Overview of Biden Administration Plans to Help Increase EV Adoption in the US

Here are the electric vehicle-related programs that we can expect the Biden administration to pursue.

Here are the electric vehicle-related programs that we can expect the Biden administration to pursue.

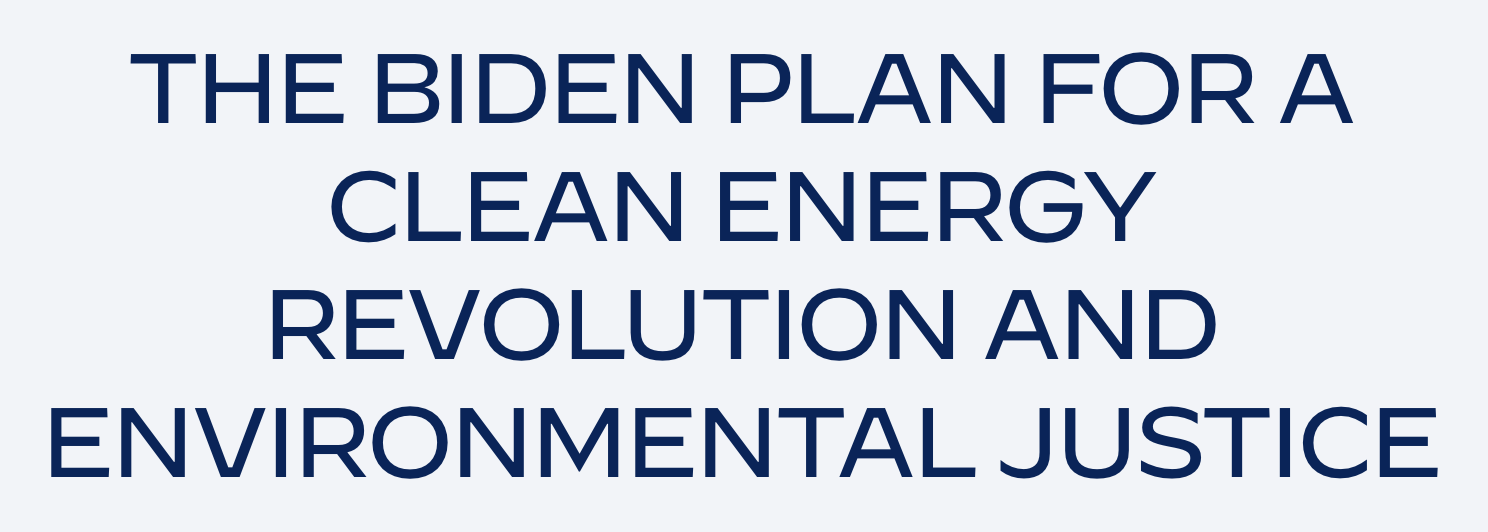

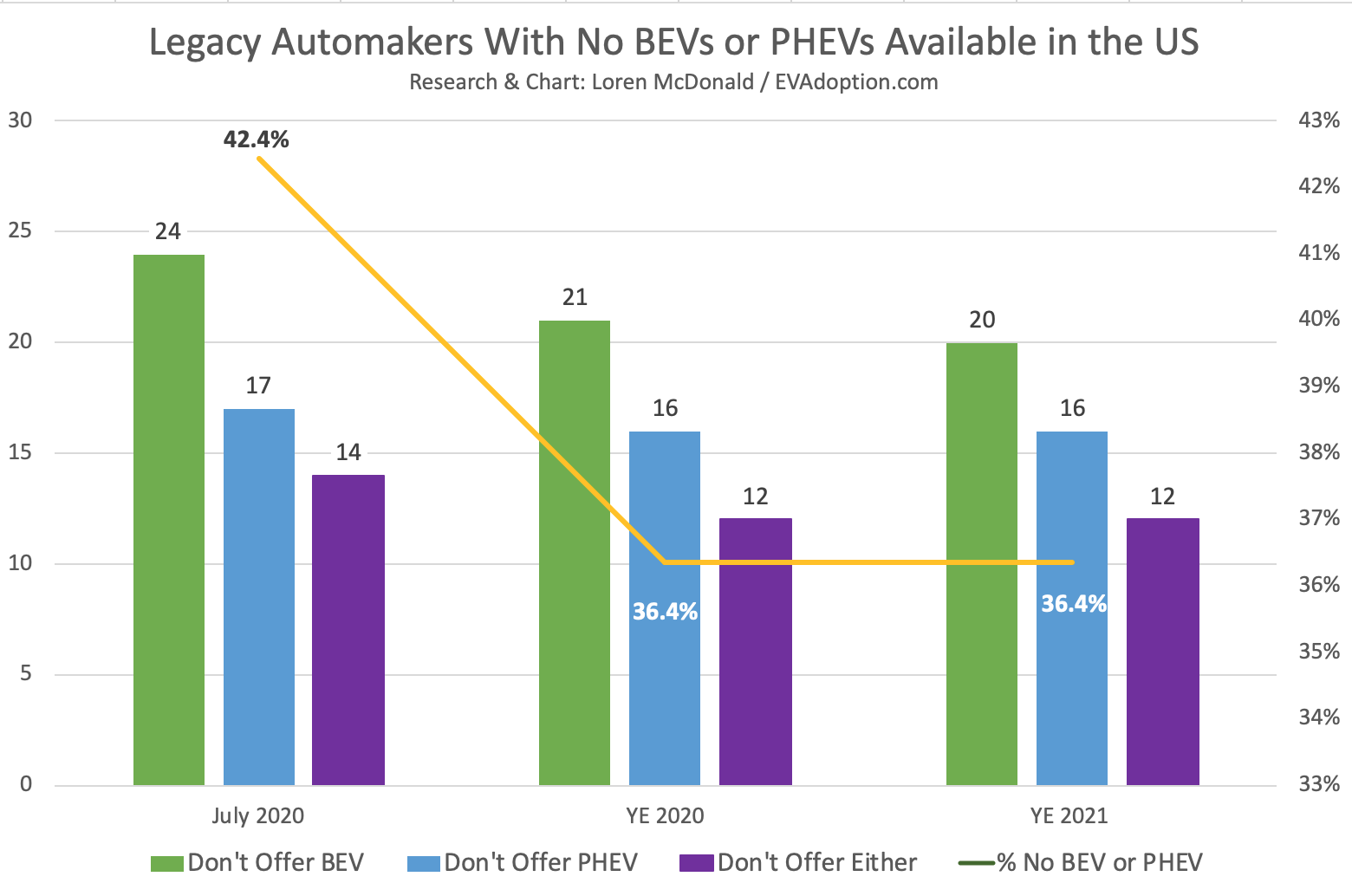

The biggest hurdle to adoption of electric vehicles in the US remains supply, as 42% (14 out of 33) of legacy automaker brands that have vehicles for sale in the US – still do not offer an EV (either BEV or PHEV) for sale in the world’s second largest auto market.

