While several automakers throughout the world are resisting the transition to electric vehicles, the path forward is now clear. The shift away from vehicles (cars, trucks, ships, boats, motorcycles, scooters, buses, snowmobiles, and eventually even planes) powered by an internal combustion engine and fossil fuels to a combination of electric motors and batteries is now just a matter of “When?”, not “If?“

This transition is poised to reshape many industries, jobs, economies and the environment. Most of these shifts will be positive in the long run, but some will create disruption and pain during the transition off of fossil fuels.

Following are 15 shifts – from modest disruptions and transformation to complete reinvention of industries – that will happen because of the transition to electrification of transportation. (Note: There are related trends such as autonomous vehicle technology, growth in use of ride sharing, connected vehicles, changing demographics and more that will also create multiple shifts, but this article is focused on those shifts caused primarily by the electrification of vehicles.)

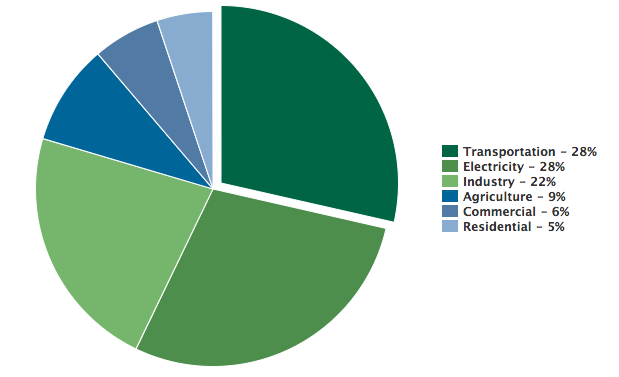

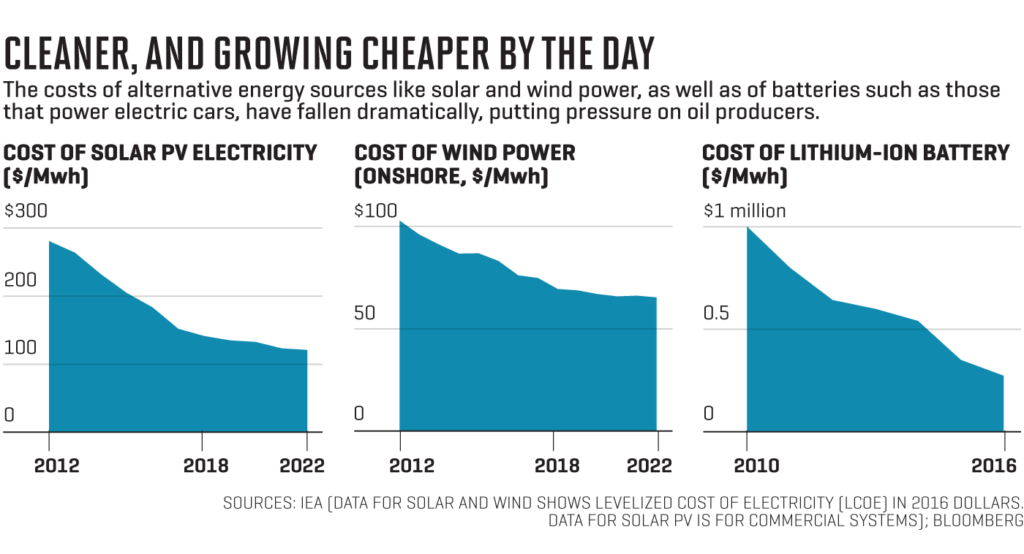

1. Lower Carbon Emissions and Cleaner Air and Water: The most obvious effect of the move away from fossil fuels is a significant reduction in carbon emissions. While many EV detractors like to cite that many regions of the world still generate electricity primarily from dirty fuels such as coal and natural gas, the reality is that the shift to clean energy sources is actually happening more quickly than the shift to electric vehicles. With solar and wind energy continuing to decline in cost each year, electric vehicles will also increasingly be powered by cleaner energy.

