[DISPLAY_ULTIMATE_SOCIAL_ICONS]

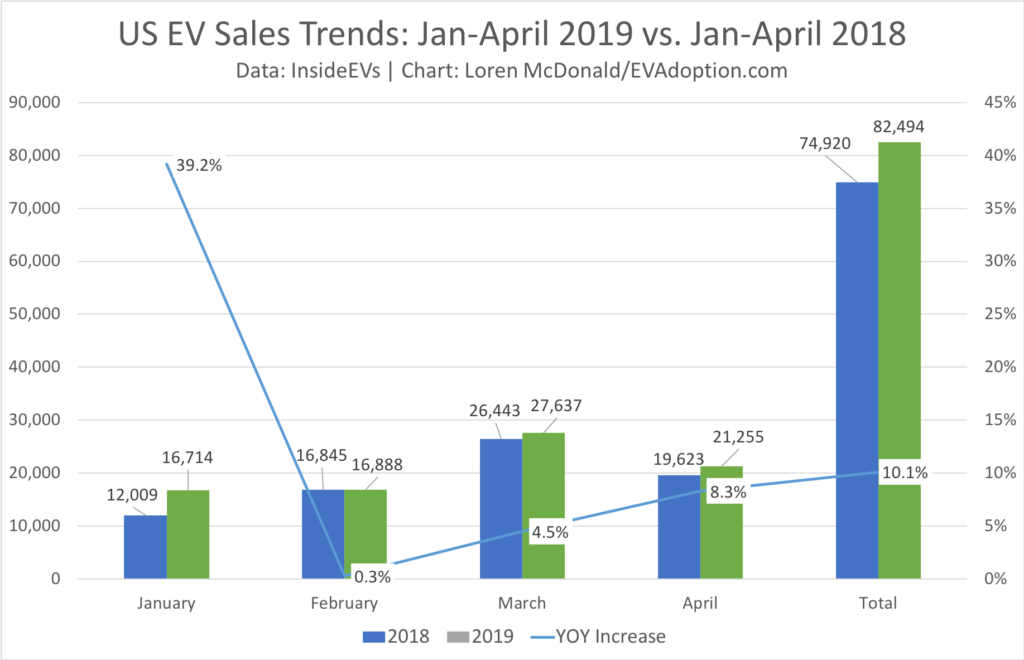

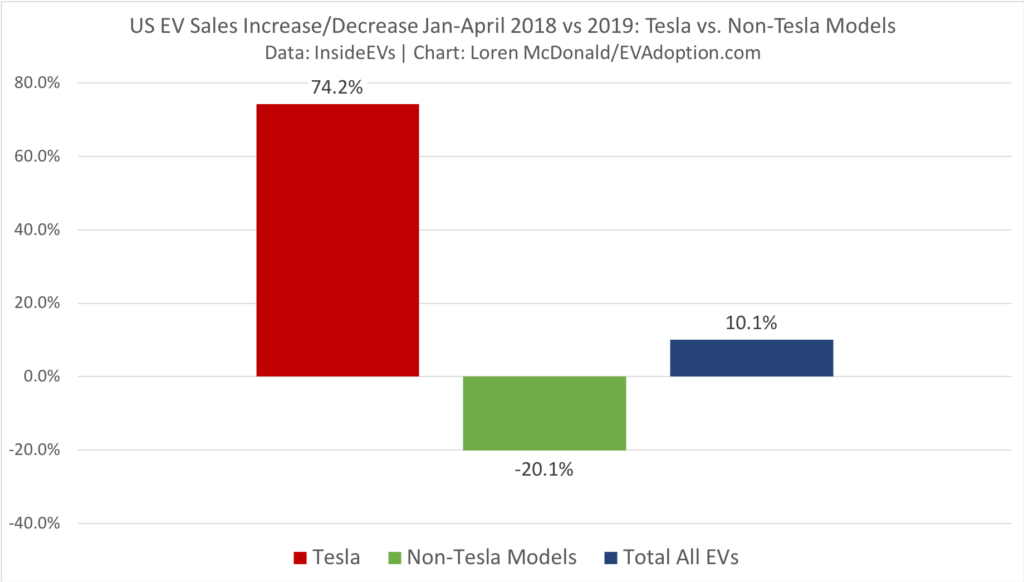

Sales of electric vehicles in the US so far in 2019 are disappointing, though the low percentage growth rate was not unexpected. Through the month of April, US EV sales are up 10.1% over the same period in 2018. April 2019 sales increased 8.3% over April of 2018.