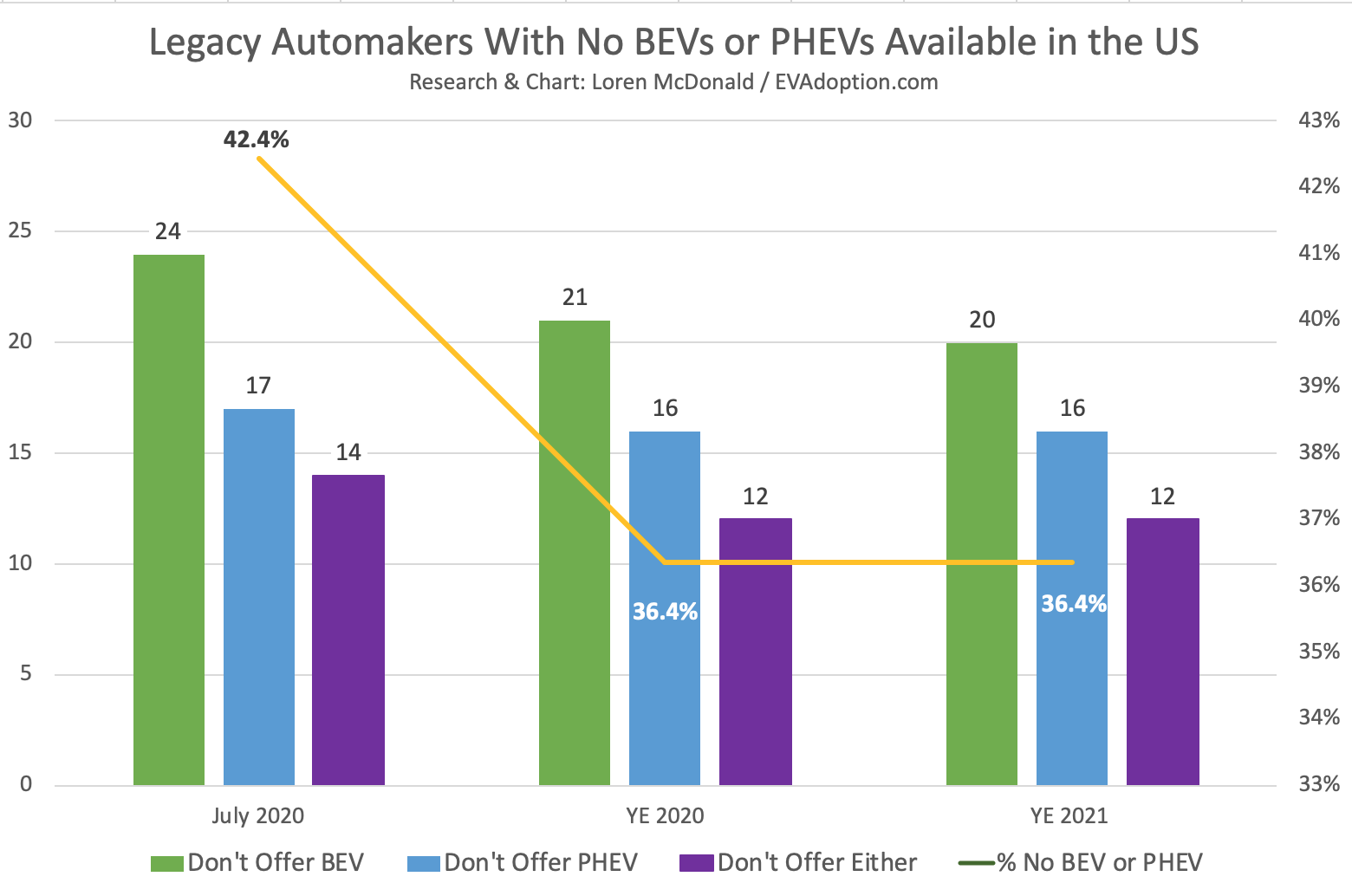

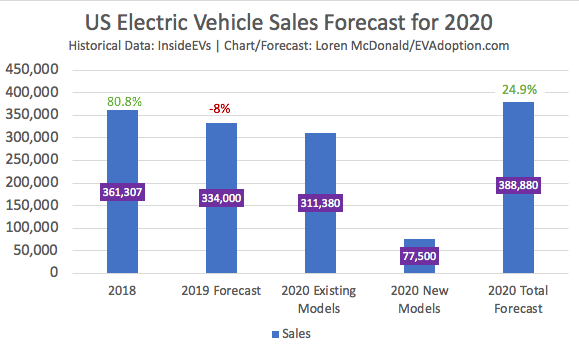

Sales of electric vehicles will return to positive growth in 2020, with a forecasted volume of new BEV and PHEV sales of 388,880.

The Federal EV tax credit isn’t working: sales of EVs in the US are slowing, are concentrated in one state (California) and brand (Tesla). It is time to tear up and rethink, not tweak the current tax credit.

