It’s time to tear up the Federal electric vehicle tax credit.

I’m probably going to upset a lot of electric vehicle associations, companies and advocates with this article series as I’m not going to tow the party line that the current Federal EV tax credit simply needs to be extended and/or tweaked. But so be it.

I believe what is needed is an entirely new incentive system that drives changes in the behavior of the automakers and leads to significant growth in EV sales across income distribution and throughout the US.

Federal EV Tax Credit Isn’t Working

To be clear, I’m not against an EV tax credit, I just don’t believe the current one is actually producing the desired effect. As such, changes in the form of tweaks and to just extend its current availability – is not the right answer.

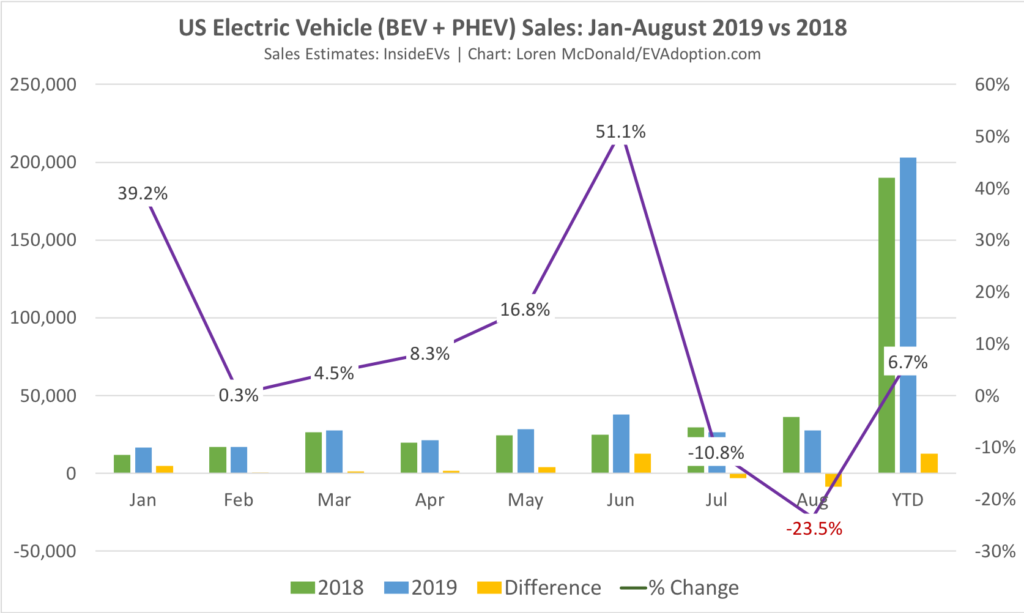

Sales of EVs in the US are stagnating, with current YOY sales for August declining an estimated ~24% and YTD YOY sales have increased only an estimated ~7%.

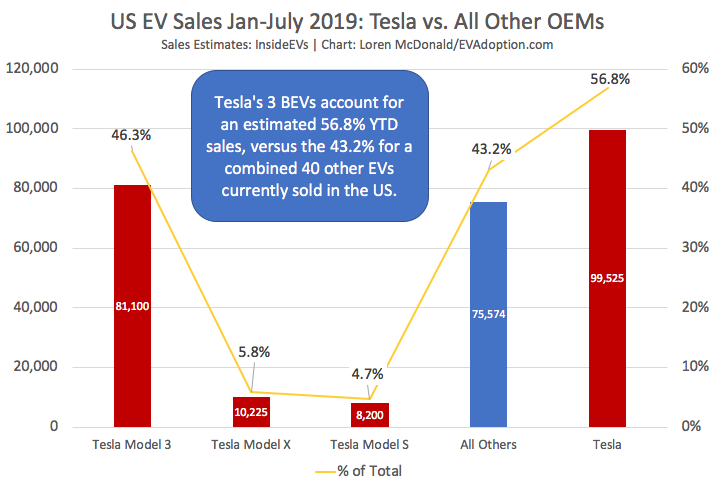

Further, more than 45% of all EVs are sold in a single state (California). And one automaker (Tesla) is approaching 60% of all EV sales in the US, with one of its models, the Tesla Model 3, responsible for 45+% of all PHEV and BEV sales in the US.

Supply, Not Demand Issue

As I wrote in “EV Adoption in the US: A Supply, Rather Than Demand Issue,” we have a supply issue more than a problem with demand. We simply don’t have enough of the right kind of EVs at the right price to meet the needs and wants of American car buyers. Many observers disagree with my view and argue that the EV sales challenge is in fact one of a lack of consumer demand.

