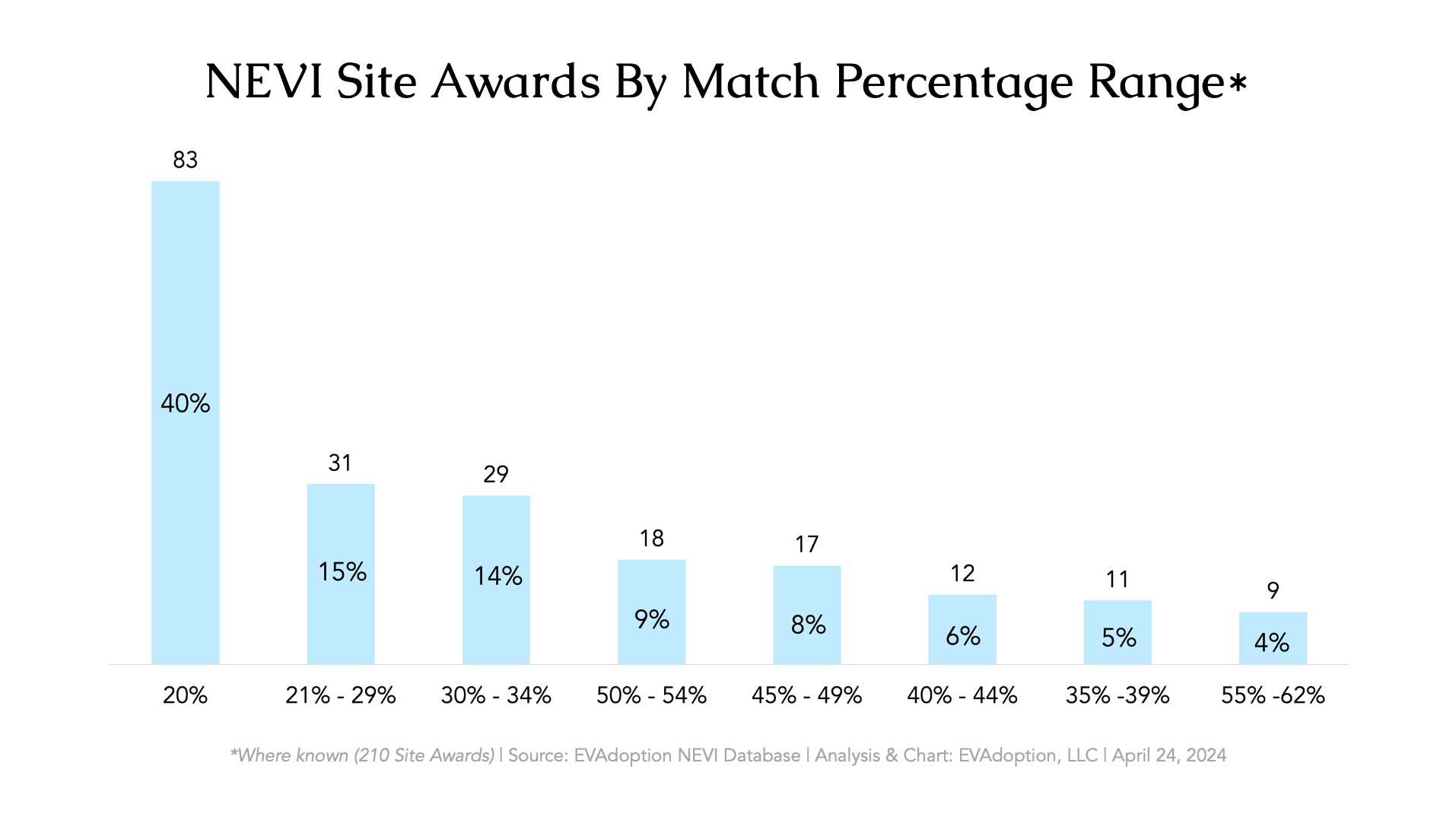

NEVI Site Awards By Match Percentage Range

Out of 210 winning NEVI applications (the amount for which we have obtained the match percentage amount), 40% of applicants have submitted a bid with the NEVI minimum 20% match.

Out of 210 winning NEVI applications (the amount for which we have obtained the match percentage amount), 40% of applicants have submitted a bid with the NEVI minimum 20% match.

