The US EV story the last 18 months has been predominantly about the Tesla Model 3. And while that media attention and buzz has been great for awareness of EVs and for Tesla specifically, sales overall for the rest of the EV market has basically been flat or down.

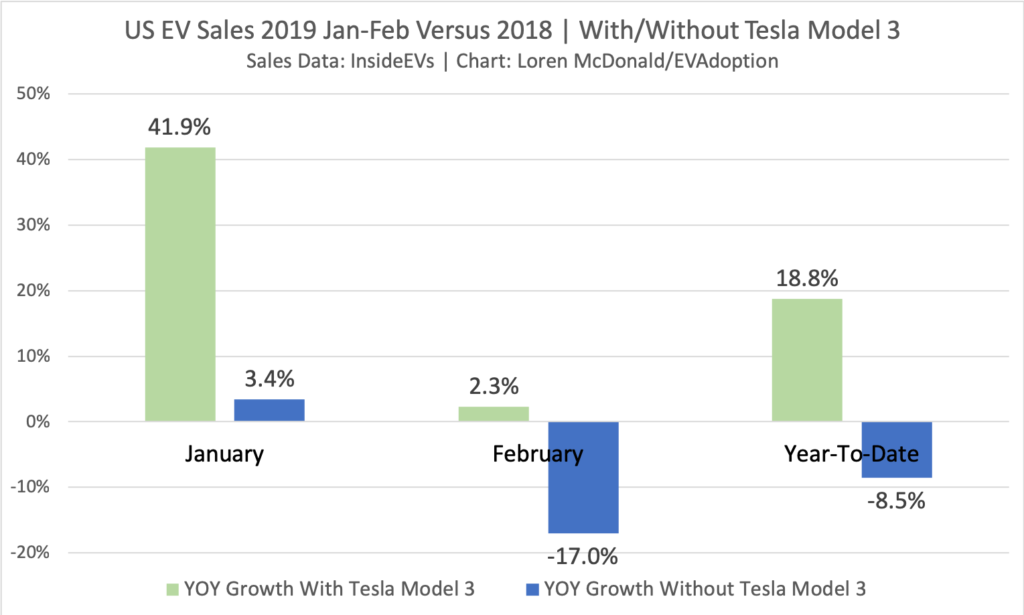

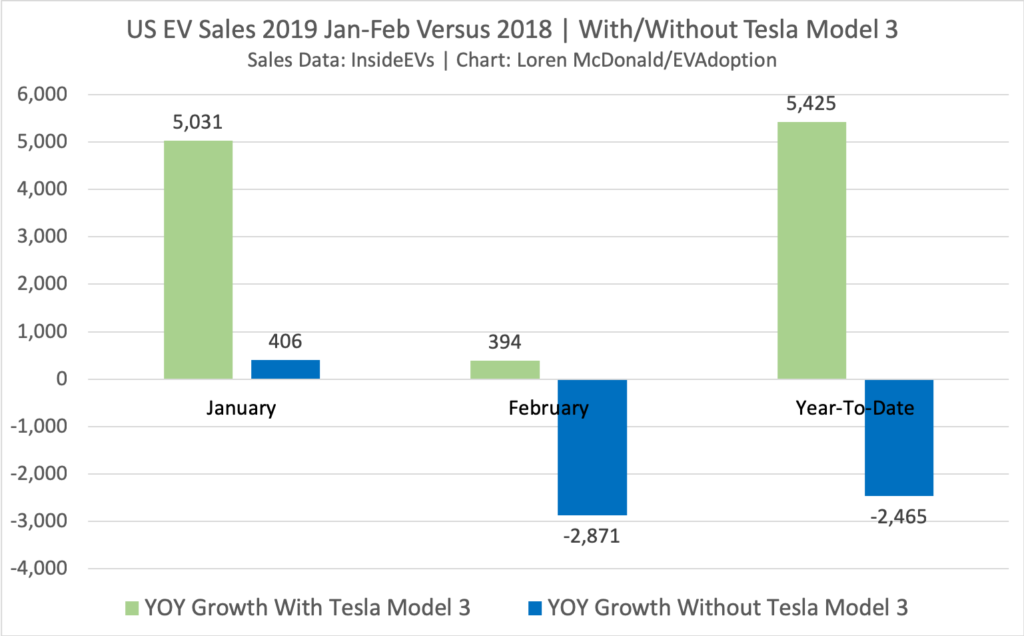

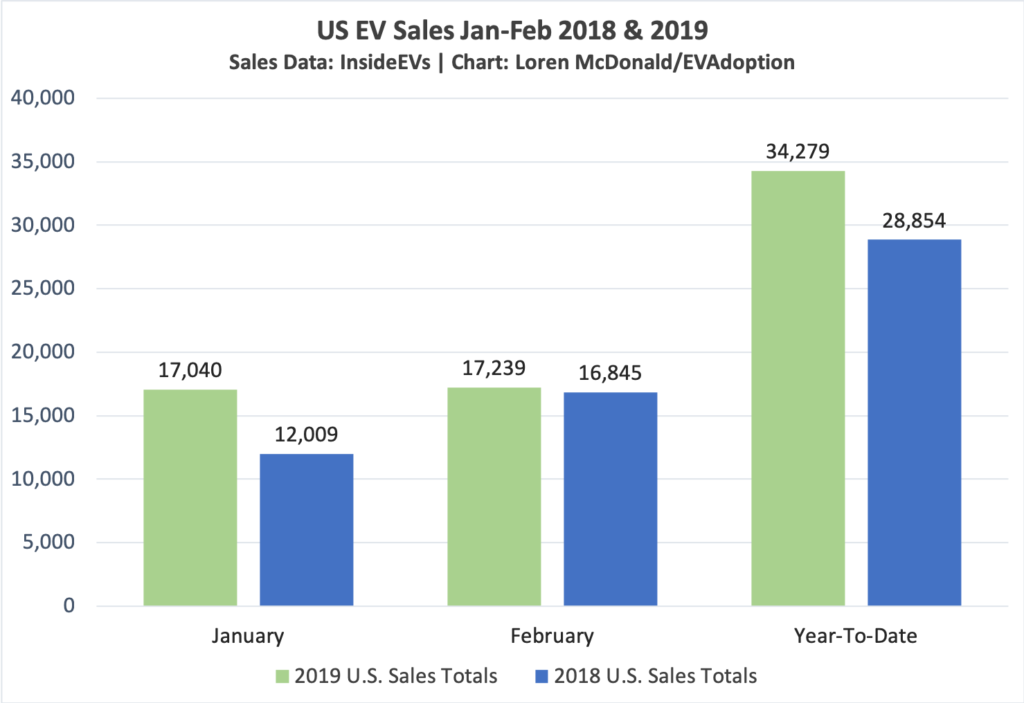

After the first two months of 2019 (using InsideEV’s Sales Scorecard) excluding sales volume for the Tesla Model 3 for the same period in 2018, sales of EVs in the US are down 8.5% compared to 2018. YOY sales without the Model 3 were up 3.4% in January, but down 17% in February.

The good news is EV sales are up 18.8% YOY for January and February when the Model 3 numbers are included. January sales were up 41.9%, while February was only up 2.3%. Keep in mind, however, that many of the EV model sales numbers from InsideEVs are estimates as an increasing number of automakers are only releasing quarterly sales data or like Tesla, also not by geographic region.

