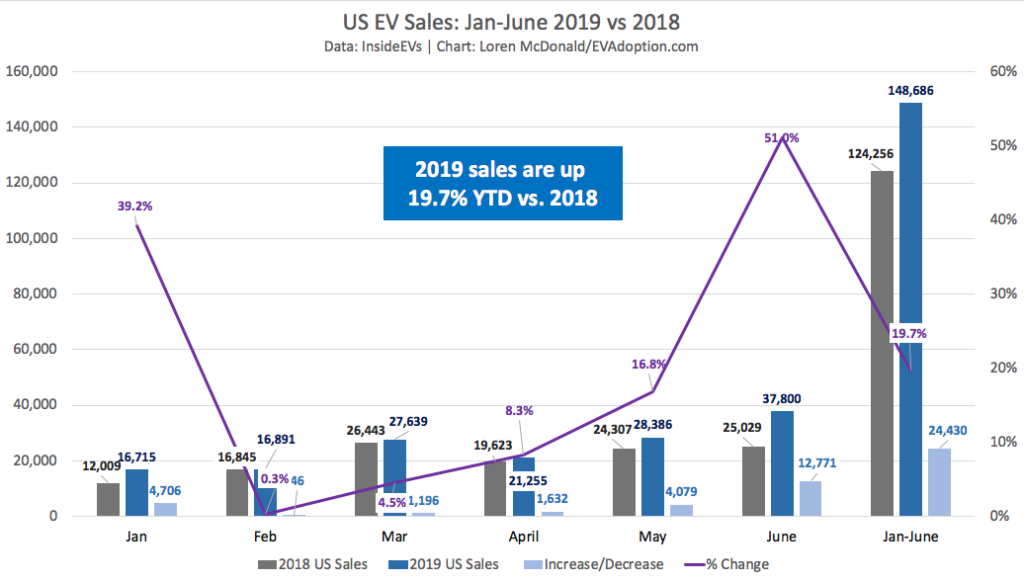

With Tesla Model 3 estimated US sales in June of 21,225 units according to the InsideEVs Sales Scorecard, YOY sales for June saw an increase of an estimated 51%. January through June’s YOY increase rose to 19.7%, up from 11.7% for January though May.

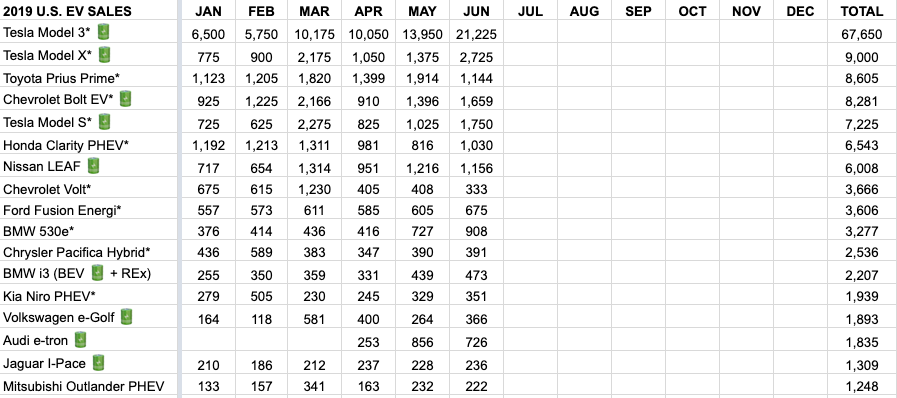

Among the top 12-selling EVs in the US, 10 of them have seen YOY sales declines of from a low of -5.3% for the Honda Clarity PHEV to a high of -53.1% for the discontinued Chevrolet Volt.

The BMW i3 is down 37% due to its range not being competitive and consumers opting for the more competitive Model 3. Tesla’s Model S is also suffering from the impact of the Model 3 as many consumers seeking a long-range BEV sedan may opt for the smaller, but lower-priced Tesla.

Interestingly, of the current top 12 selling EVs, no new vehicle that has been introduced in 2018 or 2019 has entered into this top-selling group. The latest of these models to make the list were the BMW 530e, Honda Clarity PHEV, Chrysler Pacifica PHEV, and Tesla Model 3 – all which launched in 2017 in the US.

The Audi e-tron will likely crack the top-12 selling EVs list in August if current trends continue. And assuming inventory of the discontinued Chevrolet Volt dwindles precipitously in the next few months and slowing of BMW i3 sales, the Kia Niro PHEV could also break into the top 12.

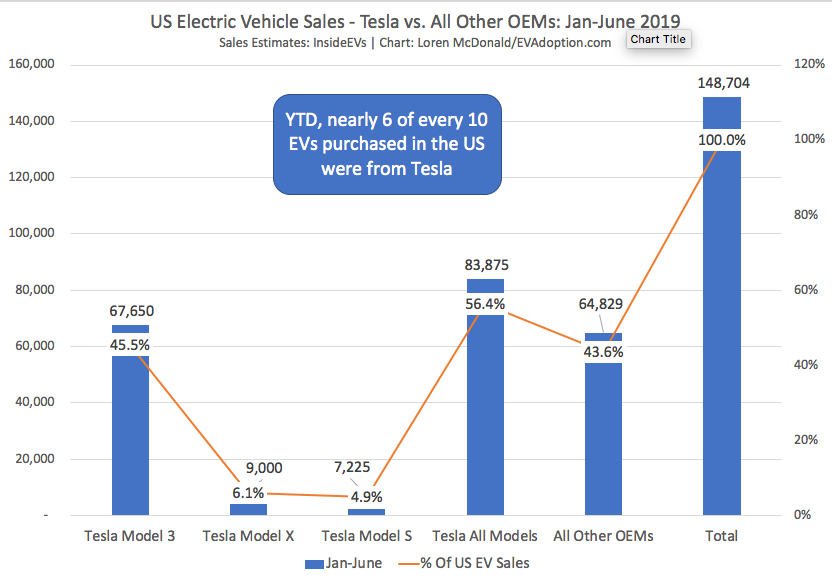

But while sales of the Tesla Model 3 have been strong in 2019 (up 183.9%) and surged in June, total sales of all other EVs (including the Tesla Model S and X) were down 19.3% for January through June versus 2018.

Sales YTD in the US are so dominant for the Model 3 that it accounts for nearly half (45.5%) of all electric vehicles sold. Add in the Model S and X and nearly 6 of every 10 (56.4%) EVs sold so far in 2019 was a Tesla.

In January I predicted in an article for CleanTechnica that 2019 would achieve a 12% YOY EV sales increase. At just under an estimated 20% YTD, I feel pretty good about this forecast based on the second half challenge. Growth in the US is clearly all about the Model 3 and to just match 2018 sales, Tesla needs to deliver an average of 12,022 per month.

This is in fact highly probable and likely, but with the rest of the EV market seeing declining sales, the Model 3 would have to crush the second half to achieve a significant rate of YOY growth.

The second half of 2019 likely won’t have any big surprises as there aren’t any significant new EV models expected until late in the year or in 2020. I have high hopes for the Ford Escape PHEV, but it remains to be seen if Ford will price it such that it is attractive to buyers.