With Tesla Model 3 estimated US sales in June of 21,225 units according to the InsideEVs Sales Scorecard, YOY sales for June saw an increase of an estimated 51%. January through June’s YOY increase bumped up to 19.7%, up from 11.7% for January though May.

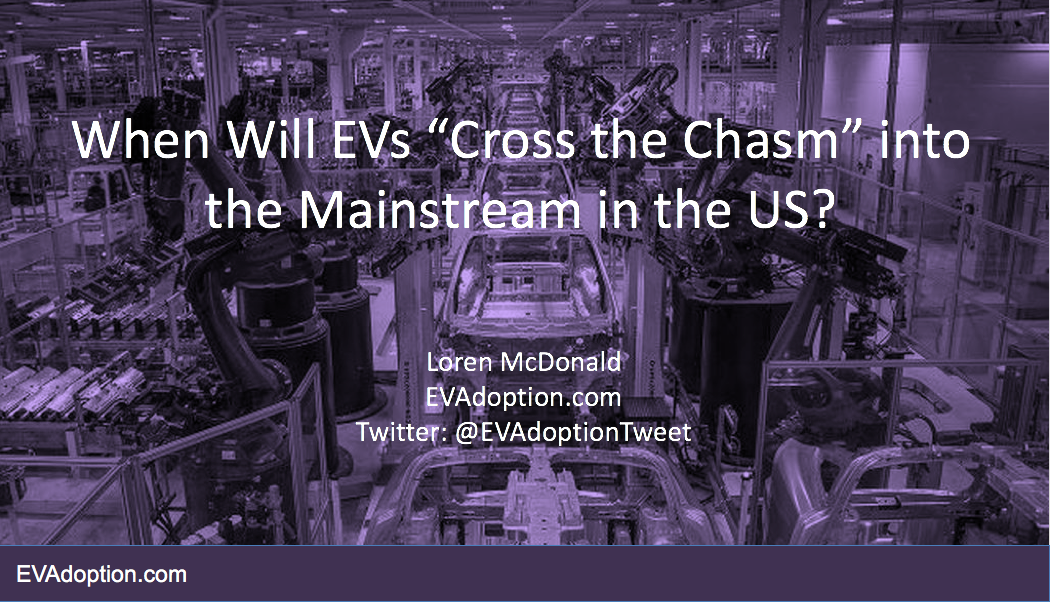

In this article I share selected screenshots of several slides from the 36-slide presentation – “When Will EVs ‘Cross the Chasm’ Into the Mainstream in the US?” – and add some underlying comments to provide a high-level flavor of my presentation.

