Sales numbers for electric vehicles from the InsideEV Monthly Plug-in Sales Scorecard are finally in for July and so I’ve crunched and analyzed the numbers looking for trends and insight. Following are 8 observations on 2018 US EV sales, specifically on the top 10 models:

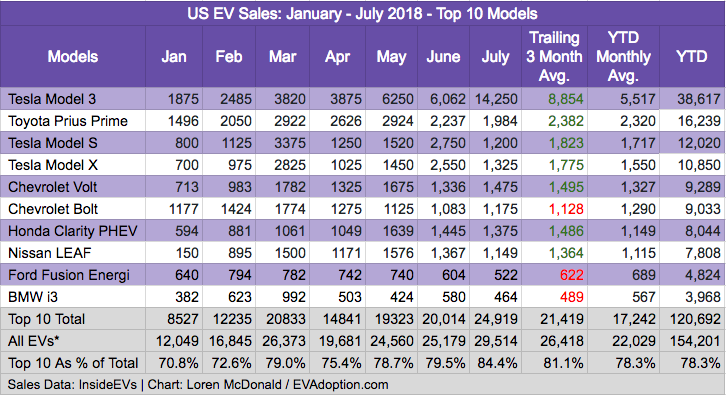

1. Tesla Model 3 is Crushing It: While InsideEV’s numbers for Tesla are estimates, it is pretty clear that Tesla has mostly moved past production hell and is delivering Model 3s in high volume. If the 14,000+ unit estimate for July is close to accurate, that 1 month sales figure would have only been exceeded by 5 EV models in ALL of 2017.

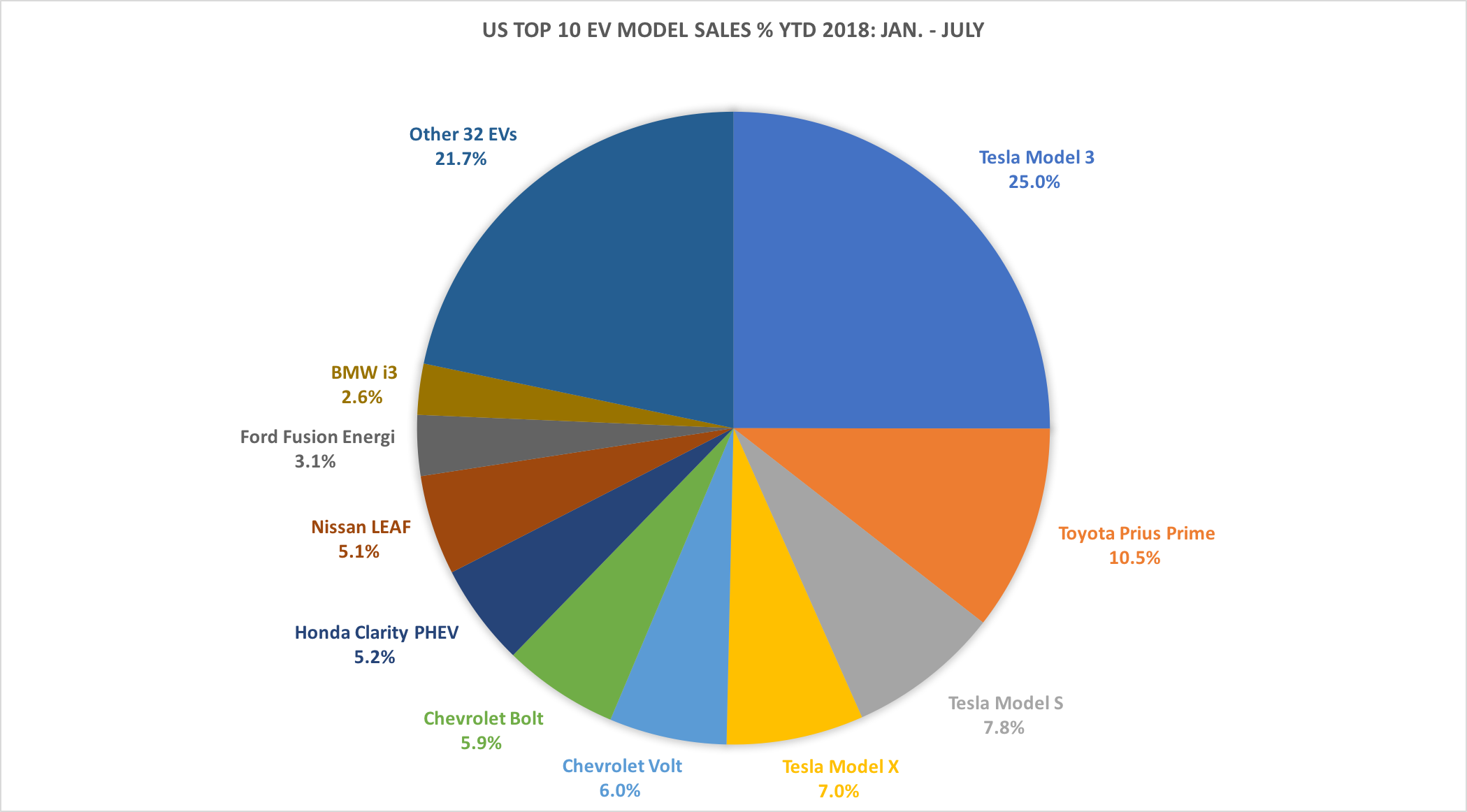

In 7 months of 2018 sales, the Model 3 has now sold more units than any EV ever in a calendar year, surpassing the Nissan LEAF’s record in 2014 of 30,200 units. The 38,617 estimated deliveries YTD also accounts for 25% (1 in 4) of all EVs sold in the US.

