[DISPLAY_ULTIMATE_SOCIAL_ICONS]

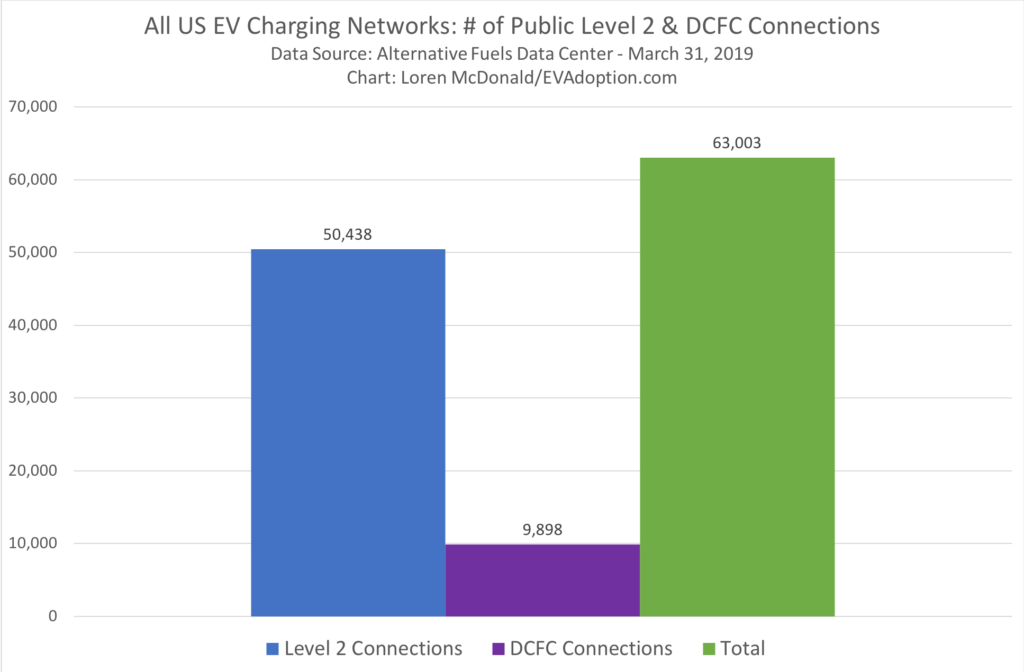

As of March 31, 2019 there were 63,003 public combined Level 2 and DC fast charger connections in the US, according to our analysis of data from the Alternative Fuels Data Center. In this post we’ll share several charts that we’ve pulled from the AFDC database.

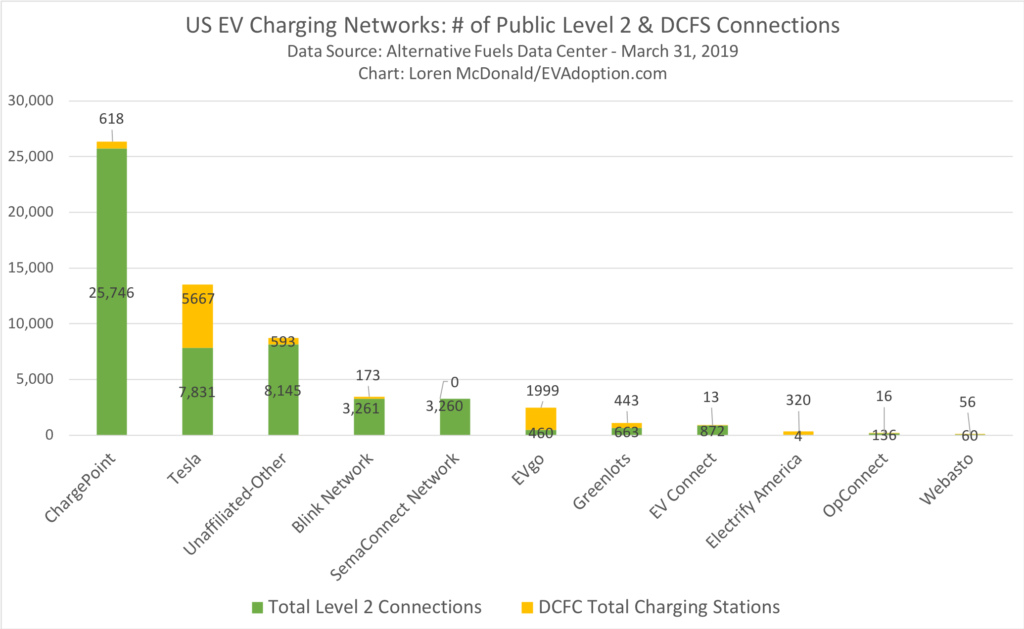

Breaking the total number of Level 2 and DCFC stations down we see that there were 50,438 Level 2 connections, more than 5 times the 9,898 DCFC connections.

