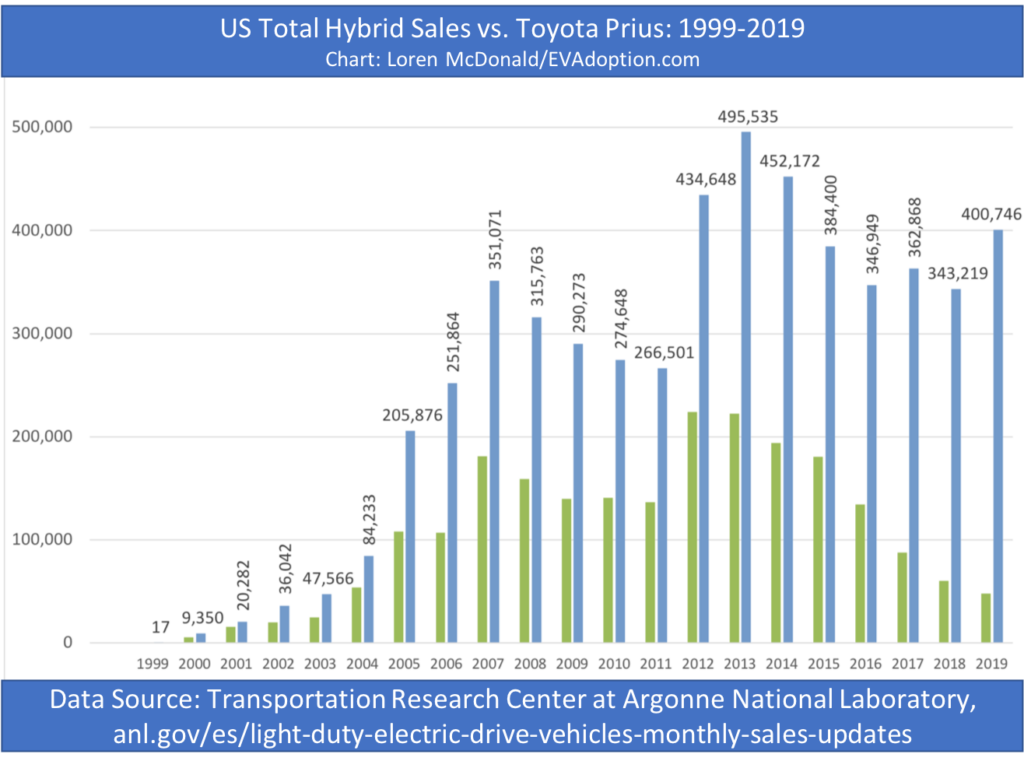

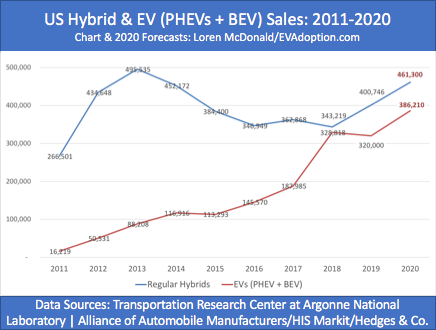

After a general downward trend in sales since the all-time high in 2013, regular gas hybrids are making a strong comeback in the US. In 2018, hybrid sales reached their lowest level in the US since 2011, but bounced back in 2019 reaching the highest level of sales since 2014.

The iconic Toyota Prius hybrid has seen sliding sales since 2012 and sales in 2019 were its lowest since 2003. As I recently wrote in Will the Toyota RAV4 Prime PHEV Become the “New Prius”?, it’s mistaken to assess hybrid sales trends based on the significant decline in sales of the once popular Prius.

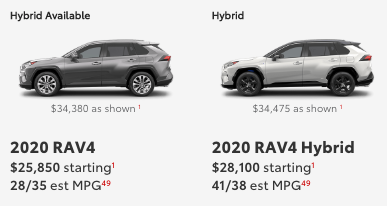

Sales of regular hybrids in fact should continue to increase for at least the next few years as more hybrids become available and the cost delta between hybrid and regular gas power trains for popular sedans, SUVs and crossovers continues to decline.

