Not a week goes by it seems without an announcement of new EV models, automaker partnerships, new battery plants and expansion of charging networks from automakers or the networks themselves.

In fact just the previous 10 days or so leading up to posting this article major EV-related announcements or teases were made by GM, Ford, Tesla (Model Y, V3 Supercharger), Fisker, Porsche, Kia/Amazon, Toyota/Suzuki, BMW/Mercedes-Benz, Volkswagen/Northvolt, and SK Innovation. I could go on but you get the idea – there is a lot going on with respect to electric vehicles in the US and around the world. Some of these activities will come to life within months, but many are 1-3 years away.

So if we step back from the press releases, tweet storms, and teaser images and videos, we must ask:

When does all of this activity actually lead to EVs going mainstream in the US?

What is it actually going to take for EVs to go mainstream in the United States?

Defining “Mainstream”

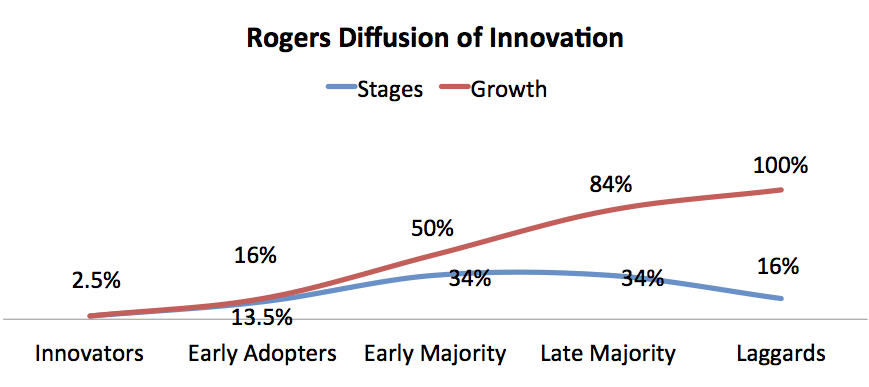

First, let’s define what I mean by mainstream. I wrote an entire blog on this topic, “When Will Electric Cars Go Mainstream?” What Does That Even Mean?, but in short I define “mainstream” as when 16% of new vehicle sales within a market are electric vehicles (BEV + PHEV). This is the point known as “crossing the chasm” when adoption of new technologies move from “Early Adopters” to the “Early Majority.” (see chart)

Where Are We Currently In Terms of EV Adoption in the US?

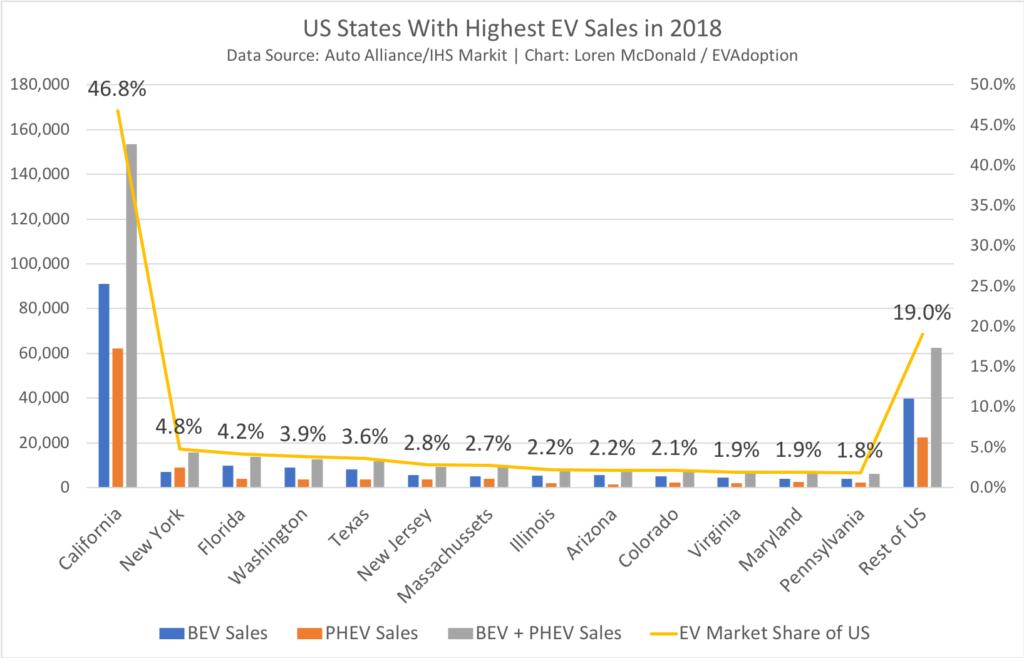

Fundamentally the EV markets in United States come down to California and Tesla. Let’s look at some key statistics:

- California accounts for just under half of the EVs sold the United States at 46.8% for all of 2018.