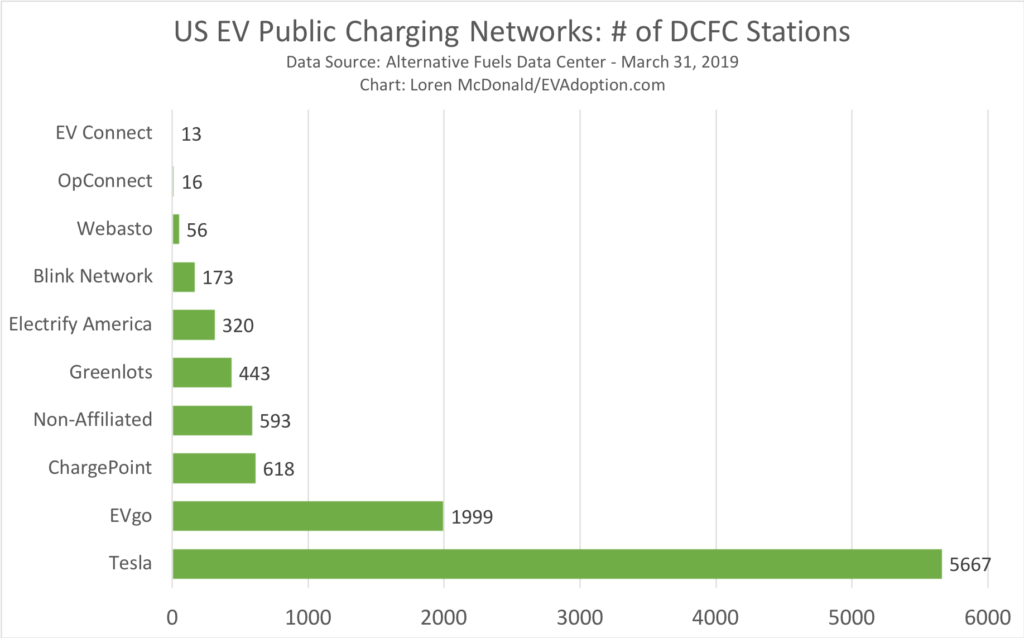

Looking at just fast charging stations, Tesla with 5,667 Superchargers has 2.8 times more DCFC stations than second place EVgo. ChargePoint (618), Greenlots (443) and Electrify America (320) are a distant 3 through 5 (not including non-affiliated stations.

