When most cars and trucks are powered by batteries and electric motors in the US, what will happen to those popular oil change service shops?

If you are on owner of an oil changing service center in the US, there is no need to worry about your business starting to dry up for probably at least another decade (more on this later). While we likely won’t reach 99% of vehicles in operation in the US being electric until around 2050 at the earliest, shops located in high adoption markets like San Francisco, San Jose, Los Angeles, Portland, OR, and Seattle, however, could start to see a decline in their business in the next five or so years.

Oil Change Services Market and Overview

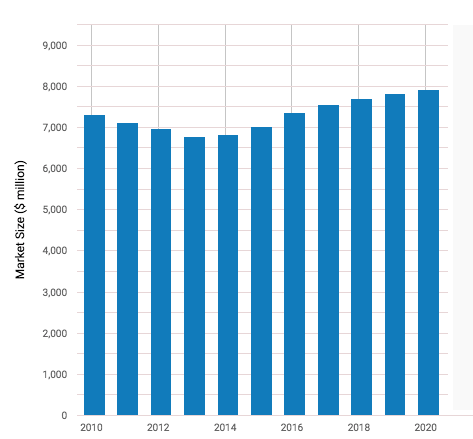

The US oil change services industry is forecast to be $7.9bn in 2020 and has grown 2.4% per year on average between 2015 and 2020, according to IBIS World.

Oil Change Services in the US Market Size 2010–2020

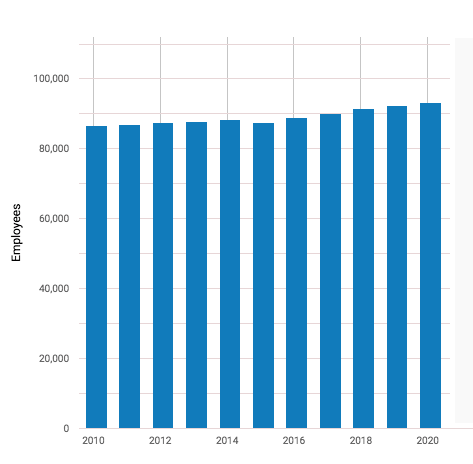

IBISWorld also estimates US employment in the oil change services at around 93,000 people in 2020, ranking it at number 327 for employment by industry.

Oil Change Services in the US Employment Statistics 2010–2020

IBISWorld also pegs the number of oil change service businesses at 28,769 in 2020, whereas Statista puts it out 32,516. The difference might be on how these businesses are defined, but regardless – there are roughly 30,000 businesses in the US whose long-term future is certain death, unless they pivot along with the shift to electric vehicles. Looking at Statista’s numbers below it appears the industry is already consolidating and becoming dominated by the major chains.

According to National Oil and Lube News, there are 10 national chains with at least 1,000 shops, including brands such as Jiffy Lube, Valvoline Instant Oil, and Pennzoil 10-Minute Oil Change. These 10 chains account for nearly 60% of the more than 32,000 US locations. And NOLN’s top ranking shows 93 chains in the US with at least 6 locations.

Oil Change Chain Services That Will Disappear in the ERA of Electric Vehicles

As the name (oil change or quick lube) of the category implies, changing oil and oil filters is the bulk of these chain’s and businesses’ services. But as the tagline “We’re more than just an oil change.” and list below from the Jiffy Lube website shows, these chains offer dozens of different type of auto services.

