To date, no EV – either plugin hybrid (PHEV) and battery electric (BEV) – has come anywhere close to breaking into the top 25 sales chart for autos in the US. The 5,850 estimated units of the Tesla Model S sold in December of 2016, would rank 75th in the month of June 2017.

This is significant for many reasons, but fundamentally it is about the math. For EVs to reach mass adoption, at least a few models will need to start selling in significant volumes and break into or come close to the top 25 sales ranking.

Top 25 US Auto Sales – By Model (Through June 2017)

Estimated Launch Year |

|||||||

|---|---|---|---|---|---|---|---|

| 1 | Ford F-Series | 77,895 | 9.80% | Pickup | No | Hybrid | 2020 |

| 2 | Chevrolet Silverado | 50,515 | 1.70% | Pickup | No | No | NA |

| 3 | Ram P/U | 43,073 | 5.00% | Pickup | No | No | NA |

| 4 | Toyota RAV4 | 34,120 | 24.70% | Small CUV/SUV | Hybrid | No | NA |

| 5 | Nissan Rogue | 32,533 | 18.60% | Small CUV/SUV | Hybrid | No | NA |

| 6 | Toyota Corolla | 31,051 | -4.50% | Small sedan | No | No | NA |

| 7 | Honda Civic | 30,909 | -2.80% | Mid-sized sedan | Hybrid | No | NA |

| 8 | Honda Accord | 29,791 | 3.40% | Mid-sized sedan | Hybrid | No | NA |

| 9 | Toyota Camry | 29,463 | -9.50% | Mid-sized sedan | Hybrid | No | NA |

| 10 | Chevrolet Equinox | 29,182 | 49.00% | SUV | No | No | NA |

| 11 | Honda CR-V | 28,342 | -4.30% | Small crossover | No | Hybrid | 2018 |

| 12 | Nissan Altima | 28,042 | -8.00% | Mid-sized sedan | No | No | NA |

| 13 | Ford Escape | 27,151 | -6.40% | Small SUV | No | No | NA |

| 14 | Ford Explorer | 24,285 | 19.30% | Mid-sized SUV | No | No | NA |

| 15 | Nissan Sentra | 22,534 | 8.70% | Mid-sized sedan | No | No | NA |

| 16 | Jeep Grand Cherokee | 20,176 | 21.00% | SUV | No | No | NA |

| 17 | Jeep Wrangler | 18,839 | -6.00% | Small SUV | No | No | NA |

| 18 | Ford Fusion | 18,139 | -31.60% | Large sedan | Hybrid, PHEV | No | NA |

| 19 | Toyota Highlander | 17,237 | 28.30% | Mid-sized SUV | Hybrid | No | NA |

| 20 | Toyota Tacoma | 16,443 | 4.00% | Pickup | No | No | NA |

| 21 | Ford Focus | 15,575 | -20.10% | Hatchback | BEV | No | NA |

| 22 | GMC Sierra | 15,473 | -8.30% | Pickup | No | No | NA |

| 23 | Subaru Forester | 15,440 | 28.40% | Small SUV | No | No | NA |

| 24 | Subaru Outback | 14,019 | 4.50% | Small SUV | No | Hybrid | 2018 |

| 25 | Ford Edge | 13,411 | 20.00% | Crossover | No | No | NA |

| Total | 683,638 | 144.90% | 8 | 3 |

In the month of June 2017, the top 25 selling vehicles in the US accounted for 46.5% of all autos sold. Using the 287 cars tracked by GoodCarBadCar.net, that means that the top 25 comprise only 8.7% of available vehicles, but sell more than 5 times that.

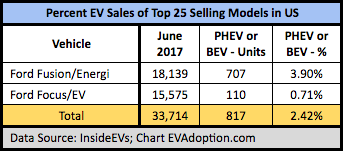

Within the top 25, there is not a single stand alone PHEV or BEV, but two vehicles – the Ford Fusion Energi (PHEV) and Ford Focus BEV – are available as EV versions of the regular internal combustion engine (ICE) models.