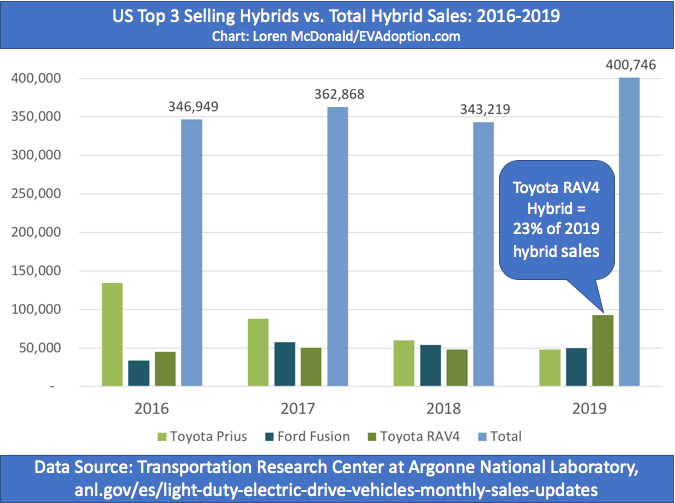

With the Toyota RAV4 Hybrid selling 92,525 units in 2019, the overall number 4 selling vehicle in the US also accounted for 23% (nearly 1/4) of all US hybrid sales.

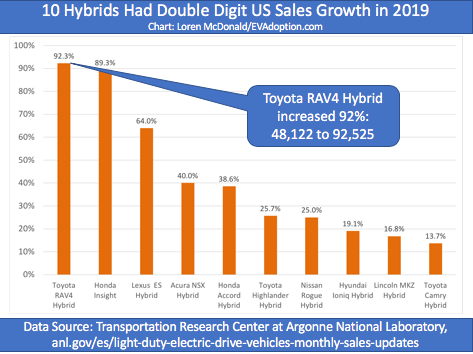

Additionally, out of 30 available hybrids in the US, 10 of them saw double-digit growth in 2019 over 2018. The RAV4 Hybrid saw an impressive 93% YOY increase in sales, but the Honda Insight (a hybrid-only model with 55/49 highway/city MPG rating) also saw an impressive increase of 89%. And the popular Honda Accord had nearly a 39% increase for its hybrid version.

And two new hybrids were introduced in 2019, the Toyota Corolla Hybrid and Lexus UX Hybrid, which combined added nearly an additional 25,000 new hybrid sales. While overall sales of the Corolla have declined from 360,000 in 2016 to 222,000 in 2019, 2020 could see significant growth in Corolla Hybrid sales to perhaps 20% of model sales or about 40,000 units. This would most likely put the Corolla Hybrid well past the Prius Hybrid in US sales.

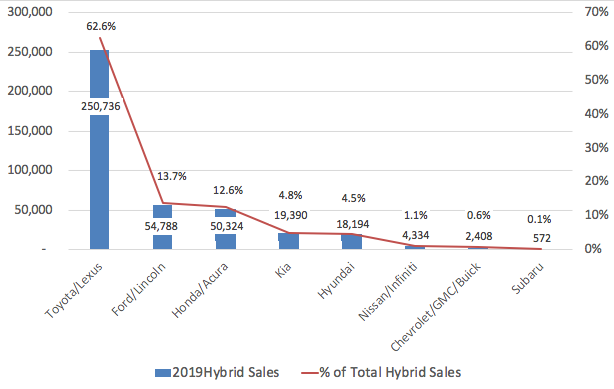

Toyota and Lexus combined account for an impressive near 63% share of hybrid sales in the US. With the Escape and Explorer hybrids coming in 2020 and a rumored F150 hybrid in 2021, Ford should easily hold onto its distant second place for US hybrid sales.

New Hybrids For 2020

Key to the hybrid sales rebound will be the continued growth in sales of models like the Toyota RAV4, Corolla and Lexus UX and the introduction of a few key new models in 2020:

- Ford Escape

- Jeep Wrangler

- Ford Explorer

2020 Ford Escape Hybrid | Image: Ford.com

Diverging Automaker Electrification Strategies

Among automakers there’s an emerging split in the role of regular hybrids in their vehicle electrification plans. Japanese automakers, especially Toyota and to a lesser extent Honda, along with Ford, FCA (Jeep), and Kia/Hyundai plan to continue to invest in new regular hybrid models for at least a few more years.

On the opposite end of the spectrum Volkswagen and General Motors both have said they have no plans to invest in hybrids or plug-in hybrids and that all new alternative power trains will be fully electric BEVs. So the question remains, what role will regular hybrids play in the transition to fully electric vehicles?

Regular Hybrids: A Mixed Bag for EV Sales

This likely resurgence in US sales of hybrids for the next few years is somewhat of a mixed bag for those that would like to see quicker adoption of EVs.

On the positive side, anything that gets American consumers into vehicles with better gas mileage in the short term through a power train that operates part of the time on an electric hybrid motor is a good thing to help reduce emissions, reliance on oil, and in reducing air pollution. The other positive is that while there isn’t a plug with regular hybrids, getting Americans into even a regular hybrid warms them up to the idea of potentially buying or leasing either a plug-in hybrid or fully electric car for their next one or two car purchases.