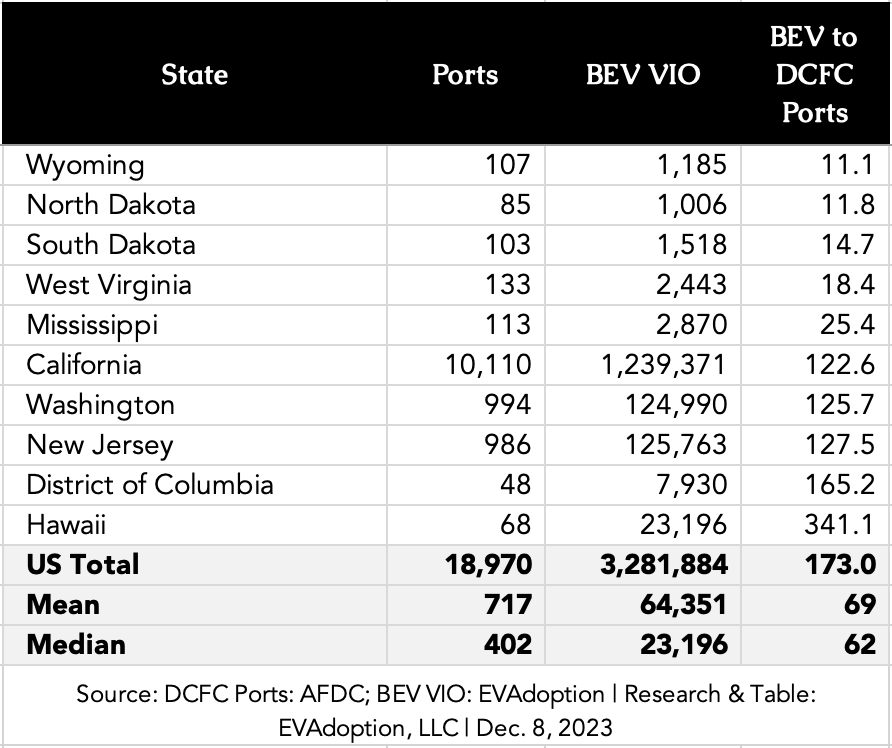

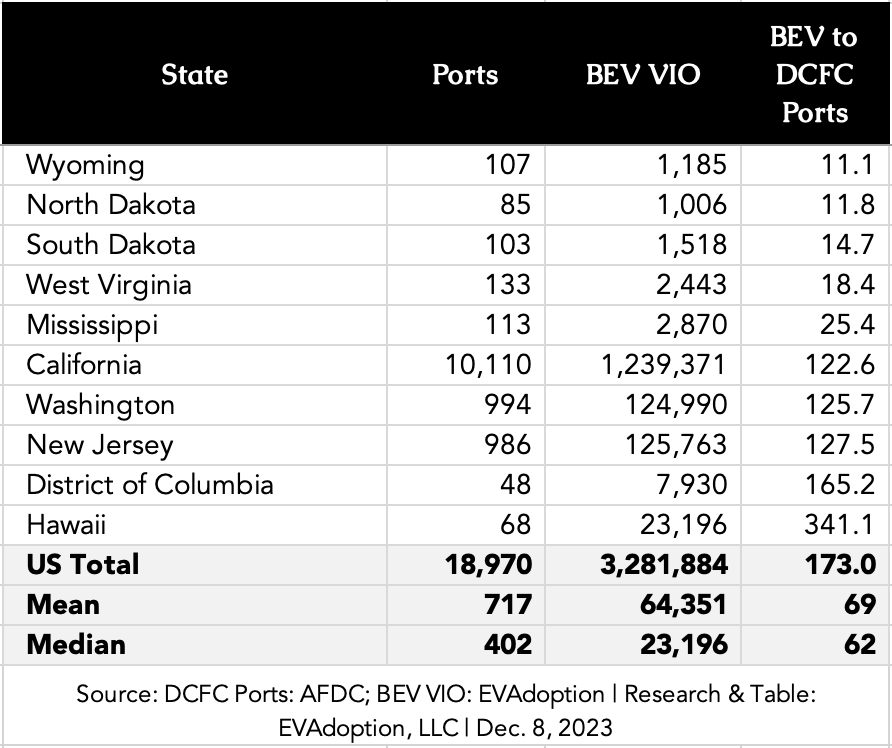

The “best” (lowest) ratio are rural and lower median-income states that have very low levels of EV adoption. In these states, the number of deployed DC fast chargers has simply outpaced BEV sales. DCFCs have been deployed, often from available grant programs and networks wanting to have at least a minimum presence in the state. But with BEV sales being so tiny, it makes the ratio look good.

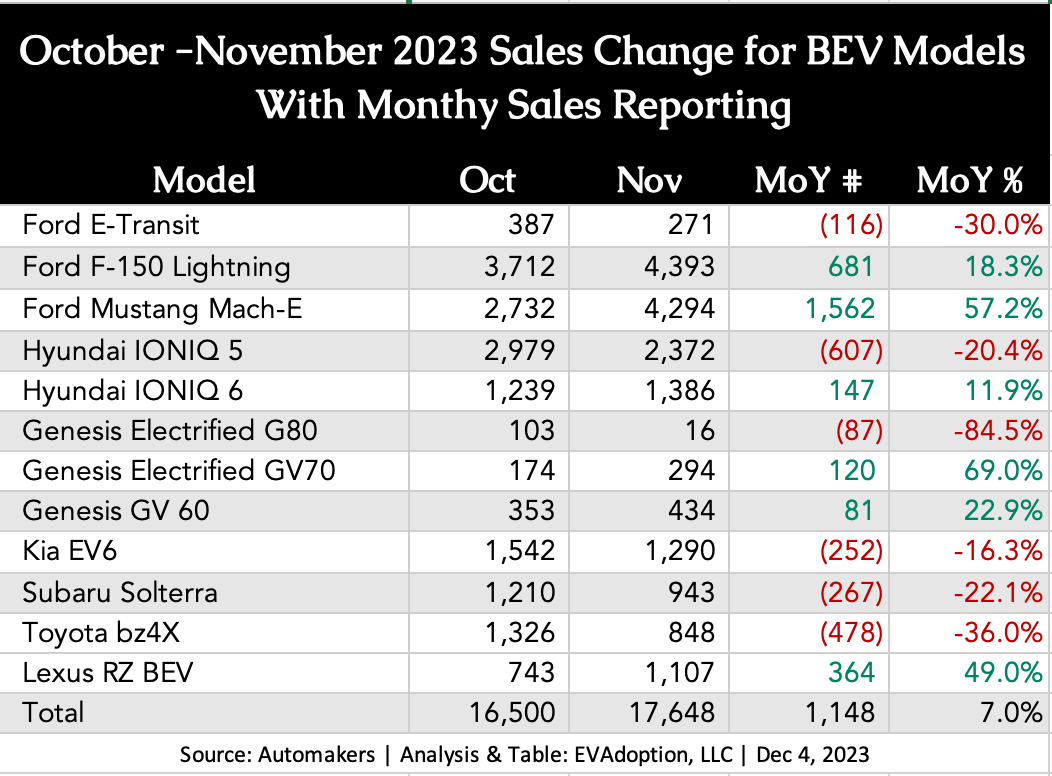

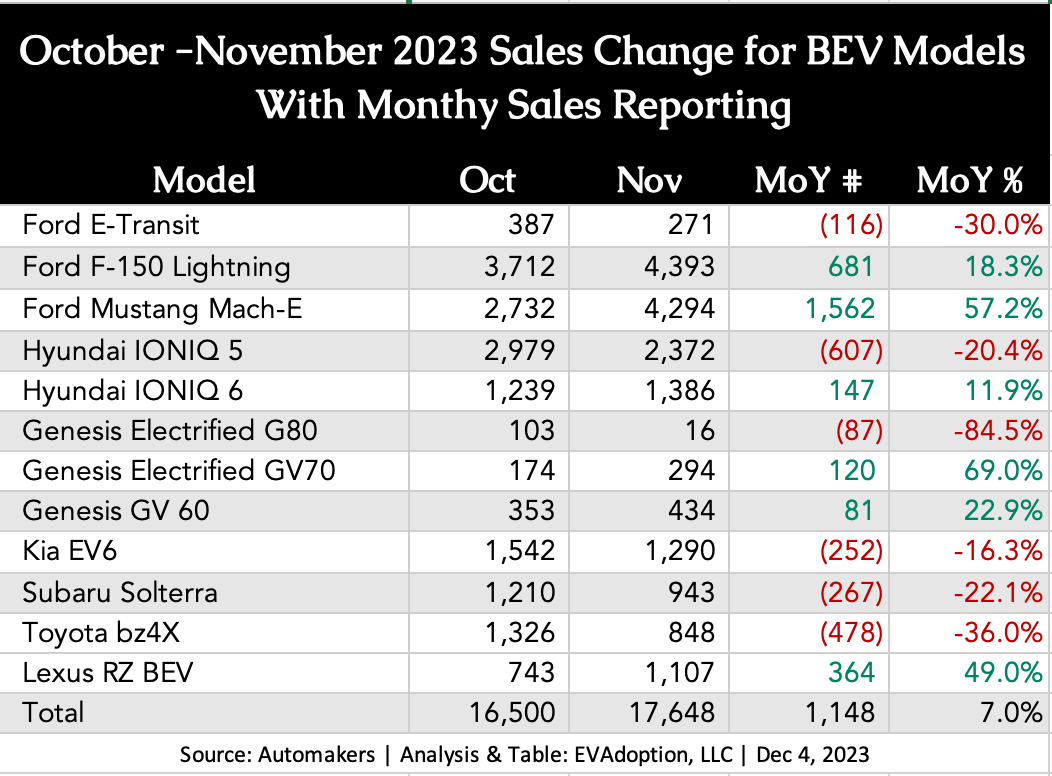

While many news stories, automakers, and analysts continue to claim that demand has fallen greatly for EVs and inventory is ballooning at dealers, actual reported sales continue to be relatively strong, despite a 20-year high in auto loan interest rates. Based on reporting from automakers for 12 BEV (full battery electric) models sold in the US, November sales were up a combined 7% versus October.