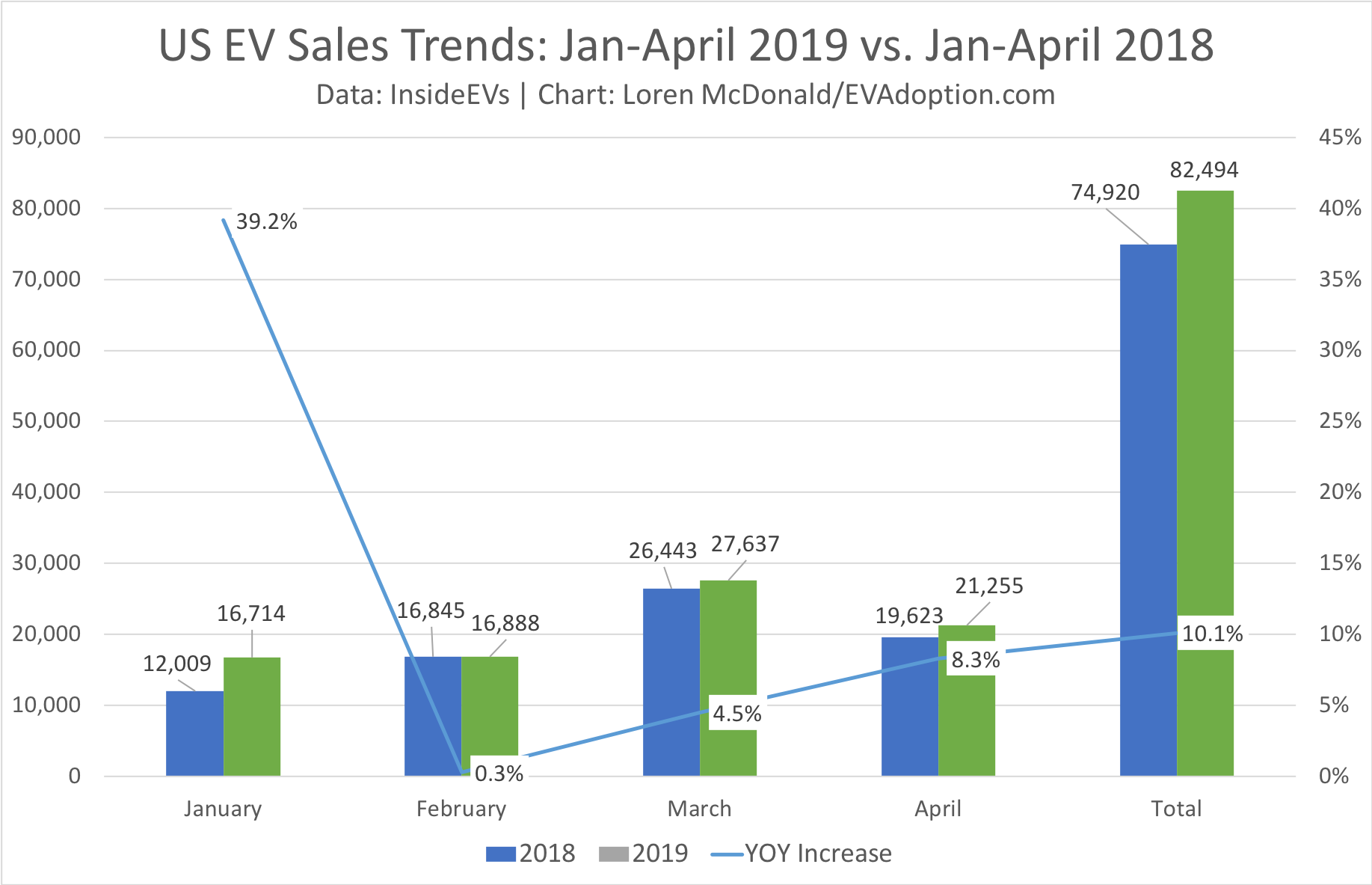

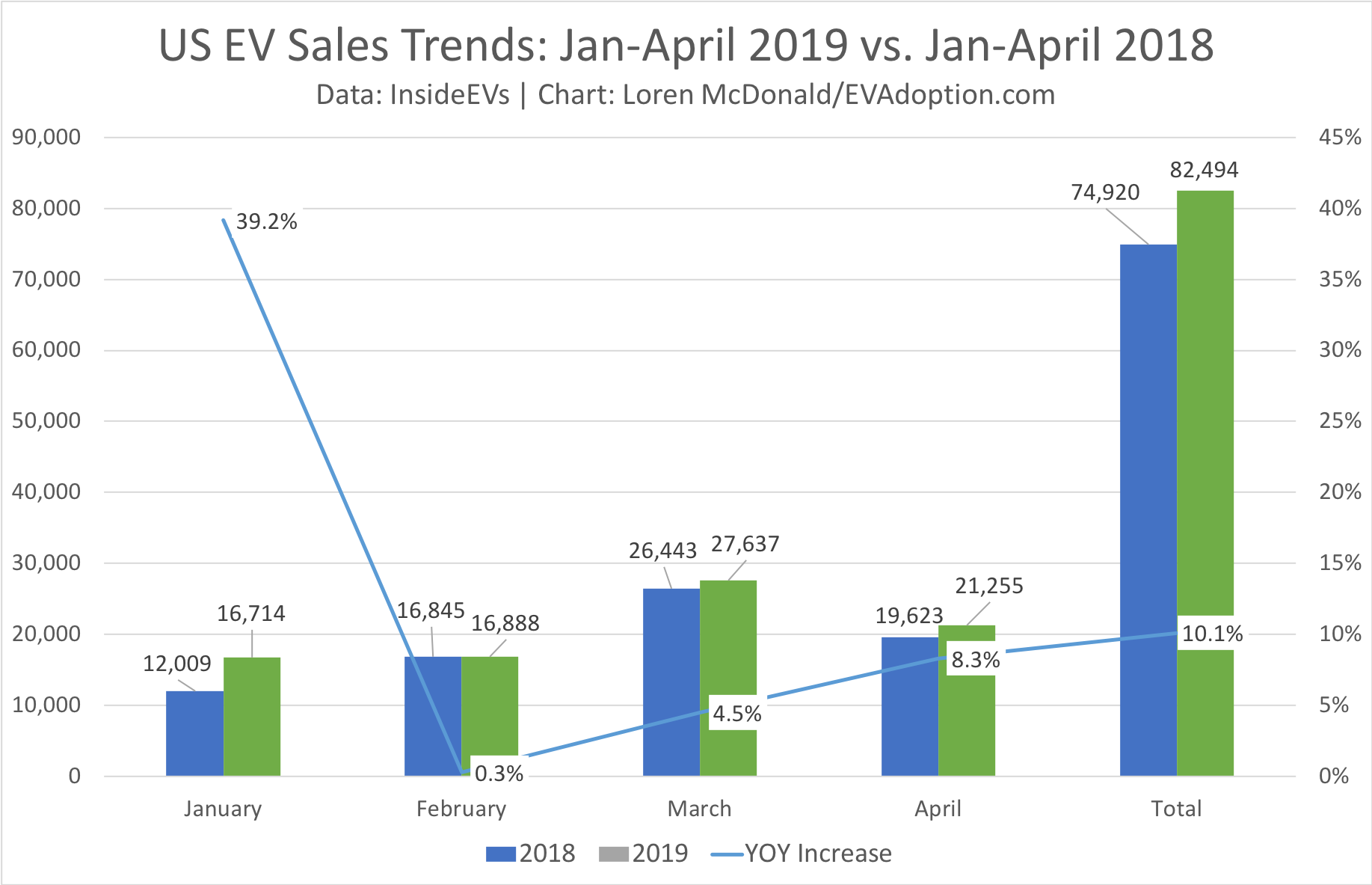

Sales of electric vehicles in the US so far in 2019 are disappointing, though the low percentage growth rate was not unexpected. Through the month of April, US EV sales are up 10.1% over the same period in 2018. April 2019 sales increased 8.3% over April of 2018.

