The Clean Vehicle Credit Is A Confusing Mess

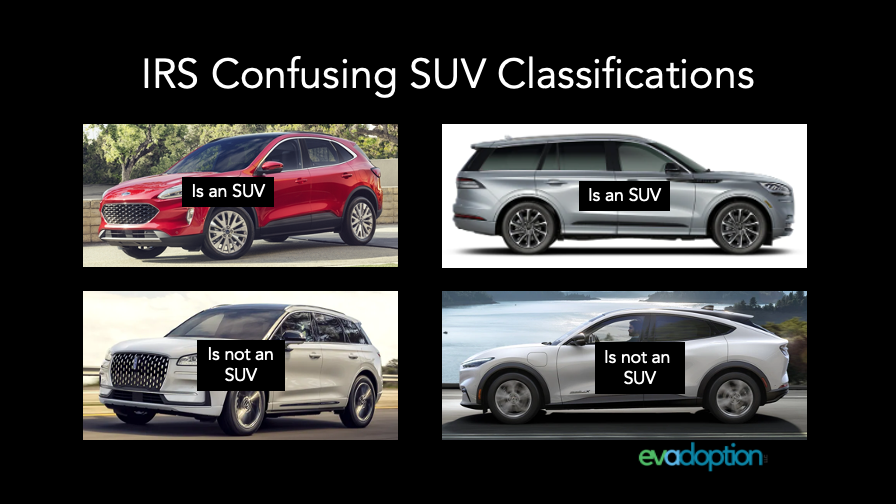

Hailed as a huge win for auto manufacturers, car dealers, and consumers, the Clean Vehicle Credit (CVC) which is part of Inflation Reduction Act (IRA),

Hailed as a huge win for auto manufacturers, car dealers, and consumers, the Clean Vehicle Credit (CVC) which is part of Inflation Reduction Act (IRA),

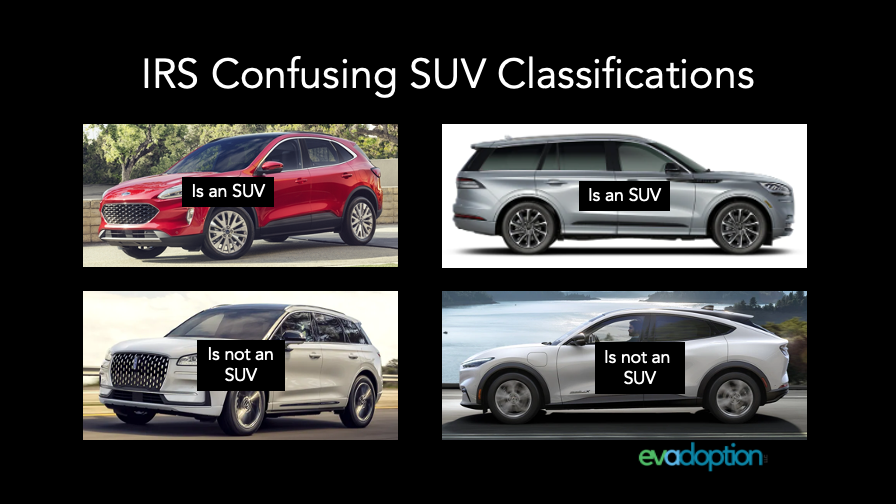

While many people are applauding the proposed revisions to the federal EV tax credit (IRC 30D) included in the Inflation Reduction Act of 2022 (IRA)

One of the top hurdles to EV adoption in the US is the often touted issue that EVs simply cost more than similar gas-powered vehicles. But assuming you can get your hands on one, roughly two-dozen BEVs and PHEVs available for sale in the US this summer have a base manufacturer’s suggested retail price (MSRP) of less than $45,000.