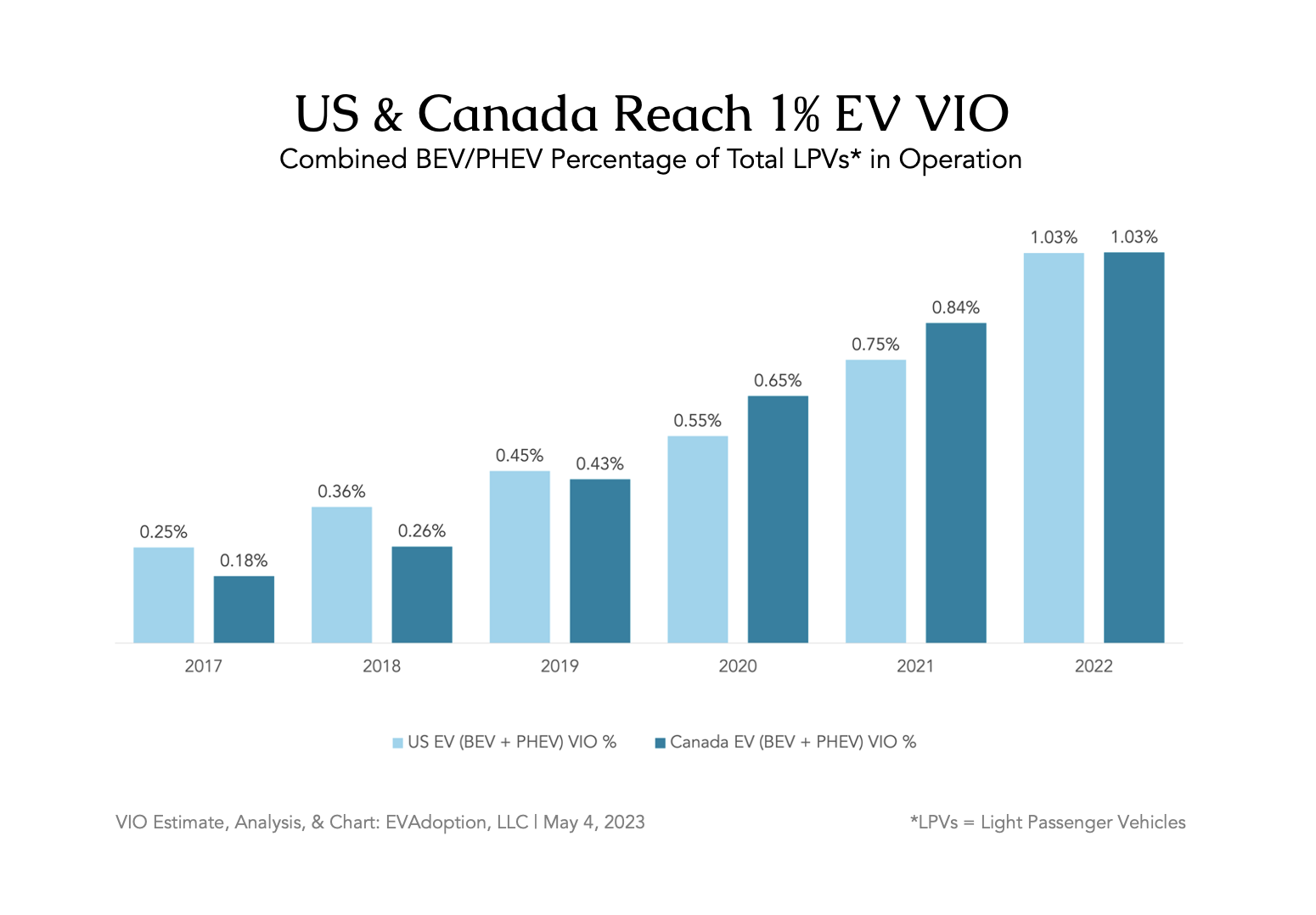

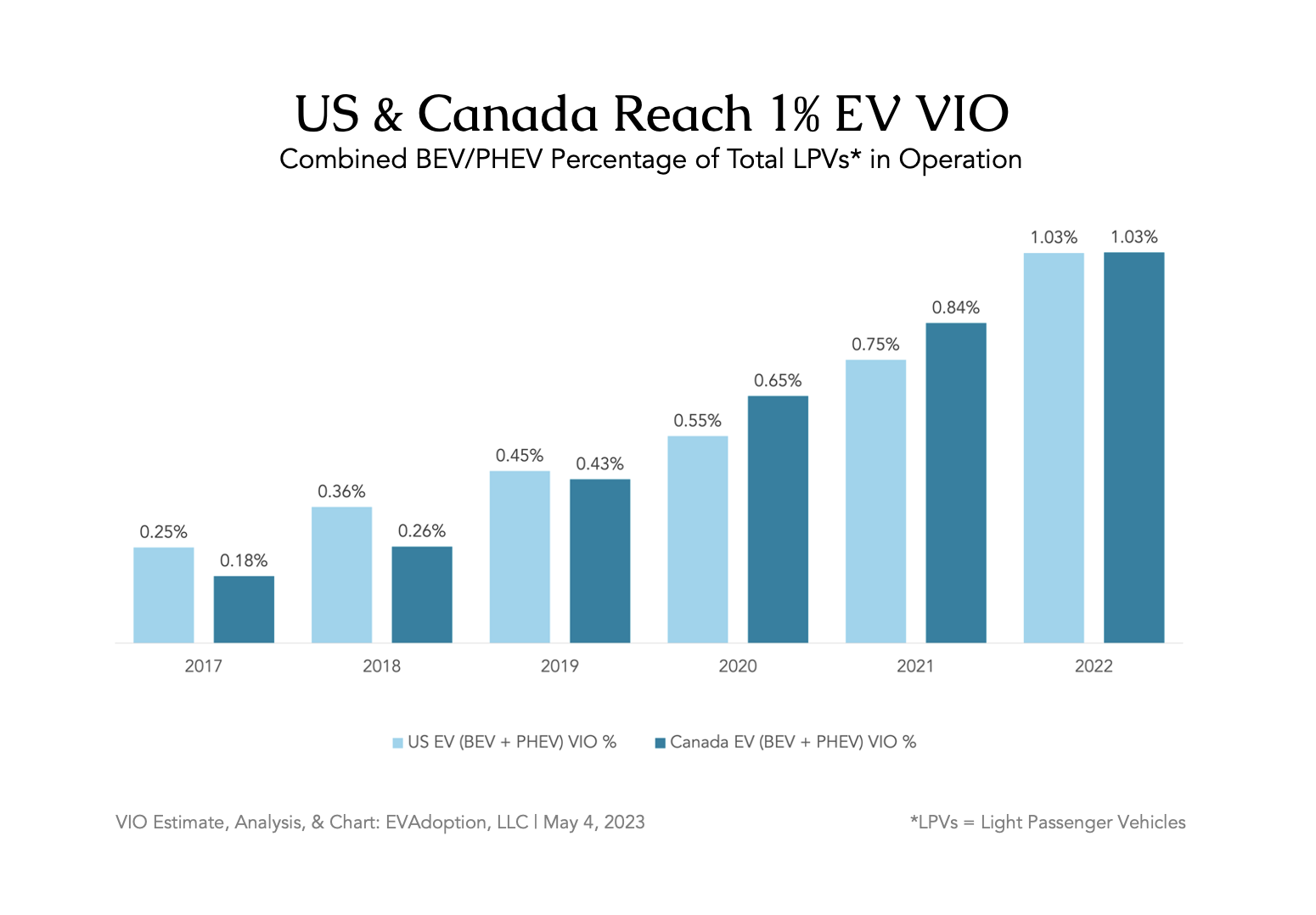

In 2022, both the US and Canada surpassed one percent of vehicles in operation (VIO) being electric vehicles (both BEVs and PHEVs), according to new analysis and estimates from EVAdoption.

