There are several factors that hold consumers back from buying an electric vehicle. Survey after survey cites range anxiety or not enough range among current EVs and lack of EV charging infrastructure as the top two factors holding buyers back.

And while those are clearly key hurdles to EV adoption, I believe there are two more equally fundamental issues: 1) The lack of choice and availability of EV models, especially in certain categories; and 2) The price differential between EVs and gas/diesel-powered vehicles.

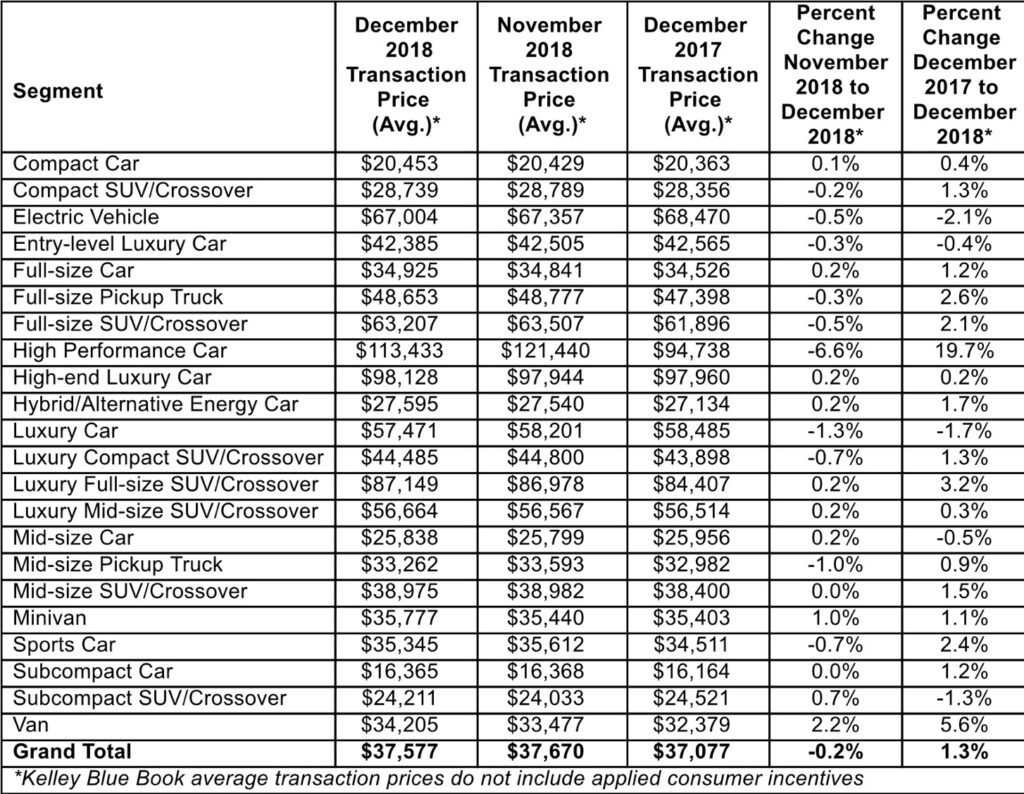

A few days ago I came across the Kelley Blue Book chart (see below), and the $30,000 difference between the sales price of all vehicles ($37,577 in December 2018) and electric vehicles ($67,044) immediately jumped off the page. Now this was not surprising as EVs in general cost more than comparable ICE models, but further, many of the currently available EVs are luxury performance cars costing north of $80,000.

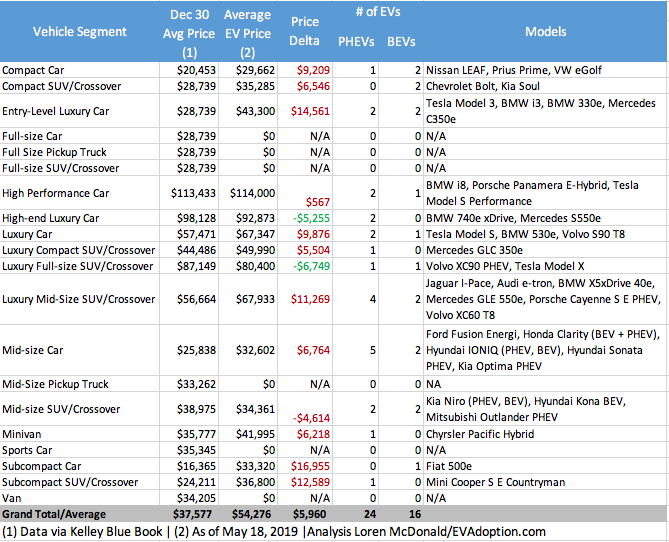

But seeing this data, I wanted to dive in a little deeper. In the chart below I categorized currently available in the US EV models as best I could to align with Kelley Blue Book’s vehicle categories. In my analysis I use the base MSRP price of the EV models as opposed to Kelley Blue Book’s actual transaction prices from December 2018.

But even with the base MSRP data, the EVs cost $17,000 more than the overall average of vehicles. More telling, however, is the price differential (delta) across most of the categories. On average EVs cost just under $6,000 in my analysis – but well above $10,000 more in several categories.

While there were only two EVs in each of the two categories – High-end Luxury Car and Luxury Full-size SUV/Crossover – the EVs actually cost less on average. Again, not a big surprise but interesting to note that the more expensive EVs also tend to be more competitive. This likely speaks to part of the reason why Tesla’s Model S and X have historically sold well. While both are very expensive vehicles, they are actually very competitively priced within their categories.

Next I wanted to look at the number of EVs that were available in the US relative to the total number of vehicles in each category. This is perhaps the bigger story and continues to be a huge hurdle to adoption.

The simple reality is that when a consumer walks into an auto dealer in the US, in many cases the automaker doesn’t even offer a single EV for sale. In 2018, in fact, 14 brands did not offer for sale a single EV, including Acura, Buick, Cadillac, Dodge, GMC, Jeep, Infiniti, Lexus, Lincoln, Mazda, and Ram. And many other brands only offer a single EV.

In the chart and analysis below we see that overall there are more than 8 times as many gas vehicles available versus electric vehicles. In two categories – pickups and convertibles – there are currently zero EVs available.

In key categories such as SUV, Crossover and Sedan there are about 90-120 more gas-powered models on the market than EVs. Using Kelley Blue Book’s categorization, the hatchback category is one exception where one-fourth of the models available are electric.

In my recent article, US BEV Fleet to Average 300 Miles of Range by Year End 2023, I shared how the average range of EVs available in the US was headed toward the magic milestone of 300 miles in the next 4 years. And in the May 15, 26 New EVs to Be Available in the US in 2019-2020 (New Analysis), I revealed the 26 new EV models coming to market in the next two years.

These additional EVs will certainly expand sales and help reach interested new EV buyers, but most of these vehicles will continue to be higher end (as they should be from a market acceptance perspective) and not make EVs available to the middle class and mass market. For the next several years, the majority of EV buyers will remain higher-income, early adopters who live primarily on the West and East Coasts.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →

2 Responses

Segment yet to be broken into by EVs is the Mid-Size SUV. Do you think the Crozz, Ford SUV EV, or future Chevy, Kia, Hyundai non-luxury EVs can tap into this? Vehicles like the Rav 4, CRV, and Tiguan are currently unchallenged.

Yes, the small/mid-sized SUV/CUV market is the one to watch. We desperately need an electric Honda CR-V, Toyota RAV4, et al. While only a PHEV, will be interesting to see how the new Ford Escape PHEV does when it comes out later this year. But this is the hot part of the market and where we need to see some EVs.