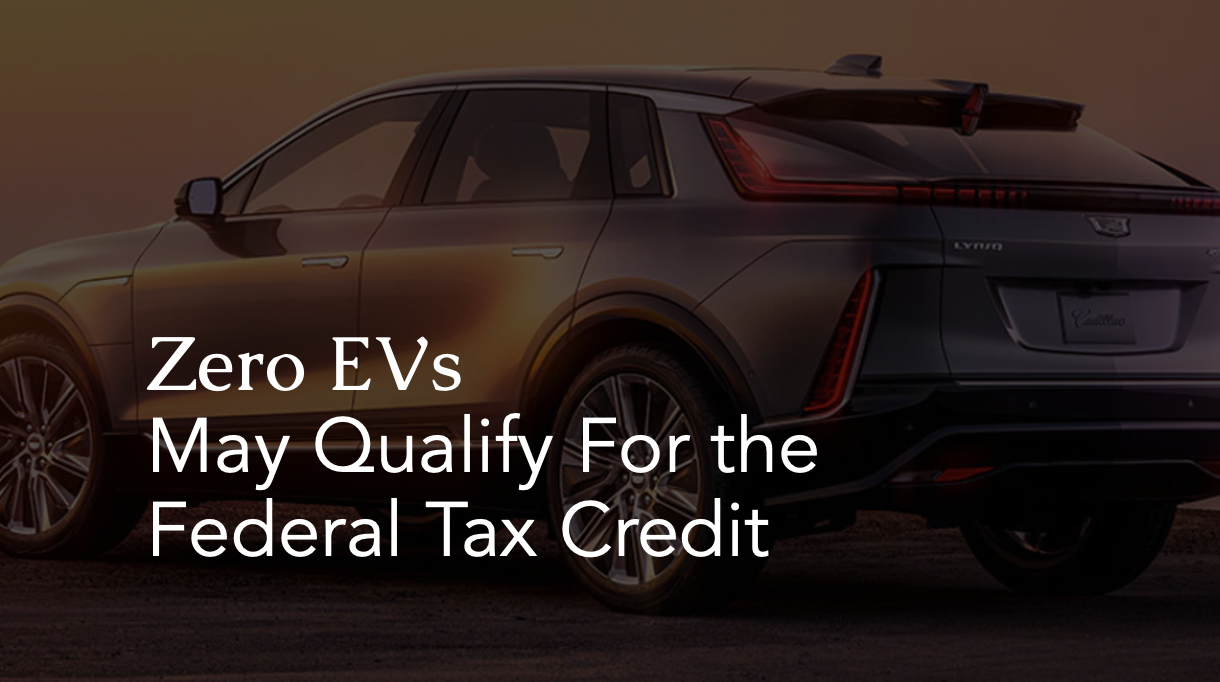

PHEVs are either loved and seen as part of the solution in the transition to vehicles with zero tailpipe emissions, or derided by BEV purists. But PHEVs are a great solution for many, the problem with them in the US is hour are EV incentives are structured. This article outlines some potential fixes.