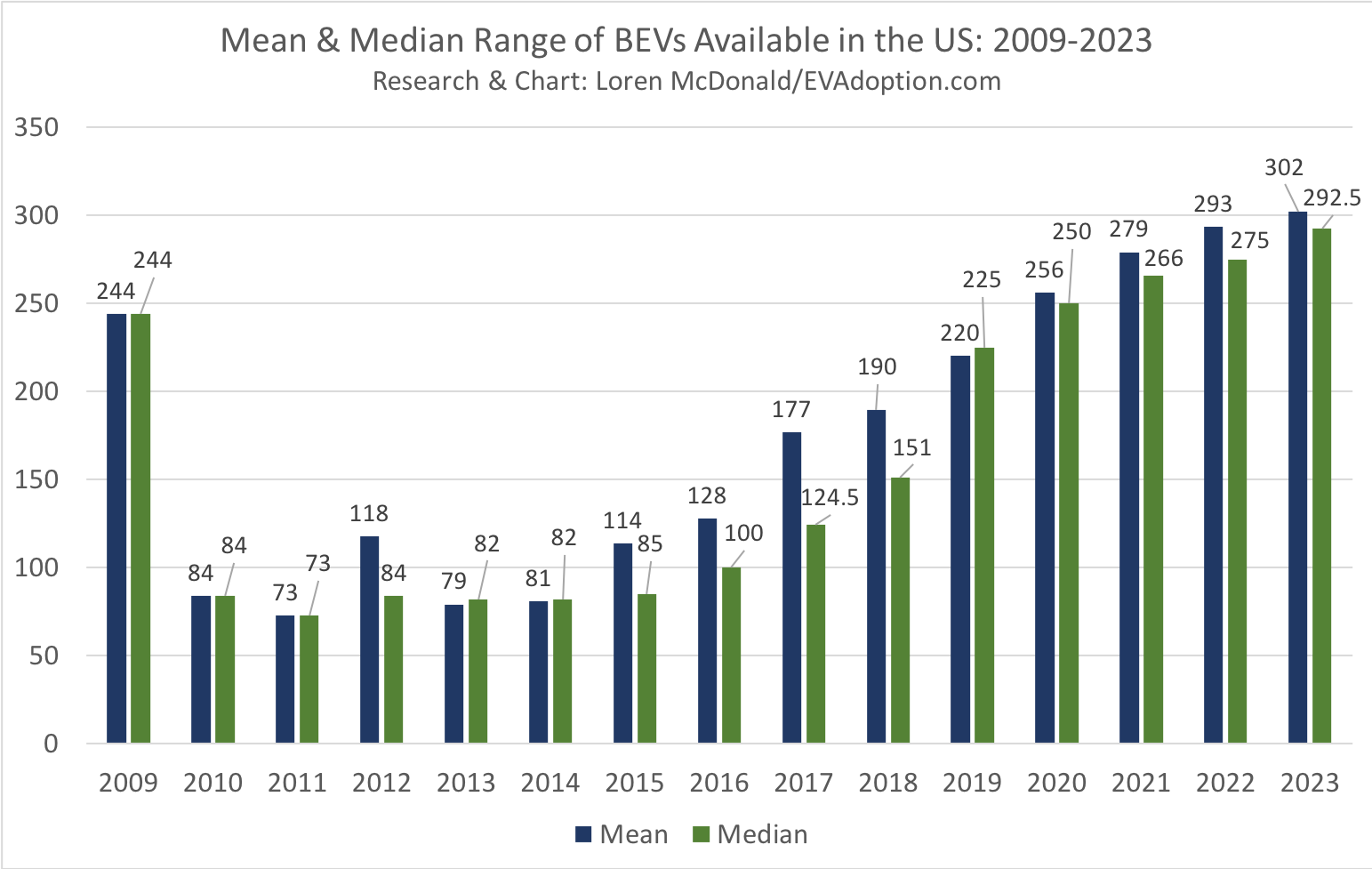

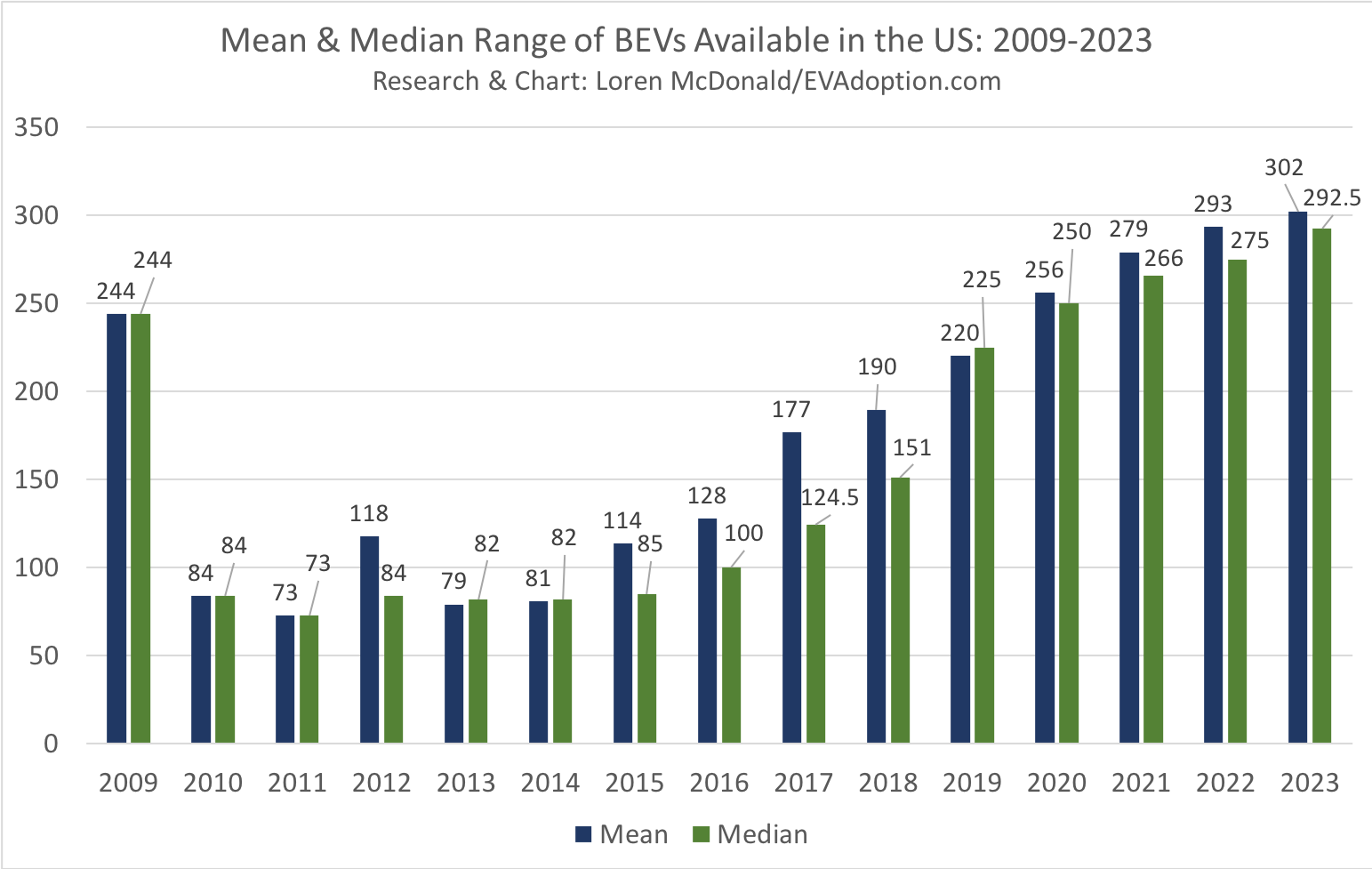

The average range of BEVs available in the US will reach an estimated 302 miles and have a median range of 293 by the end of 2023, a key finding from our updated and latest EVAdoption forecast.

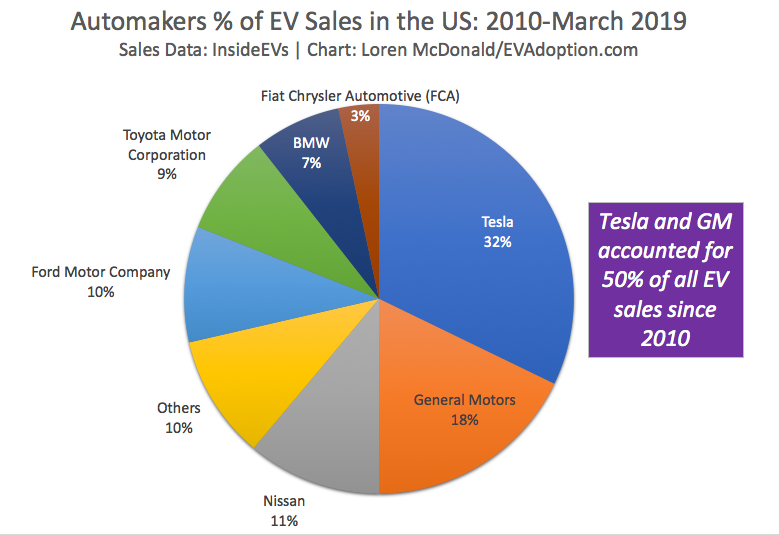

