Yet another survey and report was released that focuses on the hurdles to mass adoption of electric vehicles.

Yawn. No offense to the folks at Castrol, yes the oil and lubricants company owned by BP, their report was well intentioned, and a high-quality effort – but it didn’t cover any new ground nor really reveal anything we didn’t already know.

And most importantly, it is just another survey and report that sends a message to consumers, fleet buyers and OEMs to just sit back and wait for the perfect storm of range + price + quick charging + charging infrastructure + more models. It ignores that there is a very large market right now if consumers were more knowledgeable about electric vehicles.

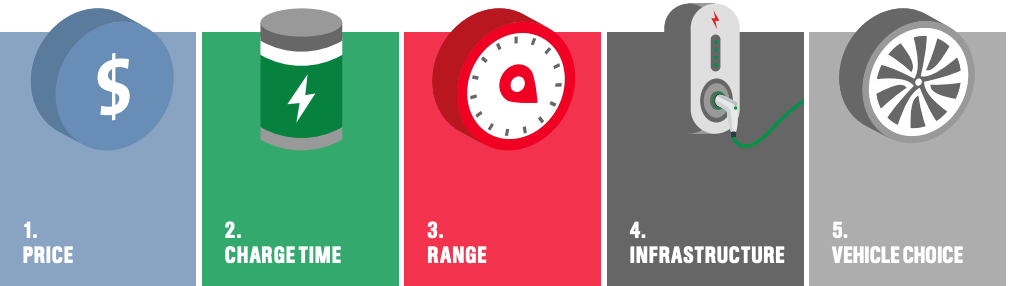

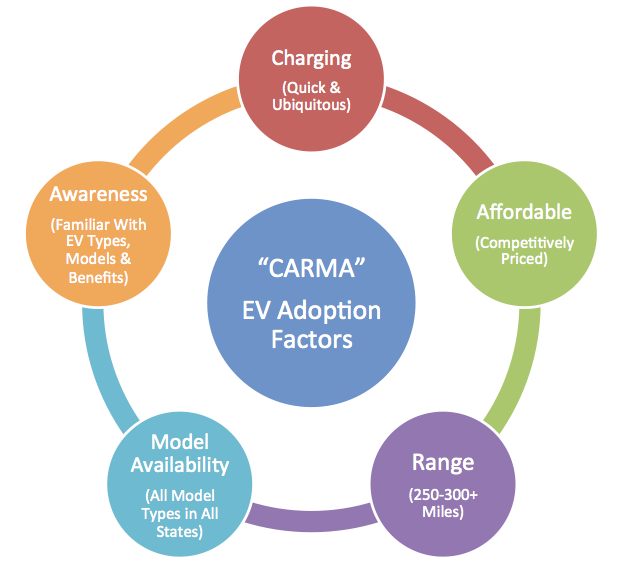

I don’t disagree that these hurdles outlined in the Castrol report are real. In fact, in my first blog post for this site in January 2017, I developed a framework called CARMA (see image below), that closely aligns with the EV adoption hurdles outlined in the Castrol report. But what this report and most of those before it didn’t address was the lack of consumer understanding and awareness of electric vehicles.

These surveys on EV adoption are focused on expectations that consumers have based on their experiences with vehicles powered by an internal combustion engine (ICE). But anyone who owns and drives an EV recognizes there are several differences between the two types of vehicles – especially the “fuel” (electricity) and “refueling” process (charging).

A Different Type of EV Survey

What I’d like to see is a survey that reveals that there is a huge market of US households for whom an EV can work just fine today. We have to grow the early-adopter market before we can ever get to the mass market – and yet we’ve barely scratched the surface on marketing EVs to the early-adopter market.

The current US EV sales share likely sits somewhere between 2%-3% (EV sales numbers are not currently available publicly), while California is at 7.8% for the first half of 2020 according to the CNCDA. Whereas the average across EU countries in 2020 through July is 8%, and many countries such as Norway (now at roughly 60%), The Netherlands, Sweden, France are either well above 10% or have hit that mark for different months in 2020.

The point is that in many markets, 1 out of 10 vehicle purchases are of either a BEV or PHEV and there is no reason we shouldn’t be seeing close to that level in the US (except for a lack of supply of course). There is a very large market of potential EV buyers TODAY in the US, we don’t need to wait for EVs to hit all of the key thresholds to grow the current market.