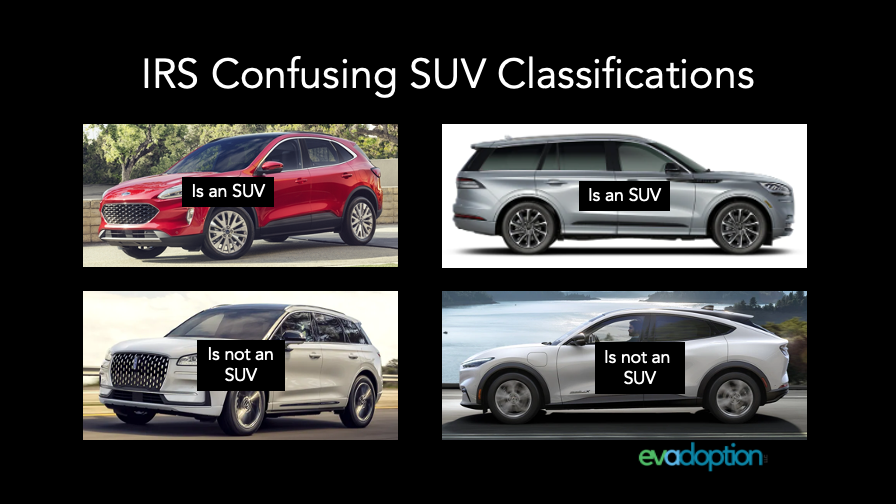

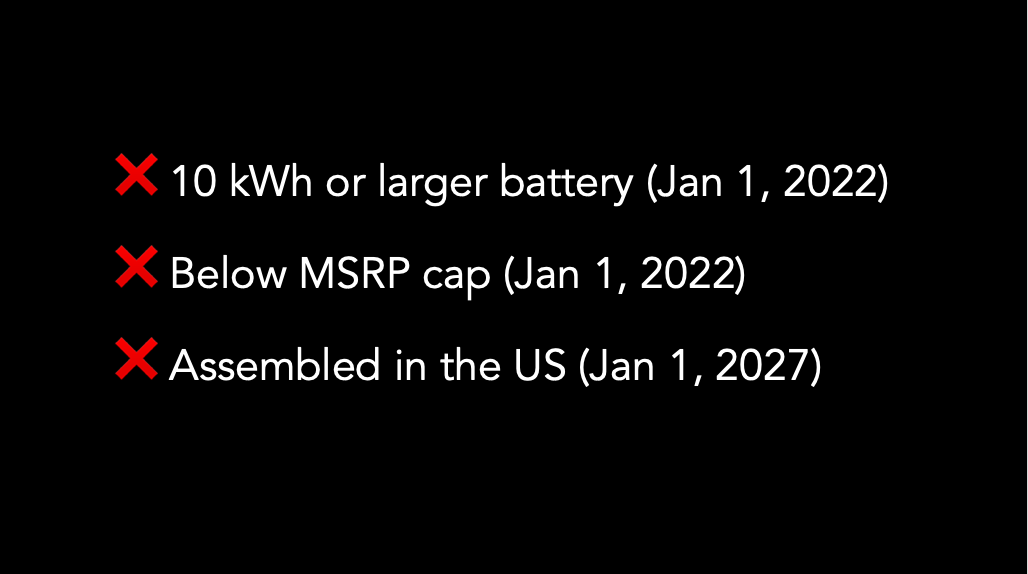

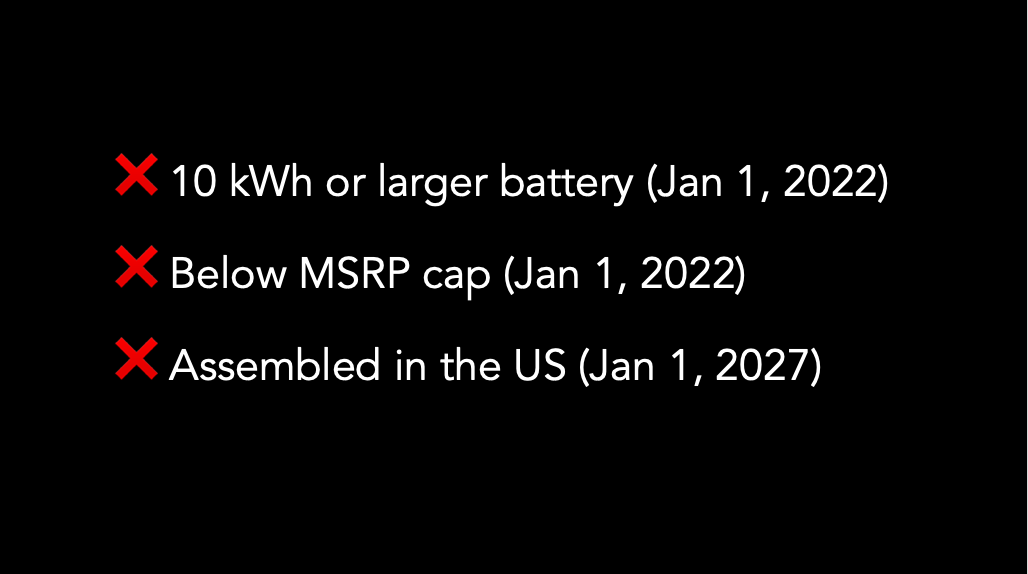

There are 3 scenarios that lead to an EV being completely disqualified from any available tax credit amount under the proposed tax credit changes in the bill passed by the US House of Representatives on November 20.