In January in this CleanTechica article, Forecast: 2019 US EV Sales Growth Will Drop To ~12%, I had forecasted that for the entire year 2019, US EV sales would be up only about 12% over 2019.

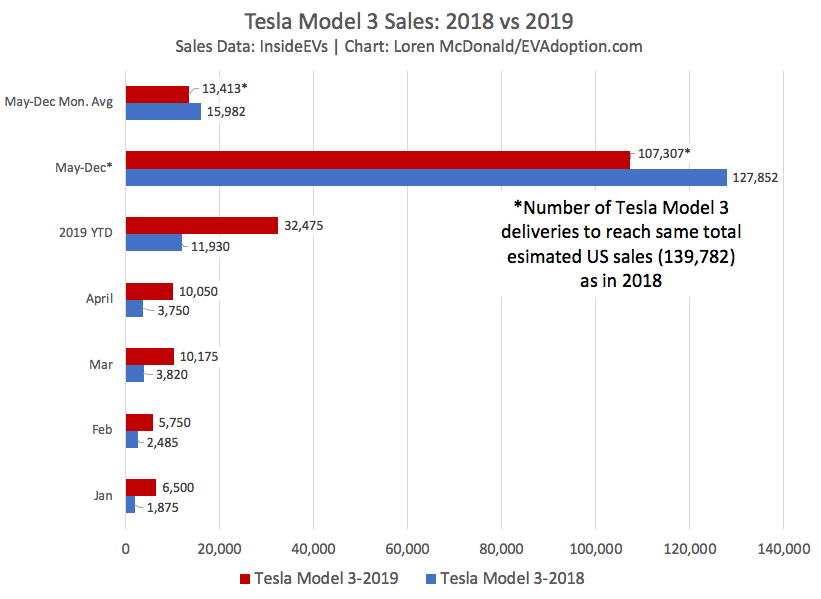

The 74.5% increase in 2018 over 2017 was primarily a result of a large number of Tesla Model 3 deliveries. For 2019 I expect Tesla will likely only match 2018 levels of Model 3 sales, and may not exceed them.

Keys will be dependent on whether Tesla can drive significant demand for the Model 3 Standard Range Plus and balance production needed for demand and deliveries in non-US markets. The other dependency is whether the Audi e-tron, Kia Niro EV and Hyundai Kona EV have exceptional years.

The 74.5% increase in 2018 over 2017 was primarily a result of a large number of Tesla Model 3 deliveries. For 2019 I expect Tesla will likely only match 2018 levels of Model 3 sales, and may not exceed them. Keys will be dependent on whether Tesla can drive significant demand for the Model 3 Standard Range Plus and balance production needed for demand and deliveries in non-US markets. The other dependency is whether the Audi e-tron, Kia Niro EV and Hyundai Kona EV have exceptional years.