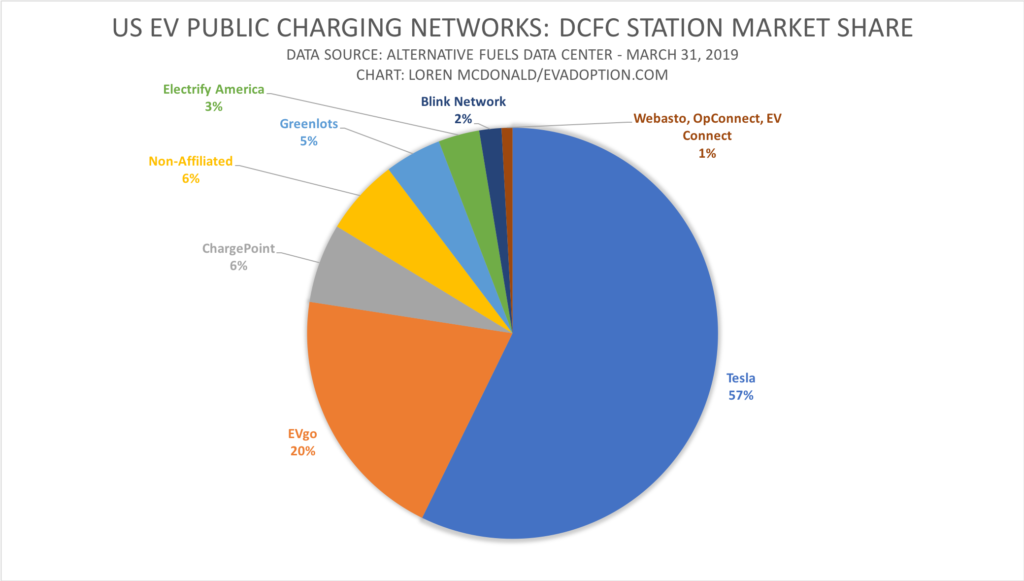

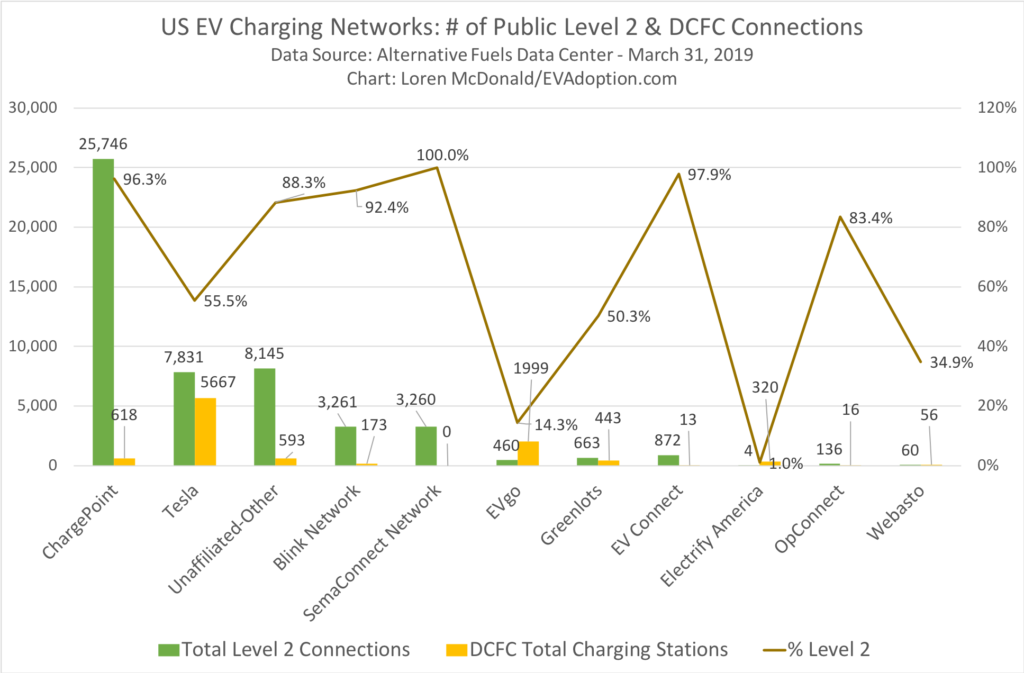

Looking at percentage market share, Tesla commands a dominant share of the DCFC connections at 57%, followed by EVgo at 20%.

