Have you ever wondered how the IRS determines the credit amount assigned to each EV for the available Federal EV tax credit? And why is it that the Chevrolet Volt, a plug-in hybrid with 53 miles of electric range qualifies for the same $7,500 credit as for a Tesla with over 300 miles of range?

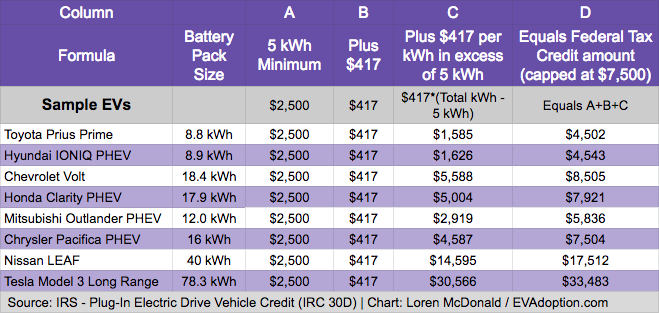

The answer is in a simple formula that the IRS uses that is based on the size of the battery pack. The formula is as follows:

To see the available tax credit amount for every EV in the US, visit this FuelEconomy.gov site. (see sample screenshot below)

© 2024 EVAdoption, LLC | All Rights Reserved.