The Qualified Plug-In Electric Drive Motor Vehicles (IRC 30D) tax credit – commonly referred to as the “Federal EV tax credit” has a number of flaws, but one of the biggest is the poorly-designed formula that determines the amount of the tax credit available for each BEV and PHEV sold in the US.

The formula, which is based on the size of an EV’s battery pack, rewards OEMs (and consumers) for using and purchasing larger batteries with no consideration to efficiency (EPA range/kWh) and price.

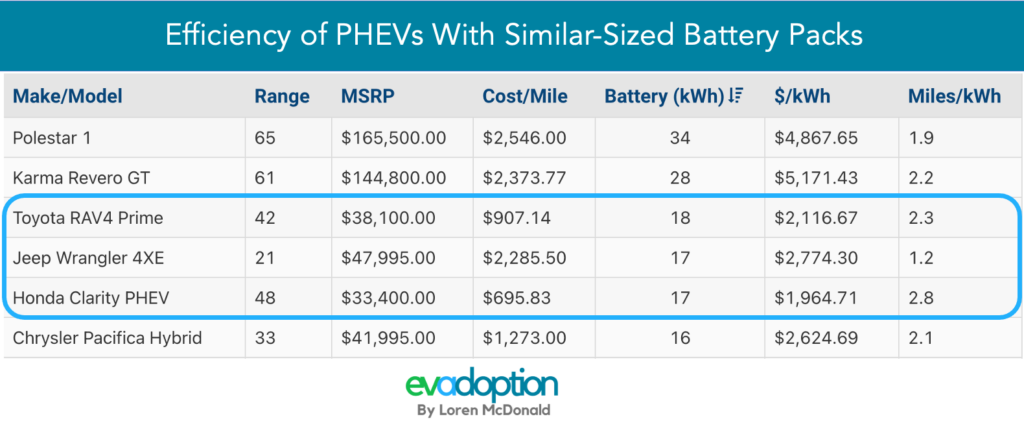

In the example above, the new Jeep Wrangler 4xe PHEV, which uses a 17 kWh battery, achieves only 21 EPA miles of range versus the 42 miles of range for the Toyota RAV4 Prime with an 18 kWh battery. And the starting MSRP for the Wrangler is about $9,000 more than the RAV4 Prime. But both PHEVs qualify for the same $7,500 tax credit, the maximum amount under the tax credit rules. Additionally, the Chrysler Pacifica Hybrid (a PHEV) with a slightly smaller battery of 16 kWh achieves one-third more range than the Wrangler 4xe – yet again, they both receive the same $7,500 credit.

Secondly, the Hyundai Kona Electric (BEV) with a 64 kWh battery pack and 258 miles of range for a 4.03 miles to kWh efficiency ratio qualifies for the identical $7,500 tax credit as the Wrangler 4xe with only 1.2 miles of EPA range per kWh.

How Does the Federal EV Tax Credit Formula Work?

Before diving more deeply into the flaws of the tax credit calculation and then how to fix them, let’s take a look at how the formula actually works. The IRS formula is based on the size of the battery pack measured in kWh and works as follows:

- A. $2,500 for a minimum of a 5kWh battery pack

- B. + $417 for all battery packs

- C. + $417 per kWh of a battery pack in excess of 5 kWh

- D. Federal tax credit amount then = A + B + C (The amount is capped at $7,500.)