In the table below I offer an assessment of which services will remain of high, medium/low, or no longer needed at all for electric vehicles.

| Oil Change | Oil & filter change | |||

| Battery (conventional) | Battery maintenance | |||

| Battery replacement | ||||

| Brakes | Brake fluid exchange | |||

| Brake inspection | ||||

| Brake replacement | ||||

| Engine | Engine diagnostic | |||

| Fuels system cleaning | ||||

| Radiator coolant exchange | ||||

| Belt replacement | ||||

| Tune-ups | ||||

| Spark plug replacement | ||||

| Exterior & Glass | Headlight cleaning | |||

| Light bulb inspection & replacement | ||||

| Windshield treatment/repair | ||||

| Windshield wiper replacement | ||||

| Filters | Cabin air filter replacement | |||

| Engine air filter replacement | ||||

| Fuel filter replacement | ||||

| Transmission filter replacement | ||||

| Fluids | A/C evacuation and recharge | |||

| Diesel exhaust fluid | ||||

| Differential fluid exchange | ||||

| Fuel system system cleaning | ||||

| Inspections | State vehicle inspections | |||

| Vehicle emissions (smog) testing | ||||

| Suspension | Shock and strut replacement | |||

| Vehicle alignment | ||||

| Tires | Tire installation | |||

| Tire pressure monitoring system services | ||||

| Tire repair | ||||

| Tire replacement | ||||

| Tire rotation | ||||

| Tire balancing |

Looking at the list above of 34 services from the Jiffy Lube website, 14 of them or 41 percent will no longer be needed when electric vehicles dominate the US market. And another 6 services or 18 percent will be of low or medium importance. But on the positive side another 14 or 41 percent remain of high value and decent revenue potential for oil change service businesses.

What’s clear from the list, however, will be the need to shift from oil changing, fluids and inspection services, to tire and brake services in the coming years. And while engines and transmissions disappear with electric vehicles, tires and brakes will remain and need repair, maintenance or replacement.

Because of the weight of battery packs and the superior acceleration of EVs, tires might need replacing even more frequently than with gas-powered vehicles. And because EVs use regenerative braking to slow the vehicle, some estimates suggest that the brakes can last three times longer than on conventional gas-powered vehicles.

Timing of the Transition to Electric Vehicles

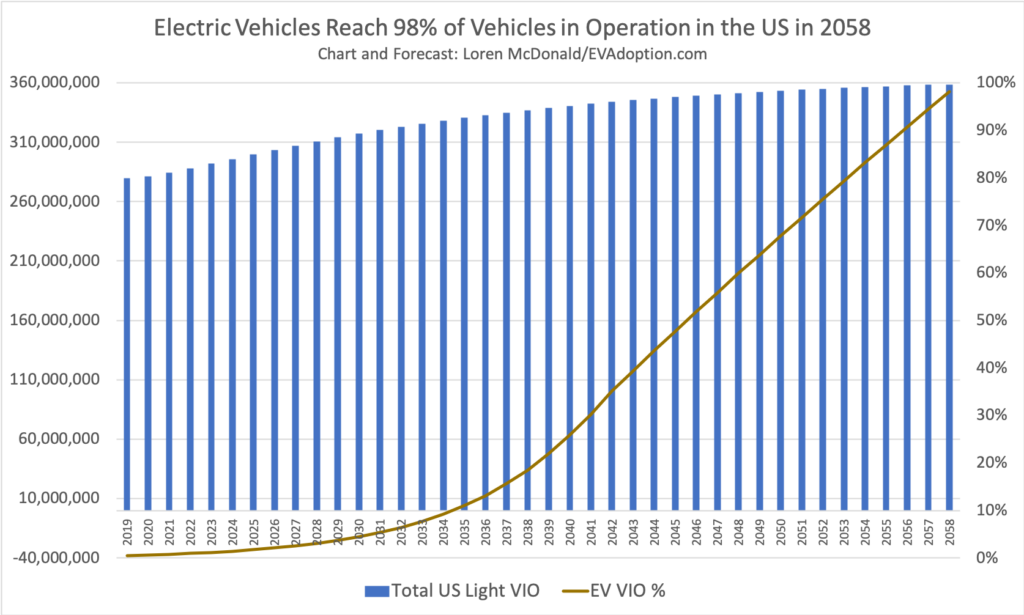

The transition to nearly 100% of vehicles in operation (VIO) being electric is decades away in the US (it will come much earlier in Europe and China). In my conservative forecast in the chart below electric vehicles will not reach 98% of all vehicles in operation in the US until around 2058. That’s 38 years from now and a couple of generations of ownership or management of oil changing businesses away from now.