Because EVs don’t directly pollute (yes, they aren’t perfect and their manufacturing and delivery process still produces carbon emissions) our air and skies will be cleaner and bluer. And while we may be 50-75 years or more away from not needing oil to produce everything from plastics, to clothes to deodorant, approximately 84% of crude oil is used for transportation or energy generation. As this percentage heads toward 0% in the next 50 years, the number of oil spills into our oceans and rivers will also decline precipitously.

2. Engine Noise Replaced With Near Silence: While perhaps a small effect upon society, when all forms of transportation are electric, our neighborhoods and cities will be quieter, more peaceful and more enjoyable. Yes, we will still have the sounds of sirens, honking horns and even tires – but the roar of trucks, sports cars and motorcycles will fade away.

That will be a sad day for many. I admit that I personally enjoy the throaty roar of a Ducati or Harley-Davidson motorcycle or big-block Ford Mustang. But over time, peace and quiet will outweigh our nostalgia for the roar of the internal combustion engine.

While perhaps a small impact, with vehicles being quieter and not polluting, combined with better transportation management and connectivity, we could see a change in how developers integrate housing and commercial buildings into the design of roads and highways.

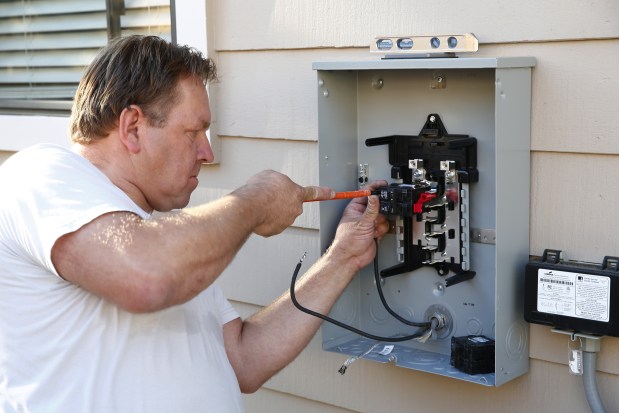

3. Electrician and Technical Jobs Replace Many Auto Industry Jobs: Perhaps the three biggest employment areas that the transition to EVs will effect are: electricians, auto repair and auto factory workers. There are roughly 1.5 billion households worldwide, which is a huge number of homes, condominiums and apartments that will need EV charging stations installed and in many cases updates of electrical systems. Look for electricians, EV charging station, battery storage and solar panel installers to be one of the hottest areas of job growth beginning in the next decade.

On the potential negative side, electric vehicles have fewer parts and are expected to require fewer assembly workers, especially when combined with increasing use of factory robots. And tens of thousands of auto repair workers who currently fix engines, mufflers, transmissions, radiators, do smog checks and change engine oil will have jobs for a few more decades, but many of these workers will retire as the shift to EVs lessens the need for these services skills.

Younger and new workers will increasingly focus on fixing autonomous technology and the hardware and software that increasingly runs vehicles, as well as repair emerging high-growth mobility vehicles such as ebikes, escooters and drones. And of course there will always be the need for workers to replace tires, brakes, and broken windows as well as for body repair and paint.

4. Gas stations transform to recharging centers: In a world of battery-powered vehicles the need for traditional gas/petrol stations obviously goes away. But while this shift can sound rather draconian, most gas stations have evolved in recent decades to become convenience stores and car washes that also happen to sell gasoline.

Replacing gas pumps with fast charging stations over time is a logical transition with the biggest challenge likely being the costs to remove underground storage tanks, install electricity substations/microgrids and replace gas pumps with charging stations. And beyond their core foundation of convenience stores, look to station operators to increasingly add gourmet coffee shops, quick-service restaurants, car detailing services and other retail and service offerings to serve consumers spending 15-20 minutes on site while their vehicle charges.

5. Home Garages Become the New Gas Station: While it varies by country, about 40% to 60% of most households throughout the world live in homes with easy access to an electrical outlet in or near their garage/carport. For these households their garages in essence become their primary “refueling” locations.

With EVs averaging around 300 miles of range by 2025, owners of EVs that also live in homes or rental housing with easy access to charging stations, will likely charge “at home” about 95% of the time. This shift for these homeowners/renters means that the “5% away from home charging” will be at destination locations, at recharging centers along major highways, hotels/resorts, retail and mall locations and at the workplace.