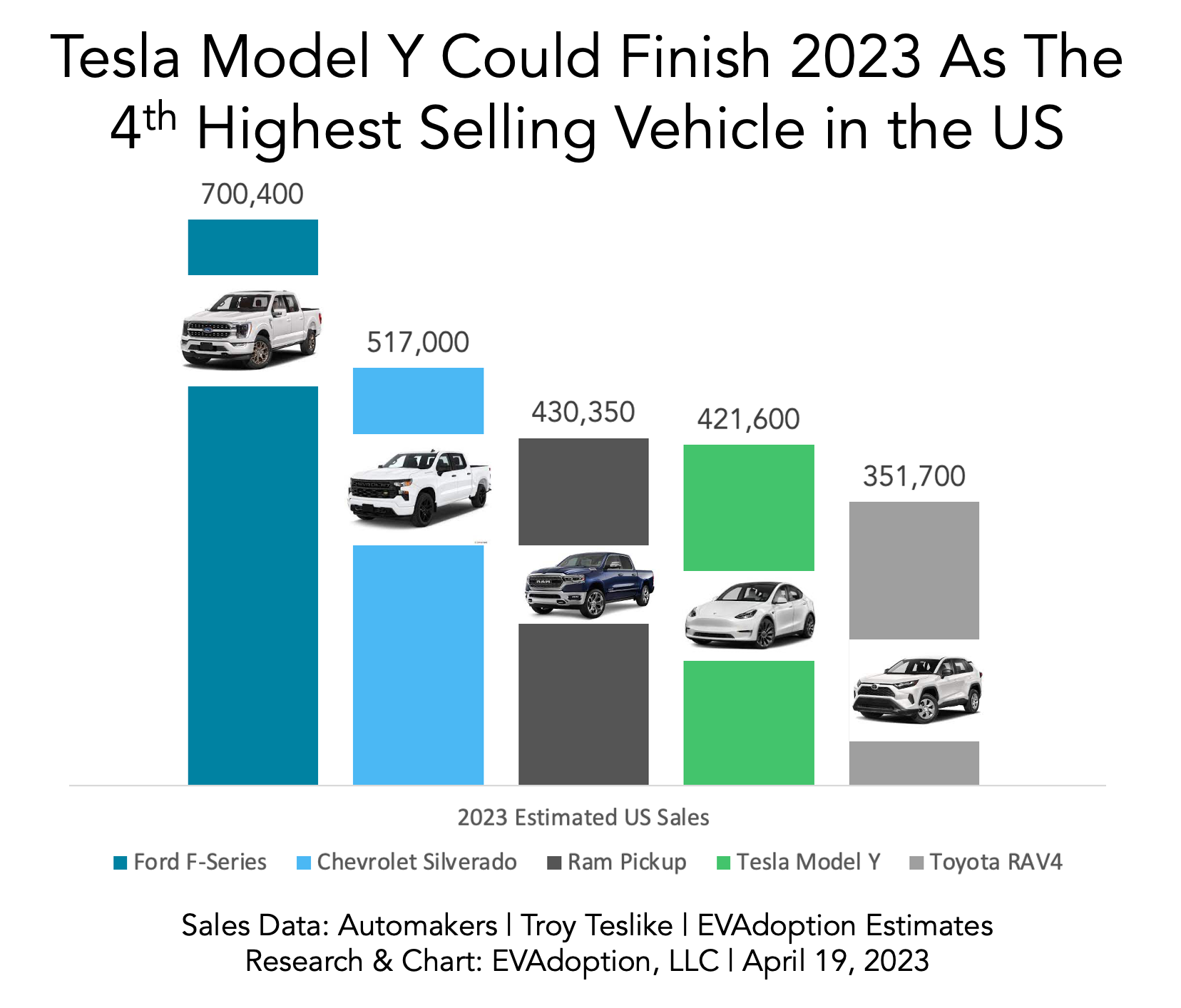

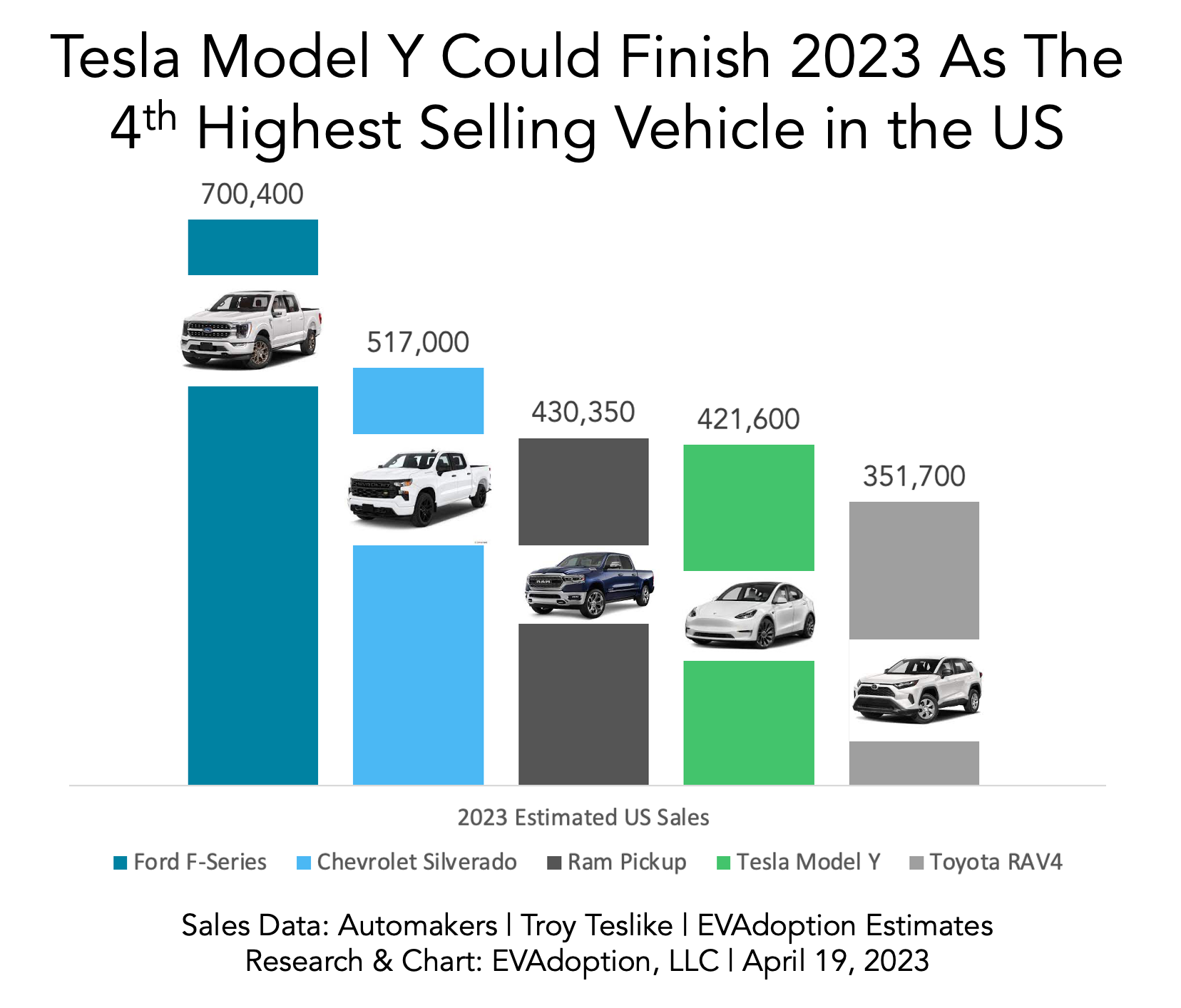

Based on EVAdoption estimates, the Tesla Model Y should finish 2023 as the 4th highest-selling vehicle in the US — beating the recent perennial #4, the Toyota RAV4.