But I see it differently. In 2004 when your choice of smartphones were basically devices like the Blackberry and Palm Treo, was the issue one of a lack of demand, or that the available smartphones did not yet have the right combination or features, value proposition, and affordability? In 2007, the Apple iPhone changed everything. In 2019, most electric vehicles are in essence at the Palm Treo stage.

Key Flaws of the Tax Credit

There are several flaws and problems with the current tax credit, officially known as Plug-In Electric Drive Vehicle Credit (IRC 30D). These include, but aren’t limited to:

- The 200,000 manufacturer threshold that penalizes early EV producers

- The complexity of the tax credit and delay of receiving the benefit

- The lack of income and price limits leading to an overweighting of upper income people benefiting when buying expensive luxury cars.

- But fundamentally, the tax credit simply isn’t working – or at least having a significant impact – or we wouldn’t be seeing the market trends I outlined earlier.

These and many other fundamental issues with the credit need to be fixed before pushing for an extension such as what’s outlined in the Driving America Forward Act (see below). Most of the proposed changes are tweaks that fix a few of the obvious flaws with the credit, but these fixes won’t actually do what the credit should do – which is to drive automakers to produce and make available (in large volumes) a variety of affordable, long-range EVs. This “supply” side factor is the best way to have incentives lead to a significant increase in EV sales.

The proposed revised legislation, known as the Driving America Forward Act, would do 3 main things:

- Increase the per manufacturer cap to 600,000

- Reduce the tax credit value for an additional 400,000 units (beyond the current 200,000) to $7,000 per vehicle (from the current 7,500)

- Extend the tax credit for hydrogen fuel cell electric vehicles for 10 years.

Ugh. Unfortunately, if this legislation passes, I believe it will do very little to drive sales growth of electric vehicles in the US. It will be several years before all but Tesla and GM (which have already surpassed 200,000 in EV sales) reach the 200,000 threshold that this revised legislation fundamentally is addressing.

So for the next several years, this revised tax credit only benefits two auto manufacturers – both of whom are already committed (at differing levels of course) to a future of electric vehicles. This is great news for GM and especially Tesla, but a large percentage of Tesla buyers would purchase or lease a Tesla even without the tax credit. Many Tesla buyers likely use the tax credit as a means to justify a more expensive model or version. Additionally, tax and utility rebates for EVs, like those in California, might have a more direct influence on someone buying an EV in those states.

Fundamentally, and from a purely practical perspective, for the next 2-3 years, this tax credit will just help sales of the Tesla Model 3 and Chevrolet Bolt – and then the Tesla Model Y, Model P and new EVs from GM.

Key Questions

When thinking about the current and any future version of tax credit or federal EV incentive program, there are several questions that should be considered, including:

- What are the fundamental goals of a tax credit or other federal incentive?

- Should it even be a credit versus a rebate or other approach?

- Should any US electric vehicle incentives be focused on consumers or rather the automakers and/or dealers?

- What is the best approach to drive automakers to fully embrace EVs?

- Is reducing the cost of EVs through an incentive even the best use of taxpayer dollars to increase EV sales?

- What type of limits around EV cost, buyer income level, range or battery size of EVs, etc need to be considered?

- Should any incentive even be limited to electric vehicles? (The proposed new regulation extends incentives for hydrogen fuel cell, but should regular hybrids, mild hybrids, etc also be included?)

- Should any type of incentives only be limited to new vehicles, or also include used EVs?

- How could any Federal EV incentives be designed so as to actually be welcomed and supported by conservatives and those groups which currently think it is a sham and complete waste of US taxpayer dollars? Or does bipartisanship even matter to help drive EV sales in a divided America?

- How should its effectiveness be measured?

What Are the Right Goals?

The above questions then lead to the larger question of: What are the right goals for an EV incentive system in the US? In this first article of a multi-part series, I will address the question of what are the right goals for a federal tax credit or more broadly, incentive system? Potential goals might include:

- The fundamental and overarching goal should be to reduce carbon emissions and pollution in the US from vehicles powered by fossil fuels.

- To drive the replacement of low efficiency, and higher polluting gas- and diesel-powered vehicles with low-emission vehicles.

- Encourage businesses to transition their fleets to low-emission vehicles quickly.

- Increase the number of longer range and affordable EVs available from automakers in the US. Both of which are critical to achieving mass adoption of EVs in the US.

- Increase affordability of EVs to lower-income households and improving EV infrastructure in disadvantaged communities.