- Tesla accounted for an estimated at 53% of US EV (BEV + PHEV) sales in 2018.

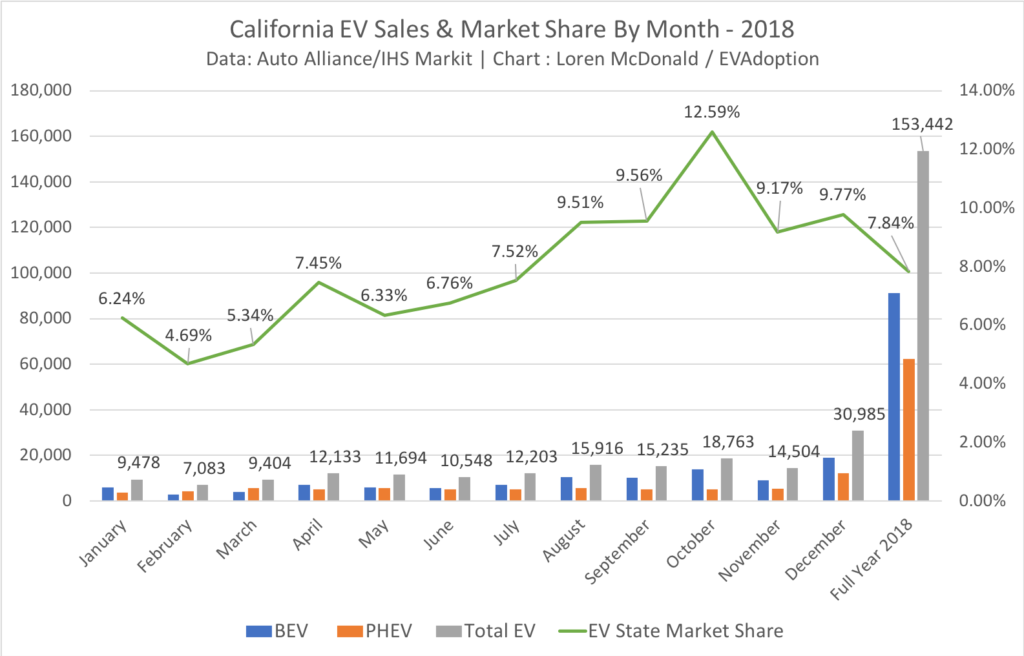

- Overall, sales of EVs in the US grew 81% over 2017 and fell just short of 2% marketshare at 1.97%.

- California nearly reached 8% (7.84%) market share for 2018 and actually reached more than 12.6% in October and averaged nearly 10% in the second half of 2018.

- That said, 43 states in the US had EV sales market share of less than 2% and 26 are under 1%.

So while the future is bright for EVs in the US and there is a strong pipeline of EV models, EV infrastructure, and battery plants – sales are still primarily confined to a few pockets of higher income buyers living primarily on the east and west coasts. In the US currently, electric vehicle sales growth is almost entirely dependent upon Tesla and its Model 3, and I predict sales will only grow about 12% in 2019.

6 Key Factors Critical to Mainstream Consumer Adoption of Electric Vehicles in the US

So what is it going to take – NOT for the pickup driving oil worker in North Dakota – but rather the middle to upper middle income SUV-driving suburban household buyer living in Florida, Illinois or Texas to make their next vehicle purchase an EV?

Here on my 6 key factors that are necessary for this second wave of consumers (the early majority) to “go EV”:

1. Two to four EVs Available From Each Major Automaker: Currently if a prospective car buyer walks into a non-luxury brand car dealership in America, the EV options tend to be very limited. In fact only three non-luxury brands offer more than one PHEV or BEV: Honda (2), Hyundai (4) and Kia (3). In the luxury performance market, however, Tesla has 3 models, BMW 6, and Mercedes-Benz 4.