A different type of survey can help reveal that there is a huge market of US households for whom an EV can work just fine today. We have to grow the early adopter market before we can ever get to the mass market – and yet we’ve barely scratched the surface on marketing EVs to the early adopter market. We need a different type of survey that uncovers this current untapped EV market and reveals in what areas are there the most misunderstandings and lack of knowledge and awareness.

Most of the current surveys focus on the ideal perfect electric vehicle scenario that makes EVs acceptable to everyone. But we are likely well more than 10 years from that point. Instead of questions that focus on the perceived shortcomings of electric vehicles, how about a survey that reveals who might be an ideal candidate to purchase or lease an EV today?

Sample Survey Questions

Such a survey could ask questions similar to the following (these are just examples):

Current Vehicles

- How many vehicles are in your household?

- 0

- 1

- 2

- 3 or more

- Do you typically buy/lease new or used vehicles?

- New

- Used

- Both type

- Do you typically buy or lease your vehicles:

- Buy (cash or loan)

- Lease

- It depends

- How much did you pay for your last vehicle?

- Use ranges

- How many years do you typically keep your vehicles for?

- 1-2

- 3-4

- 5-6

- 7-10

- 11+

Driving distance and EV range

- What is the average daily trip length in miles for each of your vehicles?

- Open ended or a range

- How many miles do you drive each vehicle on an average week?

- Open ended or a range

- On average, how many trips do you take each year of the following distance (one way) in miles:

- 100-249

- 250-499

- 500+

- What do you think the average range is for fully electric vehicles currently available in the US?

- Under 100 miles

- 100-149 miles

- 150-199 miles

- 200-249 miles

- 250-300 miles

- Above 300 miles

Available EV incentives

- Including Federal, state and utility incentives, the lower cost of “fuel” (electricity), and lower maintenance costs, many electric vehicles actually have total ownership cost that is about the same, less or only slightly more than a comparable gas or diesel-powered vehicle. Under which of the following scenarios would you likely consider purchasing an electric vehicle (ignoring any range or charging concerns)?

- Total cost of ownership is roughly the same as a comparable gas/diesel-powered vehicle

- Total cost of ownership is at least a few thousand dollars less than a comparable gas/diesel-powered vehicle

- Total cost of ownership is within a few thousand dollars more than a comparable gas/diesel-powered vehicle

- Total cost of ownership does not matter, electric vehicle must be roughly the same cost not including incentives and lower maintenance costs

- Were you aware that electric vehicles are eligible for a credit on your federal income tax return for up to $7,500 based on the model and its eligibility?

- Yes

- No

- Were you aware that many states and utilities offer rebates on the purchase of new electric vehicles from $500 to as much as $5,000?

- Yes

- No

Fuel costs and charging

- How much per month do you typically spend on gas or diesel for your primary and secondary vehicles?

- Open field or ranges

- Do you have access to an electrical outlet to plug-in an electric vehicle where you live?

- Yes

- No

- Unsure

- What percent of charging an electric vehicle do you think is typically done at home and overnight for homeowners and other EV owners with convenient access to an electrical outlet?

- 0-24% of the time

- 25% to 49% of the time

- 50% to 74% of the time

- 75% to 100% of the time

- How much do you think it would typically cost to “refuel” an electric car that drove the same number of miles that you currently drive in your gas or diesel vehicle?

- About the same

- A little more

- About twice as much

- Slightly less

- About half as much

Maintenance

- How much do you typically spend per year on service, parts and maintenance of your primary gas/diesel-powered vehicle?

- Open field or ranges

- Were you aware that electric vehicles can require little to no maintenance except for tires, brakes and wiper blades?

- Yes

- No

I could go on, but hopefully you get the idea of the types of questions that could be asked in a survey that helps uncover the current market for electric vehicles, not just the mass market many years in the future. If your company would be potentially interested in sponsoring a survey like what I’ve outlined above, please reach out to me.

2 Responses

We recently completed a survey of the type you are recommending in Colorado. I can share that the charging issue is nuanced, and we are failing in our collective messaging, and it greatly hurts our success.

Take a look at some of my LinkedIn posts.

Bill LeBlanc, Chief Instigation Agent, E Source

Bill – thanks for the comment – I will check out your LI posts.