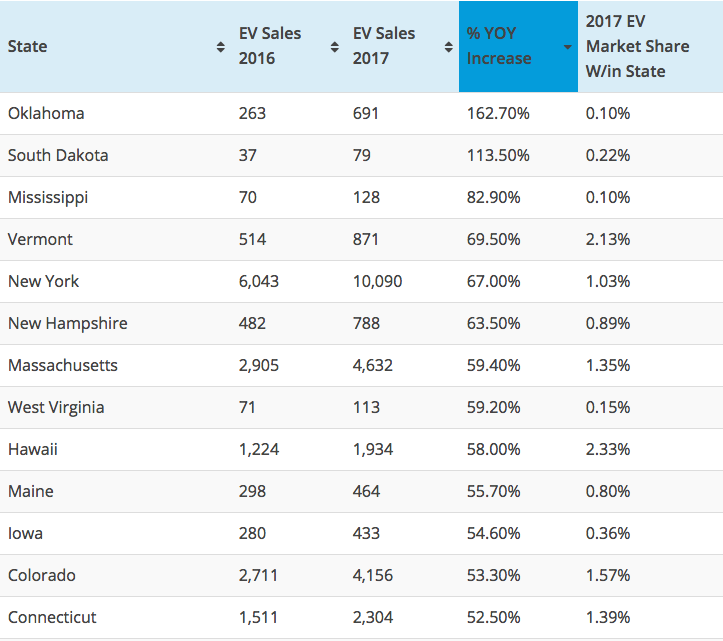

Which US state saw the biggest year-over-year increase in EV sales in 2017 versus 2016?

If you guessed that EV powerhouse state of Oklahoma at 163% you would be correct. But there is a catch of course – Oklahoma was also tied with Mississippi at 0.10% for the lowest EV market share in the US.

Among states with the largest number of EV sales, New York, Massachusetts and Colorado had the highest year-over-year increase at 67%, 59.4% and 53.3% respectively.

We’ve created a new sortable table that includes sales of electric vehicles (PHEV and BEV) and the EV market share (percent of EVs sold of total light vehicles sold) for all 50 US states and Washington, D.C.

Check out the new EVAdoption sortable table of EV sales and market share by state.

Here are a few other highlights from from the data:

- 9 states (including Washington, D.C.) exceeded the 1.20% overall US EV market share for all of 2017. Five of those states also saw YOY sales increases of more than 50%.

- Overall US YOY unit sales grew 42,415, a 29% increase over 2016.

- As always California had the highest sales by a huge amount and saw an increase of 28.5% and 21,019 additional units.

- 13 states had increases greater than 50% and 2 states had increases of more than 100%.

Check out the new EVAdoption sortable table of EV sales and market share by state.

- 6 states actually saw a decline in sales with the state of Wisconsin having the largest percent decrease of -11.40%.

- The median year-over-year increase among the 50 states and Washington DC was 28.6% and the mean was 33.9%.

- Perhaps the most surprising state is Georgia with a decline of 0.30% or basically flat. As a state that has the 16th most EV sales in units it shows how the holdover of the elimination of state incentives has affected buyers in this market. However, this requires further investigation to understand why sales continue to be flat in the once high EV sales state of Georgia.

- While most of the top EV states tend to be on either the east or west coast, the red state of Texas had a respectable 20.2% increase in EV sales in 2017. At the same time, Texas’ EV market share is rather tiny at 0.27%.

Subscribe to our email alerts now!

You’ll also receive our exclusive special report: Analyzing US Sales Trends of EVs Versus ICE Powertrains Across Shared Models.

Data Source: Alliance of Auto Manufacturers, Advanced Technology Vehicles Sales Dashboard | Data compiled by Alliance of Auto Manufacturers using information provided by IHS Markit

2 Responses

I’m curious about the Utah numbers, which we track closely. For August 2018, the EV market share is listed as 1.87%, which looks almost double the 2017 EV market share of 0.94%. However, is August representative of how large the market share for EVs and plug-in vehicles will be for the full year? Right now, it looks like total sales of EVs & Plug-In EVs is around 1000. Assuming that Q4 2018 sales are roughly similar to the rest of the year, that would lead to total 2018 sales of around 1300, or just around 1% of total passenger vehicle sales. I fear that the much higher figure of nearly 2% might lead to confusion and unwarranted excitement about a jump in EV adoption here

Josh, thanks for the comment and question. So for August 2017, the Utah BEV + PHEV sales market share was actually 0.75% – so August 2018 is actually well more than doubling.

The share of only BEV sales in Aug 2018 was 56.7%, but it rose a bit to 60% in August of 2018 – was trying to assess the potential impact of Tesla Model 3 sales, and it wasn’t as large as I expected. I do however, expect the BEV share percent to probably reach 65-70% for Sept/Oct.

Utah market share for Jan-Aug 2017 = 0.89% and for Jan-Aug 2018 = 1.22%. The 1.87% just for August reflects solid increase as Model 3 and other EVs increase in sales in Utah later in the year (and should rise above 2% for Sept and Oct) – but I expect the total year numbers to probably be in the 1.50%-1.70% range.

175 BEVs + PHEVs were registered in Utah in Aug and Jan-Aug was 1002. So if we assume say an average of 200 units per month Sept-Dec = 800, Utah would end the year at roughly 1,800 sales.

With Tesla now being able to sell direct in Utah, I expect the impact of the Model 3 AWD and Model X (think snow) to start to grow fairly significantly – but would love your thoughts being local.