6. Automakers Become Energy Companies: While Tesla gets most of the press among automakers around their energy-related products (residential and commercial battery storage, solar PV and roof tiles) – Mercedes-Benz, BMW and Nissan-Renault in particular have entered the battery storage and vehicle to grid market.

When cars run on gas or diesel, there is a clear need for a separate ecosystem of oil companies that are focused on oil exploration, refining/production and distribution. But when electricity and batteries are what fuels our cars, trucks, buses, motorcycles, etc – that battery production overlaps with a future of commercial and residential battery storage systems.

The same battery systems that power your car’s electric motor may store clean energy, supplement the grid and also power your home or business – which means that almost by default, most automakers will enter the energy storage and vehicle to grid/home/building business.

7. Utilities Become the “New Oil Companies” – Transportation Energy Providers: Smart utility executives are licking their chops as vehicles transition to battery electric propulsion. In the US, for example, households are using less electricity per capita because appliances and tech devices are becoming more energy efficient along with the growth in solar PV installation. Electric vehicles provide one of the few paths for growth for utilities which also are making lower returns from a declining need to build expensive coal and natural gas power plants.

We are already seeing many electricity utilities, including the 3 majors in California, move aggressively to build out charging stations at multifamily housing and workplace locations. They have also launched special rates for charging EVs during off peak times and have begun testing vehicle to grid programs with automakers.

Electric utilities’ core business of producing and distributing electricity to businesses and households will obviously still be their primary business, but the growth in EVs, solar and local energy/micorgrids means that utilities’ increasingly pursue opportunities to install and manage distribution points, such as EV charging centers, microgrids and mini solar farms. Utilities increasingly become technology and service companies that manage and optimize the flow of locally-produced energy between battery storage (EVs, homes and commercial) and the grid.

8. Electric Vehicles Become Mobile Energy Storage Devices: When vehicle to grid (V2G) functionality is standard on most EVs and utilities support V2G programs, vehicle owners will be able to use their BEVs to store excess clean energy during the day and either use it to power their home in the evening or get paid for energy storage by their utility to send it back to the grid during periods of peak demand. Additionally startups such as Fermata Energy have developed a vehicle to building (V2B) solution that reduces or eliminates a business’s demand charges by tapping into a vehicle’s battery storage during periods of high electricity use.

Improvements in battery technology and use of artificial intelligence software will optimize frequency of battery discharges so as to reduce battery degradation. The result of these programs, however, is that our cars and trucks will transition from energy users and underutilized assets to energy storage vehicles that generate income or reduce energy costs for their owners.

9. Retailers and Food Service Companies Add Recharging Centers: A major shift with the transition to EVs is that we will charge our EVs wherever we are rather than driving to a location where we are stopping just to charge. The historical gas station was not a place we went to hang out out, but rather to stop, do our business and leave as quickly as possible. Recharging centers change this with our goal switching to doing things like shopping, eating, watching movies, getting a massage, having our car detailed, etc. while it charges.

In the future, the modern airport – with its mix of restaurants, airline clubs, retail and services – will likely be the model for recharging centers. Because of this we could see EV charging become free or discounted by retailers based on membership programs of the amount you spend with the host. Large retailers that are able to operate microgrids and manage electricity costs may give charging away for free to customers or loyalty program members similar to how the major hotel chains currently offer free WiFi.

10. Oil Companies Become Electricity Producers: The world will still need oil for many decades to come, but it is possible that we will reach peak oil in the next decade, especially if the transition to EVs in China and India can outpace the growth of the emerging middle class buying ICE vehicles. Oil companies have already begun their transition with acquisitions of EV charging companies, battery technologies and wind and solar power companies.

As the transition to electric vehicles gains momentum in the next 5 years and the cost of solar and wind energy continues to decrease, oil companies with their huge cash war chests will make significant investments in these fields, while simultaneously riding the oil wave as long as they can.

In the US the major oil companies pretty much exited the retail gas station business – a decision that may come back to haunt them. Because they own very few gas stations, the major oil companies don’t control their destiny in how gas stations evolve into recharging centers in the future. It is a challenge experienced by fast food companies in the US which are prohibited by franchise laws from forcing franchisees to add expensive new food equipment when launching new food items.

On the flip side, however, the major oil companies with all of their billions of dollars in cash could tap into the major retailers (CostCo, Walmart, 7-11, etc) and independent station/convenience store operators to open new branded recharging centers.

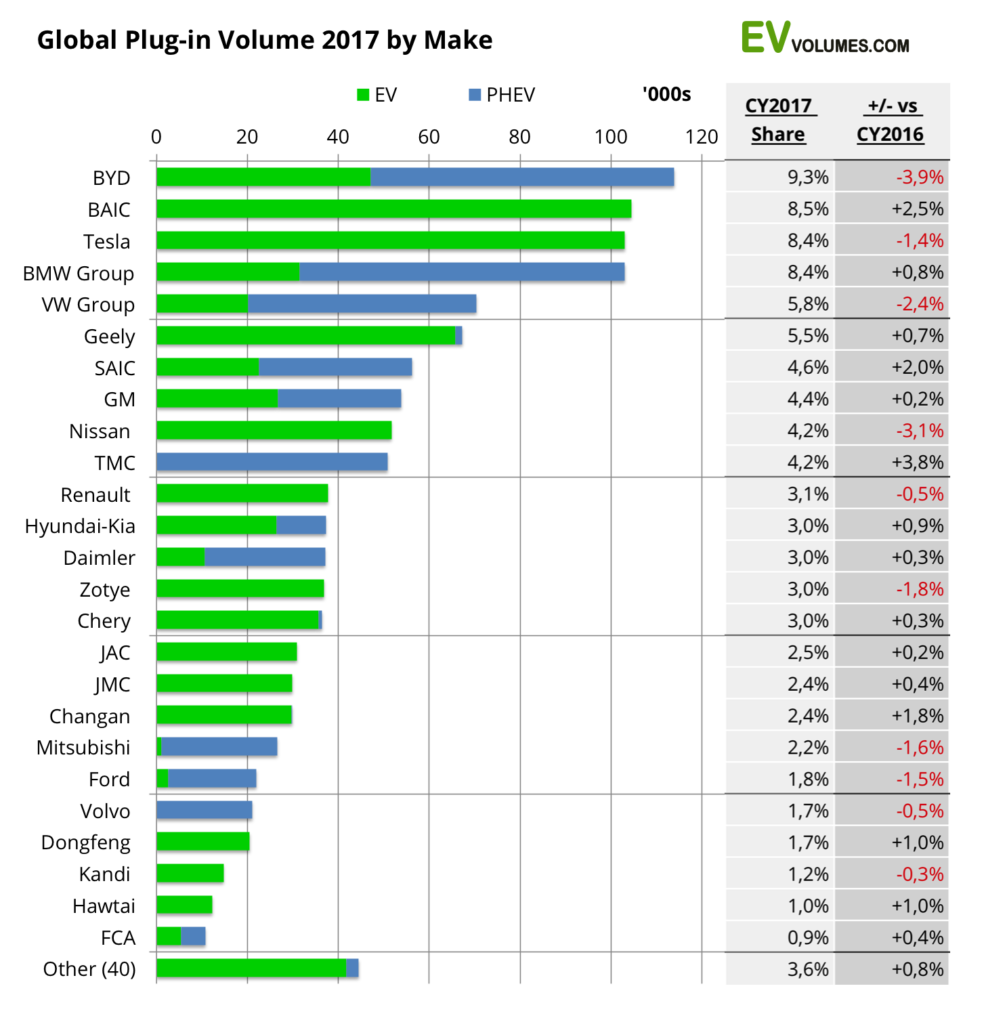

11. Chinese Companies Become Dominant Global Automakers: The Chinese government has gone all in on electric vehicles for three key reasons:

- Chinese cities are extremely polluted and the air is so bad that it is the cause of death of 1.6 million Chinese citizens each year, according to analysis by Berkeley Earth.

- The country has a very fast-growing middle-class population that is for the first time buying many modern conveniences such as cars. If China doesn’t transition to clean energy and electric vehicles these new consumers will outpace EV purchases with ICE vehicles and pollution will get even worse in the country.