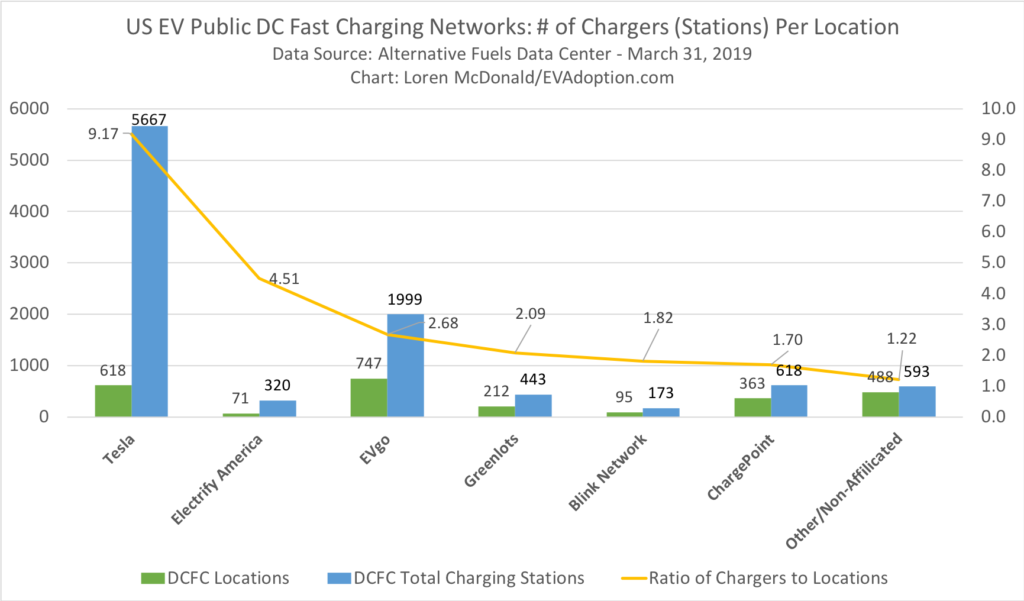

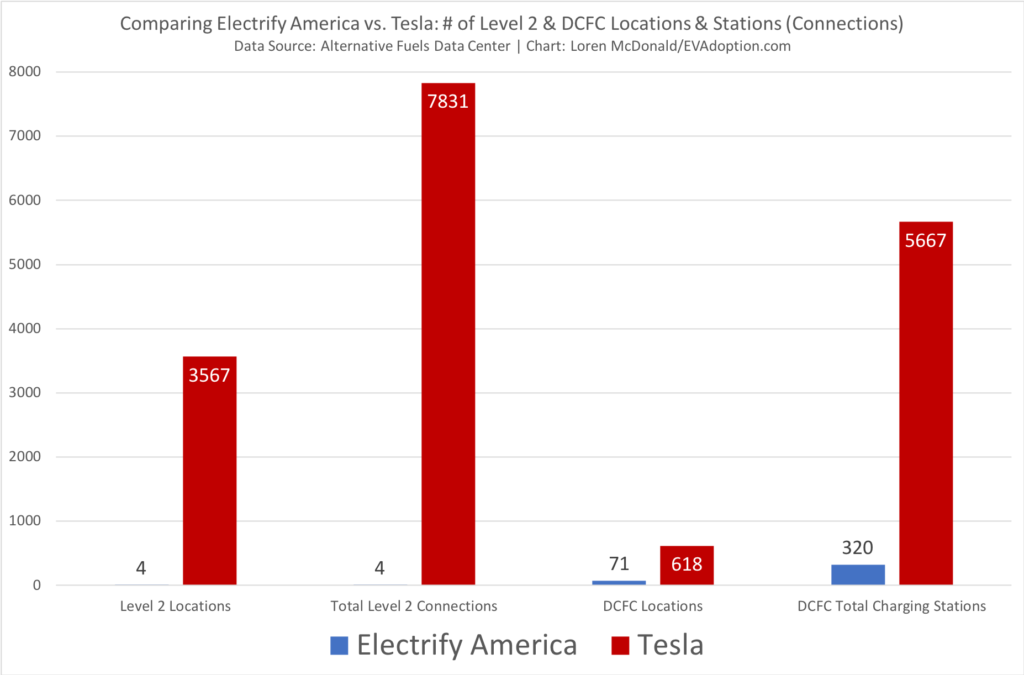

Tesla has an average of more than 9.2 stations per Supercharger location, double the 4.5 of Electrify America. EVgo (2.7) and Greenlots (2.1) were third and fourth, but far behind.

