Read just about any article on electric vehicles in the US and the reporter will use some variation of this phrase: “ … but electric vehicle sales are only 1% of overall auto sales in the US (or world).” (Los Angeles Times)

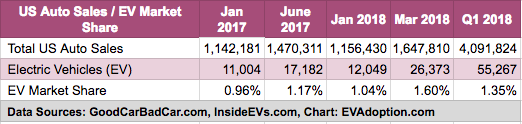

While US EV sales have been hovering in the 1% neighborhood for about the last year, EV sales in March 2018 were 1.6% of total light vehicle sales and could end up close to 2% by the end of 2018 primarily because of deliveries of the Tesla Model 3.

I hear you snickering – even at 1.6% EVs are still well under 2% and in the 1% ballpark. True, but this is a fairly significant increase in market share of roughly 50%over the last 12 months.

While the percent of sales of EVs compared to overall auto sales is one measure of progress, this metric is fundamentally flawed as a true measure of consumers’ interest in purchasing an EV. A few reasons why this straight market share measure falls short include:

- 250 Fewer Models: GoodCarBadCar.net current tracks 287 available light cars and trucks in the US versus 42 PHEVs and BEVs tracked by InsideEVs. And 31 of the 42 are multi-platform models with hybrid and regular gas/diesel versions also available.

- No Pickups: In the US there is not a single electric pickup truck available. Pickup trucks currently comprise roughly 16% of vehicle sales in the US.

- No Small SUVs/Crossovers and Few SUVs/CUVs Overall: There are only 10 electric SUVs/CUVs currently available in the US – none of which are in the hottest growing category of small SUVs. GoodCarBadCar.net lists 104 SUVs/crossovers for sale in March 2018 which means that consumers looking for an electric SUV or crossover have 90% fewer options to consider.

- No Top Selling Models: The highest selling multi-platform model that has an electric version was the Ford Fusion at #23 in April 2018. Meaning that there are basically no comparable models to choose from among the top-selling vehicles in the US.

- No Small Sedans: While sales of sedans are declining, there are no small, affordable electric sedans that would compete against models like the Toyota Corolla, Honda Civic or Nissan Sentra.

Where Are EVs Selling Well Above the US Average?

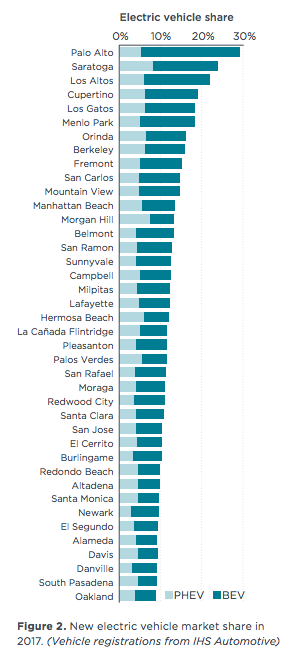

No surprise, EVs continue to sell extremely well in upper-income cities in California. Thirty California cities had electric vehicle shares above 10% in 2017, up from 19 such cities in 2016, according to new analysis from ICCT.

There were 109 California cities with a greater than 5% share of new electric vehicles in 2017, up from just 64 in 2016, according to ICCT.

Across the US, only four states and the District of Columbia have EV sales market shares above the March national average of 1.6%, according to data from the Alliance of Automobile Manufacturers. But residents of California purchase 50% of EVs in the US which means that the near 5% share in California is significant.