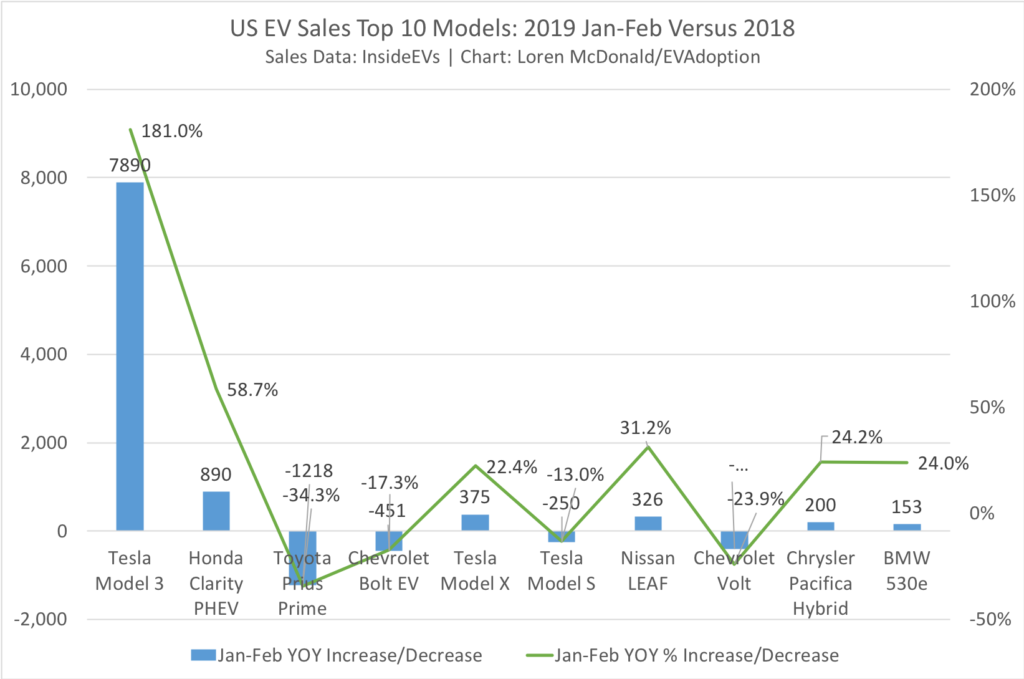

Among the top 10 selling EVs in 2019, six models saw YOY sales increases after two months of the year, with the Tesla Model 3 and Honda Clarity PHEV leading the way. The Toyota Prius Prime was the biggest loser, down 34.3% over 2018. The Nissan LEAF is up over 2018 when it had a poor start to 2018 with only 150 units sold in January. Even though the LEAF has longer range at 151 miles (and an optional 225 miles of range later in 2019), it will likely see a sales decline versus 2018 in the coming months.

And in typical Pareto Principle fashion, YTD the top 10 EVs comprised 79.7% of US EV sales.

Why Are EV Sales in the US Not Growing Outside of the Tesla Model 3 and A Few Other Models?

What’s going on? While it is only two months into 2019, the flat or declining EV sales when excluding the Model 3 is not surprising to me. As I wrote in this CleanTechnica article, Forecast: 2019 US EV Sales Growth Will Drop To ~12%, I wasn’t expecting much of an increase in sales for 2019 anyway.

There are several factors at play, including:

1. Fundamentally, 2018’s strong EV sales growth was due to the huge demand and product and deliveries of the Model 3, which may be tough to match in 2019. Much of this is due to the shift to deliveries for China and European markets and the limits on demand for the high-end versions of the Model 3 in the US.

2. Additionally, many potential EV buyers are simply waiting for the lower-priced Model 3 which will continue to fuel overall market growth, but also limit sales growth of other EV models.

3. As I wrote in this EVAdoption post in 2018, New EV Models Responsible For Nearly All Annual US EV Sales Growth – New Analysis, because EVs are advancing rapidly, models that are just a few years old can quickly become uncompetitive. As such, EV buyers will shy away from models that have fallen behind newer models with more range and advanced features – often at lower price points.

In 2019 this means many buyers are awaiting new BEV offerings from Hyundai (Kona) and Kia (Niro), as well as luxury models from BMW, Audi and Mercedes-Benz. The Kona has only just become available in the US in a few markets and sold 16 units in February according to InsideEVs. Those numbers will climb significantly, along with those of the Niro BEV when it becomes available, but both models will be constrained by supply and availability in only a few ZEV markets.

4. And now the upcoming Tesla Model Y CUV preview announcement on March 14 could further put a freeze on many potential BEV buyers in the US in 2019. With American car buyers being in love with SUVs and CUVs, many potential Tesla Model 3 (and other models) buyers might now simply hold on to their existing car and wait for the Model Y or another SUV/CUV BEV in the next few years that will have 250-300 miles of range at a lower price point than today.

Until there are dozens of competitively priced SUV/CUV BEVs available from a wide range of brands, including US and Japanese automakers, US EV sales will like remain choppy and dependent on the market reception to just a few key models.