While many people are applauding the proposed revisions to the federal EV tax credit (IRC 30D) included in the Inflation Reduction Act of 2022 (IRA) — my view is that while it fixes some flaws in the existing tax credit, it would remain an incredibly poorly designed and ineffective plan that doesn’t achieve what it should be designed to do — which is to significantly reduce GHGs from personal transportation.

On Thursday, August 4 Senator Kyrsten Sinema, the Democrat from Arizona, who previously said she would not support the IRA, got a change she wanted in the Act and said she would now vote for its passage. While not a certainty, it looks like the Act will have enough votes to be approved over the weekend.

(Update: August 8) On Sunday the Senate in a bipartisan vote of 51 to 50 passed the Inflation Reduction Act of 2022 (IRA). Now the act goes on to the House for reconciliation and voting perhaps on Friday.

Additionally, the IRA could actually receive enough votes to pass, but not without potentially several significant changes — including to some of the EV tax credit requirements. In an August 4 article in the Wall Street Journal, Auto Makers Ask Congress for Easier Path to Electric-Vehicle Tax Break, it was revealed (unsurprisingly) that “the major automakers are pressing lawmakers to ease a proposed battery-sourcing requirement for electric-vehicle tax breaks, saying that few, if any, plug-in models on sale today would qualify.”

Battery Material and Component Requirements Cannot Be Met in the Near Term

It is very clear that the proposed changes agreed upon between Senators Joe Manchin and Chuck Schumer have very little to do with reducing GHGs (at least in the near term and specific to personal transportation), but rather is about forcing automakers to lessen their EV battery supply chain dependency on China. That is a very good thing, but tying this requirement to a consumer-facing tax credit that results in few or zero EVs qualifying, is probably not the best approach.

“Tell them (automakers) to get aggressive and make sure that we’re extracting in North America, that we’re processing in North America and we quit relying on China”

— Joe Manchin, via the Wall Street Journal

The battery mineral and component requirements include:

Critical Mineral Requirements: $3,750 credit claimable if critical mineral criteria is met when the vehicle is placed into service by the buyer. The critical materials in the battery that were extracted or processed in a country with a free trade agreement (which includes Australia, Chile, South Korea, etc.) in effect with the U.S. or recycled in North America, must account for a minimum percent by dollar value. Is effective:

• Between implementation of the Act and Dec. 31, 2023: 40% or higher

• Then the percentage increases 10% each calendar year through 2029 and 100% thereafter.

Battery Components Criteria: $3,750 credit claimable if battery components criteria are met when the vehicle is placed into service by the buyer. The battery contains components manufactured or assembled in North America that account for a minimum percentage of the battery’s total component value. Effective:

- Between implementation of the act and Dec. 31, 2023: 50% or higher

- CY 2024 through CY 2025: 60% or higher

- Then increases 10% each calendar year through 2029, and 100% thereafter.

(Thanks to Edward Stewart at Autos Drive America for the above summary.)

These two battery mineral and component requirements are a challenge to automakers because the majority of minerals used in EV batteries as well as battery cells come from China. From the Wall Street Journal article, Douglas Johnson-Poensgen, chief executive of Circulor, shared that only about 15% of electric-vehicle minerals are extracted or processed in the U.S. or by its free-trade partners.

Secondly, according to the Wall Street Journal and Benchmark Minerals, “China accounts for 59% of global lithium processing, compared with only 4% for the U.S. China also processes 68% of the world’s nickel, compared with 1% for the U.S.,” according to Benchmark.

“There is and remains a total domination by China on the processing side,” said Morgan Bazilian, director of the Payne Institute and professor at the Colorado School of Mines. “It’s definitely not changing in the short term. That would be a decadal shift.”

I reached out to Ford, GM, and Stellantis asking them if any of their EVs would qualify based on the above requirements, and as of August 4, I’ve only received a link to a press release from GM. While it doesn’t say so, I take the statement below to mean that at least initially, zero GM EVs will be able to meet the battery requirements.

We are encouraged by the framework set forth in the legislative text. While some of the provisions are challenging and cannot be achieved overnight, we are confident that the significant investments we are making in manufacturing, infrastructure and supply chain along with the timely deployment of complementary policies can establish the U.S. as a global leader in electrification today, and into the future. We will continue to review the details and we look forward to engaging all stakeholders and working collaboratively on these important issues.

— GM Press Release, August 1, 2022

So while we don’t yet have a definitive answer, it appears that of the roughly 22 BEVs and PHEVs that would otherwise qualify (see analysis below), perhaps just a few or even zero would qualify for the revised federal EV tax credit. The reality is, we won’t know until the specifics of the regulations are finalized, and they could undergo significant changes. But it is possible that a few EV models such as the Tesla Model 3 and Model Y might qualify for $3,750 by meeting the battery component requirement.

