While all eyes of electric vehicle advocates and potential future owners are on Washington, D.C. and the fate of the Federal EV tax credit, the race to see whether GM Or Tesla will reach the 200,000 phase-out threshold marches on.

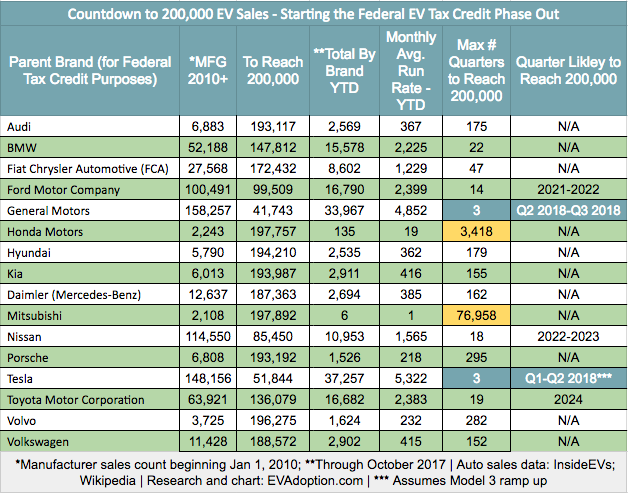

Through October 2017 (using sales numbers from Inside EVs), General Motors remains closest to the 200,000 mark having sold 158,257 EVs since 2010, followed by Tesla with 148,156 (Tesla does not break out sales by geographic market, so these numbers are estimates from InsideEVs). Nissan and Ford are the only other manufacturers with more than 100,000 sales of EVs in the US.

(View complete sortable version of this EV tax credit table for all manufacturers)

At current sales run rates, GM should reach 200,000 sales in about 9-10 months or July-August 2018. Sales of the Chevrolet Bolt continue to climb each month, while the Volt on the other hand is seeing a gradual decline. The Volt’s decline is likely due to many EV buyers choosing the Bolt or Toyota Prius Prime instead of the Volt.

Projecting when Tesla will reach the 200,000 mark is a bit more difficult because: A) Tesla does not break out sales by geographic market, so sales numbers for the US are only estimates; B) The Model 3 “production hell” and unpredictability of how many might be delivered in the coming months; and C) Both the S and X tend to see sales spikes at the end of quarters. At the current average monthly sales run rate of the combined S, X and 3, Tesla would reach the 200,000 mark also in about 9-10 months, or July-August 2018.

Tesla, however, could reach 200,000 in US sales by May 2018 if we assume an average run rate of 5,000 Models S and X and Tesla is able to start delivering about 5,000 Model 3’s per month by the end of Q1 2018. This projection could vary by a few months in either direction depending primarily on Tesla’s ability to scale the Model 3.

Tax Credit Phase Out

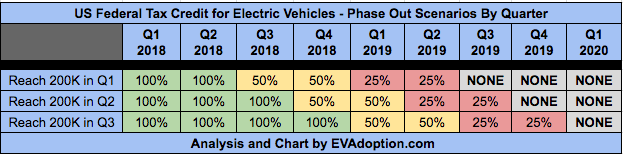

As a reminder, the federal tax credit is phased out over time beginning the second quarter AFTER the quarter in which a manufacturer reaches a total of 200,000 BEV or PHEV vehicles sold since 2010. Here is how the phase out works:

- The full amount of the EV qualifying tax credit is in place DURING the entire calendar quarter in which 200,000 EVs are sold by a manufacturer, AND through the subsequent quarter.

- Then the tax credit amount is reduced by 50% ($3,750 for Tesla models and Chevrolet Bolt and Volt) for the next 2 quarters.

- The credit is reduced again to 25% ($1,875 for Tesla models and Chevrolet Bolt and Volt) of the original amount for the subsequent 2 quarters.

- At that point the credit expires completely.

Of course the threat of losing the Federal tax credit could increase sales for many brands in November and December, or beyond if the end of the credit is extended by Congress into say mid-year 2018. Or if as is outlined in the House of Representatives version of the tax plan, the credit is eliminated on December 31, 2017 – than all of these projections are just an exercise in math.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →

One Response