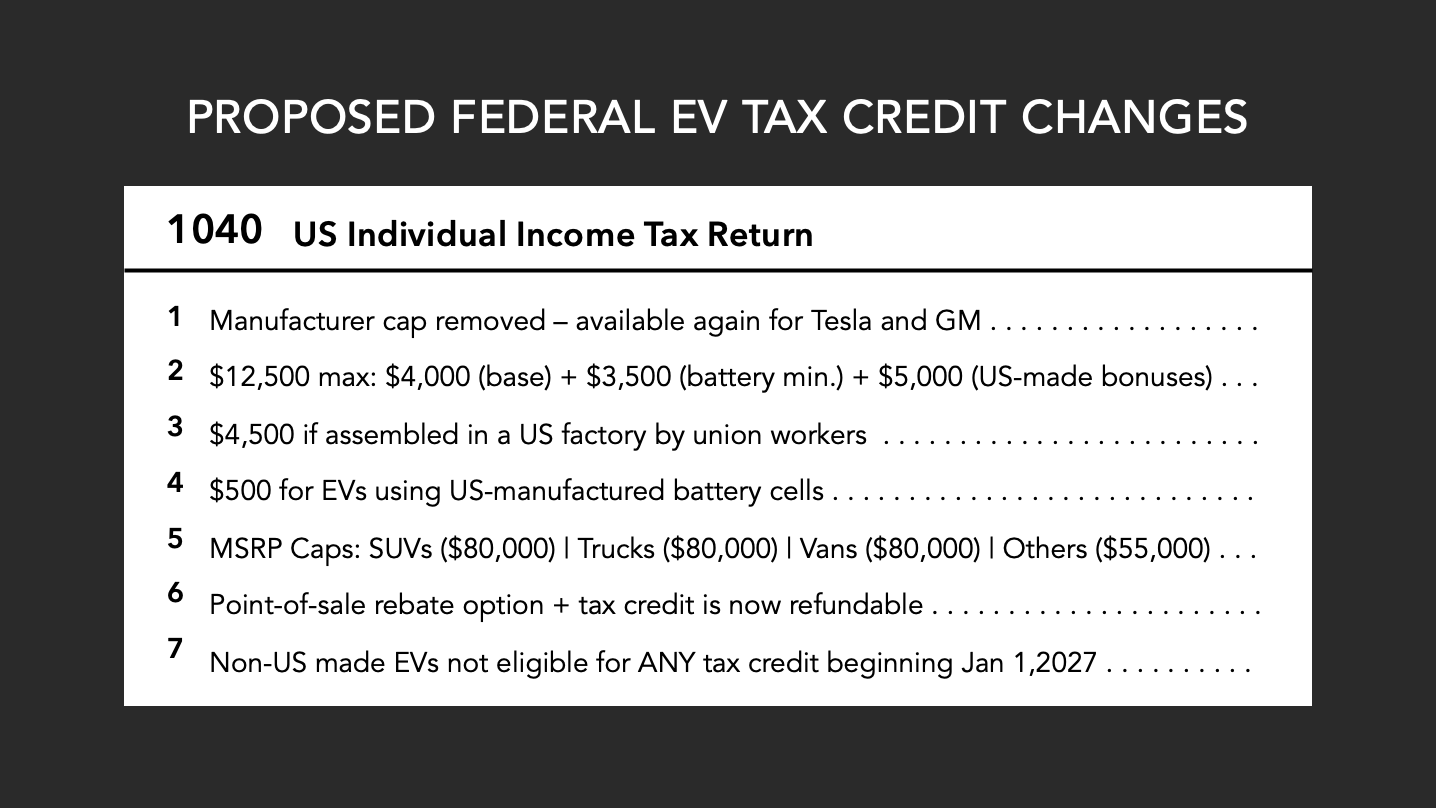

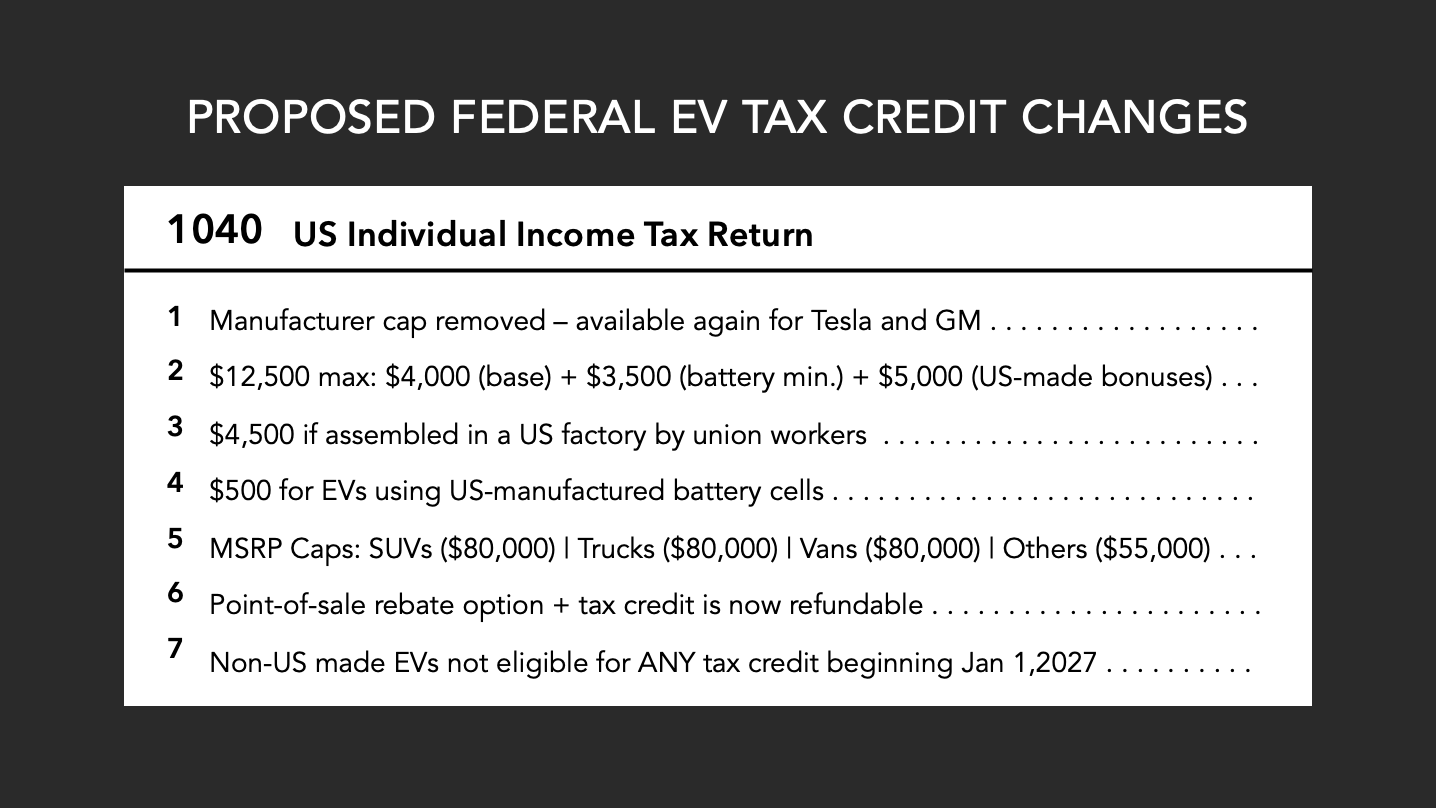

The House of Representatives passed the Build Back Better Act (BBBA), sending it to the Senate. This article examines 13 different proposed revisions to the federal EV tax credit (IRC 30D).

