On Friday November 20 the House of Representatives passed the Build Back Better Act (BBBA) which means the bill is now off to the Senate where we can expect the possibility of many changes to the current proposed legislation. For electric vehicles, the BBBA includes multiple proposed changes to IRC 30D, more commonly knows as the federal EV tax credit.

According to CNBC, Senate Majority Leader Chuck Schumer wants to pass the Build Back Better Act by Christmas. Passage by the Senate is far from a certainty and will require all 50 yes votes including from conservative-leaning Democrat Senator Joe Manchin of West Virginia to the Independent Senator Bernie Sanders of Vermont.

It is expected that BBBA will undergo several changes in order to obtain the necessary 50 votes, but it is not clear what, if any, changes in the proposed revisions to IRC 30D might be pushed by the Senate. Perhaps the most likely is the requirement for EVs to be assembled in the US in a union factory to qualify for an additional $4,500 tax credit. More on this below.

To try and understand and document all of the key proposed revisions, I combed through the Rules Committee text of H.R. 5376: BUILD BACK BETTER ACT from November 3, 2021 (which as far as I know is the version of the BBBA text that the House voted on and passed).

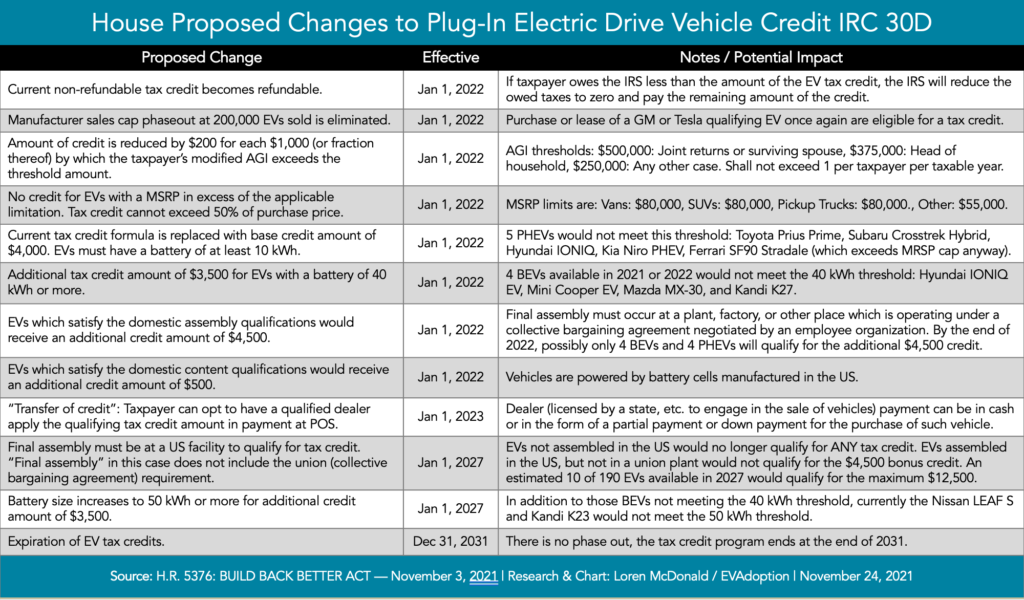

Below is a summary table (download a PDF version) of the proposed changes to the EV tax credit for new 4-wheeled electric vehicles. There are separate provisions for 2 & 3-wheeled EVs, electric bikes, and used 4-wheeled EVs — of which this article will not cover.

Summaries of the Major Proposed Changes

There are at least a 13 significant proposed changes to the existing tax credit which I explain and analyze below:

1. Tax Credit Becomes Refundable

Changing the tax credit to be refundable from nonrefundable is one of the more important revisions as it eliminates a common complaint that the tax credit is only for the wealthy because taxpayers with zero tax liability could not benefit from the tax credit.

For more background and detail on changing to refundable tax credit, read my article from September — Proposed Changes to Federal EV Tax Credit – Part 5: Making the Credit Refundable.

The current tax credit is non-refundable which means if your tax liability is say $500 and your EV qualifies for the $7,500 maximum tax credit, you would only get to use $500 of the $7,500 to offset your $500 tax liability. So in essence, you would lose out on most of the benefit of the tax credit. And if you had zero tax liability, you would receive zero benefit.

Refundable tax credits are called “refundable” because if you qualify for a refundable credit and the amount of the credit is larger than the tax you owe, you will receive a refund for the difference. For example, if you owe $800 in taxes and qualify for a $1,000 refundable credit, you would receive a $200 refund.