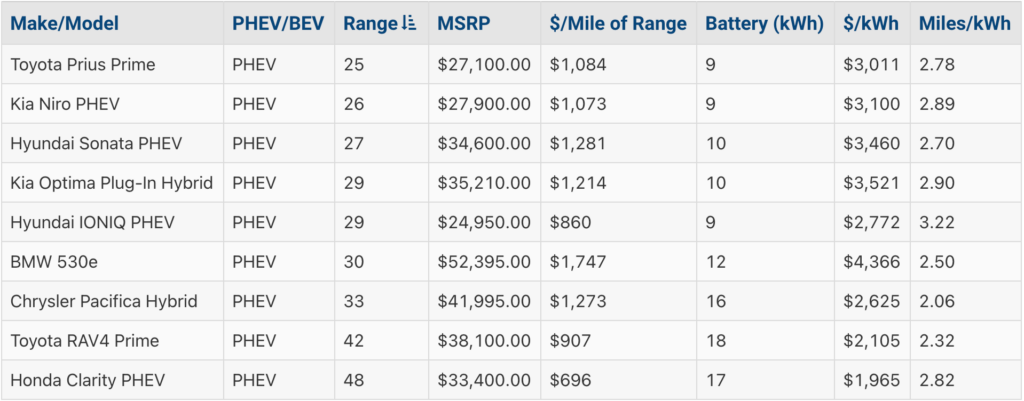

Below is a table show sample calculations for 9 BEVs and PHEVs/

The Key Flaws of the Federal EV Tax Credit Formula

Tax laws fundamentally are – and should be – designed to change the behavior of businesses and consumers. In the case of the EV tax credit it should motivate:

- Automakers to produce more EVs in general; more affordable EVs, and EVs – whether BEV or PHEV – that are as efficient (getting maximum miles per kWh of the battery pack) as possible.

- Consumers, preferably those with modest and lower-incomes, to buy EVs – whether BEV or PHEV – instead of gas-powered vehicles; and to choose those that are more efficient hence requiring fewer battery cells.

From where I sit, there are 3 main flaws with the current IRS formula:

1. Basing it on the size of the battery pack: Using a few analogies, basing the formula on battery pack size might be akin to basing the mortgage deduction on the square footage of a house or a tax credit fro cars based on number of gallons in the gas tank of a gas-powered car. The current formula, which was presumably conceived in 2009 before it went into effect in 2010, was at a time when battery technology and efficiency was not what it is in 2021.

According to InsideEVs, In 2008-2009 there were basically only 4 electric passenger vehicles available in the US – 3 expensive sports cars – the Tesla Roadster, Fisker Karma and McClaren P1 and the CODA sedan. These four vehicles then stopped being produced and the first mass-market EVs were launched in December of 2010 with the Chevrolet Volt and Nissan LEAF, followed a year later with the Mitsubishi iMiEV city car in December 2011.

That first Nissan LEAF BEV had a 21.2 kWh and 73 miles of EPA range and amazingly, the Chevrolet Volt PHEV achieved 40 miles of range from a 16kWh battery pack. And while the average of BEVs has gone up considerably, the range and battery pack efficiency of PHEVs has actually declined relative to the first generation Volt.

The federal EV tax credit should incentivize automakers to produce the most efficient EVs possible, rather than just dropping the largest battery pack that will fit into an existing ICE model so that the PHEV version qualifies for the highest credit available. Whether BEV or PHEV, the tax credit formula and resulting credit amount per model should be designed to encourage automakers to produce the most efficient EVs and make them more attractive to consumers.

2. Using the same formula for BEVs and PHEVs: Because PHEVs have much smaller battery packs and much less range than BEVs, the current formula provides the same $7,500 tax credit for an inefficient Jeep Wrangler 4xe with 21 miles of range and a Honda Clarity with 48 miles of range. That Wrangler 4xe with the lowest efficiency of 1.2 miles/kWh also gets the same $7,500 credit as the very efficient Hyundai IONIQ Electric with 4.5 miles/kWh.

3. The current kWh formula means any BEV or PHEV with a 16 kWH or larger battery pack receives the same $7,500 credit: This aspect to the formula simply makes zero sense. As explained above on one hand it rewards OEMs to focus on battery size for PHEVs, and on the other it provides no impetus or reward to OEMs to produce more efficient BEVs or PHEVs.

The credit – and hence the formula for determining the credit – needs to reward and encourage automakers to produce and consumers to buy more efficient EVs. The credit should be structured to drive innovation and encourage automakers to strive to get more range and efficiency out of increasingly smaller battery packs. This is critical for at least 3 reasons:

- Battery packs are the single biggest cost today with EVs, and so driving innovation leads to the need for smaller battery packs and lowers the cost for both automakers and consumers.

