[DISPLAY_ULTIMATE_SOCIAL_ICONS]

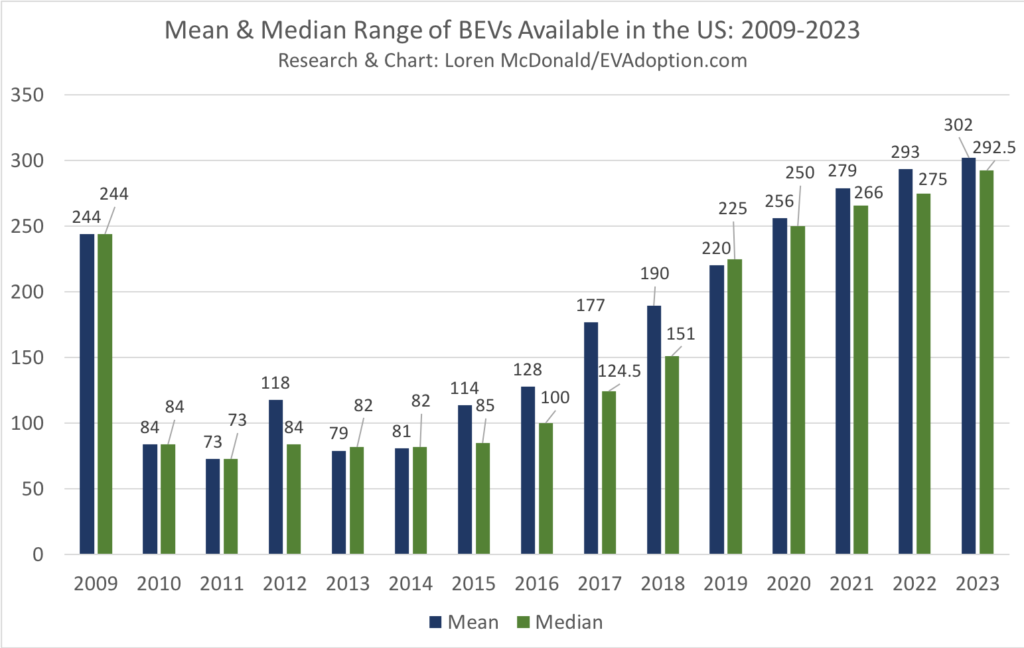

The average range of BEVs available in the US will reach an estimated 302 miles and have a median range of 293 by the end of 2023, a key finding from our updated and latest EVAdoption forecast.

The current average and median range are 216 and 236 miles respectively and should reach 256 and 250 miles by the end of 2020.

There are three key drivers of the increase to an average of 300 miles of range across the US fleet of BEVs by the end of 2023:

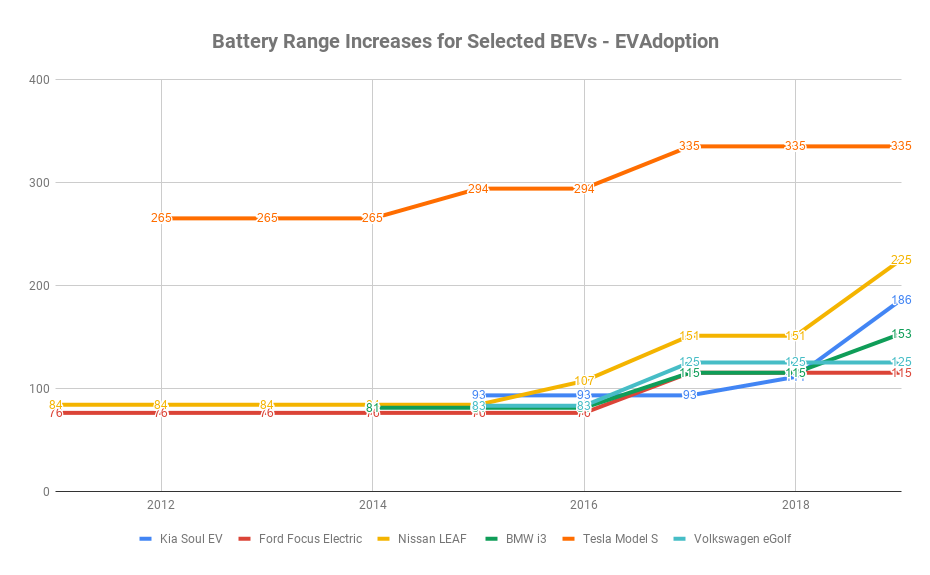

- The discontinuation or replacement of lower range BEVs including the smart fortwo (58 miles), Volkswagen eGolf (125), Fiat 500e (87), and Kia Soul EV (111 and increased to 243).

