3 Scenarios That Would Make An EV Ineligible For the Federal EV Tax Credit

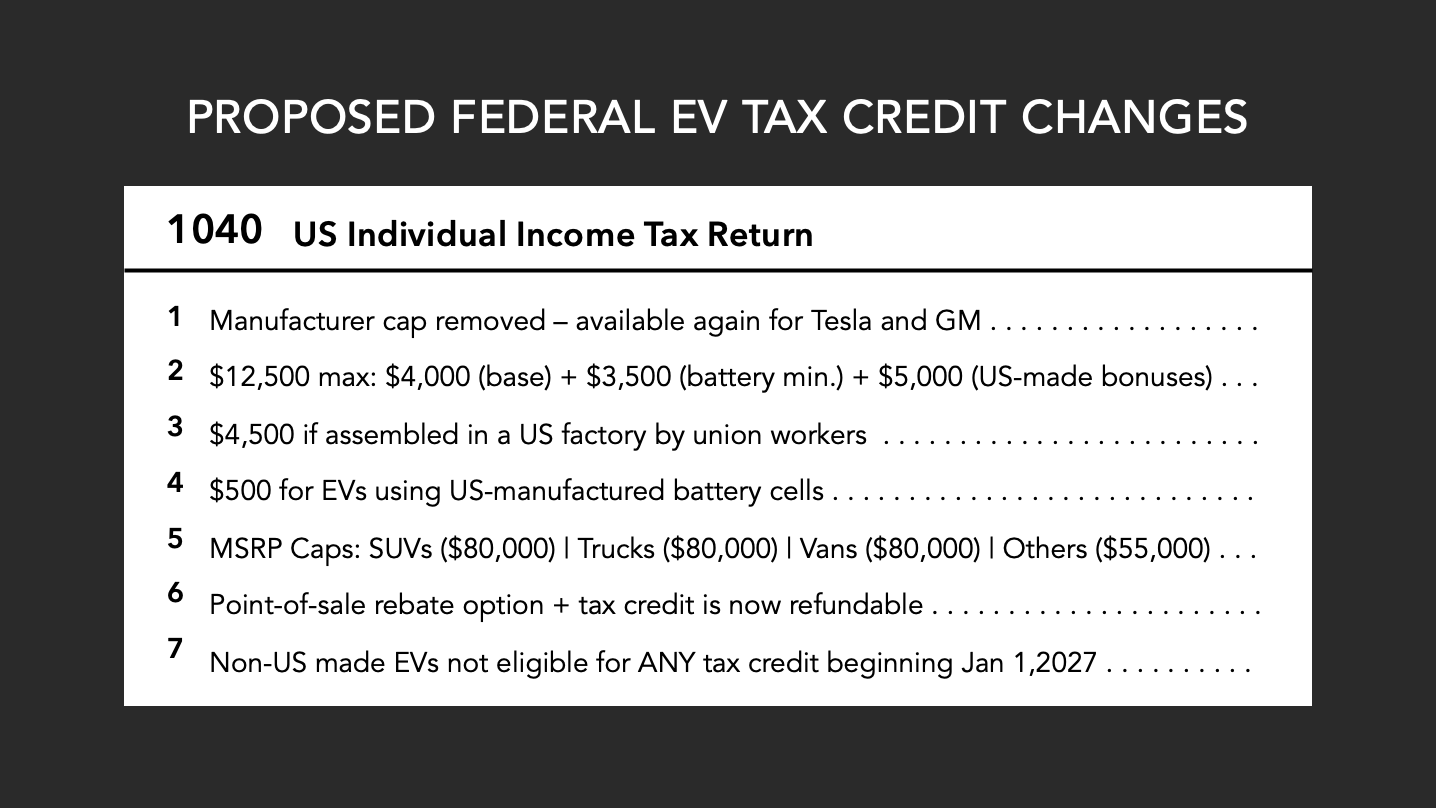

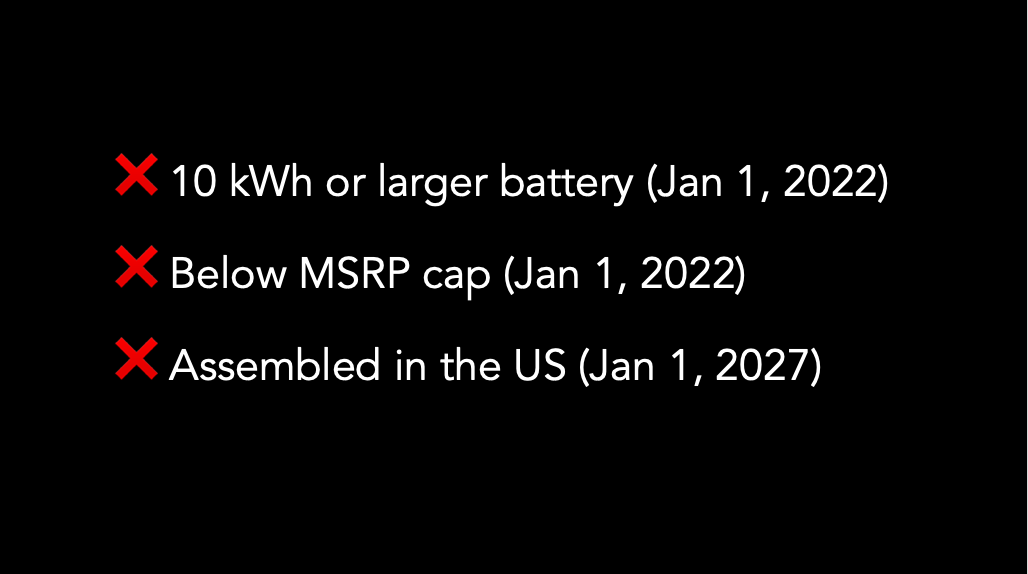

There are 3 scenarios that lead to an EV being completely disqualified from any available tax credit amount under the proposed tax credit changes in the bill passed by the US House of Representatives on November 20.