Did you know that trucks, vans, SUVs and crossovers are not subject to the gas guzzler tax in the US?

Many organizations, including the Union of Concerned Scientists in “Fuel Economy Fraud” way back in 2005, have called for trucks and SUVs to be included in the gas guzzler tax. The automotive market has changed significantly since the gas guzzler tax was established by Congress as part of the Energy Tax Act of 1978 – and it is time for this now embarrassing oversight to be corrected.

Gas Guzzler Tax Rates and Collection

The Gas Guzzler Tax is based on a vehicle’s combined city and highway fuel economy value. Manufacturers must follow U.S. Environmental Protection Agency (EPA) procedures to calculate the tax. Fuel economy values are calculated before sales begin for the model year, while the tax amount is determined later and is based on the total number of gas guzzler vehicles that were sold that year. It is assessed after production has ended for the model year and is paid by the vehicle manufacturer or importer. (Source EPA)

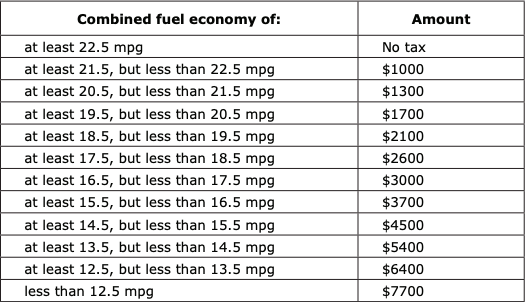

The IRS collects the tax directly from the manufacturer or importer of the vehicles. The following table shows the gas guzzler tax rates which have been in effect since January 1, 1991. The manufacturer or importer must pay this amount for each vehicle that doesn’t meet the minimum fuel economy level of 22.5 mpg.

Trucks, SUVs and Minivans Oversight

According to the EPA site:

The Gas Guzzler Tax is assessed on new cars that do not meet required fuel economy levels. These taxes apply only to passenger cars. Trucks, minivans, and sport utility vehicles (SUV) are not covered because these vehicle types were not widely available in 1978 and were rarely used for non-commercial purposes.

Excluding pickups, SUVs and minivans from the Gas Guzzler Tax is idiotic, irresponsible, and simply doesn’t make any sense in 2019 for several reasons:

- High Market Share: When the Gas Guzzler Tax law went into effect in 1980, only a few SUVs existed and they sold in very low volume. And while pickups were popular especially in rural areas, construction workers and with “weekend warriors, they evolved into “family cars” for many households in the last decade. In 2019, SUVs (and crossovers), pickups and minivans accounted for roughly 70% of all new light vehicle sales. Light trucks outsold cars for the sixth straight year – jumping nearly 8%, year-over-year, to a 69.2% market share, according to the Auto Alliance/Wards Auto. This segment was led by a record demand for crossover utility vehicles (CUVs) with an all-time high annual penetration of 38.7% in 2018.

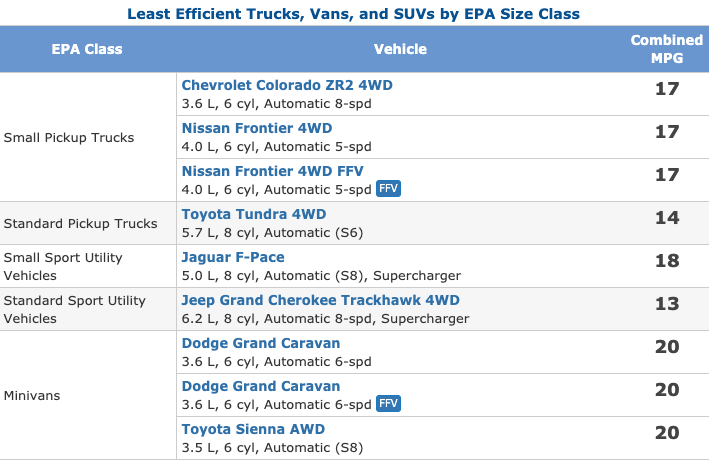

- Lower Fuel Efficiency: Pickups, SUVs and minivans in general get fewer miles per gallon than sedans and therefore if the intent of the Gas Guzzler Tax is to to discourage the production and purchase of fuel-inefficient vehicles – then of course these vehicles should be included. Below are the least efficient vehicles available in the US in 2018 by category according to FuelEconomy.gov:

- Higher Weight: The table below shows how the average midsize SUV, large SUV and half-ton pickup all weigh well north of 4,000 pounds. Large SUVs in particular are heavy weights averaging 5,600 pounds. Heavier vehicles not only are less fuel efficient, but they are less safe for the occupants of other vehicles that might be in an accident with these large beasts of vehicles.

A second issue with the Gas Guzzler Tax is that the minimum miles per gallon threshold hasn’t changed since 1991. The original threshold was 15 MPG but was then increased in 1991 to 22.5 MPG. It has remained at that level now for 28 years. With hybrids becoming popular 20 years ago and electric vehicles growing in sales in the last decade, not increasing the MPG minimum for nearly three decades is unfathomable.

Proposed Changes to The Gas Guzzler Tax

In light of the above, following are 5 suggestions on how to fix/improve the Gas Guzzler Tax:

- A no brainer, the tax must Include pickups SUVs and crossovers and minivans.

- Increase the MPG threshold to a more current figure such as 25 MPG for cars and 18 MPG for pickups, SUVs and minivans.

- Increase the threshold for each vehicle category by 1 mile every two years or similar regular increase.

- Include a separate weight component to the tax that adds an additional penalty for very heavy vehicles

- Create a “cash for clunkers” program that would redistribute taxes collected from the Gas Guzzler Tax to consumers who replaced older, very low-MPG vehicles with new low-emission vehicles.

The goal of a revised Gas Guzzler Tax is to drive change at the automakers and incentivize them to produce more efficient and low-mission vehicles. With the Trump administration trying to roll back CAFE standards, however, getting changes made to the Gas Guzzler Tax in the current political environment in Washington, D.C. is a real long shot, but it is worth the fight.

Let me know your thoughts in the comments.

For further background and reading on the Gas Guzzler Tax, check out these resources:

- Gas Guzzler Tax overview from EPA

- IRS Gas Guzzler Tax Form

- Fuel Economy Fraud, Union of Concerned Scientists – 2005

- The Taxation of Fuel Economy – University of Chicago/NBER – 2010

- Background on CAFE standards

- Vehicles Subject to the Gas Guzzler Tax for Model Year 2016

One Response

Ireland taxes all vehicle based on carbon dioxide emissions. Taxes are paid annually instead of one time like the gas guzzler tax. Taxes are from €10 to €100 per month for normal vehicles, and then jump to ~€200 per month for gas guzzlers (roughly 25 miles per hour, but actually measured in grams of CO2 per kilometer driven).