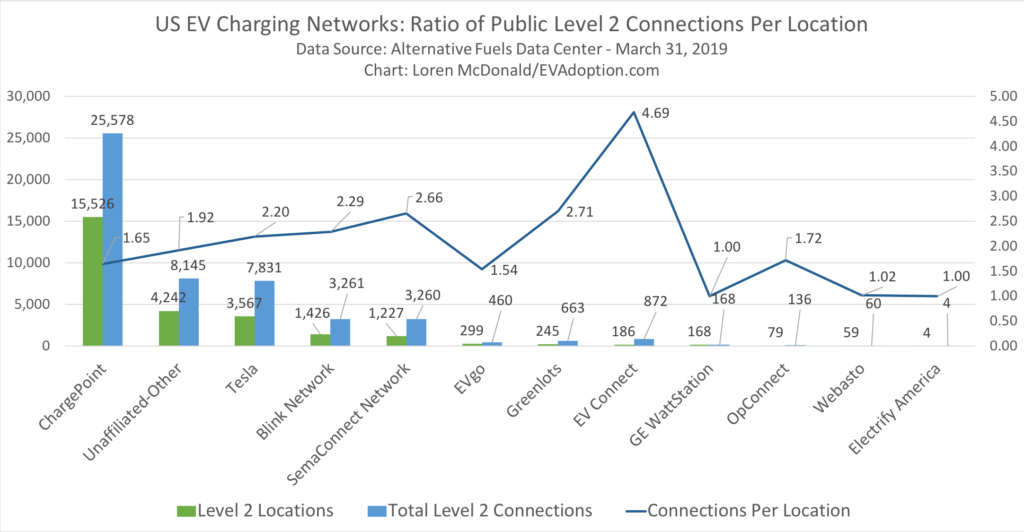

When it comes to Level 2, ChargePoint with 25,578 has more connections than all of the other networks combined. After Unaffiliated stations, Tesla is then far ahead of the other networks with 7,831 connections. EV Connect, however, has the highest average number of connections per location at 4.69, about 2-3 connections more on average than the other networks.

When combining both Level 2 and DCFC connections, ChargePoint is far ahead of the other networks because of its nearly 26,000 Level 2 stations. Tesla, with nearly 13,500 combined connections has a solid lock on the number 2 spot.

SemaConnect (100%), EV Connect (97.9%), ChargePoint (96.3%), and Blink Network (92.4%) have the highest percentage of Level 2 connections in their US networks. Electrify America (1.0%), EVgo (14.3%), Webasto (34.9%), and Tesla 55.5%) have the smallest percentages of Level 2 connections.

When comparing the two US charging networks owned or affiliated with automakers (Electrify America was set up from the Volkswagen dieselgate settlement), Tesla is well ahead. Electrify America only has 4 Level 2 connections compared to Tesla’s 7,831 Destination Chargers. For DCFC connections, Tesla has nearly 18 times more connections than Electrify America.

One Response

These charts above make Tesla’s charging availability look superior and could easily lead for people considering the purchase of a BEV as their next new car to choose a Tesla car over the BEV of any other manufacturer. But in my opinion these charts, which are a bit outdated by now, require some additional clarifications, at least in regards of the subject availability of DCFC charging stations and the time to develop new DCFC station locations.

While Tesla, as per the charts above, has utilized an impressive number of 618 super charger locations with 5667 chargers in a time frame of 7 years, Electrify America (VW) has utilized 339 new DCFC locations with 1171 CSS and 339 Chademo chargers in a time frame of mid July 2018 to November 16th 2019, within only 16 months! (source electrifyamerica.com/locate-charger)

If Electrify America will hold up to this speed / trend of the development of new location during cycle 2 thru cycle 4 of their 10-year investment plan, there soon will be many more Electrify America DCFC charging locations available than Tesla’s super charging network locations. 339 new EA stations within 16 months vs 618 with 6-7 years looks pretty impressive to me.

It may also be worth mentioning, although Tesla’s availability and numbers of fast chargers look superior in those charts above, those chargers are meant to be used solely by Tesla cars while on the other hand Electrify America chargers but also the chargers of their roaming partners EVgo, Greenslot and ChargePoint are available to all BEV and PHEV utilizing CSS or Chademo plugs, even to Tesla cars if the Tesla driver has invested in the purchase of a CSS adapter or Tesla may decide to use CSS as standard plug for all their cars instead of Tesla’s own but non industrial standard plug.

Good luck to e.g. Chevy Bolt, Kia Niro or Jaguar iPACE drivers charging their cars at a Tesla super charger. It’s simply impossible.

It may also be worth to mentioning, by Electrify America establishing agreements with the already above mentioned networks EVgo, Greenlots and ChargePoint will allow the public to have an easier access to an even broader network of fast chargers and although most of the older and non Electrify America chargers may still be only 50kWh chargers at this time, these chargers will be upgraded step by step to accommodate 125kWh – 150kWh fast charging (if not even higher fast charging speeds a few more years down the road from today).

Looking at charging availability from this perspective, Tesla’s advantage shrinks quite a bit and it shrinks even more since Tesla has stopped offering the free charging benefit for most of their new car sales, which used to be another one of their major sales arguments. Please don’t get me wrong, Tesla cars are superior BEVs and leading the current li-io battery and EV powertrain technology but Tesla’s charging availability should not necessary be the main reason to neglect the consideration of any of the other new BEV models offered by the other manufacturers.

VW, who stands behind Electrify America has not even started selling their own models here in the US other than the discontinued e-Golf, the Audi eTron or as recently released, the Porsche Taycan.

I’m really anxious to see updated charts like the ones above again in 2025 and 2028.