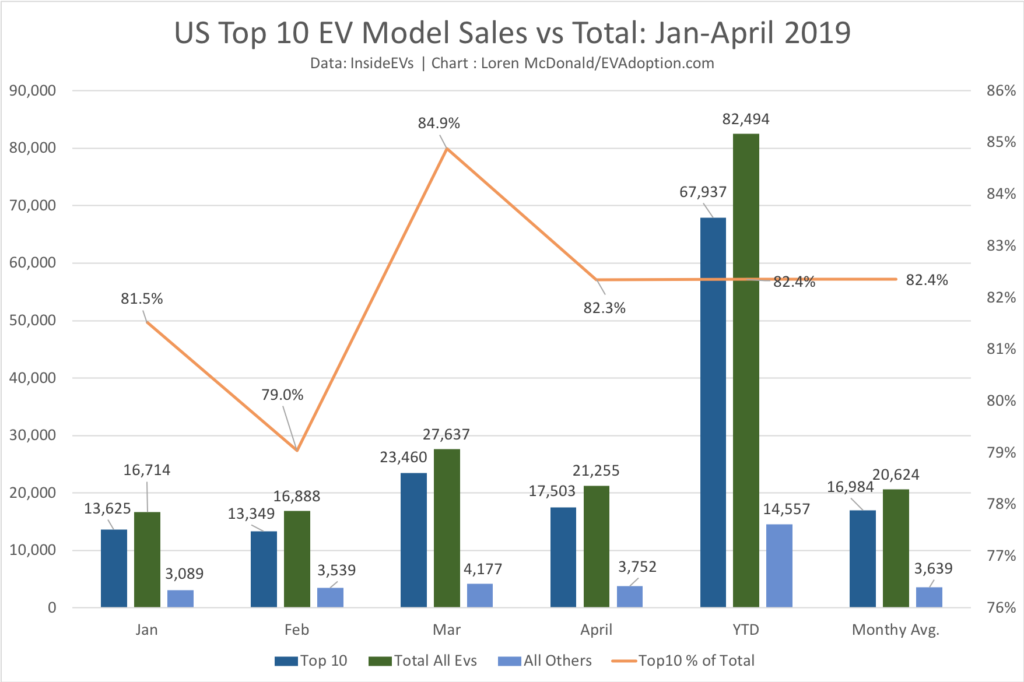

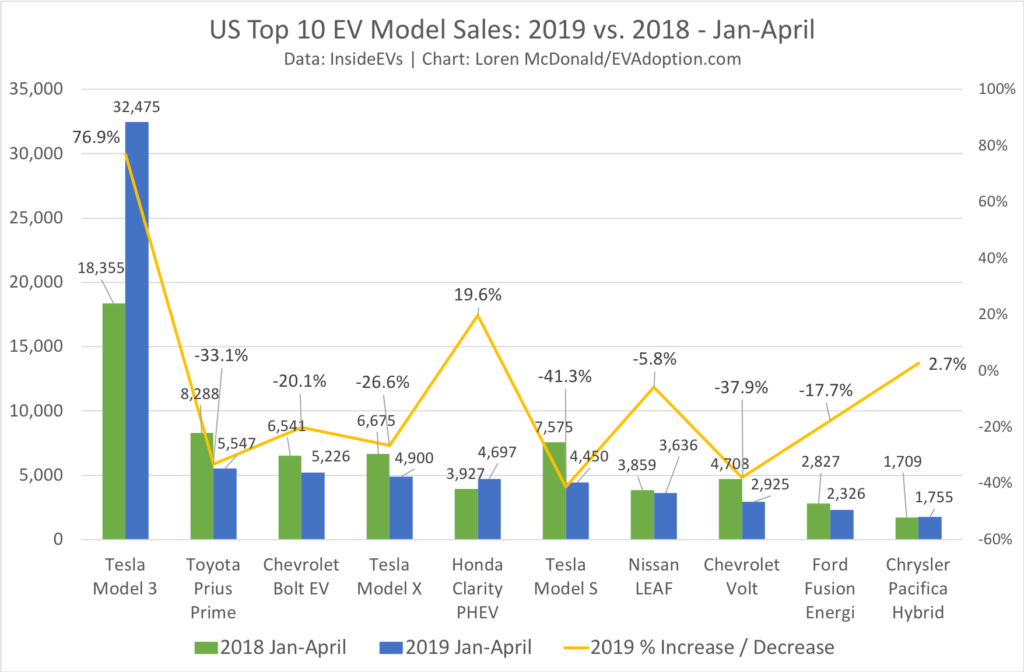

The Pareto Principle (“80/20 rule”) trend continues in the US with the top 10-selling EVs accounting for 82.4% of YTD sales out of the 45 models now available in the US. April was at 82.3%, while March reached a high of 84.9% for the top 10-selling EVs, a phenomenal percentage but also a level that is worrisome for the growth of EVs overall in the US.