The big question remains of course: Can Tesla keep delivering Model 3s at 10,000+ units per month in the US, and is there sufficient demand? I believe they can and there is, but a huge factor that will determine the number of US deliveries going forward will be what volume of Model 3s are shipped to outside the US.

2. Honda Clarity is the Hot New PHEV on the Block: Perhaps the most interesting trend to me is how well the Honda Clarity PHEV is selling. In the 3 month period of May–July, the PHEV version of the Clarity has outsold the Chevrolet Bolt by more than 1,000 units and was in a near tie with the Volt.

Hondas tend to sell very well in EV-crazy California, and with various available federal, state, utility, HOV lane incentives, a 340 mile total driving range, and a $33,400 price, the Clarity PHEV has found a market competing against the Volt and Prius Prime. The Clarity PHEV has moved into 7th position YTD for 2018, easily passing long-time Top 10 EVs Nissan LEAF, Ford Fusion Energi and BMW i3. If current sales trends continue, the Clarity PHEV could pass the Chevrolet Bolt by November or December of 2018.

3. Six of the Top 10 EVs Are Seeing Growing Sales: During the trailing 3 months of May through July, 7 of the top 10 EVs had sales volume higher than their YTD monthly volume. In essence, 7 of the EV models are seeing increased sales volume. On the downside, the Chevrolet Bolt, Ford Fusion Energi and BMW i3 are seeing lower sales.

Declining sales for the Fusion makes sense because of the growing interest in PHEV models like the Prius Prime and Honda Clarity. The BMW i3 is likely getting crushed by buyers now taking delivery of Tesla Model 3s.

4. Chevrolet Bolt Has Lost Its Thunder: The Chevrolet Bolt seems to have lost some of its initial luster among EV buyers, but GM also has not been able to keep up with demand. The question remains: How much is GM’s inability to produce higher volumes of the Bolt actually affecting sales? The company has promised an increase in supply of Bolts, so the coming months will be interesting to watch the supply/demand trends.

5. The Top 10 EV’s Comprise 80% of Total US EV Sales: The Pareto principle is clearly at work with EVs in the US as the top 10 models comprised 84% of sales in July, 81% the last 3 months and 78% YTD. Further, Tesla’s 3 BEVs (S, X and 3) comprise 40% of EV sales YTD in 2018.

6. Prius Prime is Locked in as a Top Seller: Toyota’s PHEV version of the iconic Prius is now firmly entrenched as America’s favorite PHEV and EV model other than those from Tesla. If gas prices rise and Toyota and its dealers started to push the Prime more aggressively versus the regular hybrid version, sales could potentially rise significantly and regularly sell above 3,000-4,000 units per month.

If Toyota and its dealers wanted to make the Prime a top seller, they could pull the necessary strings and replace the volume of the regular Prius hybrid with the Prime. Toyota, however, is not showing an interest in selling EVs.

7. Tesla Model S and X Are Holding Steady: With the ramp up in deliveries of the Model 3, sales of the larger Models S and X have been expected to decline. And while both models are on pace to sell fewer units than in 2017, they will likely each end the year down only a few thousand units compared to 2017. This in my view should be viewed as a success as significant attention and sales has shifted to the smaller Model 3.

The question remains, however, in 2019 when the lower-priced version of the Model 3 is produced, will sales of the Model S in particular take a huge hit? It is hard to predict at this point, but if there are a lot of consumers like my wife who prefer the larger size and roominess of the Model S, a solid market for the Model S (and X) will continue.

8. Chevrolet Volt is Rebounding: Despite stiff competition from the Prius Prime PHEV and Honda Clarity PHEV, the Volt seems to be holding on and doing well after a slump early in 2018. The relative success of the Prius Prime, Volt and Clarity PHEV suggest that PHEVs will remain a popular choice for years to come. But a key question also is whether the Volt will continue to outsell its BEV sister model, the Bolt?

What do you think? Notice any trends that I have missed or disagree with any of my observations? Let me know in the comments.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →

2 Responses

Still no electric trucks and SUV. Can electric not handle it?

Joe, there are several electric SUVs (BEV and PHEV) either available or coming to market: Tesla Model S, Mitsubishi Outlander PHEV, Jaguar I-PACE, Volvo XC90 and XC60, Audi e-tron, Lincoln Aviator PHEV, Range Rover PHEV, Rivian R1S, etc. You can sort future models by body type in my table here: https://evadoption.com/future-evs/

Pickups are coming from Workhorse, Rivian and Tesla. Pickup truck buyers will generally be late adopters and so the timing is still too early, especially as those that are coming to market will be priced at a premium for the near future.

EVs have an amazing amount of torque, something that many SUV and pickup truck owners want. Google “Tesla Model X towing video” to get a flavor of the power and towing capability.