Assembled in North America and MSRP Caps

There are two other key proposed revisions in the Act that would significantly limit the number of qualifying EVs. The first stipulates that final assembly of the EV must be in North America. This means EVs like the Mustang Mach-E which is assembled in Mexico, and the Chrysler Pacifica Hybrid (PHEV) which is assembled in Canada, would qualify.

The second disqualifying provision is two caps on the manufacturer’s suggested retail price (MSRP). The caps are $80,000 for trucks, vans, and SUVs and $55,000 for sedans, sports cars, and station wagons. It is generally believed that the EPA classification will be used, which can at times seem odd. The EPA, for example, classifies the Chevrolet Bolt as a “small station wagon.” Because the Bolt EV has a starting MSRP well below the $55,000 MSRP cap, it would not be affected. But if the upcoming Cadillac LYRIQ, for example, which has a starting MSRP of $62,990, was classified as a station wagon and not an SUV, then it would not qualify under the MSRP cap rules.

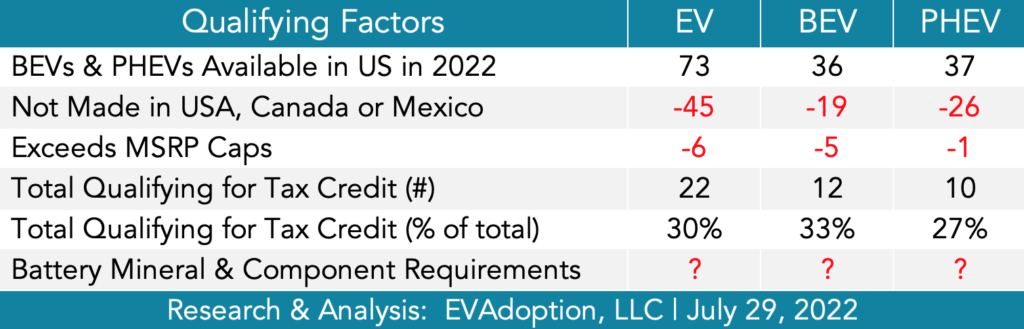

By my initial analysis, those two provisions would disqualify roughly 70% of all EVs from the tax credit. Here is a sort of our EV model database, that shows the 22 BEVs (12) and PHEVs (10) that are assembled in the US AND have MSRPs under $80,000. Note, that there are EV sedan models that would be disqualified under the assembled in North America requirement before being disqualified under the $55,000 MSRP cap.

Other EV Tax Credit Changes in the IRA

So far I’ve focused on the “negative” aspects of the IRA (from the perspective of most EVs not qualifying for the tax credit). Here are three key positive proposed changes:

- Elimination of the manufacturer 200,000 sales cap. EVs from Tesla and GM currently do not qualify for the tax credit and Toyota reached the 200,000 sales threshold in Q2 and I’m forecasting that Ford will reach the threshold this quarter. (Note the tax credit phases out over 5 quarters.)

- The addition of a $4,000 credit/rebate for used EVs.

- EV buyers can choose to transfer the amount of the applicable tax credit to the car dealer who can then apply the rebate at the time of purchase amount as a discount off the purchase price or down payment.

Closing Thoughts

While I am in favor of MSRP caps, a $7,500 credit or rebate on a $75,000 luxury EV does not make them more affordable. In 2019, 78% of those who claimed the tax credit had an adjusted gross income (AGI) of $100,000 or above and 46% were above $200,000.

What US policy should do is actually incentivize the automakers to produce more affordable EVs, not provide discounts on more expensive ones. Example: Provide a $5,000 rebate on EVs below $40,000 MSRP and cap AGI at $100,000.

But even more importantly, 25% of the gas-powered vehicles on the road in the US are 16 years or older — that is 70 million cars and trucks — most of which are likely gas guzzlers and producing significantly more emissions than recent model gas cars. Any rebate and policy first and foremost HAS to reduce or replace these older vehicles with more efficient vehicles (gas, hybrid, or EV).

Today, too many of the tax credits go to people replacing a Prius hybrid with an EV, which does very little to actually produce a net decline in GHGs. There will be more gas-powered vehicles on the road in the US in 2030 than there are today. We must take a “subtraction by subtraction” approach to GHG reduction because simply adding EVs to the vehicle mix doesn’t remove an increasing fleet of gas cars.

The federal EV tax credit sounds like a good thing, but in reality — it is not an effective means to significantly reduce GHGs — which is the policy we actually need in the US.

One Response

Me thinks you got the MSRP incorrect on 2023 Bolt EV. It is $27,090.00 as I have read and understand,