- Finally, China is now the largest market for automobiles in the world and the government wants to seize this opportunity to become the largest supplier of electric cars, buses and trucks not just domestically, but throughout the world. It is a market opportunity for Chinese companies that is perhaps as much as 100 times larger than that of computers and smartphones.

Currently there are only a couple of Chinese made cars available in the US, including the Buick Envision, Cadillac CT6 Plug-in Hybrid (GM will stop importing this model in 2019), and Volvo S60 Inscription. With almost all automakers building new electric models for the Chinese market, expect many of these to be exported to markets around the world. The current growth in nationalism and global trade wars will, however, have an impact on China’s ability to export EVs in significant volumes in the coming years.

Warren Buffett-backed Chinese manufacturer BYD is already a strong player in producing electric buses in the US and around the world. This foothold could open the doors for the company to also increasingly bring its electric cars and trucks to the US and other countries outside China. Additionally, there are several auto manufacturing startups in the US that are majority owned by Chinese companies or investors.

And though it took more than a decade for both Japanese and South Korean automakers to improve the quality of their cars and to start grabbing significant market share from American and German automakers, Chinese automakers will likely be able to win the hearts and minds of car buyers within 5 to 7 years of entering US and European markets. Though it is unclear what trade policies will be in place in the future in the US, European Union and elsewhere it’s possible that Chinese automakers will be able to compete aggressively especially on the lower end of the auto market.

Chinese companies will likely speed up their success and entrance into global markets via acquisitions or mergers with automakers such as Fiat Chrysler, Mazda and Subaru and others. And we could also see a shift in the power of brands in the domestic markets such as with Buick which is a popular brand in China, with GM importing Chinese-made electric Buicks back into the US.