- Secondly, batteries are simply in short supply. Smaller battery packs that are also more efficient means OEMs can actually deliver more EVs to consumers.

- Thirdly, many automakers are producing low electric range PHEVs that qualify for the maximum $7,500 tax credit (or close to it, e.g., $6,000 and up) primarily to meet state emissions requirements. But then many consumers are buying or leasing these low-electric range PHEVs to take advantage of the federal, state, utility, and HOV-lane incentives – but then may rarely use the electric range because it is so short.

Fixing the Federal EV Tax Credit Formula Flaws

So enough about the flaws, what would be a better approach to the current formula?

1. PHEVs must meet a minimum EPA range to qualify for the tax credit: This approach is not without precedent as the California tax rebate added this in 2020. As I wrote in November 2019, California increased its minimum requirement for the all-electric range of plug-in hybrid electric vehicles to 35 miles from 20 miles using the Urban Dynamometer Driving Schedule (UDDS) testing procedure. UDDS is different from the EPA range and is a city-driving testing standard. The 35-mile electric range requirement for PHEVs equates to roughly 23-24 miles of EPA range.

My view is that taxpayers should not incentivize the production and purchase of PHEVs that can’t meet the typical average daily vehicle miles traveled (VMT) of most Americans. The general rule of thumb is that 30 miles is the average VMT, but more importantly, can 30 miles of range get most people to work (where they can charge for the return home), to a mass transit station, to school, or handle their typical shopping and chores trips? And more importantly, PHEVs simply need to have enough range that encourages their owners to plug in each night and drive on electric-only power as much as possible. Currently, however, 18 of the 31 PHEVs available in the US have EPA ranges of less than 25 miles.

If we look at these current 31 PHEVs available in the US, only 7 or 22.5% of the PHEVs would qualify for the tax credit if 30 miles of range with the minimum threshold.

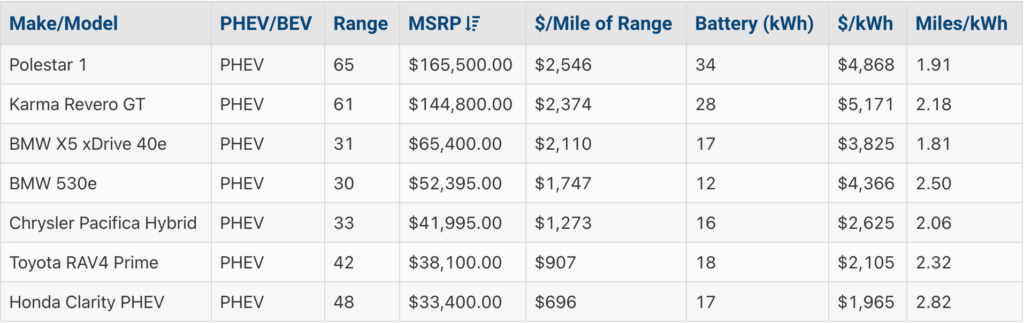

Additionally and separate from the formula changes, I believe there should be a cap on the MSRP of EVs to qualify for the credit. If we set the cap at say $50,000 (about $10,000 above the average vehicle purchase price), then only 3 of the 7 PHEVs in the above table would qualify. So for the moment, that combination might be a bit too strict.

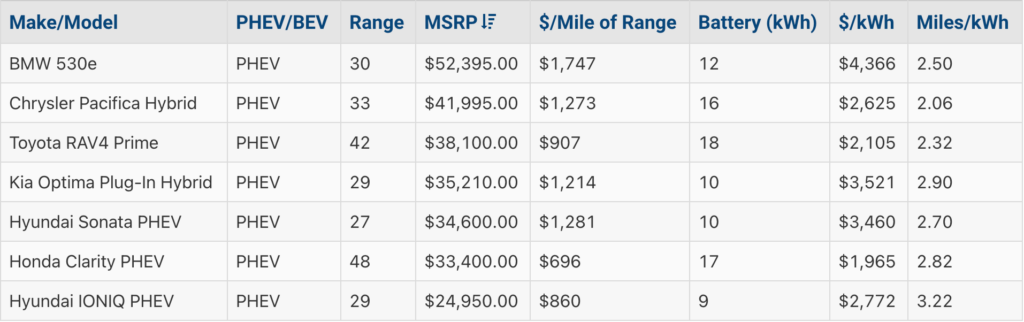

If we filter our PHEV table on 27+ miles of range and less than $60,000 MSRP, there would be 7 currently available PHEVs that meet these thresholds. All 7 also achieve an efficiency of more than 2.0 miles per kWh.