But at what point does the transition to EVs start affecting the volume of business and hence revenue for oil change service operators? In the above scenario, EVs would comprise about 10% of vehicles in operation around 2036.

In a more aggressive forecast and scenario, EVs might reach 98% of VIO around 2050. But that would likely require regulations that penalize automakers based on vehicle emissions like in the EU or an outright ban on ICE vehicles. In the current political environment in the US, however, these types of regulations may be unlikely for at least another decade. But if gas prices rise to and stay at around $4 per gallon and battery prices make EVs cost competitive we could see mass EV adoption a bit earlier than expected. But regardless, there will be more than 275 million ICE vehicles that need to be replaced by EVs before we get close to 100% EVs in operation.

Even if somehow we magically moved to 100% of new vehicle sales being electric beginning in 2021, it would take until rough 2042 before the US would reach 100% EVs in operation. But at around 2% new vehicle sales share today, this is of course impossible. So even an incredibly quick switch to EVs would take 30 years to replace all ICE vehicles.

Regional Adoption Rates Will Affect Some Businesses Much Sooner Than Others

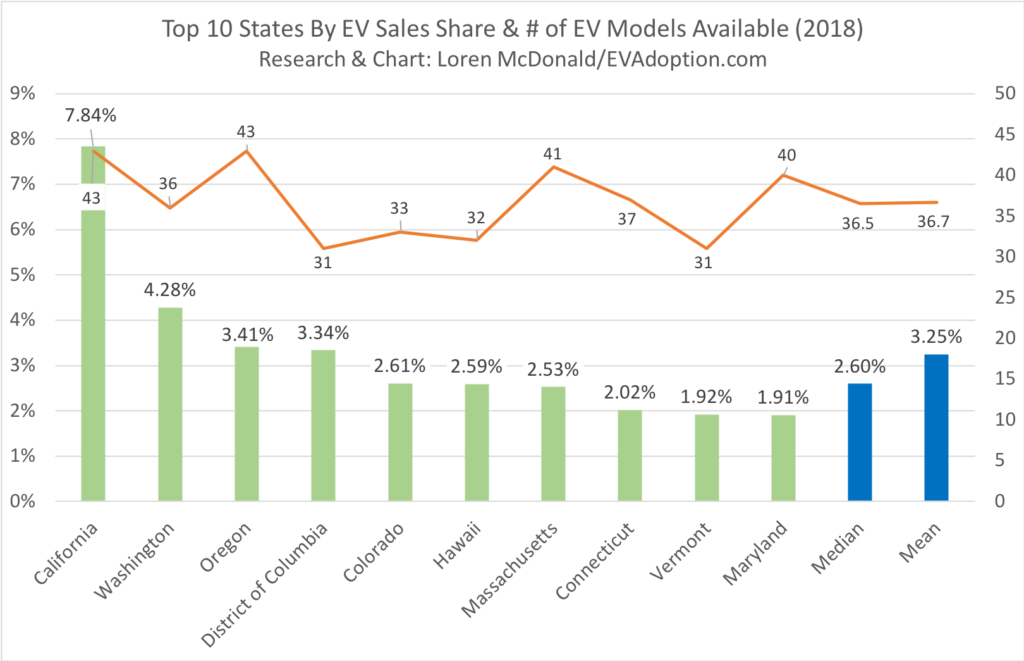

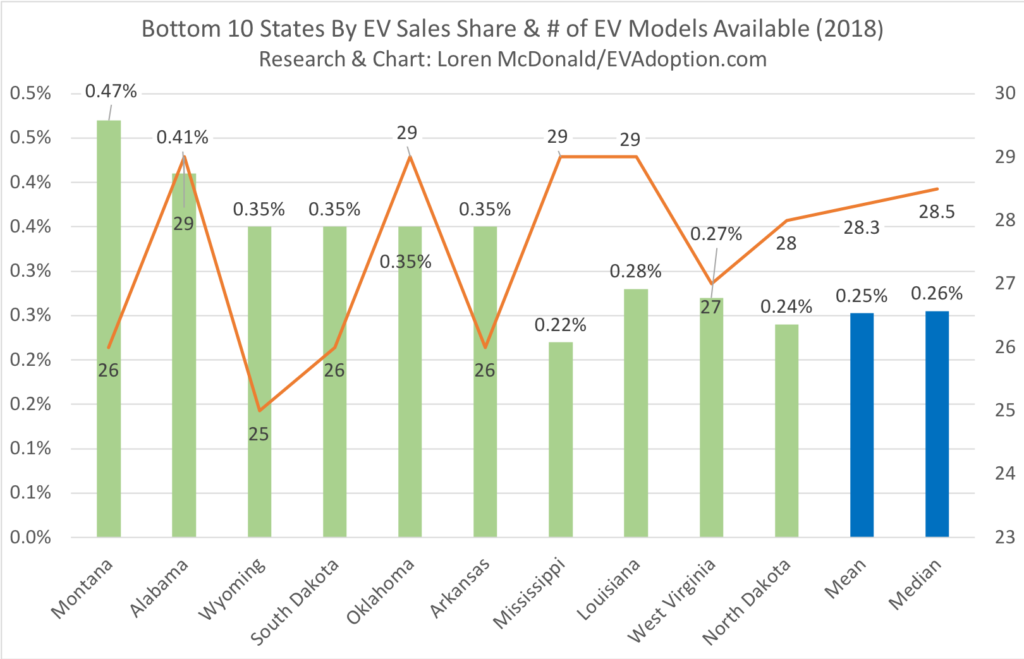

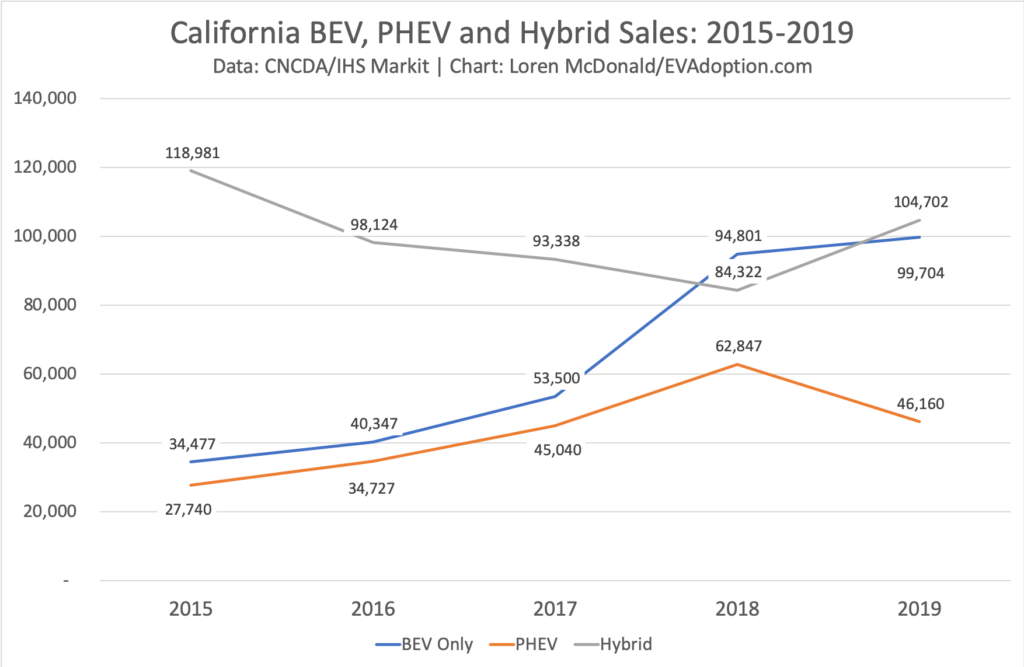

While electric vehicles’ share of new auto sales is currently about 2 percent in the US, the rate varies widely by state and city/region. Roughly 10 states are seeing only about 5 out of 1,000 car sales being electric, but in California about 8 out of 100 new vehicles purchased are electric.