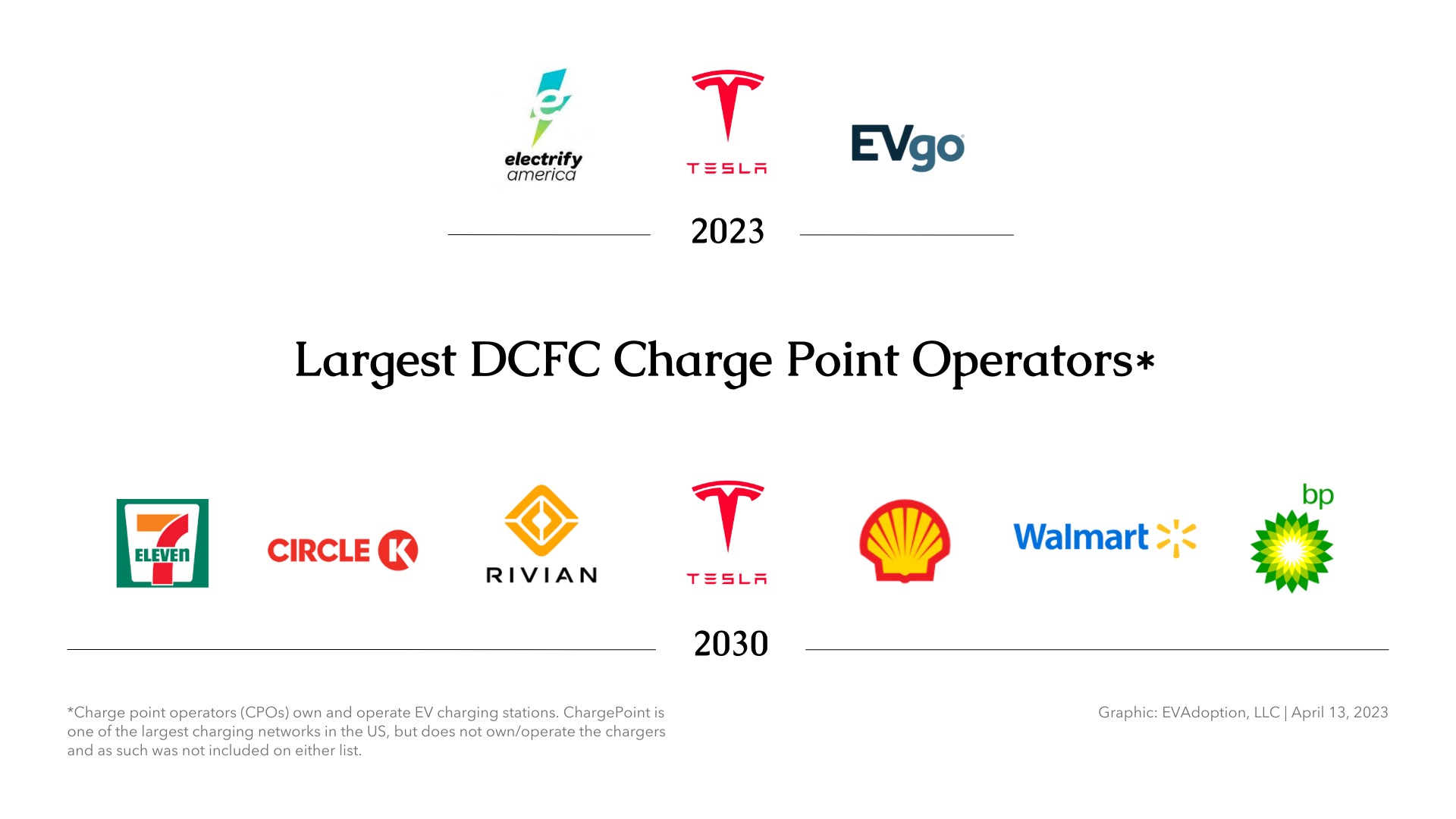

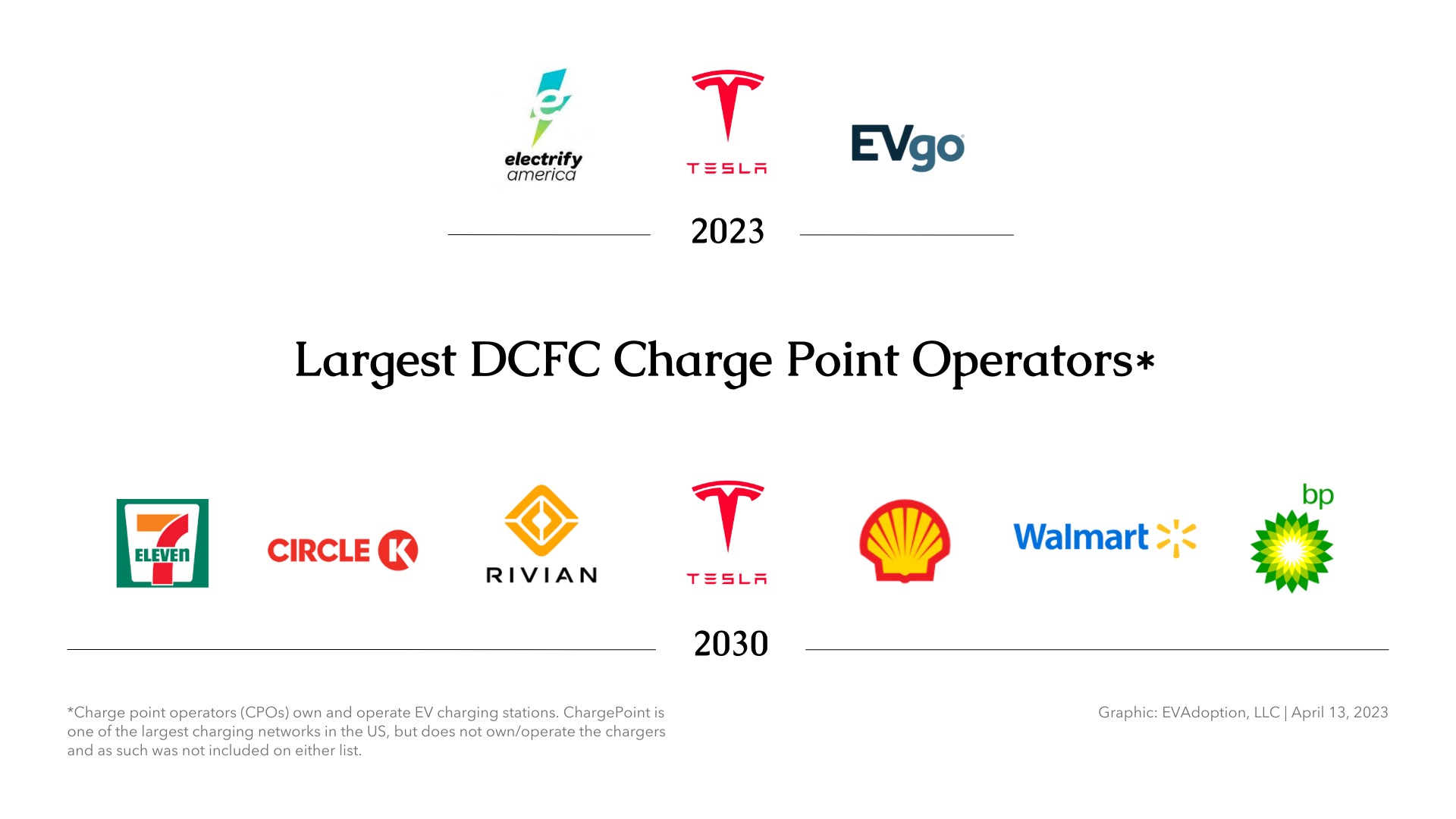

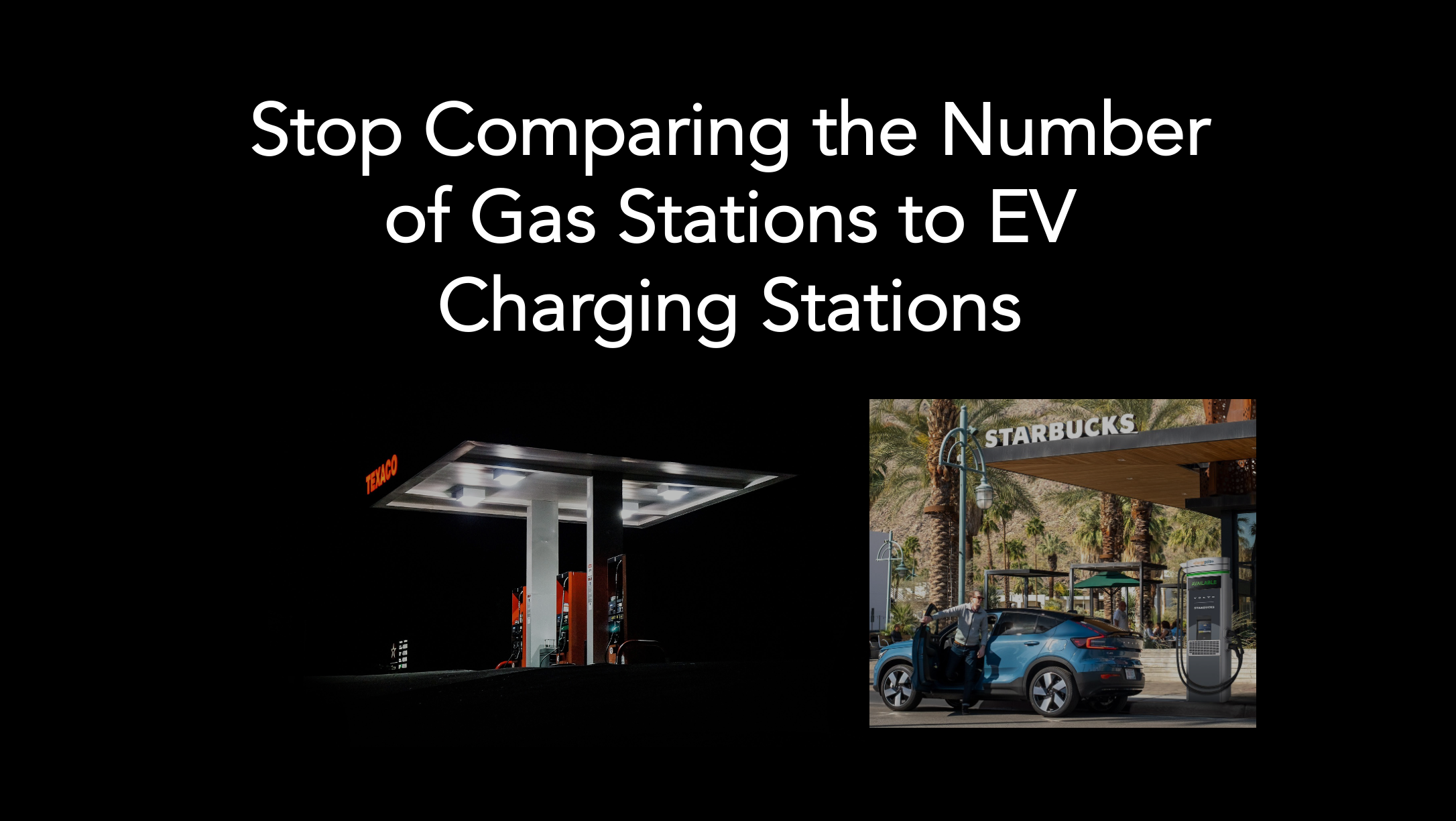

The largest US charge-point operators in 2030 are likely to be convenience store chains, travel center operators, retailers who already sell gasoline, and of course fuel retailers (gas station/convenience store companies).

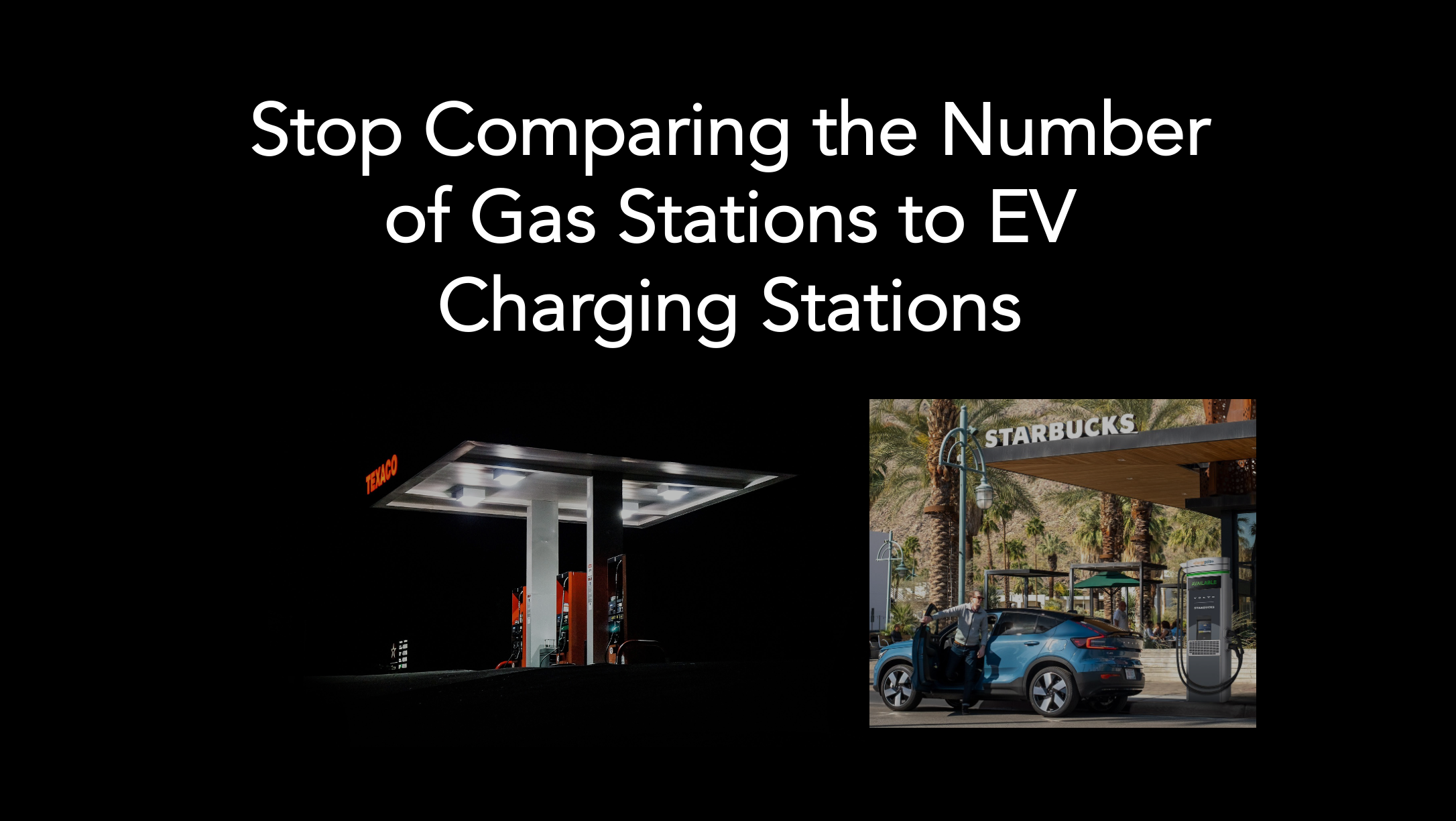

There are 197 vehicles to every gas pump nozzle. If you drive an EV, there are 25.7 EVs to each public Level 2 + DCFC port and 1.6 to 1 if you include those chargers at home where you park your car each night.