Now if we lower the EPA range minimum to 25 miles and keep the $MSRP cap at $60,000 there are currently 9 PHEVs that would qualify under this criteria. Interestingly, the 3 additional PHEVs are all pretty efficient with a 2.7 miles/kWh efficiency or higher.

Based on the above analysis, my recommendation is that PHEVs would have to have a minimum of 25 or more miles of EPA range AND achieve at least 2 miles per kWh of efficiency. This reduces wasting tax dollars that support the production and purchase of EVs with minimal range and poor efficiency. Some of the low-efficiency PHEVs like the Jeep Wrangler 4xe actually have a lower MPGe than its ICE version. I would also recommend that the minimum range requirement increases 1 mile each year until the credit expires.

2. Tax credit formulas should be based on efficiency, not battery pack size: As outlined earlier, using battery pack size as the basis of credit formula makes little to no sense. Instead, I’m proposing the use of a formula that encourages automakers to focus on producing highly-efficient powertrain combinations and consumers to buy them.

Batteries are in short supply, larger batteries increase the weight of EVs making them less efficient and result in more impact on roads, and they simply cost more than smaller batteries making EVs less affordable. The tax credit should first and foremost incentivize getting the most efficiency out of batteries, and secondarily reward more range – NOT battery pack size.

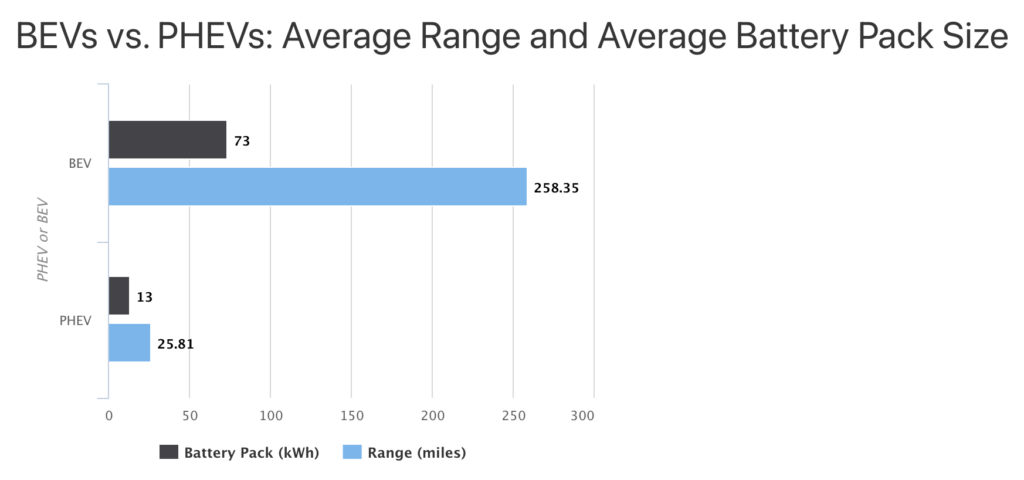

3. Formulas should be different for PHEVs and BEVs: As mentioned earlier, the current IRS formula makes zero sense to be used for both PHEVs and BEVs which have average range differences of roughly 10 X (25 miles for PHEVs versus 250 miles for BEVs). And battery packs are roughly 5 times larger for BEVs (73 kWh) versus PHEVs (13 kWh). Because the current formula doesn’t take these differences into account, you have vastly different EVs qualifying for the exact same $7,500 tax credit:

- Jeep Wrangler 4xe: 17 kWh battery, 21 miles of range and poor efficiency at 1.2 miles/kWh = $7,921 calculation and $7,500 credit.