One of the many contributing factors to this huge disparity between the top and bottom EV-buying states is the availability of EV models. Several of the automakers only make their EVs available in California and other ZEV states. At the end of 2018, for example, the top 10-selling states averaged 37 EVs sold in their states versus 29 in the bottom 10 states.

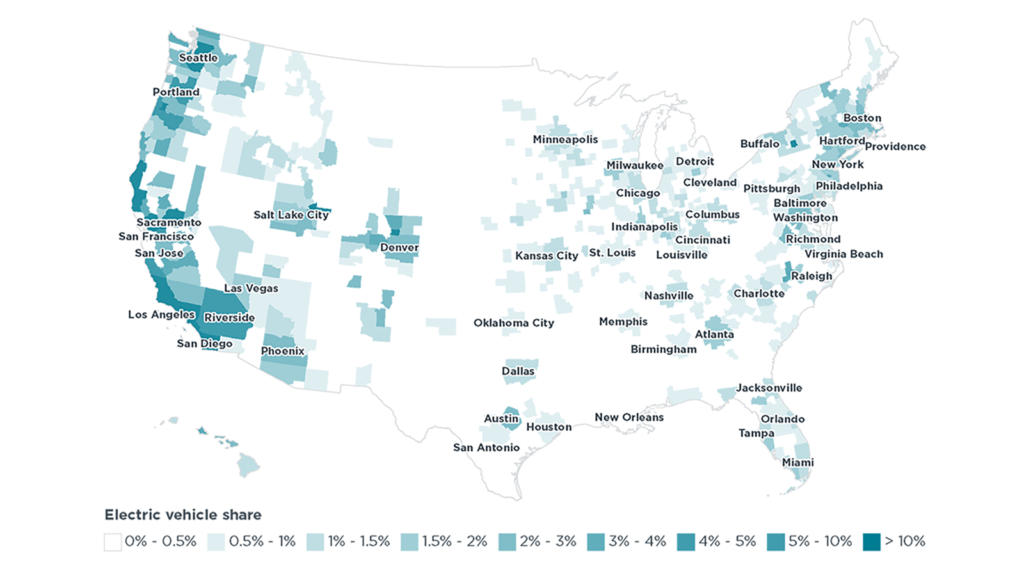

Secondly, beyond the wide difference in EV adoption rates across states, several US cities have new EV sales shares of 10 times or more the national average.

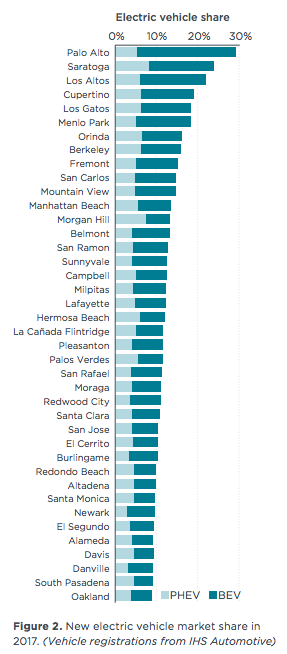

And in California at the end of 2017, there were 40 cities with a new EV sales share of more than 10%. The implications are obvious. If you have oil change centers located in Silicon Valley you might already be seeing an impact on your business, but even if not yet, your business will likely start to see a decline in customer visits around 2025.