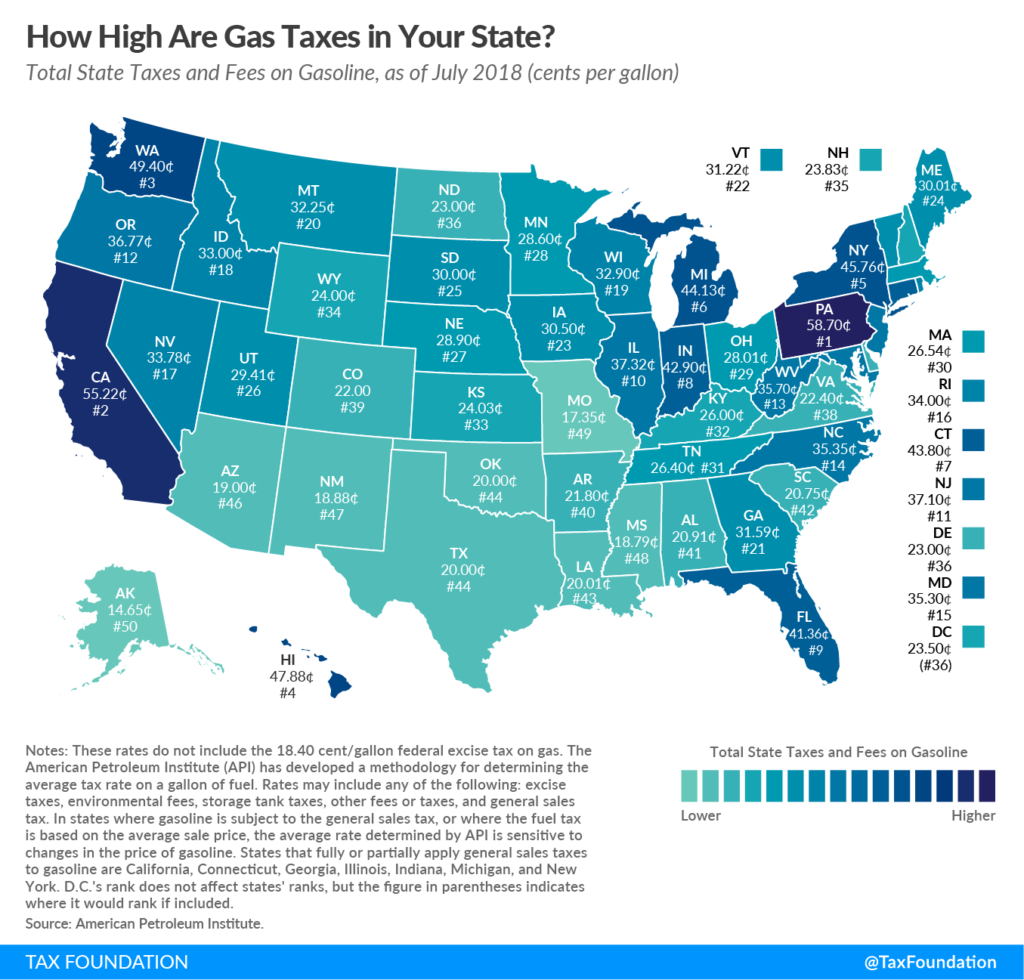

12. From Gas Taxes to Vehicle Fees: The per gallon or liter tax to generate revenue for governments to build out road and bridge infrastructure has been a relatively straightforward calculation and approach, including in the US for a century. The more you drove (the greater impact a driver had on roads and bridges) the more you paid in gas taxes because you burned more gasoline/diesel. This was a simple and equitable model – the more gas you use in theory the more you benefited from the taxes.

As the world transitions to electric vehicles, new methods to raise revenue for transportation infrastructure will be necessary. There are many ideas about how to pay for roads and bridges in the future and politicians are recommending a variety of approaches with no single idea yet winning favor.

Ideas include everything from vehicle miles traveled taxes (VMTT) collected via tracking devices, tire taxes, increased vehicle registration fees, property tax fees, to electricity surtaxes. Regardless of what model(s) wins out, the per gallon/liter gas tax is on the way out.