With the proposed switch to a refundable tax credit, the taxpayer in my example with a $500 tax liability would offset their $500 tax liability and then receive a check or direct deposit from the IRS for $7,000.

Effective Date: Jan 1, 2022.

EVAdoption Analysis: Making the tax credit refundable is presumably one of the least controversial proposed changes and fixes to one of the current credit’s biggest flaws and inequities — that people with little to no tax liability do not benefit from the credit. It remains to be seen how significant of an impact this change will have, but it should clearly increase sales of lower-cost EVs among households of modest income.

2. Elimination of the 200,000 Sales Cap Per Manufacturer

Probably the most needed and least controversial proposed change is the elimination of the phaseout of the tax cap that begins in the quarter after a manufacturer sells 200,000 BEVs or PHEVs in the US. To date, two manufacturers — Tesla and General Motors — saw the tax credit phaseout completely. The credit is not available for Tesla vehicles acquired after December 31, 2019 and General Motors EV purchased after March 31, 2020.

Effective Date: Jan 1, 2022.

EVAdoption Analysis: The next automakers most likely to reach 200,000 EV unit sales in the US are Toyota, Ford, and Nissan in 2022 and 2023. But interestingly, despite the loss of the tax credit, the Tesla Model Y and Model 3 and Chevrolet Bolt have been the top-selling EVs in the US since EVs from Tesla and GM no longer qualified. The elimination of the manufacturer cap will, however, clearly be a boon to Tesla and GM.

Because Teslas are not assembled in union plants, however, GM models will benefit more as they qualify for the bonus $4,500 as all of their EVs are assembled in the US in union plants. The Tesla Model 3 will qualify for an $8,000 tax credit, whereas the Chevrolet Bolt would be eligible for the maximum $12,500 tax credit.

Fundamentally, the elimination of the manufacturer phaseout puts all automakers back on a level playing field – at least with respect to their models even qualifying for a tax credit. I’m sure many observers and especially recent buyers of the Bolt and Tesla models wish the change was retroactive, but the current bill did away with an earlier provision that made the change retroactive to May 24, 2021.

3. Manufacturer Suggested Retail Price (MSRP) Caps

The current tax credit has no cap on the price of an EV meaning electric cars costing well over $100,000 are eligible for the same credit as one costing $40,000. Under the current proposed changes, EVs are categorized into four body types and two different manufacturer’s suggested retail price (MSRP) caps. They are:

‘‘(2) APPLICABLE LIMITATION.—For purposes of paragraph (1), the applicable limitation for each vehicle classification is as follows:

‘‘(A) VANS.—In the case of a van, $80,000.

‘‘(B) SPORT UTILITY VEHICLES.—In the case of a sport utility vehicle, $80,000.

‘‘(C) PICKUP TRUCKS.—In the case of a pickup truck, $80,000.

‘‘(D) OTHER.—In the case of any other vehicle, $55,000.

Notes:

- SUVs are not defined, but presumably this category includes crossovers.

- The text of the bill doesn’t define “Other,” but presumably this classification applies to sedans, station wagons, hatchbacks, and sports cars.

Effective Date: Jan 1, 2022.

EVAdoption Analysis: Caps on the manufacturer’s suggested retail price (MSRP) for EVs elicits very different and impassioned viewpoints. Some EV advocates believe that there should not be any MSRP cap and that incentives that encourage the purchase of ANY electric vehicle regardless of price is a good thing.

Our belief is that this is a very flawed argument. The goal of using taxpayer dollars to increase sales of electric vehicles should serve two primary purposes: 1) To reduce the cost differential between comparable EV and ICE vehicles to make EVs more attractive and more affordable to more people. And 2) To incentivize automakers to produce more affordable mainstream EVs in high volume to get them into the hands of middle-class America, rather than primarily just providing purchase discounts to higher-income early adopters.

With caps on vans, SUVs and pickups at $80,000 the proposed revisions fundamentally fails these two goals. With this high of an MSRP cap it simply means that a large percentage of the tax credits will go to households that purchase $60,000, $70,000 and near $80,000 vehicles. This encourages automakers to continue focusing on these lower-volume, higher-cost luxury and performance vehicles. And many of these vehicles are large SUVs and trucks, with near or above 100 kWh battery packs which produce significant CO2 emissions in their mining and manufacturing process. In fact, it is possible that some of these larger, higher-end EVs will have have roughly the same “wells to wheels” CO2 emissions as similar ICE vehicles.

A better approach in our view would be to have an MSRP cap of perhaps $40,000 to $45,000. This would encourage automakers to shift their focus to producing more affordable and higher-volume EVs which would help get them into more driveways of average Americans. These lower cost EVs will also come with smaller batteries that produce fewer carbon emissions than their larger counter parts.

The reality is that households that can afford to purchase or lease a $75,000 vehicle don’t need a tax credit enable them to buy the vehicle.

The proposed revisions to the tax credit also includes a $55,000 MSRP cap for vehicles classified as “Other.” These “other” vehicles clearly include sedans, sports cars, hatchbacks, and station wagons. The EPA vehicle classifications are not entirely clear, however, on whether crossovers — the hottest vehicle category — would be categorized as “Other” or “SUVs”. The Ford Mustang Mach-E, for example, is classified by the EPA as a station wagon, whereas similar crossovers such as the Volkswagen ID.4 and Tesla Model Y are classified as small SUVs.

This vehicle classification is significant because several vehicles would not qualify for ANY tax credit if they fall under the “Other” classification. Front and center is the Cadillac LYRIQ pictured below which currently has a base MSRP of $58,795. If classified as a station wagon (very likely), it would fall under the “Other” category and exceed the $55,000 MSRP cap and would be disqualified completely from eligibility. If categorized as an SUV, however, the LYRIQ would qualify for the maximum $12,500 tax credit.

I reached out to the Cadillac PR team to see if they had any insight as to whether the LYRIQ will be classified as an SUV or station wagon and received this response: “I heard back from the team (engineering) and it is too soon to speculate what it means for future products.” So GM is either holding their cards close to the vest, or also may not know how the LYRIQ will be classified.

It is unclear why the House of Representatives decided to provide a $25,000 higher tax credit for the larger and less efficient SUVs, vans and pickups than smaller sedans? Because sedans are increasingly less popular in America, this has the feel of the automakers lobbying for this higher MSRP for trucks and SUVs since many of the automakers are reducing the number of, or even no longer producing sedans.

While we can understand the intent behind these different cost classifications, policy makers should not favor one vehicle body type over another — especially when those policies encourage people to spend more money on larger, less efficient SUVs and trucks that require larger batteries, and have a bigger impact on roads.

A counter argument from some is that these larger SUVs and trucks will often be replacing large and inefficient ICE trucks and SUVs which emit more emissions than a typical sedan. This may be true, but the focus needs to be on getting older, gas-guzzling trucks and SUVs off the road, not providing a massive discount to the owner of a Ford F-150 Raptor to replace it with a $70,000 Rivian R1T.

4. Adjusted Gross Income (AGI) Caps

Currently there are no income caps on the use of the tax credit. Meaning someone making $1 million a year can take advantage of the tax credit. With the proposed revisions, however, adjusted gross income (AGI) thresholds would be established. Taxpayers exceeding the following AGI thresholds, would have the amount of the tax credit reduced or eliminated. Below is the proposed reduction provision, which would reduce the qualifying tax credit amount by $200 for every $1,000 (or fraction thereof) above the applicable threshold:

‘‘(d) LIMITATION BASED ON MODIFIED ADJUSTED GROSS INCOME.—

‘‘(1) IN GENERAL.—The amount of the credit allowable under subsection (a) for any taxable year shall be reduced (but not below zero) by $200 for each $1,000 (or fraction thereof) by which—

‘‘(A) the lesser of—

‘‘(i) the taxpayer’s modified adjusted gross income for such taxable year, or

‘‘(ii) the taxpayer’s modified adjusted gross income for the preceding taxable year, exceeds ‘‘(B) the threshold amount.

The AGI caps are:

- $500,000 in the case of a joint return or surviving spouse (half such amount in the case of a married individual filing a separate return),

- $375,000 in the case of a head of household, and

- $250,000 in any other case.

Effective Date: Jan 1, 2022.

EVAdoption Analysis: Again, like the MSRP caps the AGI thresholds are simply too high. While there is no simple and perfect answer to what is the right AGI threshold, $500,000 puts a household in the top 1%-2% of US households.

A cap of say $200,000 includes 90% of US households and can still account for households living in very expensive markets such as San Francisco and New York City. Using taxpayer dollars to help increase sales of EVs by in essence just providing a discount to higher-income households is not the right answer.

A more modest AGI cap helps ensure that more households that might be on the fence when comparing an EV to similar ICE vehicle are able to afford the electric vehicle. A key purpose of the tax credit should be to reduce or eliminate the cost factor in a middle-class household’s buying decision — not provide a discount to upper-income households that can afford an EV with or without the incentive.

5. Option to Convert the Tax Credit to a Time of Purchase Rebate

This new provision would give buyers of new EVs the option to convert the qualifying tax credit amount to a credit applied to the purchase amount at the time of sale.

If a buyer chooses to convert the tax credit, the auto “dealer” would make a “payment to such taxpayer (whether in cash or in the form of a partial payment or down payment for the purchase of such vehicle) in an amount equal to the credit otherwise allowable to such taxpayer.” In other words, an EV costing $50,000 and the vehicle and the buyer qualifying for an $8,000 tax credit, would have the $8,000 applied as either a downpayment – reducing the balance of the car loan to $42,000 or the credit amount applied as partial payment.

Effective Date: Jan 1, 2022.

EVAdoption Analysis: The ability for consumers to in essence convert the tax credit to an instant rebate is one of the most significant proposed changes to the tax credit. Under the current tax credit structure it’s entirely possible that the buyer of an EV might not receive the benefit of the tax credit until nearly 18 months from the time of purchase. For example, someone who purchased an EV in January 2021 and then filed their taxes in April 2022 might not receive their tax refund until June 2022.

Perhaps the most significant aspect of this proposed change is that instead of reducing your tax liability which many households might not actually use to help pay for a new EV, the rebate means EV buyers can reduce the vehicle cost or monthly payments from day one. This change should have one of the biggest positive affects among all of the proposed revisions.

6. $4,000 Base Tax Credit

The current tax credit has a base of $2,500 and is replaced with a new $4,000 base credit as long as the EV has a battery of at least 10 kWh and can be plugged in and recharged.

Effective Date: Jan 1, 2022.

EVAdoption Analysis: Increasing the base credit amount to $4,000 from $2,500 is fine. As mentioned below, however, the 10 kWh battery minimum requirement is the incorrect metric to use as the minimum requirement.

7. Battery Size Minimum of 10 kWh

The current minimum battery requirement is 5 kWh, which makes an EV eligible for the base $2,500 credit. The credit then increases by $417 per additional kilowatt hour up to a maximum of $7,500 in a convoluted formula. Under the proposed revision, to qualify for any tax credit an EV must have a battery of at least 10 kWh.

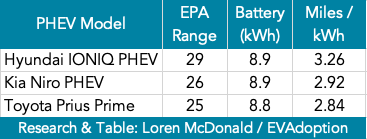

Currently only five PHEVs would not meet the proposed 10 kWh threshold: Toyota Prius Prime, Subaru Crosstrek Hybrid, Hyundai IONIQ, Kia Niro PHEV, Ferrari SF90 Stradale (which exceeds MRSP cap and would not qualify anyway). Of these five, the Toyota Prius Prime is the only one that sells in any significant volume. But all of these PHEVs have batteries of around 9 kWh and so they could easily be upgraded to 10 kWh to qualify for the tax credit.

Effective Date: Jan 1, 2022.

EVAdoption Analysis: The increase to a minimum 10 kWh battery is a significant flaw in the tax credit design. Rather than focus on battery size, the tax credit should be based on efficiency and minimum range thresholds for EVs, especially PHEVs.

Out of 31 PHEVs currently available in the US, the top 3 most efficient PHEVs have less than a 10 kWh battery. For example, the Toyota Prius Prime, one of the top-selling PHEVs for many years, has a ratio of 2.84 miles per kWh with its 25 miles of EPA range and 8.8 kWh battery. The tax credit minimum should be based on efficiency, not battery size to encourage automakers to get the most range out of smaller batteries.

And in addition to an efficiency minimum, they should have an EPA range minimum as well as California did recently by increasing its minimum to 30 or more EPA miles to qualify for the California Clean Vehicle Rebate Program (CVRP). BEVs on the other hand, should probably have a minimum efficiency requirement based on a metric like miles/kWh or MPGe. But a minimum of 150-175 miles of range for BEVs could also make sense.

8. $3,500 Bonus Credit for Minimum 40 kWh Battery

Instead of the current convoluted tax credit formula that requires an Excel spreadsheet to calculate, the proposed changes … well also require an Excel spreadsheet and add multiple new variables. A new variable is that a qualifying EV with a battery of at least 40 kWh would have an additional $3,500 added to its qualifying tax credit base amount of $4,000.

Effective Date: Jan 1, 2022.

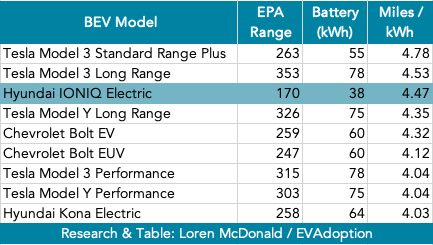

EVAdoption Analysis: A 40 kWh battery minimum is the wrong approach. It is like incentivizing automakers to produce ICE vehicles with larger gas tanks instead of a higher MPG rating. Four BEVs available in 2021 or 2022 would not meet the 40 kWh threshold: Hyundai IONIQ EV, Mini Cooper EV, Mazda MX-30, and Kandi K27.

In the chart below you can see that the Hyundai IONIQ Electric, which was recently discontinued by Hyundai, would be the third most efficient EV if still available in the US. But under the proposed tax credit revisions, the IONIQ wouldn’t qualify for the bonus $3,500 because its battery pack is less than 40 kWh. This is simply wrong. The tax credit should encourage the production and purchase of the most efficient EVs that use the smallest batteries while delivering solid range in miles.

Presumably the intent of the 40 kWh battery pack size and $3,500 bonus is to correct flaws in the current tax credit formula. PHEVs with a 16 kWh or larger battery under the current tax credit qualify for the $7,500 maximum tax credit amount. Since all current BEVs have batteries of at least double the 16 kWh level and a growing number of plug-in hybrids have near or greater than 16 kWh batteries, the formula clearly needed to be blown up and rethought.

But the 40 kWh battery minimum threshold to qualify for the $3,500 would penalize smaller and typically very highly efficient BEVs — as well as efficient and long-range PHEVs. If the intent is to favor BEVs over PHEVs, the tax credit should instead use a combination of a minimum miles of range and efficiency instead of battery size. California for example, recently established an EPA 30 mile range minimum to qualify for its California Vehicle Rebate Program (CVRP) incentive. With a minimum such as 30 miles of range, automakers would be forced to focus on efficiency of the plug-in hybrids and offer high-enough range to incentivize buyers to drive mostly on electric range and regularly plug in to recharge it.

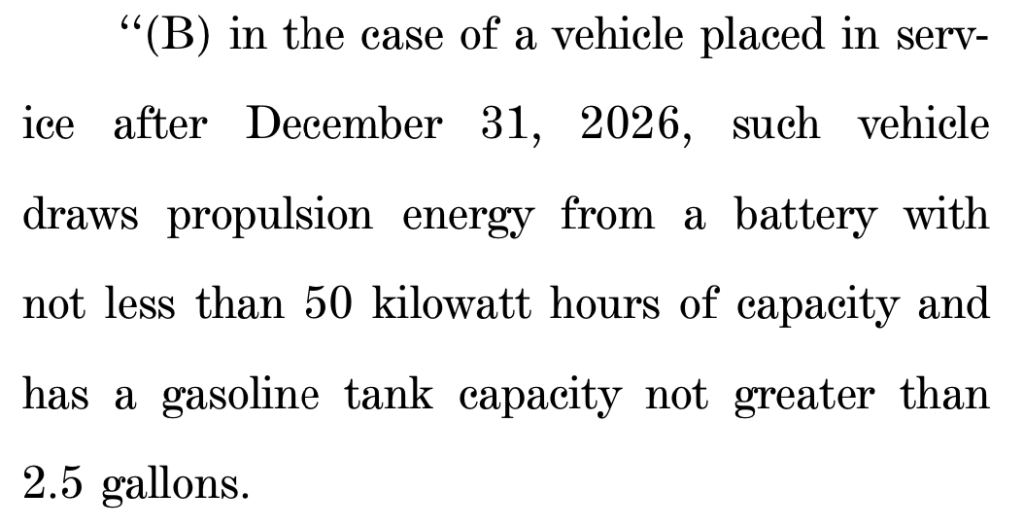

9. $3,500 Bonus Credit for Minimum 50 kWh Battery (2027)

Effective January 1, 2027 the $3,500 bonus credit for battery size would increase to a 50 kWh minimum. In addition to the BEVs above that do not meet the 40 kWh threshold, currently the Nissan LEAF S and Kandi K23 would not meet the 50 kWh threshold.

Effective Date: Jan 1, 2027.

EVAdoption Analysis: The provision to increase the minimum battery size to 50 kWh beginning January 1, 2021 is perhaps even more wrong-headed than the 40 kWh January 1, 2022 threshold. Five years from now, many BEVs will deliver around 4.5 miles/kWh. This means that a 49 kWh battery would enable 220 EPA miles and yet not qualify for tax credit. Having driven a BEV with 210 miles of range for 3 years, I can attest that for many households and use cases that is an ideal amount of range.

Each year that passes EVs are getting more efficient and the batteries themselves are producing more energy from smaller batteries and at a lower cost. Additionally, by 2027 solid state batteries should start powering BEVs from BMW, Ford, VW, Toyota, and others and a less than 50 kWh battery could conceivably delivery 300-350 miles of range. This provision is short-sighted and doesn’t take into account advances in battery technology and overall electric vehicle efficiency from design and powertrain optimization.

10. $4,500 Bonus Amount for EVs Assembled in the US in a Union Plant

Easily the most controversial proposed revision is a $4,500 bonus for EVs that are assembled in the US in “union” factories. The specific provision is quoted below:

DOMESTIC ASSEMBLY QUALIFICATIONS.— The term ‘domestic assembly qualifications’ means, with respect to any new qualified plug-in electric vehicle, that the final assembly of such vehicle occurs at a plant, factory, or other place which is located in the United States and operating under a collective bargaining agreement negotiated by an employee organization.

Effective Date: Jan 1, 2022.

EVAdoption Analysis: One of the most politically-motivated changes, the Domestic Assembly requirement is intended to encourage American consumers to purchase EVs from Ford, GM, and Stellantis that are assembled in the US. Currently, these three automakers are the only manufacturers with collective bargaining agreements. Meaning the dozens of EV models from foreign-based automakers from BMW to Volvo but that are assembled in the US would not qualify for the $4,500 bonus.

In addition to the many non-US headquartered automakers affected by this requirement, no models from any of the US-based new EV automakers including Tesla, Rivian, Lucid Motors, Fisker, Canoo, and others would qualify for the $4,500 bonus. Additionally, a handful of EVs from Ford (Mustang Mach-E, possibly future models such as the Ford Explorer BEV, Ford Nautilus BEV, Lincoln Aviator BEV) and Stellantis (Chrysler Pacific Hybrid – PHEV) are currently or in the future may be assembled in Mexico and Canada.

Looking at currently available EVs and those expected to be available in the US by the end of 2022, there are likely only eight EVs that would qualify for the $4,500 bonus credit amount. And if the Cadillac LYRIQ is classified as a station wagon, it would fall under the “Other” category and not qualify for any tax credit, unless Cadillac reduced its base MSRP to something like $54,999.

BEVs:

- Bolt EV

- Bolt EUV

- F-150 Lightning

- Cadillac LYRIQ

PHEVs:

- Escape PHEV

- Lincoln Corsair Grand Touring

- Jeep Wrangler 4xe

- Jeep Grand Cherokee PHEV

Notes: The Ford E-Transit would also qualify for the $4,500 bonus, but we typically don’t include it in our tables as it is generally considered as a commercial vehicle and in a separate category. Only the 4 BEVs listed above would qualify for the maximum tax credit of $12,500. I did not include the GMC Hummer EV as the base Hummer EV2 version priced at $79,995 won’t be out until 2024.

If Congress wants to increase competitiveness of America and have more electric vehicles assembled in the US, then the automakers should be incentivized through corporate tax breaks, job incentives, factory incentives, and other means to encourage both foreign and domestic automakers to build EV factories in the US. But by putting the decision into the hands of consumers means that a new car buyer may feel compelled to purchase an EV that is not their first choice, simply because the workers assembling the vehicle are part of a union.

If the goal is to ensure good paying jobs for US factory workers, then simply establish a minimum wage and benefits requirement for an EV model to qualify for a bonus tax credit amount.

11. $500 Credit for US-Manufactured Battery Cells

Because the tax credit amount is only $500, the “Domestic Content Qualifications” provision is getting very little attention and has not sparked any controversy. To qualify for the bonus $500, an EV must be powered by battery cells made in the US.

‘‘(2) DOMESTIC CONTENT QUALIFICATIONS.— The term ‘domestic content qualifications’ means, with respect to any model of a new qualified plug-in electric vehicle, that vehicles of that model are powered by battery cells which are manufactured in the United States as certified by the manufacturer at such time and in such form and manner as the Secretary may prescribe.

Effective Date: Jan 1, 2022.

EVAdoption Analysis: Currently, a significant percentage of EV battery cells are made outside the US in China, Japan, and South Korea. But Tesla produces all of its battery cells used in models for North America in the US with its joint-venture partner Panasonic. And GM will increasingly produce its battery cells in two joint-venture plants with LG Energy Solution, located in Lordstown, Ohio and Springhill, Tennessee.

In the next few years, US battery cell production is expected, including:

- Ford/SK Innovation

- Stellantis/LG Energy Solution

- Toyota

- Rivian/Samsung SGI

- Volkswagen/SK Innovation

As a result of the investment in the above battery cell plants, a large number of EVs produced after 2023/2024 will qualify for the $500 bonus.

12. US Final Assembly Requirement in 2027

Another controversial proposed change would eliminate qualification for ANY tax credit if an EV was not assembled in the US. “Final assembly” in this case does not include the “Domestic Content” requirement of being assembled in a factory with a collective bargaining agreement (union). EVs assembled in a foreign country — whether Canada, Mexico, Japan, Germany, South Korea or elsewhere — would not be eligible for any level of tax credit. However, EVs assembled in the US but not in a union factory, would still be eligible for the tax credit, but not the $4,500 bonus amount covered in the previous provision.

Effective Date: Jan 1, 2027.

EVAdoption Analysis: While increasing manufacturing jobs and American competitiveness is of course an important goal, the question is what is the best role and approach to achieve this goal. Any approach that provides a few companies an advantage needs to balance that with the larger goal of reducing green house gases through significantly increasing sales of electric vehicles.

Foreign-headquartered automakers including BMW, Hyundai/Kia/Genesis, Mercedes-Benz, Volvo, Polestar, and Volkswagen have announced plans to expand manufacturing of EVs in the US in the next few years. A few examples include:

- Volkswagen will begin producing its ID.4 BEV in Tennessee in mid-2022

- Hyundai will produce the GV70 EV in Montgomery, AL beginning in 2022

- Polestar 3 SUV will be manufactured in Ridgeville, SC starting in 2022

- Mercedes-Benz will produce the EQE and EQS SUVs in Vance, AL in 2022

If this provision is passed as is currently written, it will affect not just the non-US automakers who import EVs into the US, but also Ford and Stellantis which currently produce EVs in Mexico and Canada. Would Ford for example, which currently produces the Mustang Mach-E in the Cuautitlán Assembly plant in Cuautitlán Izcalli, Mexico factory, eventually shift production to the US?

Hyundai and Kia will invest in growing its EV manufacturing footprint to scale production and satisfy U.S. market demands. Hyundai Motor will offer a suite of American-made electric vehicles to U.S. consumers starting next year.

Hyundai and Kia will monitor the market conditions and U.S. government EV policy to finalize its plan to enhance its U.S. production facilities and gradually expand its local EV production.

Source: Hyundai press release — May 13, 2021

But as strongly hinted at from the Hyundai press release quoted above, it is clear that many domestic and foreign automakers will increasingly build EVs in US factories. But should EVs, which are supposed to help America reduce GHGs from the transportation sector, that aren’t assembled in the US be at a potential $12,500 disadvantage relative to similar EVs assembled in the US?

A group of 25 ambassadors to Washington wrote U.S. lawmakers and the Biden administration late Friday saying “limiting eligibility for the credit to vehicles based on their U.S. domestic assembly and local content is inconsistent with U.S. commitments made under WTO multilateral agreements.”

Reuters — October 30, 2021

With representatives from the European Union, Germany, Canada, Japan, Mexico, France, South Korea, Italy and other countries protesting the US-assembly requirement and that it “violates international trade rules,” this provision may be at the top of the list to be revised or eliminated by members of the Senate. If passed, it could also spark a trade war with foreign countries imposing significant import taxes on EVs imported from the US into their country.

The US should clearly use various policies and tax treatments to encourage automakers to produce EVs n the US, but complete elimination of the EV tax credit for foreign-assembled EVs is ultimately unfair to both consumers and automakers.

13. Expiration of EV Tax Credits

Unlike the current tax credit which phases out over several quarters once a manufacturer sells 200,000 EVs in the US, the revised version will end abruptly on December 31, 2031.

Effective Date: Dec. 31, 2031.

EVAdoption Analysis: Eliminating the manufacturer-based cap and phaseout is one of the most overdue changes to the current structure of the tax credit. However, an arbitrary date of December 31, 2031 is also not the right answer as there are no checks and balances to address how the cost differential of EVs versus ICE vehicles will decline over the next decade.

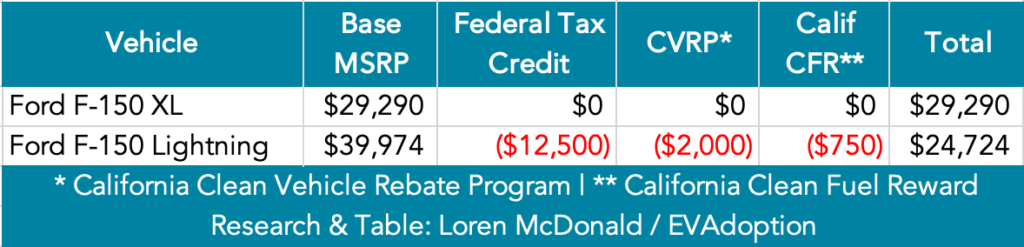

One simple example is the starting MSRPs for the Ford F-150:

- F-150 XL: $29,290

- F-150 Lightning: $39,974

Since the tax credit is based on base MSRP, this is a valid comparison as the cost differential between the ICE and BEV versions of the F-150 is $10,684. The Ford F-150 Lightning will actually qualify for the maximum $12,500 tax credit making the base version of the Lightning $1,864 less than the base XL version in 2022. Add in state and utility incentives and the Lightning could cost $3,000-$6,000 less than the XL version.

As consumer demand for EVs increases, automakers significantly increase production volume, and the cost of batteries decline each year, the price differential between electric vehicles and ICE vehicles will decline and head toward zero. A smarter and better use of taxpayer dollars would be to build in reductions in the tax credit amounts, perhaps ending at zero on January 1, 2032.

How Many EVs Will Qualify for the Maximum $12,500 Tax Credit?

Prior to January 1, 2027 all but a few BEVs will qualify for $7,500 in tax credits from the base amount of $4,000 and $3,500 for a battery of at least 40 kWh (and then 50 kWh in 2027). Where the separation takes place is with the two US-made provisions: US assembly in a union factory ($4,500) and US-made battery cells ($500).

While a growing number of EVs from both foreign-based legacy automakers and new startups will be assembled in the US, none of them today and likely in the near future will employ workers with union representation. And while battery packs are increasingly also assembled in the US, a large percentage use cells made in South Korea, Japan, and China and so many EVs will not qualify for the $500 battery cell bonus credit.

So, of the current, future known and expected EVs to be available in the US by around 2025, perhaps only about 15-20 EVs will qualify for the maximum $12,500 tax credit in 2027. They might include:

- Ford F-150 Lightning

- Ford Explorer BEV

- Cadillac LYRIQ

- Chevrolet Silverado E

- Ram 1500 E

- Jeep Wrangler Magneto

- Jeep Grand Cherokee BEV

- Dodge Challenger BEV

- Chevrolet Camaro BEV

- Chevrolet Crossover BEV (model name unknown)

- Buick Crossover BEV (model name unknown)

- Chevrolet Equinox BEV

- Chevrolet Blazer BEV

In the coming days and weeks I hope to share more detail in articles and presentations – to explain what the proposed changes mean, how they will affect individual models, and address common questions or confusing aspects to the bill.

Related Articles on the Federal EV Tax Credit

- Proposed Changes to Federal EV Tax Credit – Part 5: Making the Credit Refundable

- Proposed Changes to Federal EV Tax Credit – Part 3: MSRP Must Be Less Than $80,000

- Proposed Changes to Federal EV Tax Credit – Part 2: End of the Manufacturer Sales Phaseout

- Fixing the Federal EV Tax Credit Flaws: Redesigning the Vehicle Credit Formula

- Overview of Biden Administration Plans to Help Increase EV Adoption in the US

- Why Only 3 Auto Manufacturer’s EV Sales Data Is Being Reported Publicly By the IRS

- Huge Flaws in Federal EV Tax Credit Will Hurt US Automakers Beginning in 2020

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →

2 Responses

I’m in line for a 2023 Lightning. I understand that the current credit may phase out over time once Ford reaches 200k sales. I don’t understand how the current credit will work on a vehicle like the lightning when there is such a lag between reservation to order to delivery/pay. At what point do you lock in the credit?

I.e. if the $7,500 credit expires in Sept ’22, and I’m able to order the lightning in July of ’22, but I don’t take delivery until December, will I still qualify for the $7,500 or would I get the half credit?

thanks!