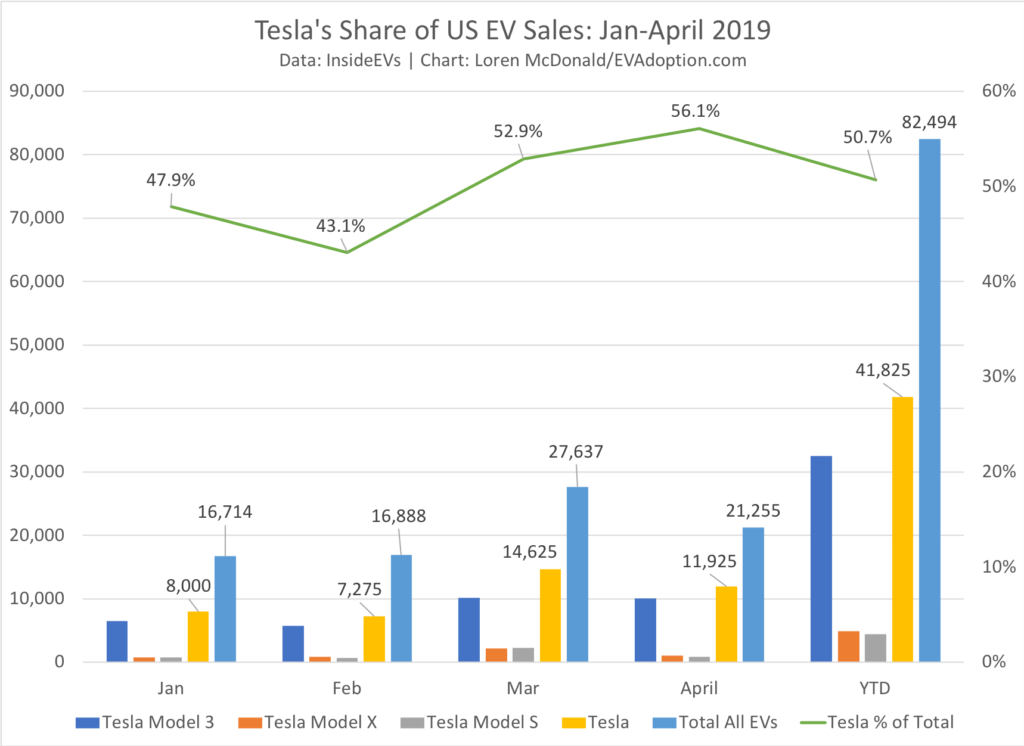

Tesla continues to account for +/- 50% of US EV sales and reached 56.1% in April, though the company saw a low of 43.1% in February. YTD Tesla is averaging a 50.7% share of sales.

While nice bragging rights for Tesla and its fans, this dominance of EV sales is not a good trend overall as it means that the US EV market is still fundamentally being drive by only one manufacturer – which also happens to be the only OEM that just produces electric vehicles. More worrisome is that a single vehicle, the Tesla Model 3, accounts for 39% of US EV sales.