- Chevrolet: Bolt (BEV)

- Chrysler: Pacifica Hybrid (PHEV)

- Fiat: 500e (BEV)

- Ford: Fusion Energi (PHEV)

- Honda: Clarity (PHEV and BEV)

- Hyundai: Kona (BEV), Sonata (PHEV), IONIQ (PHEV, BEV)

- Kia: Soul (BEV), Niro (PHEV, BEV – Spring 2019)

- Mitsubishi: Outlander (PHEV)

- Nissan: LEAF (BEV)

- smart: fortwo ED (BEV)

- Toyota: Prius Prime (PHEV)

- Volkswagen: eGolf (BEV)

With at least 2 or 3 EVs available at a non-luxury brand dealer such as Ford or Toyota it sends a message to consumers that EVs are no longer just for the fringe early adopters. And for the dealers themselves it means that EVs will not be sold by just 1 or 2 sales people, but likely all or most of the sales staff who will have to become competent and knowledgeable enough to effectively sell an EV. And the EVs will not just be relegated to out-of-the-way space in the showroom, but may be fairly visible – and hopefully fully charged.

Today a consumer walking into a Ford or Toyota dealership could easily miss the one EV model (both PHEVs) from each brand (Fusion Energi, Prius Prime). Now roll forward a few years when Ford offers a 300-mile range CUV and 30+ mile range Escape PHEV. Now that prospective buyer has a couple of compelling and serious options to consider in addition to Ford’s gas-only or regular hybrid models. This small difference of a few models will go a long way in attracting new EV buyers during the shopping process.

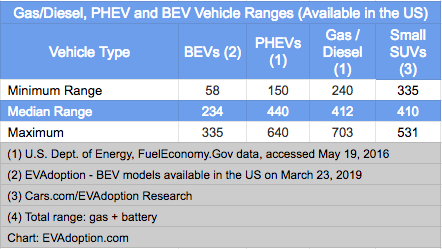

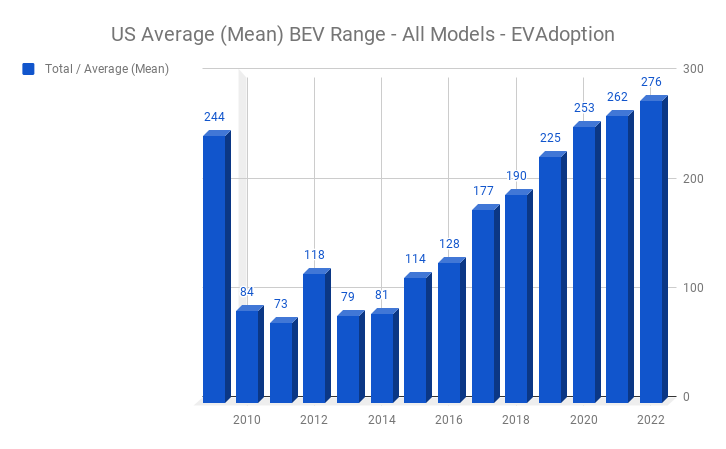

2. 275-300 Miles Range for BEVs/35 to 40 Miles Range for PHEV‘s: American consumers have been trained to expect about 400 miles of range from most gas vehicles. The typical range of a gas-powered vehicle is from about 350 miles to more than 500. By comparison the current median range of BEVs is about 230 miles, but I estimate it will reach 275 miles in 3-4 years.