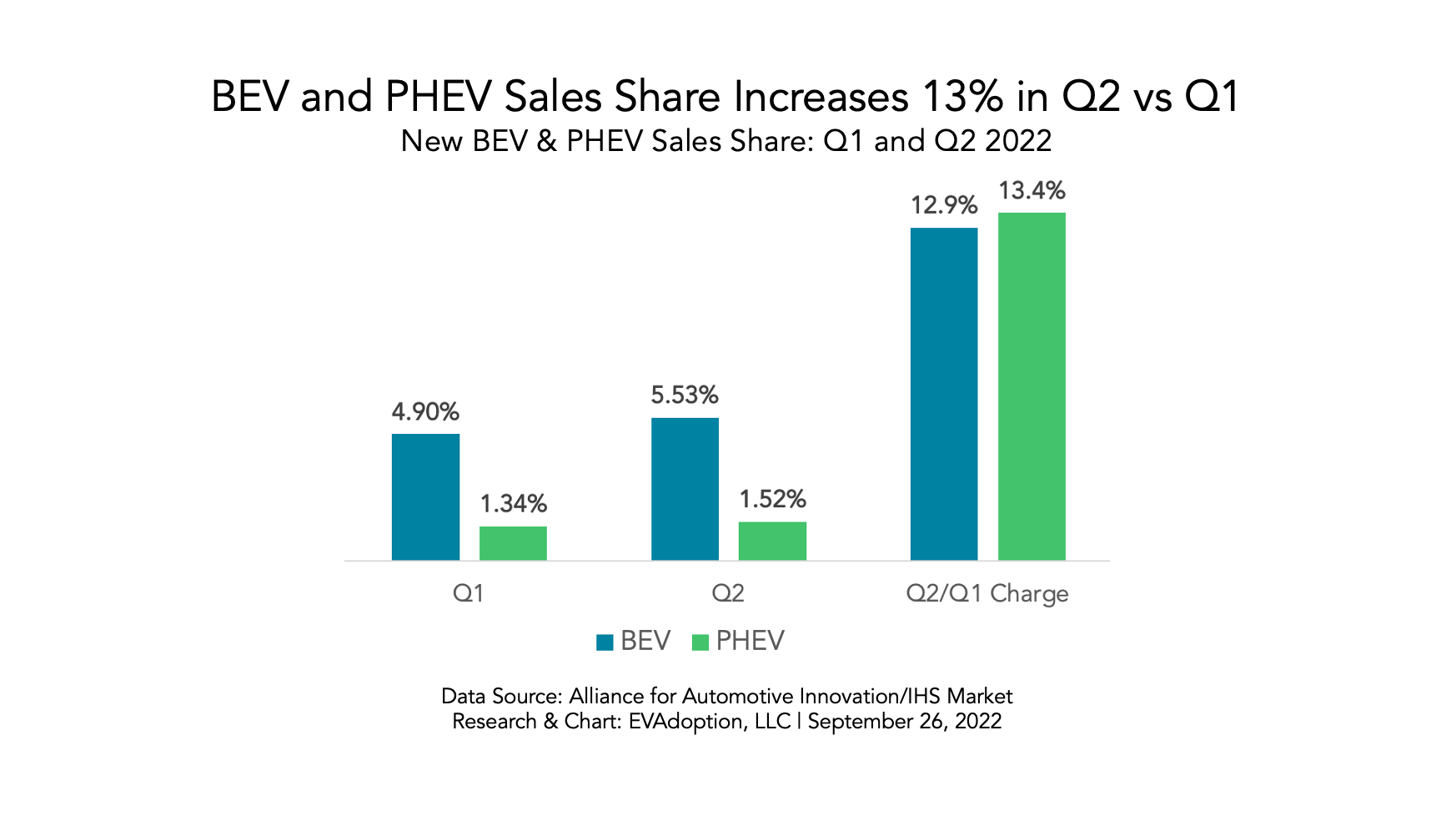

Sales of the EV models with automaker reported sales were up 11.6% in Q3 versus Q2 2022, according to new analysis from EVAdoption’s EV Sales Scoreboard. While solid overall growth, this was a decline of roughly 34 percentage points from the second quarter increase of 45.3 percent over Q1.