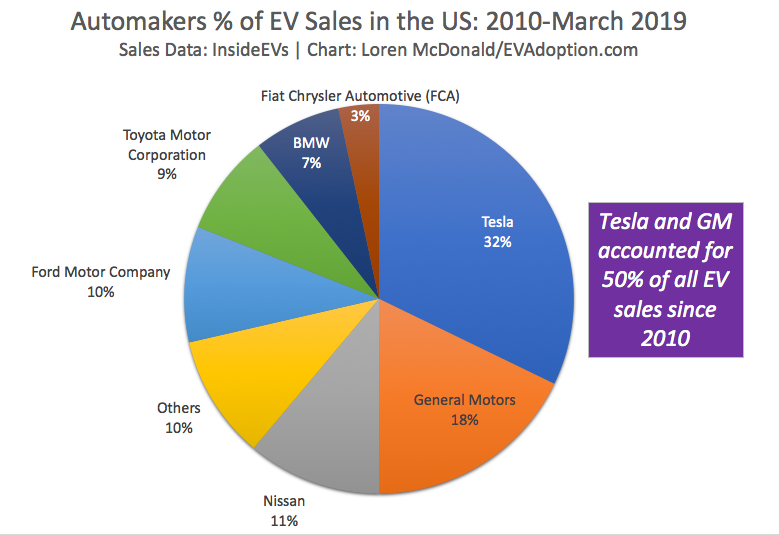

Through March of 2019 and using data from the InsideEVs Sales Scorecard, Tesla has accounted for 32% of all electric vehicles in the US. General Motors is a distant second at 18% share of total EV sales. The two automakers combined have accounted for 50% of sales.