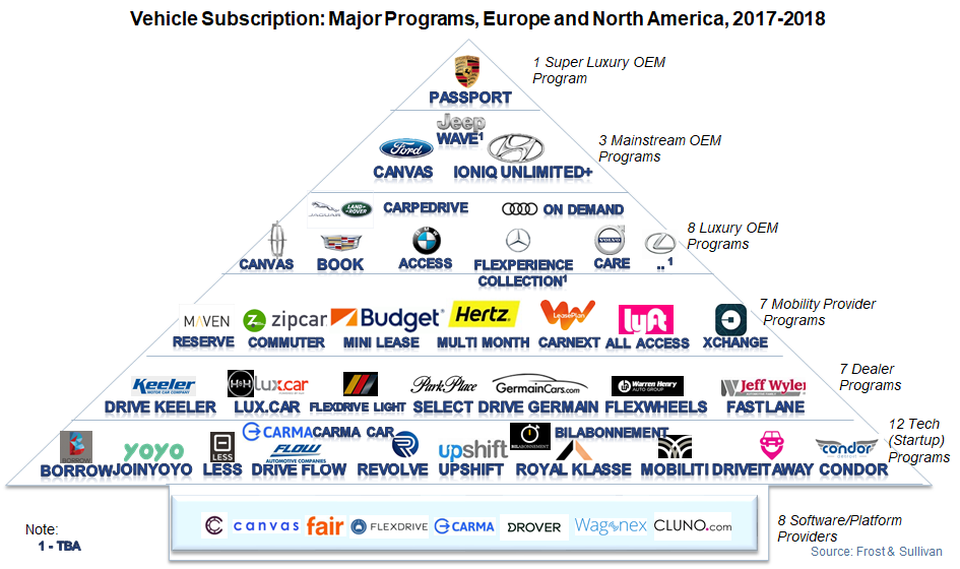

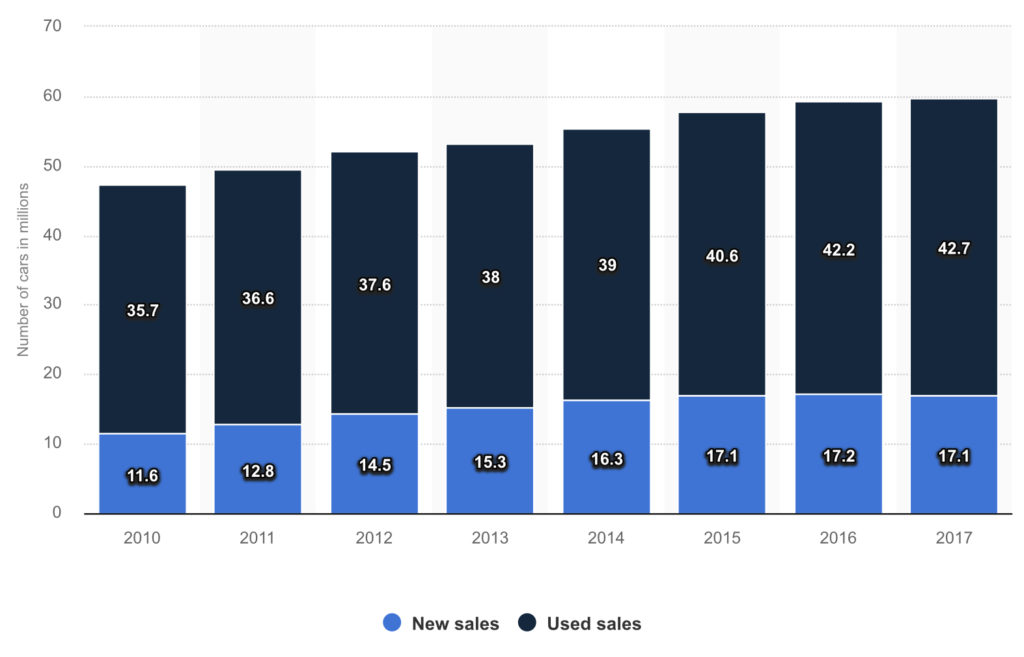

13. Shift to Leasing, Subscription Models and Growth in the Used Car Market: With significant increases in battery range, fast-charging capability, V2G functionality, and new autopilot hardware every few years many consumers will trade up to new cars every few years (similar to smartphone upgrades as I pointed out in Technology Obsolescence: The Auto Industry’s Lurking Challenge). By upgrading every 2-4 years, consumers will look to shift the car value risk to the auto finance companies, while paying for the benefit of increased flexibility and the latest and greatest features.

In the US approximately 70% of all new vehicles are purchased versus 30% being leased. However, 80% (according to Bloomberg New Energy Finance) of all BEVs (except Tesla which does not disclose lease versus buy numbers) are currently leased. We may also see a significant shift to the subscription model for cars instead of buying or leasing – especially among the luxury car makers whose customers can more easily afford the premium cost of this approach.

The shift to subscriptions and leasing rather than buying EVs means there will be more frequent turnover of cars and value-oriented buyers will be able to buy used EVs at significant discounts. And because buyers can get 3 year-old vehicles with advanced technologies and features at significantly reduced prices, we may say an even higher percentage of consumers opting for used vehicles over new.

Underpinning this potential further increase in used car sales is the growing awareness by consumers that electric vehicles have fewer moving parts and will require less maintenance and replacement parts as the vehicles age. The one rub and unknown will be how the fear of needing to replace older battery packs after perhaps 8–10 years affects consumers’ appetite for used EVs. A net result may be a trend of consumers buying 3 year-old lease returns, driving them for 3–4 years, selling, and then buying another used EV.

14. Electrification of Fleets: Medium and heavy-duty trucks in the US account for nearly one-fourth (23%) of greenhouse gas emissions from the transportation sector and the vast majority of these vehicles are owned by fleet operators. Because electric vehicles have a lower total cost of ownership (TCO) than traditional ICE vehicles they are especially attractive to fleet operators tasked with managing vehicle operation costs.

A fast-growing segment are electric buses including from companies such as Yutong, BYD, Proterra and Volvo, which are seeing strong sales because of a combination of zero emissions and lower TCO over their lifetime of operation. The global electric bus market size is estimated to be valued at over $35 billion in 2018 and global unit sales (excluding China) will register a impressive 26.1% CAGR between 2018 and 2028, according to market research firm Bekryl.

Another hot and growing segment is that of delivery vans, with companies such as Daimler, Chanje, Workhorse, Nissan and others bringing electric vans to market. Semi trucks have received a lot of press because of new players such as the planned entrance of Tesla and Thor Trucks into the market, but established players such as Volvo, Daimler and others are moving quickly.