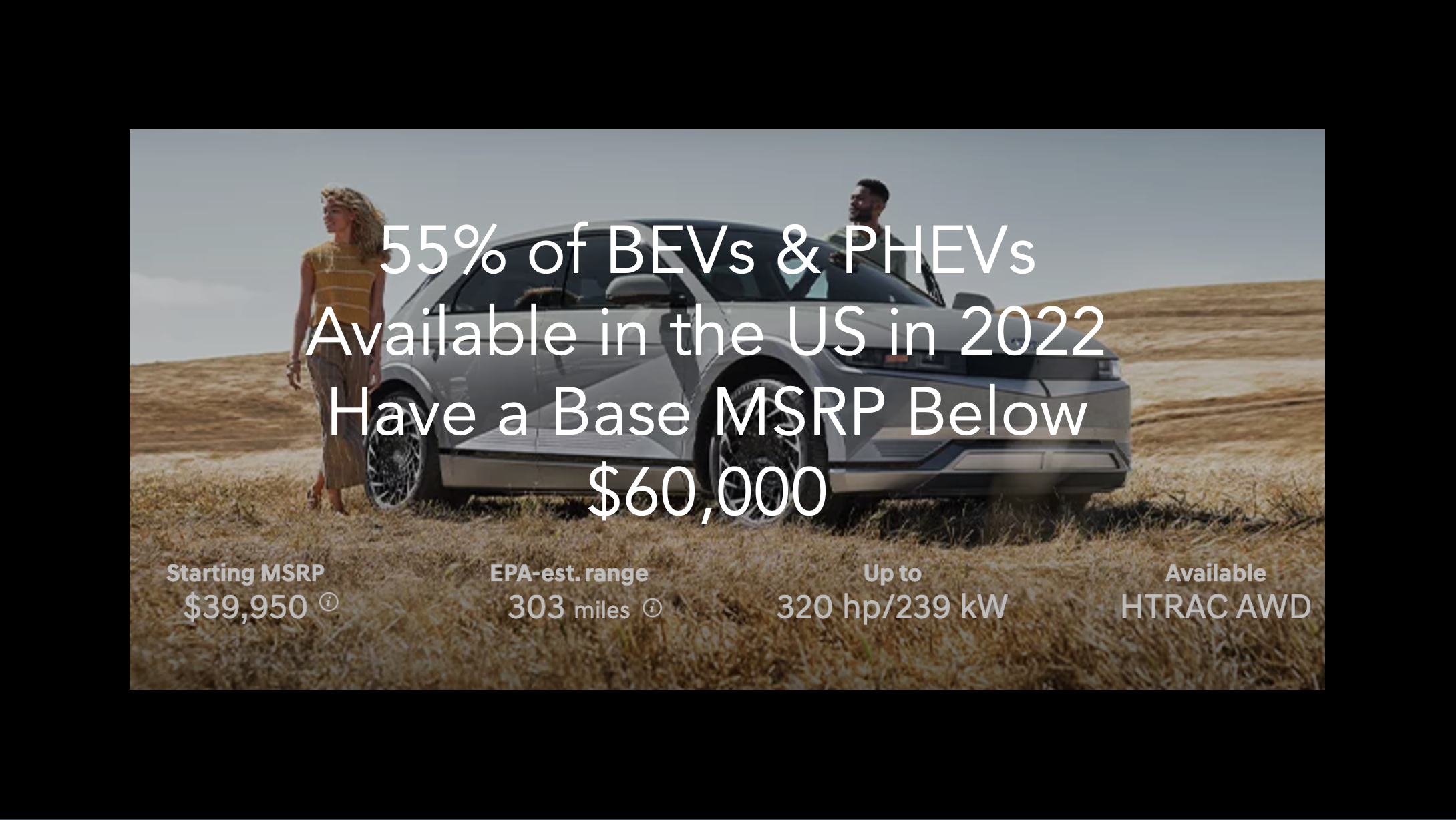

Out of 82 BEVs and PHEVs that are either currently available for sale in the US, or expected to be so be the end of 2022, 67 of them or 81.7%, have a base manufacturer’s suggested retail price (MSRP) higher than $39,999, according to new analysis from EVAdoption. Fifteen or 18.3% have a base MSRP below $40,000 and 31 or 37.8% are at $70,000 or higher.

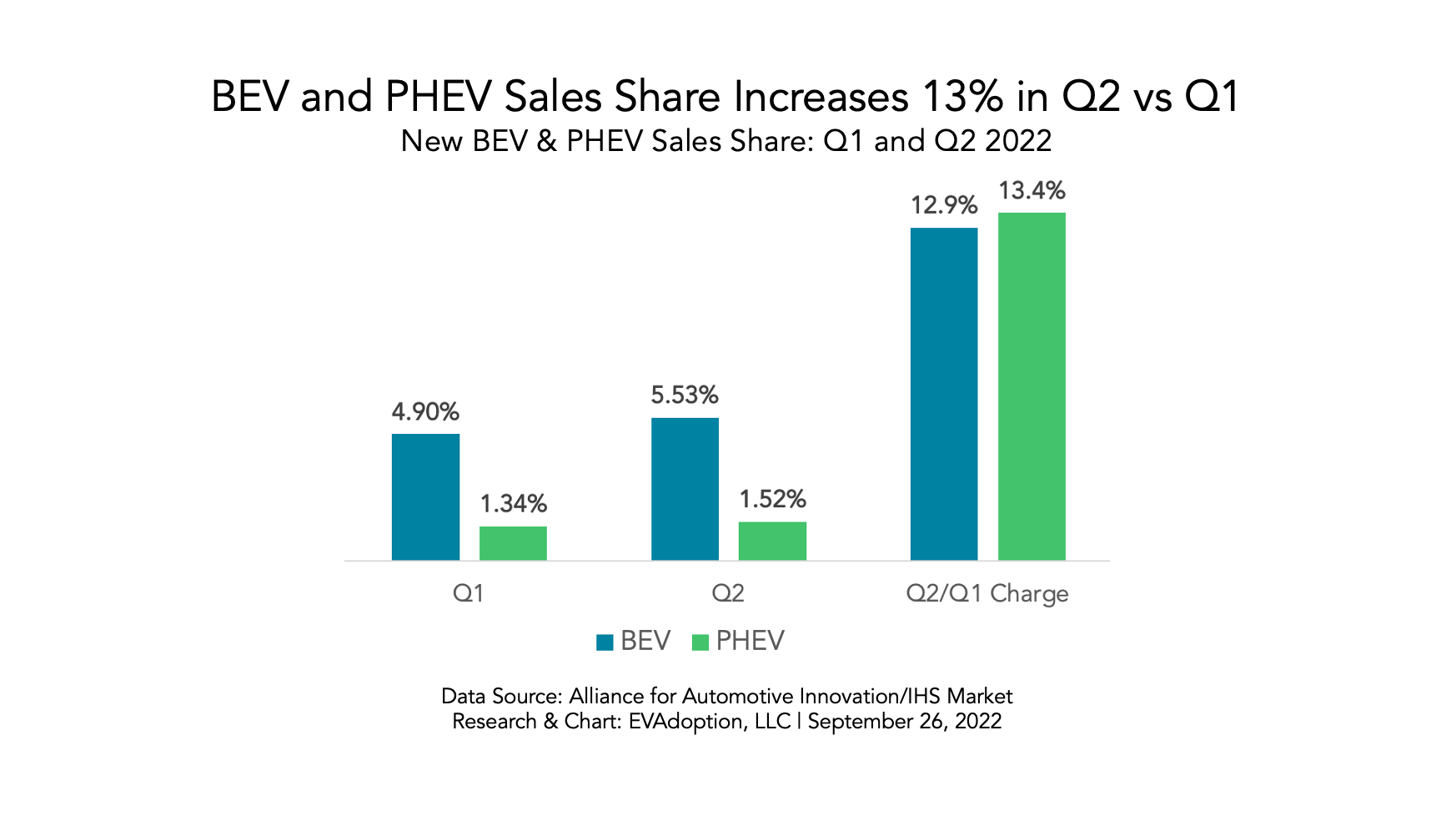

Electric vehicle sales in the US continue to see a significant uptick, with EV (BEV and PHEV) share of new light passenger vehicles (LPVs) reaching 7.05% in Q2 of 2022.

Out of 210 winning NEVI applications (the amount for which we have obtained the match percentage amount), 40% of applicants have submitted a bid with the NEVI minimum 20% match.

The “best” (lowest) ratio are rural and lower median-income states that have very low levels of EV adoption. In these states, the number of deployed DC fast chargers has simply outpaced BEV sales. DCFCs have been deployed, often from available grant programs and networks wanting to have at least a minimum presence in the state. But with BEV sales being so tiny, it makes the ratio look good.

While many news stories, automakers, and analysts continue to claim that demand has fallen greatly for EVs and inventory is ballooning at dealers, actual reported sales continue to be relatively strong, despite a 20-year high in auto loan interest rates. Based on reporting from automakers for 12 BEV (full battery electric) models sold in the US, November sales were up a combined 7% versus October.

In 2022, both the US and Canada surpassed one percent of vehicles in operation (VIO) being electric vehicles (both BEVs and PHEVs), according to new analysis and estimates from EVAdoption.

Based on EVAdoption estimates, the Tesla Model Y should finish 2023 as the 4th highest-selling vehicle in the US — beating the recent perennial #4, the Toyota RAV4.

The largest US charge-point operators in 2030 are likely to be convenience store chains, travel center operators, retailers who already sell gasoline, and of course fuel retailers (gas station/convenience store companies).

There are 197 vehicles to every gas pump nozzle. If you drive an EV, there are 25.7 EVs to each public Level 2 + DCFC port and 1.6 to 1 if you include those chargers at home where you park your car each night.

Sales of the EV models with automaker reported sales were up 11.6% in Q3 versus Q2 2022, according to new analysis from EVAdoption’s EV Sales Scoreboard. While solid overall growth, this was a decline of roughly 34 percentage points from the second quarter increase of 45.3 percent over Q1.

Out of 82 BEVs and PHEVs that are either currently available for sale in the US, or expected to be so be the end of 2022, 67 of them or 81.7%, have a base manufacturer’s suggested retail price (MSRP) higher than $39,999, according to new analysis from EVAdoption. Fifteen or 18.3% have a base MSRP below $40,000 and 31 or 37.8% are at $70,000 or higher.

Electric vehicle sales in the US continue to see a significant uptick, with EV (BEV and PHEV) share of new light passenger vehicles (LPVs) reaching 7.05% in Q2 of 2022.

© 2024 EVAdoption, LLC | All Rights Reserved.