- Virtually all new BEVs coming to the US market in the next few years (with a few exceptions) will have ranges of at least 250-275 miles.

- Existing or soon to be released BEVs will typically see range increases of 25-40 miles about every 2 or 3 years.

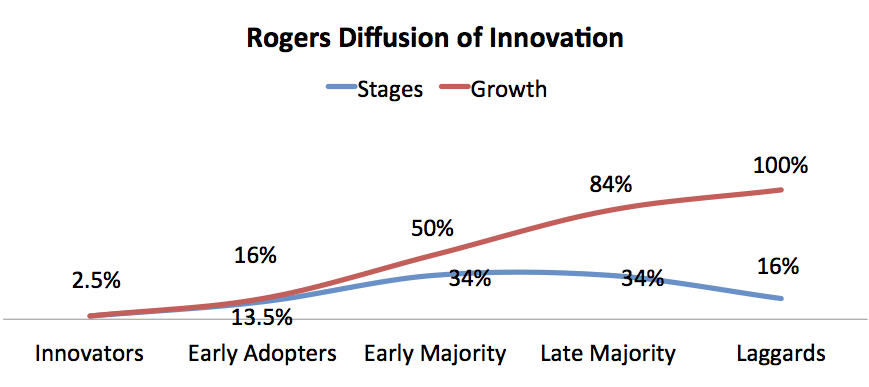

As I wrote in my first official EVAdoption blog post back in January 2017, “CARMA”: An EV Adoption Framework for U.S. Auto Buyers, there are five key factors to achieving mass consumer adoption of electric vehicles. Adequate range is obviously one of, if not the most important factors and in the US 300 miles will be a key milestone.

American consumers, especially those living in the suburbs or more rural regions have a significantly greater desire for range than those living in many regions of the US and world with more dense city and urban populations.

In Europe for example, it’s fairly easy to take a train to another country many hundreds of miles away for a weekend trip whereas in America, households are more likely to load up the family into an SUV for that 400-500 mile drive to Disneyland, Disney World or to visit grandma.

For these and many other reasons, 300 miles is in my belief the magic minimum acceptable range in order for EVs to cross the chasm into the early majority of buyers in the US.

Having just returned from our second road trip of more than 425 miles each way I can also attest to the increased flexibility that 300 miles of range provides. On our road trip in our Tesla Model S 60, which has a range of a little more than 200 miles, we had to stop and charge six times on the round-trip.

While that sounds like a lot of stopping – and would be a non-starter for many or most non-early adopters – for three of those stops we had lunch or dinner and were able to charge the Tesla to 100% in roughly the exact same amount of time that it took us to eat our meals and use the restroom.

Two of the stops were for 10-15 minutes for adding a short amount of range and we took advantage to stretch and relax, grab a beverage and use the restroom. With 300 miles of range we likely would only need to stop three times to charge, and all charging stops would have been stops we would make in a gas/diesel-powered car for meals, beverages and restroom breaks.

In order for EV sales to expand significantly beyond early adopters, the industry must eliminate disadvantages of EVs and excuses for buyers to easily say that EVs do not meet their needs. While I believe late adopters will require 400-500 miles, the magic of reaching 300 miles should convince a large number of American buyers to take the plunge and buy an EV. By the end of 2023 there will be around 55 BEVs available in the US and with about 35 of them having near or more than 300 miles of range.

The timing of 2023 is also key because several other key adoption factors will have made significant progress by then, including:

EVs widely availability in most states: Several manufacturers including Kia, Hyundai, Honda, Fiat and Volkswagen have limited availability of their EVs to just a few ZEV states. With awareness increasing among consumers and greater battery supply, within 3-4 years hopefully OEMs will make their EVs available in all or most states.