When robotaxis and and other autonomous vehicles grow in market viability and acceptance in the future, ownership of ride-sharing vehicles will likely shift from individuals to large fleet owners who will predominantly favor electric vehicles.

15. Batteries Underpin the Shift to Multimodal Transportation: A key to better transportation is improving the quality and convenience of public transportation. But a challenge in many regions of the world is the first and last mile – getting commuters conveniently to and from transit stations.

The last few years has seen explosive growth in ride sharing service such as Uber and Lyft, electric scooter and bike/ebike services from Bird, Lime, Skip, Scoot, Jump (acquired by Uber) and microtransit offerings like Ford’s Chariot. Escooters are obviously all powered by batteries, however bike services, ride sharing and microtransit vehicles are currently a mix of human, gas and battery powered.

Many of the companies operating in these spaces have yet to figure out business models or are experiencing huge financial losses in these nascent markets, however the continuous decline in battery costs and build out in charging infrastructure will be fundamental to the future success of these companies and their ability to turn a profit.

What do you think of these 15 shifts? What did I miss or do you think I got wrong? Post a comment with your thoughts.

5 Responses

I think, unfortunately, you are absolutely correct about taxes will shift towards VMTT. The better option would be for government to decide on a fixed total income for gasoline taxes and then increase them as consumption decrease. This would accelerate the shift towards electric and the last gallon consumed would be awfully expensive:-)

I also think you present some exiting business opportunities for gas stations and utility companies that are hit by pv and battery technology. I hope they see them and charge on.

However, I do not believe in ride sharing other than small groups in large cities. If you have a fairly recurrent need for a vehicle you will buy or lease it rather than subscribe with others. Car companies has the last decades also made us believe that you are what you drive, so car sharing would go against that.

Other than #2 most of these trends are correct. By 2020-2021 most countries including the US will require EVs to emit some sort of artificial noise as a safety feature. I’ve crept up on a lot of people walking in the middle of the street not realizing I’m right behind them driving an EV. Pedestrians will also have to be better at gauging how fast EVs can “accelerate” and come to a full stop.

Thanks for writing the article. Not sure but I would guess that you are probably in California. Had to say it but it seems that you are as dillusional as your governor. I have worked and continue to work at battery plant in TN for Nissan/AESC. The infrastructure for and required development for your 15-20 minute stop to get the required battery recharge is several years away at the earliest. Works in China where the government will spend the equivalent of billions for charging stations and this transition to EV’s, which will still take several years to happen there. EV’sl probably won’t equal the number of ICE vehicles being used in the United States in my life time. Somebody has to pay for it, and it’s not like electricity generation today is anywhere near greenhouse gas generation free. In terms of energy value, nuclear is the only was to generate energy that is better or anywhere even close to that of petroleum. Mike Rinehart – Chemical Engineer

I never hear anyone address the issue of what happens to the price of the petrochemicals used to make plastics and other chemical

products. If we continue to refine enough crude to supply the needs for these other by-products, what will we do with the 45-46% that is now our gasoline? Seems to me that ultimately we will find that as the polluting diesel trucks are converted to electric either the cost of plastics and other petrochemical products will increase as the refineries produce less and the overall economic gains for the consumer will just evaporate. If we keep the refineries running to meet the petrochemical feedstock needs, what will we do with all the gasoline produced? Seems like we either need to develop a use for a lot of gasoline or let the price of gasoline fall to a low enough price that IC vehicles are competitive with EVs and let the market determine the value of lower pollution levels. Obviously the best solution is finding a productive non-polluting use for the gasoline or find an economical way to produce benzene and other base chemicals other than from crude oil. I do not hear anyone finding either. Are we just replacing one problem (pollution) with a lot of other problems?

I agree with Ester, no doubt there is a need for artificial sounds for EVs and there is also a need for everyone to realize how quickly EVs can now accelerate. Prius has us thinking EVs are turtles.

The other comment I have is coming from Illinois where I will pay an extra $100 on the license fee while on the other hand I’m one of the customers just voted to bail out nuclear power stations.