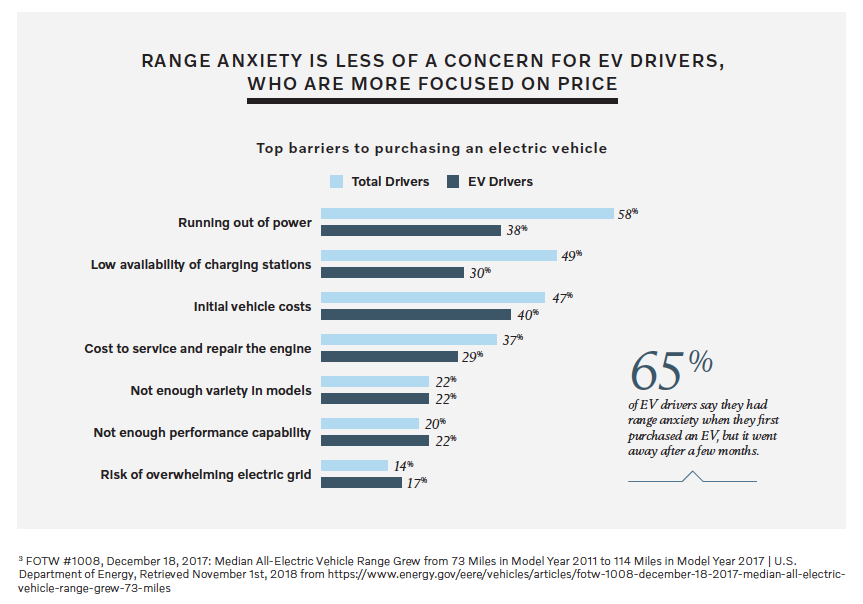

Early adopters seem to find 200-250 miles of range acceptable, but my guess is that most consumers will want a range approaching 300 miles, but at least 275. The magic of the number “300” or close to it should get many early majority American consumers over their initial fear of range anxiety.

3. 80% Charge in ~30 Minutes: Current EV owners understand the refueling paradigm that happens with charging an electric vehicle: your thought process switches from needing to find a place to drive to for refueling, to charging while you do other things (sleep, eat, shop, etc). If you live in a single-family home, most likely you can charge your EV at home 90%-95% of the time.

Assuming you have an EV with 200+ miles of range it is only when you take long road trips or weekend getaways that you need to plug in to a public charging station. And that is when the speed of fast charging will matter to many consumers. They are accustomed to refueling their gas/diesel vehicle in about 5 minutes and many will not accept charging times of 45-60 minutes to add 200 or more miles of range.

Tesla and Electrify America are both launching super fast DC fast charging stations and updating their EVs so that the vehicles can add roughly 200 miles of range in about 15-20 minutes. These charging speeds will be acceptable to many consumers as they realize that they can shop, eat, get coffee, and use the rest room while their EV charges to or near 80% within the 20-30 minutes they are stopped.

4. Adequate Charging Options Along Every Major US Interstate Highway: In addition to faster charging speeds, consumers will want to have confidence that when they head out on a long road trip to Disneyland, Disney World or to see grandma a few states away, that there is an adequate number of reliable DC fast chargers along their route. Currently only Tesla owners have any sense of road trip charging because of the company’s investment in both its Supercharger and Destination Charger networks.

This means not just that there are DCFC stations available every 30-50 miles like gas stations, but that there are 10-20 or more stations (not just a few) at each charging location.

5. Urban/Renter Charging Solutions: As EV adoption increases, access to charging stations for the roughly 36% of US households being renters will be a huge challenge. Currently most apartment complexes do not offer charging options so EV drivers must charge at work, school, Tesla SuperChargers or various public charging stations are stores such as Target or municipal parking lots.

This scenario is workable for eager early adopters, but for the mainstream consumers who rent, they will need or expect very convenient charging options. I don’t expect budget, ROI-focused multi-family housing owners/mangers to add charging stations in any significant level until they start losing renters to competitors or see significant demand and/or complaints.

Until then, I expect urban charging stations installed in parking lots of retailers like Target to fill some of the void. But additional retailers such as CostCo, Walmart, Whole Foods, Safeway and others will need to step up to the plate and add 10-20 charging stations at each store in key markets before renters will likely feel they can charge their EV conveniently when needed.

Additionally, workplace charging can fill a huge need for renters as well as mass transit stations.

6. Cost Competitiveness: One of the most obvious challenges with EVs currently is that they tend to cost anywhere from $8,000-$20,000 more than similar ICE vehicles. Now, EV fans will argue that when you factor in the lower cost of “fuel,” less maintenance, and Federal, state and utility incentives that much or all of the cost difference goes away.

And while that may or may not be true depending on the EV and comparable ICE vehicle, consumers must still finance or pay with cash this cost differential up front. The vast majority of the various tax incentives, rebates and lower cost of ownership comes anywhere from months to several years later to be realized.

With this in mind, I believe that when EVs are within $2,000-$4,000 sticker price of comparable ICE vehicles, many consumers will realize that the incentives and lower cost of “fuel” can be offset fairly quickly. But a $10,000 difference will be too much to swallow for buyers outside of the early adopters.

Closing Thoughts – No, Electric Pickups Can Come Later

That’s basically it from the perspective of the consumer. They want ~300 miles or so of range, adequate access to fast charging stations, several EV model types and options from brands they like and they don’t want to pay more than a few thousand dollars higher than the cost of a comparable ICE vehicle.