Ford and GM Get Serious: With plans for a new EV based on the Chevrolet Bolt platform, a Cadillac EV (and the brand eventually going 100% EV) and Ford launching its crossover BEV and partnering with Rivian and Volkswagen on EVs – Ford and GM’s growing commitment to EVs will be an important statement to both dealers and consumers that the time is right to buy an EV.

Pickups: I believe the that the market is still too early for all-electric pickups, but by 2023 there should be solid offerings on the market from Rivian, Tesla, Bollinger, Workhorse and possibly Ford and GM. While these models will be high end, their availability will have an important impact on non-early adopters that their next vehicle could indeed by an electric pickup.

Fast Charging: Both Electrify America and Tesla are rolling out super fast charging stations that can add 150-200 miles in 15-20 minutes. Expect EVgo and ChargePoint to begin rolling out similar fast charging stations in the next year. Within 3-4 years almost all new DC fast charging stations will likely be able to charge (and new EVs able to accept these fast charging rates). While not as quick to refuel as the 5 minutes or so at gas stations for ICE vehicles, knowing you can charge up your EV while you have a meal and restroom break will reduce or eliminate a key concern among many reticent buyers of EVs.

Battery Supply: The biggest current challenge to EV adoption in the US is supply of battery packs. Hyundai, Kia and GM in particular have said limited battery supply is the main reason that their EVs are not widely available in the US. By 2023 several major new battery factories will have come on line and should reduce or eliminate battery supply issues.

Cost Competitiveness: EVs aren’t likely to be truly cost competitive on a straight up comparison (not factoring in gas prices, credits and rebates, lower maintenance) until at least 2025, but by 2023 the difference in price for many comparable EVs and ICE vehicles should be in the $2,500-$4,000 range. Then when factoring in lower operating costs and potential available federal, state and utility credits and rebates – most EVs should have a lower total cost of ownership.

Charging Infrastructure: With more than one-third of US households living in multifamily housing, access to convenient charging is a huge hurdle to EV adoption for these consumers. While there is no clear solution to this challenge, I expect new business models to emerge in the next 3 years that encourage and enable multifamily housing owners to invest in charging infrastructure for their EV-driving tenants. Similarly, the major charing networks, utilities and energy companies will invest heavily in fast charging stations on major interstates to minimize road trip concerns among EV buyers.

All of these factors combined are why I continue to believe that 2024-2025 is when EVs cross the chasm into mainstream adoption in the US. But when considering an EV, range is typically the top concern of buyers. With most new BEVs having a range at or near 300 miles by 2023, the biggest concern among mainstream consumers will have been lessened or eliminated.

3 Responses

Fantastic article —

Interesting how the US EV market seems to thwart itself in the near term. Consumers require massive batteries sized to their ‘once a year’ demand, while a shortage of battery supply limits access to a broader model portfolio. It seems increased battery metals supply, higher energy density, or lower range expectations are a must for the American EV consumer.

Thanks Zane!

On the battery supply issue, this is one reason while I remain a fan of PHEVs, especially those with at least 30 miles of range. That level of range means people can drive around town, possibly even to their work location on battery power. And then for the small number of longer trips they can tap into gas engine. Not perfect, but I’d rather have a bunch of people driving around most of the time on battery power, than not at all.

Not sure where you live, but America is so spread out and our biggest negative is that we don’t have good train systems like in Europe and much of Asia, so flying or long road trips are the only options. We will get there, but is especially going to take longer in the middle of the country as folks in the midwest have cold weather and love to take long road trips (instead of flying).

I think the list of when the tipping point for battery range hitting an average of 300 miles can be here sooner rather than later. If one examines the drive motors of Model 3 Tesla and focuses on the efficiency aspect, then perhaps auto makers can achieve a longer range with a similar motor or two in their designs? Of course Tesla Model 3 can already be had with a 310 mile range. Also Model S with a 100 Kwh battery can achieve 370 miles of range. You’re talking $80k+ car. VW is bringing a Tiguan sized EV suv to the USA late next year that is supposed to get around 312 miles of range on an 82 Kwh battery pack. They claim to have the EV (called ID4) starting price about the same as the ICE Tiguan? They want an apples to apples comparison model to promote EV sales here.