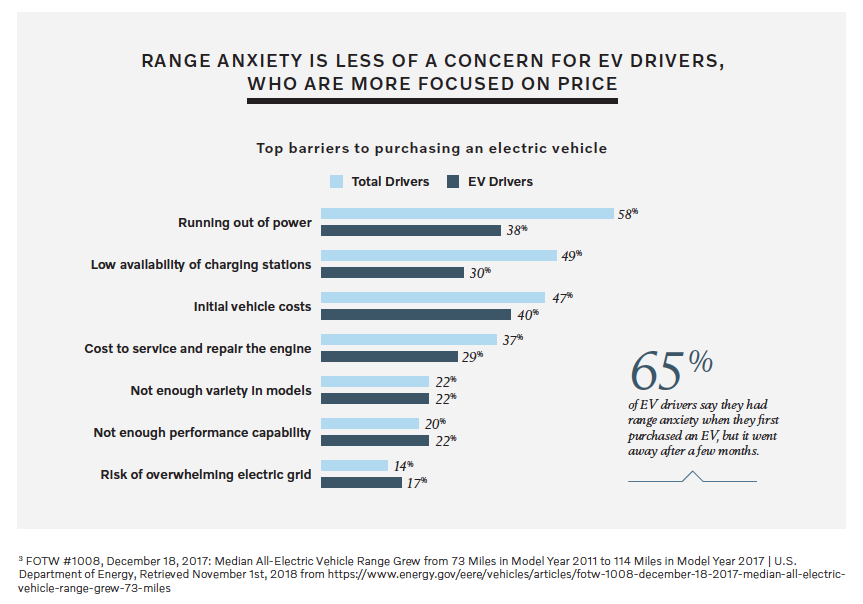

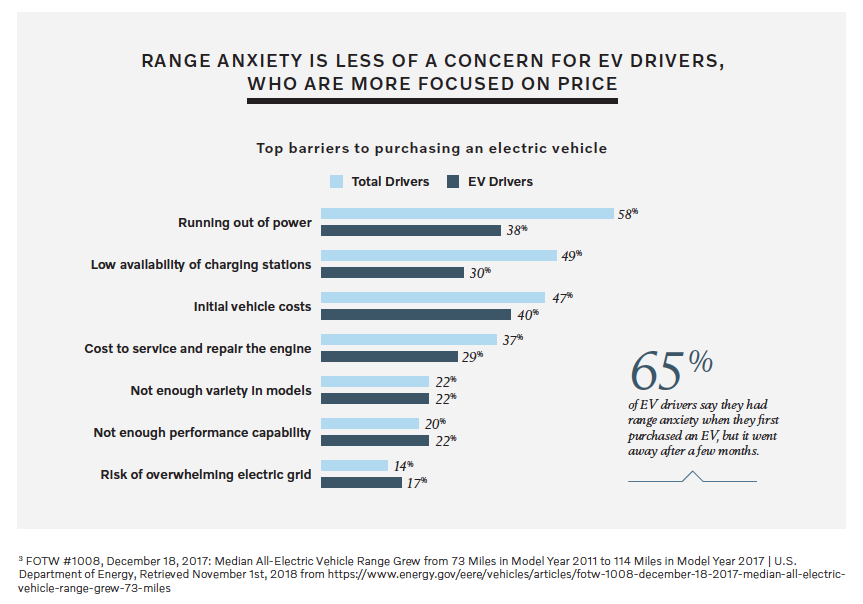

Range, cost competitiveness and availability of charging stations remain the top barriers to EV adoption, according to recently released survey results from Volvo Car USA/The Harris Poll. As the average range of US available BEVs heads toward 250 miles, automakers will need to focus significant resources on EV charging infrastructure.

Here are the electric vehicle-related programs that we can expect the Biden administration to pursue.

The biggest hurdle to adoption of electric vehicles in the US remains supply, as 42% (14 out of 33) of legacy automaker brands that have vehicles for sale in the US – still do not offer an EV (either BEV or PHEV) for sale in the world’s second largest auto market.

Sales of electric vehicles will return to positive growth in 2020, with a forecasted volume of new BEV and PHEV sales of 388,880.

The Federal EV tax credit isn’t working: sales of EVs in the US are slowing, are concentrated in one state (California) and brand (Tesla). It is time to tear up and rethink, not tweak the current tax credit.

With Tesla Model 3 estimated US sales in June of 21,225 units according to the InsideEVs Sales Scorecard, YOY sales for June saw an increase of an estimated 51%. January through June’s YOY increase bumped up to 19.7%, up from 11.7% for January though May.

In this article I share selected screenshots of several slides from the 36-slide presentation – “When Will EVs ‘Cross the Chasm’ Into the Mainstream in the US?” – and add some underlying comments to provide a high-level flavor of my presentation.

Sales of electric vehicles in the US so far in 2019 are disappointing, though the low percentage growth rate was not unexpected. Through the month of April, US EV sales are up 10.1% over the same period in 2018. April 2019 sales increased 8.3% over April of 2018.

The average range of BEVs available in the US will reach an estimated 302 miles and have a median range of 293 by the end of 2023, a key finding from our updated and latest EVAdoption forecast.

Through March of 2019 and using data from the InsideEVs Sales Scorecard, Tesla has accounted for 32% of all electric vehicles in the US. General Motors is a distant second at 18% share of total EV sales. The two automakers combined have accounted for 50% of sales.

Range, cost competitiveness and availability of charging stations remain the top barriers to EV adoption, according to recently released survey results from Volvo Car USA/The Harris Poll. As the average range of US available BEVs heads toward 250 miles, automakers will need to focus significant resources on EV charging infrastructure.

© 2024 EVAdoption, LLC | All Rights Reserved.