If on the other hand your centers are located in city such as Birmingham, Alabama or Fargo, ND, your business might see little impact from the transition to EVs until around 2030-2035.

The Potential Wrinkle on Timing From a Rise in PHEV Sales

There is a general assumption by EV advocates and forecasters that as the cost of batteries declines to a point where BEVs are at cost parity with ICE vehicles, that plug-in hybrids (PHEVs) will slowly fade away. Automakers like Tesla, Volkswagen, GM, and Nissan are focused on a future of producing only BEVs, but others such as Toyota, Ford, Honda, FCA, and BMW are planning to produce a mix of BEVs and PHEVs.

In fact two of the most anticipated EVs, the Toyota RAV4 Prime and Ford Escape PHEVs will arrive at US dealers later this year. As SUVs/CUVs with around 40 miles of all electric range and qualifying for all or near all of the $7,500 US Federal EV tax credit, these PHEVs are expected to sell well once production volume gears up. If PHEVs grow in popularity then these combination gas/electric vehicles will extend the need for oil changes, tune ups, smog checks and other services needed for gas-powered vehicles.

It is also possible that PHEVs will be more popular in the middle of the country where winter weather can affect EV range and long road trips are fairly common. Again for owners of oil change shops it will be key to understand the specific local EV sales trends which may be very different from other parts of the country.

Is Battery Swapping A Future Opportunity for Oil Change Service Centers?

While much of the core business of oil change centers will gradually disappear in the coming decades, battery swapping services is one possible growth area. Battery swapping is non-existent in the US, but Chinese EV manufacturer NIO has now completed 500,000 battery swaps through its subsidiary NIO Power, that operates the battery swapping stations.

The core idea behind battery swapping is to replace a near depleted battery with one that is fully charged in around 5 minutes so drivers on long trips can continue on their way without having to wait 30-60 minutes for a fast charge. But with the average range of BEVs approaching 300 miles and DC fast charging often able to add 200 miles in around 30 minutes, the interest in battery swapping has waned.

But there is a scenario that could change this and provide opportunities for oil change centers. Most US households can get by on their daily commutes and weekend getaways with an EV range of about 200-225 miles. But when they take those 500 mile road tips to visit grandma or Disneyland, an EV with 300-400 miles of range makes the trip much more convenient, often requiring 2-3 (or more) fewer stops on a round trip.

So while it is far from a reality, automakers in the coming years might focus on selling BEVs with a shorter range of about 200-225 miles, but then when consumers venture on long road trips they’d pull into a battery swap station or the dealer and exchange their EV’s battery for a much larger one. This approach would enable consumers to buy a more efficient and lighter weight BEV that met 98% of their annual driving needs but then swap out the battery for those infrequent long road trips.

Oil change/quick lube centers are set up perfectly with their lifts and below ground access to adapt to battery swapping. But a second area is simply battery replacement. As EVs reach 10 or more years in age, customers may want to replace their battery packs for a new and more efficient one with more range. These used battery packs that will likely still have 80% of their original energy storage capacity, will be recycled into affordable home energy storage units. Oil change businesses could be at the center of this trend.

For owners of oil change/quick lube centers, the core services of your business will eventually not be needed in a world of electric vehicles. But except in heavy EV adoption markets such as on the West Coast, oil change centers may not see a negative impact on their business from the transition to EVs until around 2030 or later.

2 Responses

How does this affect the auto parts chains?

Brennan, great question. So a bit similar as to oil changer shops – in that the transition away from ICE vehicles to EVs will take another 30+ years. In 2030 there will be probably around 295 million gas-powered cars and trucks on the roads in the US – about 15 million more than today. And as used vehicles are more popular than ever and people are holding on to vehicles longer – and many may want to hold on to certain vehicles even longer before buying an EV. But is the powertrain mix shifts towards EVs, the number of parts needed will be minuscule – tires and windshield wipers – and interior accessories, etc. The opportunity, however, is for auto parts stores to sell EV chargers.