How The Federal EV Tax Credit Amount is Calculated for Each EV

How The Federal EV Tax Credit Amount is Calculated for Each EV Have you ever wondered how the IRS determines the credit amount assigned to

How The Federal EV Tax Credit Amount is Calculated for Each EV Have you ever wondered how the IRS determines the credit amount assigned to

The survival of the Federal electric vehicle (EV) tax credit is a good thing for the auto industry and consumers, but several flaws in its

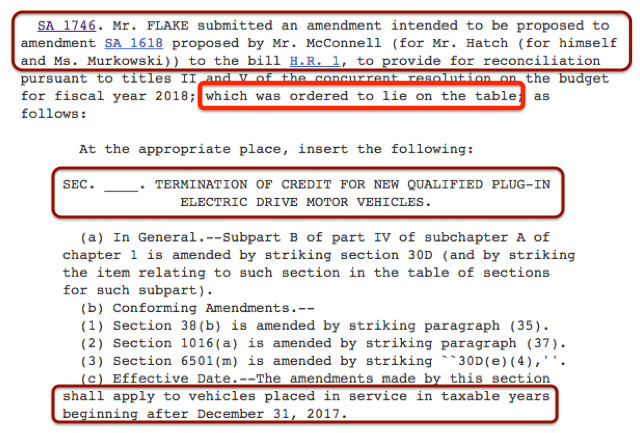

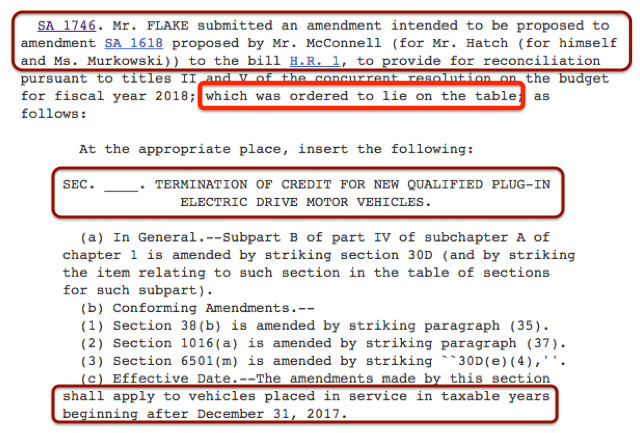

Up until this morning, there was still strong hope that Congress would not eliminate the Federal electric vehicle tax credit, but a late amendment puts

The House of Representatives tax plan would end the Federal electric vehicle (EV) tax credit while the Senate version of the tax plan announced on

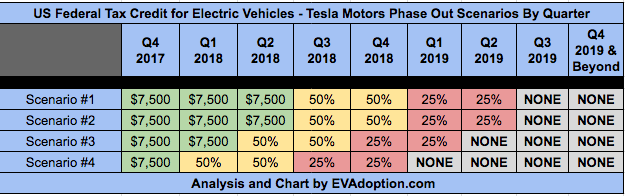

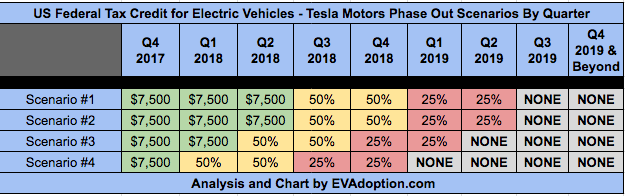

When will the US Federal electric vehicle (EV) tax credit begin to phase out for a specific manufacturer? This is a question that many consumers,

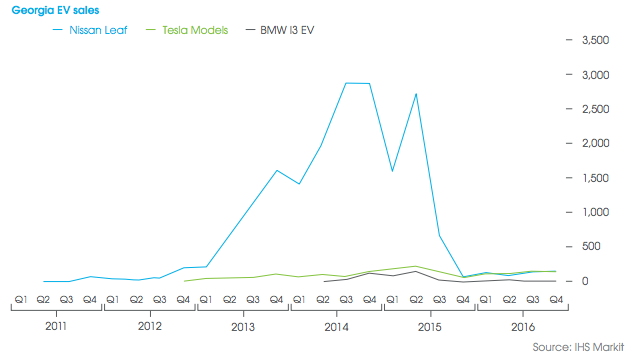

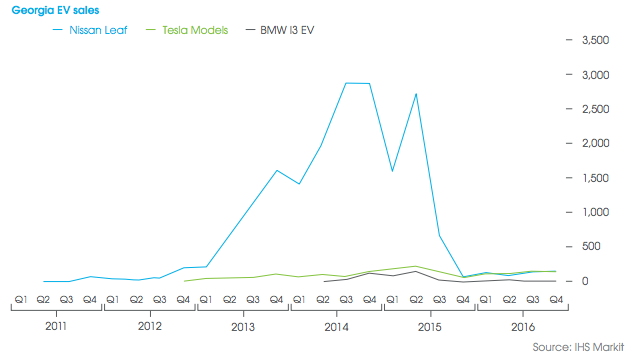

Consumers, analysts, electric vehicle advocates, lawmakers and others are all curious about what will happen to the growth in EV sales when the US Federal

One of the most frequent questions you see these days in electric vehicle forums, blog comments and Facebook groups is some variation of the following:

While many people are applauding the proposed revisions to the federal EV tax credit (IRC 30D) included in the Inflation Reduction Act of 2022 (IRA)

Battery electric and plug-in hybrid vehicles purchased in or after 2010 may be eligible for the US federal income tax credit of up to $7,500.

“Without these (federal and state tax) credits, this (electric vehicle) market is likely to crash.” This is the prognostication in a new report from Edmunds,

How The Federal EV Tax Credit Amount is Calculated for Each EV Have you ever wondered how the IRS determines the credit amount assigned to

The survival of the Federal electric vehicle (EV) tax credit is a good thing for the auto industry and consumers, but several flaws in its

Up until this morning, there was still strong hope that Congress would not eliminate the Federal electric vehicle tax credit, but a late amendment puts

The House of Representatives tax plan would end the Federal electric vehicle (EV) tax credit while the Senate version of the tax plan announced on

When will the US Federal electric vehicle (EV) tax credit begin to phase out for a specific manufacturer? This is a question that many consumers,

Consumers, analysts, electric vehicle advocates, lawmakers and others are all curious about what will happen to the growth in EV sales when the US Federal

One of the most frequent questions you see these days in electric vehicle forums, blog comments and Facebook groups is some variation of the following:

While many people are applauding the proposed revisions to the federal EV tax credit (IRC 30D) included in the Inflation Reduction Act of 2022 (IRA)

Battery electric and plug-in hybrid vehicles purchased in or after 2010 may be eligible for the US federal income tax credit of up to $7,500.

“Without these (federal and state tax) credits, this (electric vehicle) market is likely to crash.” This is the prognostication in a new report from Edmunds,

© 2024 EVAdoption, LLC | All Rights Reserved.