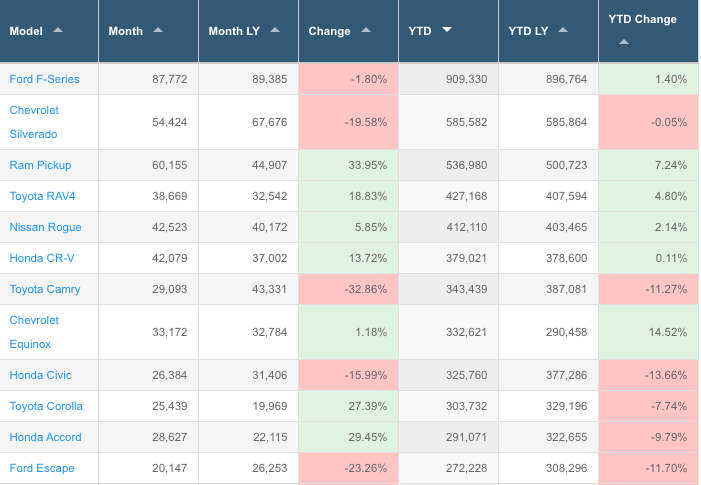

Readers might ask, but what about electric pickups, won’t they be required for mainstream adoption of EVs in the US? In short, I believe the answer is no. While pickups are obviously very popular and the top-selling vehicles in the US, they will be critical during the “Late Majority” stage of adoption, but not vital in the next 5 years or so.

More practically, we simply may not see any price competitive pickups reach the market until around 2025. The high-end pickups coming to market in the next few years from Rivian, Tesla, Bollinger, and Workhorse look to be impressive efforts, but will primarily be purchased by higher-income, early-adopter type consumers rather than mainstream pickups buyers.

There are of course many hurdles and challenges from the automakers’ perspective to be able to support and deliver on the above expectations of consumers, but we will cover those – and provide a forecast of exactly when EVs will reach mainstream adoption in the US – in separate future articles.

What do you think? Do you agree or see additional hurdles for mass consumer adoption of EVs? Let me know in the comments.

6 Responses

I think we need to see changes in the non-TESLA charging infrastructure. Right now charging stations are hard to find and unreliable, and it’s confusing how to pay. Different models of cars require different types of charging station attachments. It is hard for a long distance driver to have confidence in charging in an unfamiliar place.

We need to see reliability, standardization, better signage, and better payment methods for charging. Right now only Tesla is reliable. A non-Tesla driver who wants to go on a longer trip will face hard to find chargers that don’t work. It is hard to pay and the charger may not work for their car. The non-Tesla driver is not confident in charging in an unfamiliar place.

Great article! I really appreciate the updated range chart! I actually agree with all of your points.

I happened to see the new Hyundai Nexo Fuel Cell SUV ad today and they actually used the long charging times (inferring BEVs but not actually saying the word) as a reason to buy a FC vehicle! Obviously, FC vehicles have their own challenges, esp. with the price of hydrogen and availability. I just thought it was interesting – they are appealing to the same early adopters and are pushing on the BEV “bruise” of charging times.

Thanks Dana! Ya, everybody is battling against the other powertrains. Toyota calls their regular hybrids “self charging” – because people who used to buy or consider a hybrid now are going for a PHEV or BEV. Nobody is buying FCEVs … sure they currently have better range than BEVs, but not a lot of PHEVs. But yam good luck finding a hydrogen station in most regions.

Great article. Thanks for all the information !

I’m still confused somewhat on why PHEVs with good EV range are not taking off more. They remove most of the items from the list, especially with offerings such as the Honda Clarity with 48 mile pure EV range. With the gas engine backup for long trips, and good pricing, and a good-sized car, about the only item remaining seems to be number 1 – the offerings available. (I had to drive over 100 miles to test-drive one.) Is it just a matter of critical mass / market education for PHEVs to take off ? Or is there something else I’m missing – like a belief that a series-hybrid is somehow not as ‘good’ as a pure EV ? Why the aversion to including an ICE ? My driving cost will be nearly the same as a pure EV, as will my carbon footprint – but there’s no range anxiety or adapting to a new lifestyle for occasional cross-state trips.

Thanks Bill. Ya, I’m a fan of the value of PHEVs, especially as a transition for people who are not ready to take the plunge to a BEV or perhaps they rent or take lots of long trips – and a BEV isn’t ideal for their needs.

Purists dislike PHEVs because they still have a gas engine. But I’d rather someone drive a PHEV than a gas-only vehicle. The transition is not going to happen overnight.