- Increase sales in states and markets with historically low EV adoption rates.

- Increase the competitiveness of US automakers.

- Encourage utilities, businesses and consumers to adopt more clean-energy sources so as to lower electric vehicles total emissions impact.

- Encourage automakers and utilities to adopt vehicle-to-grid and vehicle-to-home/building capabilities to better manage peak demand on the grid.

- Increase the availability of EV charging, especially where charging availability is critical and currently less available (e.g., for long road trips and for renters/households without home access to their own charging stations).

- Increase jobs from electric vehicle manufacturing, battery production, and the buildout of EV charging infrastructure.

- Address how the US will fund road and bridge infrastructure as the growth in sales of electric vehicles reduces government revenue from declining gas tax collection.

In future articles I will explore in more detail the flaws of the current tax credit, why I believe it is failing, shortcomings of the currently proposed changes in the tax credit, and ideas on creating a more successful EV incentive system that also enjoys broader support from taxpayers and legislators.

Let me know in the comments if I’ve missed any key goals.

5 Responses

Good post, and I appreciate your position of taking a hard look at current policies.

I agree I’m not a fan of the proposed legislation, but I think it’ll be far more helpful for Tesla than you give them credit for. The margin squeeze must be enormous for them as they lose the credit. Just because they’re already committed as you say, doesn’t mean they’re not worthy of the credit, they need it to help them compete with other OEMs who can subsidize their BEV sales with ICE truck (25% tariff) sales.

I also think scrapping the federal tax credit at this point would be insanely unfair to Rivian, Bollinger, and any other pure-BEV startup – again because the legacy OEMs can continue subsidizing their BEV options with ICE sales.

If I was Congress, I’d continue the whole tax credit for all BEVs and fund it with an excise tax on luxury ICEs (similar to some European countries).

Thanks for the kind words and comments Charles. TO be clear, I’m not saying necessarily to end the credit, I just I think it isn’t having the impact that it should – which I think needs to driving the automakers to make more affordable, attractive, long-range EVs. 15 automakers who sell cars in the US currently do not offer a single EV. Many offer one 1, or maybe 2 – and then only make them available in low volumes in ZEV states. Price differential is a significant issue for consumers, but the bigger issue is that one a consumer walks into a Ford, Chevrolet or Toyota dealer and would like to buy a small or mid-sized crossover for $30-$35K and with ~300 miles of range – zero exist. Solving that problem is a fundamental change I would like to see in how the tax credit (incentives regulation) is structured.

Secondly, sure, extending the tax credit would indeed help Tesla, especially when the Model Y is launched. But creating tax incentives to primarily benefit a single company is not the right answer and in fact would do more broader harm than good as the credit would be accurately attacked as the “Driving Tesla Forward Act.”

So what is the goal? I would say it is saving the planet by cutting CO2. If that is true then burning the least fossil fuel for transportation is part of the solution.

modify the existing gas guzzler tax and set the target combined MPG at 30 for 2020 then up from there till 50 in 2040.

$1000 * ( 30 – EPA combined ) = tax or (tax credit) capped at $7,000. If tax credit make it carryover so middle income folks can use it all.

Base cars

f150 = 9000 tax

Rav4 = 0

Camry Hybrid = 7000 credit

honda civic 1.5 sedan = 3000 credit

Thanks Tony, I like where you are headed. To me one of the flaws ins the ZEV and CAFE standards is that it can be fudged through the portfolio average – sell some EVs, but then still sell a bunch of low MPG trucks. And with ZEV, you can be credits if you fall short.

To drive change with the OEMs, they should be penalized directly on producing low MPG vehicles – and there should be a higher minimum MPG for all vehicles you sell. And then use the penalty and tax revenue to offset the EV tax credits.

Thank you for all of your research and information. This is a great website! I think the 200k production for any manufacturer is not fair to them or the consumer. As with Tesla vehicles, they are geared to the upper income class for the most part. I appreciate your list of future arriving vehicles along with the prices, company names, battery ranges etc. I know some of those will change and adjust as time goes by. I have been spending countless hours viewing videos about startup EV’s and getting a feel for cost, range and styling. Also looking at charger infrastructure around the country and what different companies are charging for their service. I think GM and Ford are finally making public announcements about their commitments to EV development and potential intended future delivery years all while keeping an eye on Tesla.

There is a lot of billions of dollars to be invested into both E vehicle production and charger infrastructure but I think it is beginning to catch on. Now all we need is for the consumer to get educated and get interested?