- Kia Niro EV: 64 kWh battery, 239 miles of range and good efficiency at 3.73 miles/kWh = $27,520 calculation and $7,500 credit.

Again, it simply makes zero sense to have a formula which provides the same $7,500 tax credit for all EVs with a 16 kWh or larger battery pack.

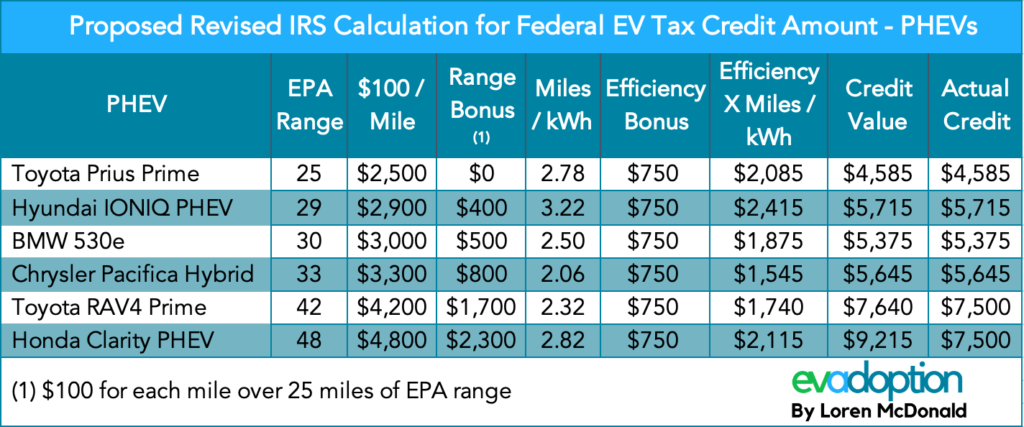

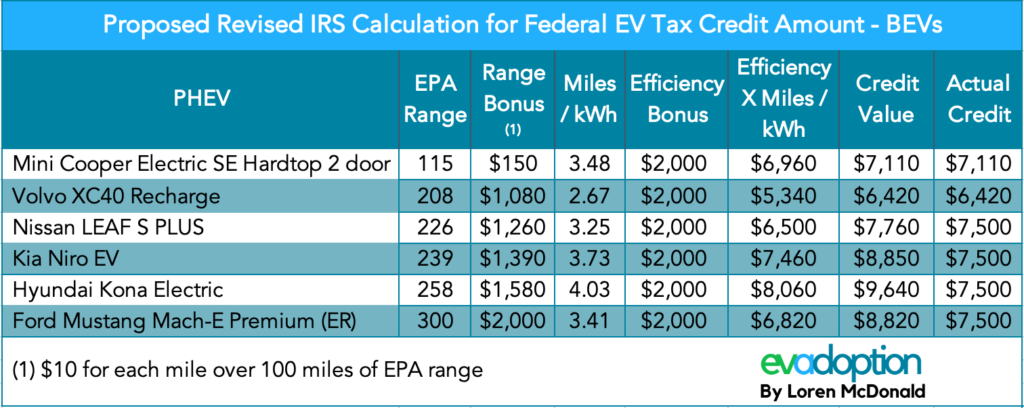

Below are my two proposed formulas each for PHEVs and BEVs that recognizes these differences:

PHEV Formula: Following is an example of a formula that would encourage more efficiency in PHEVs and consumers to purchase higher mileage/higher efficiency PHEVs. In this example and formula, while the Chrysler Pacific Hybrid PHEV has 4 miles more of range than the Hyundai IONIQ PHEV, because the IONIQ PHEV is more efficient, it ekes out a slightly higher credit amount.

Formula = (EPA Range in Miles X $100) + (EPA Miles Bonus: $100 for each mile above 25 miles of EPA range) + (Miles/kWh X $750 Efficiency Bonus) = Total Credit Amount. Any calculation that exceeds $7,500 is of course capped at $7,500 – the same as the current IRS formula.

BEV Formula: Following is an example of a formula that would encourage the development and purchase/lease of more efficient BEVs. While the majority of BEVs under $60,000 MSRP and using my proposed formula would be eligible for the current full $7,500 credit, a few would fall slightly below. In the example below, the Mini Cooper Electric would only have a credit of $7,110 because of its relatively short range of 115 miles. And the Volvo XC40 Recharge with 208 miles of range would have a credit amount of $6,420 due to its low BEV efficiency calculation of only 2.67.

The above formulas may not be perfect, but I believe they are a better approach than the current one which results in any EV – BEV or PHEV – with a 16 kWh or larger battery pack qualifying for the full $7,500 credit amount. When combined with household income and MSRP caps, along with a minimum range for PHEVs of 25 miles – the above approach should help drive better production and purchase behavior from automakers and consumers respectively.

There are many flaws of the current approach to the federal EV tax credit and over the next several months I believe we will see a number of changes being proposed and debated in Congress. A good place to start would be with the formula for calculating the credit amount. Let me know what you think in the comments section below.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →

6 Responses

Dear Mr. McDonald,

I have heavily updated my Google spreadsheet on EV sales, new model launches (now with source articles), battery & lithium demand forecast. Maybe you are interested. Do you have anything to add in terms of forecasted sales numbers or BEV model launches that I may be missing in my list? Any feedback that enables me to improve my forecasts is greatly appreciated. I am especially interested in your opinion on how EV sales might end up in the US in 2021, given Joe Biden’s recently announced infrastructure program.

https://docs.google.com/spreadsheets/d/1tUYfLuzui3ygxZpPFvCX9zr1liI47_3c6Cl3j_PGNQg/edit?usp=sharing

Hi Loren. Very enjoyable article, as usual. I’m not holding my breath that the government will adopt a more rational incentive program, but it would be nice if they did. My only substantive comment was about the first Leaf (built in 2010) having a 40kWh battery and 153 mile range. I believe the 40kWh battery pack first became available in the 2018 Leaf with an EPA range of 151 miles. That much range would have been pretty extraordinary in 2010. Best regards, Ken

Thanks Ke. You know when I first typed that it didn’t seem right and then I never went back and checked – just updated it with this: That first Nissan LEAF BEV had a 21.2 kWh and 73 miles of EPA range … Thanks foer the catch!

You are right to question the flawed logic behind these tax incentives. I’m not sure that we need an incentive for PHEVs at this point. I’m inclined to put all our eggs in the EV basket and let consumer desire for gas pump savings drive demand for PHEVs and hybrids. I am mostly concerned about climate change. The government needs to curb CO2 emissions, so the incentive should be tied directly to energy efficiency. I prefer a simple approach using MPGe. Any EV over an MPGe of 110 gets the full $7,500, then it scales down to zip when MPGe drops below 80. A 100 MPGe EV would come in at $5,000. A 90 MPGe EV would get you $2,500. An 80 MPGe EV would get you nothing. As long as the automaker/consumer gets their model’s efficiency above 110 MPGe, they can then maximize its range, acceleration, or size, but Mother Nature comes first. EPA already calculates and publishes MPGe, and it is a valid measure of efficiency.

Peter – thanks for the comment and the MPGe suggestion. I considered using MPGe – but perhaps wrote it off too quickly. It is not a metric that most industry folks find of value, so I guess I just skimmed past it. That said, it is an official government EPA metric that is already calculated and published – so it could have easy acceptance by our elected officials. I’ll dive into it a bit more and see how it lines up with my efficiency metric by comparison. So thanks again!

On PHEVs we disagree. I think for a lot of buyers – especially those who do a lot of road trips or are otherwise feel they are not ready to go all in on a BEV – PHEVs with significant range are a great option. But that’s why I believe the tax credit needs to have a minimum level – ideally at least 30 miles and below say $60,000 MSRP – but per my article there would be so few. So a compromised might be around 25 miles to start and go up each year.

Great! Thanks for sharing how the Federal EV Tax Credit Formula Work. I am now informed and keep posting these type of pieces.