One of the biggest complaints about the federal electric vehicle (EV) tax credit (IRC 30D) is that its structure of using a non-refundable tax credit is clearly more beneficial to higher-income households. But Congress may actually get something right (well mostly) as among the nine key proposed changes to the tax credit contained in the Clean Energy for America Act (CEAA) is changing the current non-refundable credit into one that is refundable.

One of the proposed changes to the federal EV tax credit that has flown a bit under the radar is also one of the most political and protectionist in nature provisions. Effective January 1, 2022, electric vehicles with final assembly* (see definition at the end) in China would no longer qualify for IRC 30D (federal EV tax credit).

A provision in the Clean Energy for America Act requires that a new qualified electric vehicle purchased by the taxpayer has a manufacturer’s suggested retail price (MSRP) of $80,000 or less. What would this change mean for automakers and EV buyers?

Arguably the biggest flaw in the Plug-In Electric Drive Vehicle Credit (IRC 30D) regulations is the triggering of a phaseout schedule of the tax credit when a manufacturer sells 200,000 total EVs (BEV and PHEV). In the Clean Energy Act for America (CEAA) proposed legislation, this per manufacturer threshold would be eliminated and replaced with an industry-wide phaseout based on reaching 50% EV sales share.

Hailed as a huge win for auto manufacturers, car dealers, and consumers, the Clean Vehicle Credit (CVC) which is part of Inflation Reduction Act (IRA),

While many people are applauding the proposed revisions to the federal EV tax credit (IRC 30D) included in the Inflation Reduction Act of 2022 (IRA)

One of the top hurdles to EV adoption in the US is the often touted issue that EVs simply cost more than similar gas-powered vehicles. But assuming you can get your hands on one, roughly two-dozen BEVs and PHEVs available for sale in the US this summer have a base manufacturer’s suggested retail price (MSRP) of less than $45,000.

PHEVs are either loved and seen as part of the solution in the transition to vehicles with zero tailpipe emissions, or derided by BEV purists. But PHEVs are a great solution for many, the problem with them in the US is hour are EV incentives are structured. This article outlines some potential fixes.

There are 3 scenarios that lead to an EV being completely disqualified from any available tax credit amount under the proposed tax credit changes in the bill passed by the US House of Representatives on November 20.

The House of Representatives passed the Build Back Better Act (BBBA), sending it to the Senate. This article examines 13 different proposed revisions to the federal EV tax credit (IRC 30D).

One of the biggest complaints about the federal electric vehicle (EV) tax credit (IRC 30D) is that its structure of using a non-refundable tax credit is clearly more beneficial to higher-income households. But Congress may actually get something right (well mostly) as among the nine key proposed changes to the tax credit contained in the Clean Energy for America Act (CEAA) is changing the current non-refundable credit into one that is refundable.

One of the proposed changes to the federal EV tax credit that has flown a bit under the radar is also one of the most political and protectionist in nature provisions. Effective January 1, 2022, electric vehicles with final assembly* (see definition at the end) in China would no longer qualify for IRC 30D (federal EV tax credit).

A provision in the Clean Energy for America Act requires that a new qualified electric vehicle purchased by the taxpayer has a manufacturer’s suggested retail price (MSRP) of $80,000 or less. What would this change mean for automakers and EV buyers?

Arguably the biggest flaw in the Plug-In Electric Drive Vehicle Credit (IRC 30D) regulations is the triggering of a phaseout schedule of the tax credit when a manufacturer sells 200,000 total EVs (BEV and PHEV). In the Clean Energy Act for America (CEAA) proposed legislation, this per manufacturer threshold would be eliminated and replaced with an industry-wide phaseout based on reaching 50% EV sales share.

© 2024 EVAdoption, LLC | All Rights Reserved.