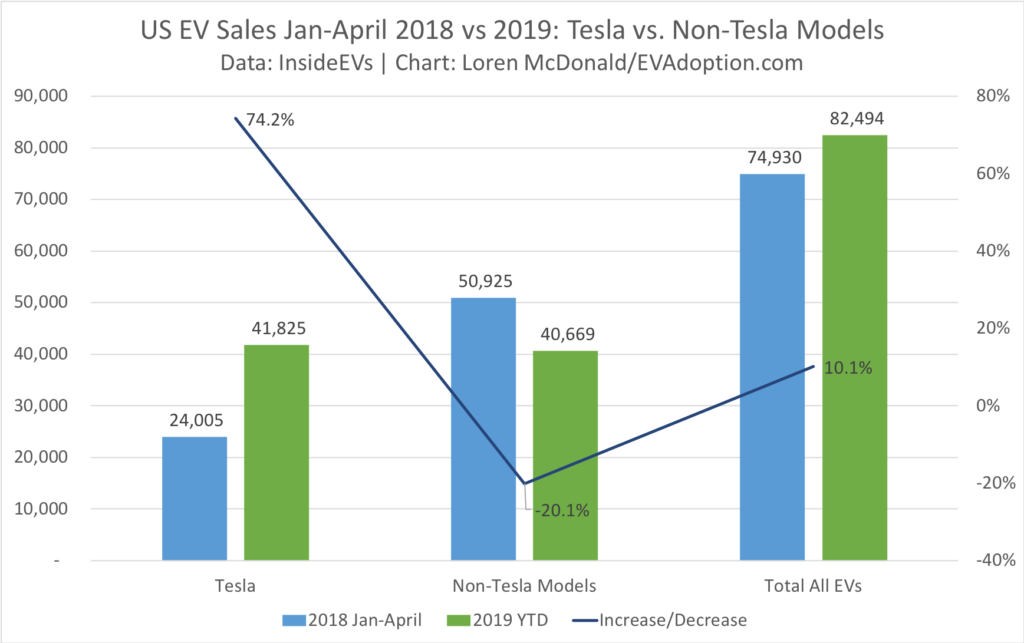

Of further concern is that sales from non-Tesla electric vehicles available in the US were down 20.1% versus YTD in 2018, while Tesla was up 74.2%. As I wrote last July in, New EV Models Responsible For Nearly All Annual US EV Sales Growth – New Analysis, electric vehicle sales growth in the US is primarily driven by the introduction of new EVs – not increased sales from existing EVs. (In this earlier post I outline 3 key reasons while 2019 sales are flat to declining for most models.)

In 2018 only two new EVs became available, the Jaguar i- Pace (October-393 sold) and Mercedes-Benz GLC350e (February – 567 sold). But again, 2018’s huge increase was driven by Tesla ramping up production and deliveries of the Model 3. In 2019, there are no new “hit” EVs being introduced that can make up for what will likely be flat Model 3 sales.

YTD 2019, only 3 of the top 10-selling EVs in the US are up YOY: the Tesla Model 3 (76.9%), Honda Clarity PHEV (19.6%), and Chrysler Pacifica Hybrid (PHEV) (2.7%). On the down side, the biggest decliners are the Tesla Model S (-41.3%), GM’s Chevrolet Volt (-37.9%), and the Toyota Prius Prime (-33.1%).

Other Sales Trends of Note

Beyond the key trends noted above, following are few tidbits on note:

- So far this year 3 new EVs have become available in the US: Subaru Crosstrek Hybrid (PHEV – available beginning in February), Kia Niro EV (BEV – available beginning in March), and the Audi e-tron (BEV – available in April).

- The Jaguar i-Pace and Kia Niro PHEV seem to be settling in at about 200-250 units sold per month.

- VW eGolf has seen a resurgence in the last few months, likely due to some aggressive deals being available.

- Hyundai Kona EV (BEV) is off to a slow start. Will Hyundai increase supply later in 2019 and make the highly-rated BEV available in more states?

- Sales of the once top-10 selling Fiat 500e has fallen off of a cliff due to its range of 89 miles being hugely uncompetitive.

- The Nissan LEAF is back to respectable sales volume, but with many new competitors (Model 3, Kia Niro, Hyundai Kona) its sales have likely peaked. The introduction of the longer range version (LEAF S Plus – 226 miles of range) might provide a boost, however.

- Tesla Model S and X sales are down though climb as they always do at the end of a quarter. Can Tesla reverse this slide with their recent range increase on its long-range versions (Models S to 370 miles from 335, Model X to 325 from 295) and return of the lower-priced Standard versions?

Things To Watch For In The Coming Months

When the history of EVs is written, 2019 is not likely to be remembered as an important year, unless something significant were to happen with Tesla. But there are a few US sales trends that will be important to monitor throughout the remainder of the year, including:

- Can Tesla increase demand for all of its models? Leasing is now available for the Model 3 and the 240-mile range Standard Range Plus is priced at $39,500 or a monthly lease payment of $420 for the 12,000 annual miles option. Will this combination provide a boost to US sales? Tesla will need to deliver an average of roughly 13,400 Model 3s per month for the rest of the year just to match deliveries for 2018.

- Will the Audi e-tron have sustained success and take a significant bite out of Tesla Model X sales?

- Will the Honda Clarity PHEV continue its sales success and catch up to the Toyota Prius Prime, which is still selling more units than the Clarity, but is seeing a significant sales decline so far in 2019.

- Now that both the Hyundai Kona EV and Kia Niro EV are for sale in the US, will Hyundai and Kia increase supply and support them through marketing and sells efforts. Both BEV models have received great reviews, have a solid combination of +/- 250 miles of range and around a $40,000 price point – but are only available in a few states and are in short supply in general.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →