California’s Clean Vehicle Rebate Project will see two key changes that could create a small shift in sales across various EV models. When the new vehicle eligibility rules take place beginning on December 3, 2019, 13 currently available electric vehicles will no longer be eligible for the rebates from the state of California.

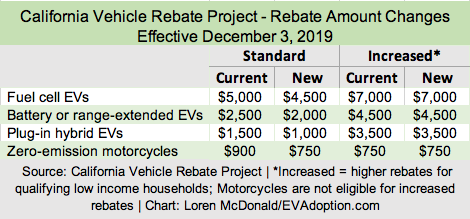

As background, the Clean Vehicle Rebate Project (CVRP) promotes clean vehicle adoption in California by offering rebates of up to $7,000 for the purchase or lease of new, eligible zero-emission vehicles, including full electric (BEV), plug-in hybrid electric (PHEV) and fuel cell vehicles (FCEV). The CVRP has “Increased Rebate” amounts for California residents whose household incomes are less than or equal to 300 percent of the federal poverty level. Current and future standard and “Increased Rebate” amounts are:

Besides the reduced standard rebate amounts, the two key changes in the program are related to Vehicle Eligibility Criteria:

- A Manufacturer’s Suggested Retail Price (MSRP) cap of $60,000 will be instituted on all vehicles with the exception of fuel cell electric vehicles.

- The Urban Dynamometer Driving Schedule (UDDS) all electric range requirement for plug-in hybrid electric vehicles will be increasing from 20 miles to 35 miles. (UDDS is different from the EPA range. The CRVP UDDS – a city-driving testing standard – 35-mile electric range requirement for PHEVs seems to equate to roughly 23-24 miles of EPA range. Under the UDDS standard and new CRVP requirements, the Toyota Prius Prime with 25 EPA miles makes the cut, but the Mitsubishi Outlander PHEV with 22 miles does not.)

The result of these two changes are that 13 currently available EVs will no longer be eligible for rebates. These EVs are:

- Audi e-tron (exceeds $60,000 MSRP)

- BMW 530e iPerformance / 530e xDrive iPerformance (Below 35 miles UDDS requirement)

- Karma Revero GT (exceeds $60,000 MSRP)

- Jaguar I-PACE (exceeds $60,000 MSRP)

- Mitsubishi Outlander PHEV (Below 35 miles UDDS requirement)

- Subaru Crosstrek Hybrid PHEV (Below 35 miles UDDS requirement)

- Tesla Model S (exceeds $60,000 MSRP)

- Tesla Model X (exceeds $60,000 MSRP)

- Volvo S60 T8 (Below 35 miles UDDS requirement)

- Volvo S90 T8 (exceeds $60,000 MSRP + below 35 miles UDDS)

- Volvo V60 T8 (exceeds $60,000 MSRP + below 35 miles UDDS)

- Volvo XC60 T8 (exceeds $60,000 MSRP)

- Volvo XC90 T8 (exceeds $60,000 MSRP + below 35 miles UDDS)

Why is the California Air Resources Board implementing these changes? According to the CVRP site:

With an increasing program demand that exceeds the current program budget, the California Air Resources Board approved changes to ensure that this year’s funding allocation provides a meaningful incentive to encourage EV purchases while maintaining a program that is viable for a longer portion of the upcoming year.

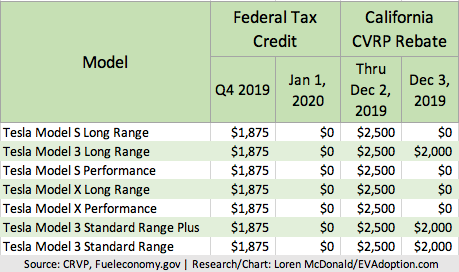

Check out our sortable table of both the Federal EV tax credit and CRVP rebate amounts. See a sample screenshot below.

How Will These Changes Affect EV Sales in California?

For EVs that remain eligible, CVRP rebates are reduced by $500 to $2,000 for BEVs and to $1,000 for PHEVs. I would be surprised if any potential EV buyer in California decided not to buy an EV and choose an ICE vehicle or none at all because of the loss of $500 in rebate amount.

But what might happen is that EVs that no longer are eligible for any rebate might be passed over by some consumers who then choose a different and eligible EV. Or in the case of PHEVs like the BMW 530e, some consumers might opt for the non-PHEV version of the same vehicle.

However, since all but the two Tesla models (as far as EVs go) sell at low volume, I wouldn’t expect the CVRP changes to reduce EV sales in California by any significant level – perhaps a decline of 5,000-10,000 at most. More likely is consumers shifting which EVs they decide to buy or lease.

Double Punch to Tesla Model S and X

Of the 13 models no longer eligible for the CVRP rebates, only two models – the Tesla Model S and X have averaged US sales of more than 1,000 units per month. In addition to no longer qualifying for the California rebate, effective January 1 the Federal EV tax credit also phases out for all Tesla models. While the Federal credit is just that, a credit applied to your income taxes, if you combine the full $7,500 amount with the state rebate of $2,000, buyers of non-Tesla BEVs that compete with the Model S and X will have a theoretical $9,500 advantage of potential savings from government incentives. (Though keep in mind, the current tax credit level for Tesla models has been phased down to $1,875.)

How will these incentives changes impact sales of Tesla models? Some California-based Tesla buyers who were already on the fence between the Model S and Model 3, for example, might simply opt for the Model 3. Because Tesla has such a strong cult brand and the advantage of the Supercharger and Destination Charger networks, I don’t expect the loss of the Federal tax credit and small reduction in CVRP rebate to significantly affect Model 3 sales. This could change of course once EVs like the Ford Mustang Mach-E and VQ ID.4 reach the US market.