However their sales numbers are rather tiny, comprising only 3.9% for the Fusion and 0.7% of total Focus sales. In fairness to Ford, the Energi sales numbers are actually respectable considering the PHEV competes with about a dozen combinations of the Fusion in ICE and regular hybrid options. Further, the 3.9% is well ahead of the overall EV sales as a percent of total auto sales of 1.17%.

On the downside, those two Ford EV models only comprise 0.06% of the top 25 models sold in June. We have a long way to go.

Is the Future of EVs New Models or Modified Versions of Existing Models/Platforms?

In EV discussion forums I often see strong debate around whether future EVs from the incumbent auto manufacturers will be new from the ground-up models, or updated platforms of existing models. I think we will see a combination of both approaches, with most PHEVs being modified platforms of existing models and most BEVs being built new from the ground up.

If we take a look at several of the current crop of EVs, we see a mixed bag approach:

- BMW i3 (new model)

- BMW 3303, 530e, X5 XDrive 40e, 740e (PHEV versions of ICE models)

- Chevrolet Bolt (new model/platform)

- Chevrolet Volt (based on Chevrolet Cruze ICE platform)

- Ford Fusion Energi (PHEV version of ICE model)

- Ford Focus EV (BEV version of ICE model)

- Kia Soul EV (BEV version of ICE model

- Fiat 500e (BEV version of ICE model)

- Hyundai Ioniq PHV, Electric (new platform)

- Hyundai Sonata PHV (PHEV versions of ICE model)

- Mercedes-Benz B250e (BEV version of ICE model)

- Mercedes S550e, C350e, GLE550e (PHEV versions of ICE models)

- Nissan LEAF (new model/platform)

- Porsche Cayenne S-E, Panamera S-E (PHEV versions of ICE models)

- Toyota Prius Prime (PHEV version of hybrid model/platform)

- Volvo SC-90 (PHEV versions of ICE model)

- VW eGolf (BEV version of ICE model)

If we peer into the crystal ball of future EVs, however, it seems that only a handful out of more than 50 announced EVs (data coming soon) from the major incumbent manufacturers will PHEV or BEV versions of existing models. However, there is an asterisk to this point. Most of the future EVs that have been announced or teased, are from manufacturers that don’t have a single vehicle on the list of top 25.

The auto companies with big plans for new EVs tend to be the European luxury/performance brands or Chinese companies that may enter the US in the next 5-7 years.

But six huge car companies – Ford, GM, FCA, Honda, Toyota and Nissan – produce 23 out of the top 25 selling autos. The outlier being Suburu with numbers 23 and 24. None of these companies, however, have actually announced any significant plans for new EVs in the coming 5 years. (Note: If you say “What about Ford?” They’ve announced 1 non-commerical SUV BEV maybe in 2020 and regular hybrid versions of the F-150 and Mustang.)

So realistically, for the next 5 years we are likely to see a significant battle (especially among luxury brands) for EV sales among the 50-100 top-selling cars. The Tesla Model 3 has the best shot at being the first EV (of any kind) to break into the top 25 – perhaps as soon as Q1 of 2018 if the company can achieve its production goals. But Tesla’s crossover cousin, the Model Y, will likely be the first EV to stay in and climb up the top 25 ranking on a consistent basis beginning about 2021 or so.

Related blog posts:

- Bolt Surpasses Prius Prime Sales in June; EV Sales Up 38% YTD Over 2016

- The ‘Light Truck’ Factor in EV Supply and Adoption

- US Tops 1% for EV Sales; California Edges Toward 5%

- US Big 3 Auto: EVs Today and Tomorrow

- “CARMA”: An EV Adoption Framework for U.S. Auto Buyers

Related EV sales and market share data pages:

- EV Sales

- EV Market Shave – US

- EV Market Share – By State

- EV Market Share – California

- Available BEVs

- Available PHEVs