On the negative side, a reasonable percentage of these consumers that opt for a regular hybrid may do so instead of buying or leasing plug-in hybrid or BEV.

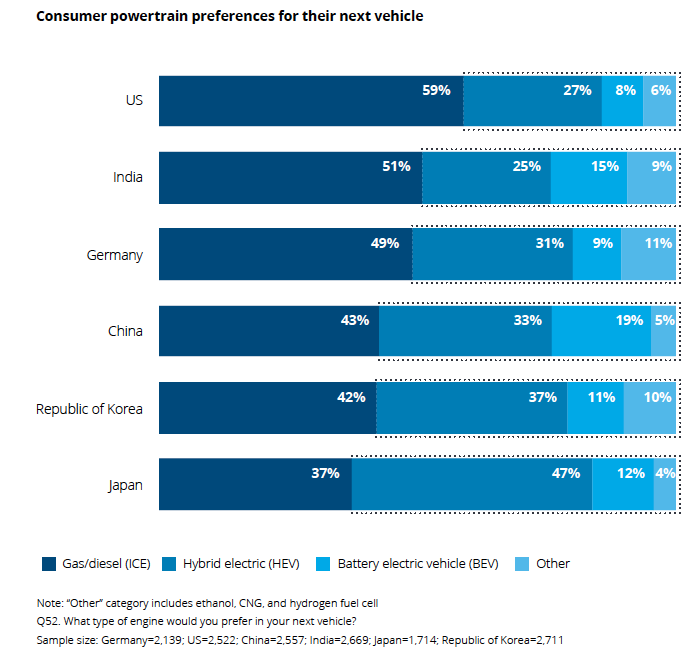

A recent study by the consulting firm Deloitte found that 27% of U.S. consumers would prefer a hybrid for their next vehicle, versus just 8% for a BEV. With several of the regular hybrids getting 40-50 MPG and with gas prices remaining relatively low in most of the US, hybrids will likely continue to be a popular choice for many American car buyers.

So How Will Hybrids Impact EV Sales?

Will a resurgence in hybrids negatively impact EV sales in the US? It’s impossible to know for sure of course, but I think it’s very likely that with the growth in hybrids – especially with models like the RAV4, Corolla, Escape, Explorer and others – we could potentially see 25,000 to 50,000 new US vehicle buyers in 2020 and 2021 decide to opt for a regular hybrid when they were also considering an EV.

While that doesn’t sound like a lot of vehicles, that volume equates to potentially more than 10% of EV sales in the US. In my forecast chart above, hybrid sales would increase about 15% or 60,000 units in 2020 versus 66,000 vehicles and 20.7% for EVs.

The bigger concern is that if more American consumers buy regular hybrids from automakers like Toyota, Lexus, Honda, Ford, Kia, and Hyundai, this success reduces the sense of urgency from those auto makers to embrace a greater investment in the production of fully electric BEVs.

That being said, I’d rather have more people driving a hybrid with 45-50 MPG than a regular gas-powered vehicle that gets 25-30 miles MPG. Regardless of what happens in 2020, the combined sales total of low emission vehicles should see solid growth in 2020.

3 Responses

Statistical analysis in this matter is difficult. The sales of these hybrids and EV’s are so small, it doesn’t take much for one “popular” model line to knock an attempt to look at the “big picture” out of whack.

If the number of new 2020 Hybrid models is going to increase vs. the number of new EV’s? Then the hybrids might “win”….whatever that means.

I suggest that the US/EU is in the midst of a classic adoption curve and, this adoption is EV’s, not hybrids. I know I’m safe on the EU side of my prediction as EU governments are getting ready to ban the sale of any “new” vehicle that features motor fuel.

The California Air Resources Board is “happy” with emissions reductions of any kind, but, a gallon of unleaded being burnt in a hybrid is what they are legislating the end of.

That Rav 4 looks fantastic and if you try and drive it in an ZEV zone? It will get the same ticket any gas car will get….and car buyers know this.

At this point non-plug-in hybrids or PHEVs with less than ~35 miles of electric range don’t make that much sense.

Reasonably-priced PHEVs with more than ~35 mi. elec. range however are a different story because they provide all-electric propulsion covering the average two-way commute distance in the USA. As such they offer all-electric operation most of the time, and for most folks this probably means a 75% or more overall reduction in the consumption of gasoline, plus eligibility for most of the electric vehicle tax credit. These kind of vehicles may become very popular if enough of them can be produced (Toyota seems to be having some issues brining the RAV4 Prime to market).

Absolutely agree re the 35 mile range. Yes, the Toyota ‘silence’ on RAV4 Prime is deafening! Have you any references on their ‘issues’?