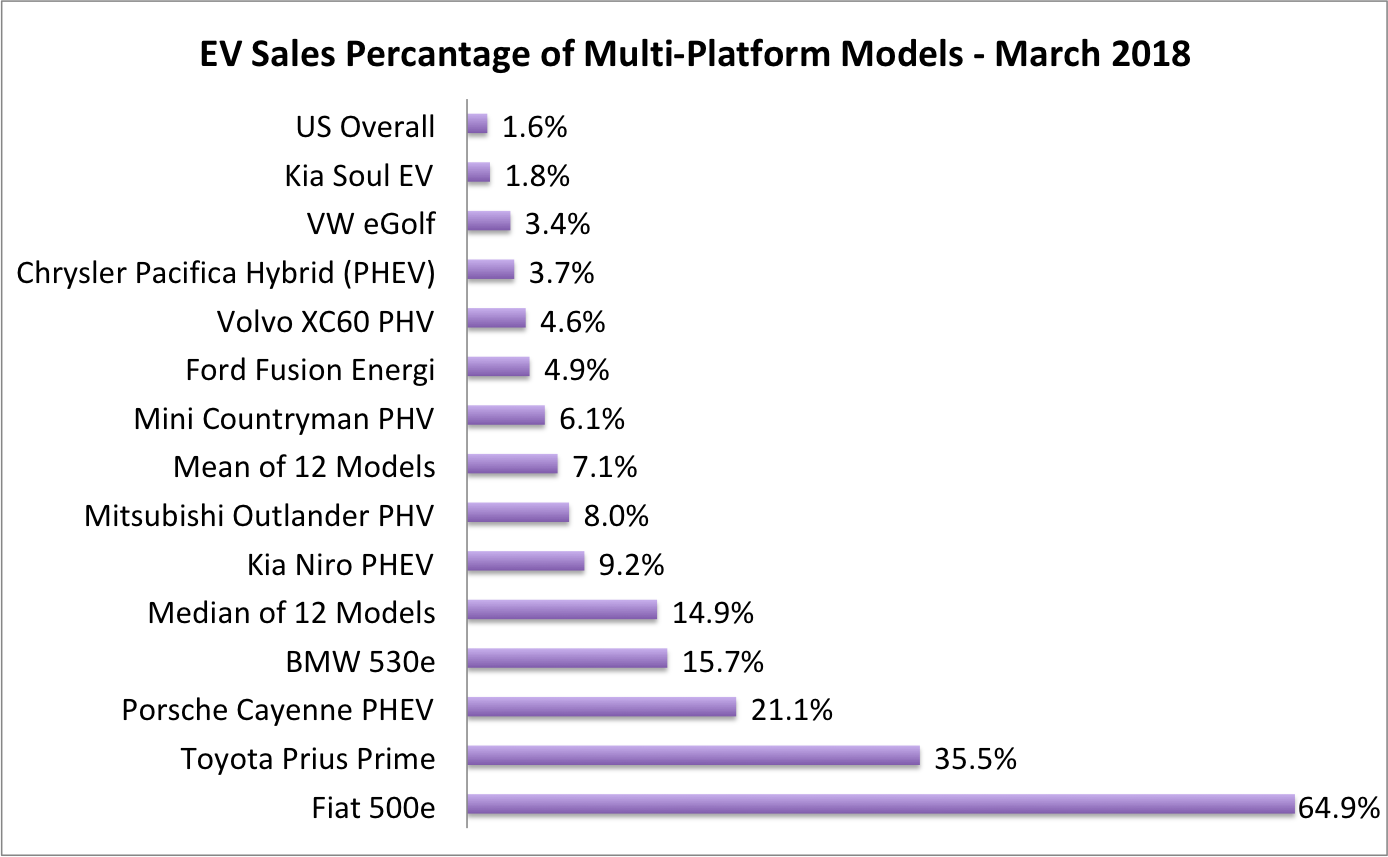

In a previous article, Consumers Are Choosing the EV Option at High Levels When They Have A Real Choice, I analyzed a cross section of different models that are currently available in the US with either a traditional internal combustion engine version or regular hybrid AND plug-in hybrid or full battery electric version.

Of the 12 vehicles analyzed, the Fiat 500e had the highest share of sales for the same base model at 65% in the month of March 2018 and the lowest share is from the pure electric Kia Soul at 1.8% in March. But across the 12 models, the median EV share was 14.9% and the mean was 7.1%.

Source: US Vehicle Sales – GoodCarBadCar.net | EV Sales – InsideEVs | Chart: EVAdoption

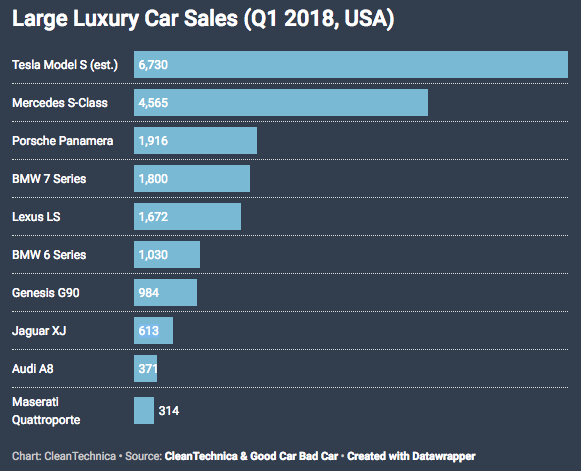

In looking at the large luxury car category, the Tesla Model S does extremely well with 34% market share.

So What Does All of This Data Mean?

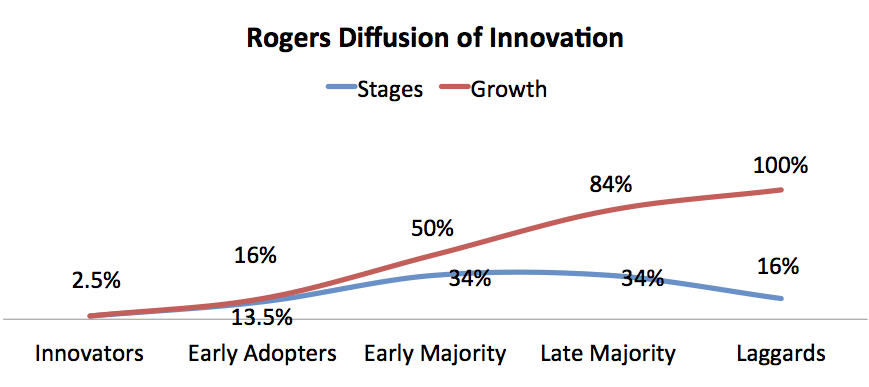

Quite simply, electric vehicles are selling significantly better than most observers and media coverage convey. Yes, EVs likely won’t cross the chasm into the mainstream (16% of new vehicle sales) for another 7-8 years. But in key early adopter markets such as in many cities in Northern California and the luxury car category – they have already crossed into the early majority phase of technology adoption.

The issue with EV adoption is NOT one of a lack of consumer demand – demand as the data above proves exists at a high level. No, when there are 250 more ICE models available than EV models and 94 fewer electric SUVs/CUVs – the problem is one of supply.

When the automakers each start producing and selling multiple EVs at scale across the United States (and world) – then and only then can we start looking at the demand side of the equation.

Until then, let’s please stop saying that EVs are only 1% of total auto sales and that consumers don’t want them.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →

17 Responses