The media and Tesla shorts and haters love to tout every new BEV that comes to market as the latest “Tesla Killer.” That moniker usually has little basis in reality, but is simply used to attract media eyeballs and haters and shorts use it to rally the bearish story on Tesla.

Headline writers will often compare any new electric vehicle to those from Tesla and use the “killer” world to drive increased readership and eyeballs. And because these headline writers actually are not experts on the trends in electric vehicles, “Tesla Killer” is the easy route to take.

But actually reading many of these articles you discover that the tone is often much more balanced, and the new EV in question isn’t actually pegged to “kill” Tesla. Rather it is typically suggested that these new EVs could be strong competition for Tesla and hurt sales. In other words there is usually a disconnect from what a reporter actually wrote and what the headline writer decided to run with.

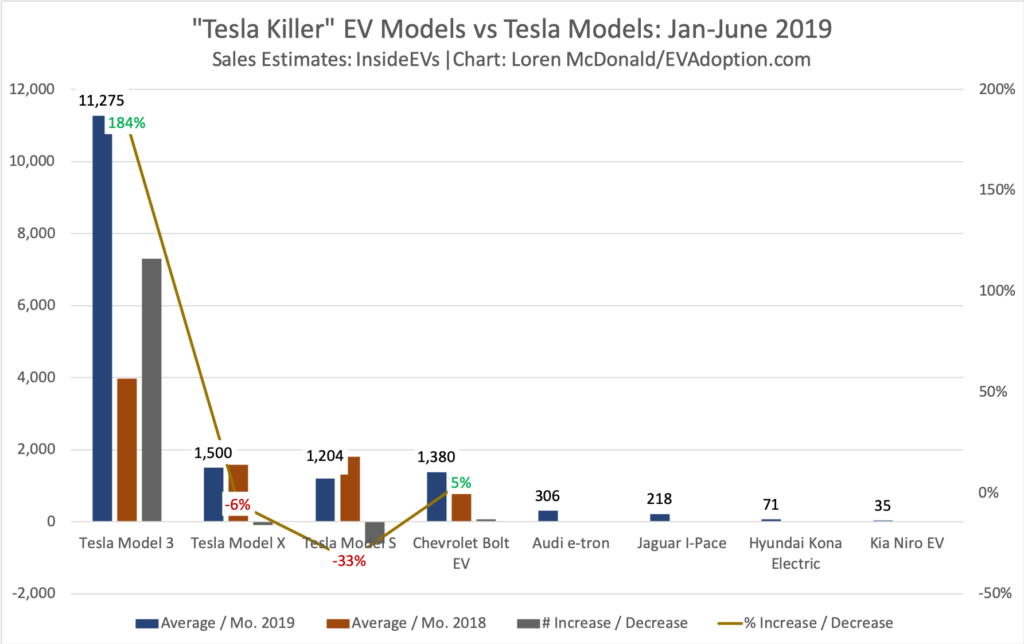

To date, and at least in the US, there is little evidence that any of the “Tesla Killer” EVs are actually having a significant impact on sales of Tesla models.

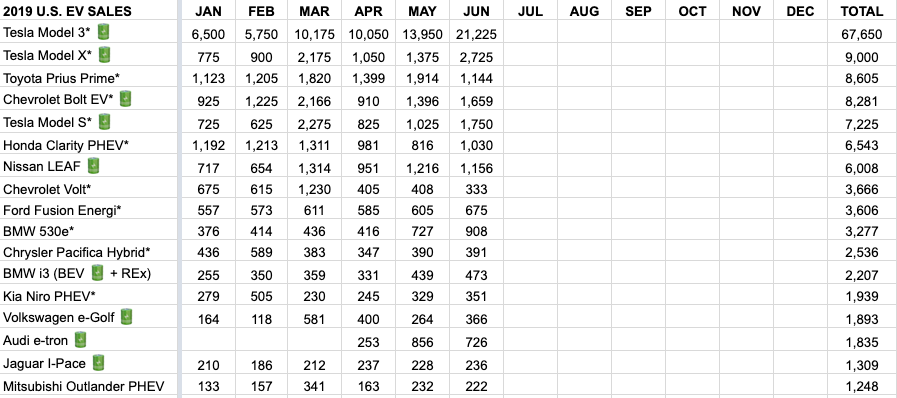

The EV models available in the US and that have received the “Tesla Killer” badge to date include the Chevrolet Bolt, Jaguar I-Pace, Audi e-tron, Hyundai Kona Electric, and Kia Niro EV. But except for the Bolt and I-Pace, it is realistically too early to confidently judge these models sales and impact on Tesla and other brands’ EVs.

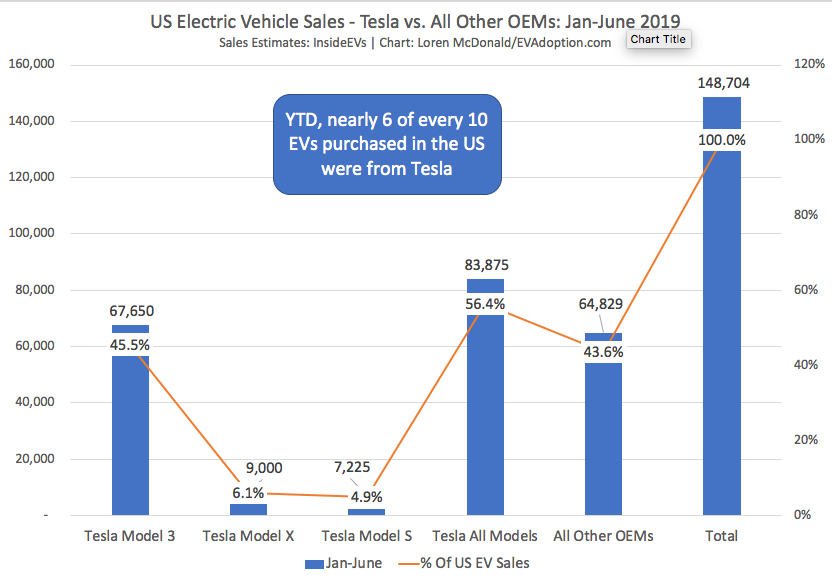

That said, none of them certainly are deserving of a “Tesla Killer” crown and it is dubious that any of them have had any significant impact on sales of Tesla models. Clearly none are affecting Model 3 sales, which for January through June of 2019 has accounted for an estimated 45.5% of all EVs sold in the US.

For the Model X, for which sales are basically flat YOY, it is pure conjecture but the Audi e-tron and Jaguar I-Pace may be grabbing a combined maximum of a few hundred sales per month that would have gone to the large Tesla SUV/CUV. While the Tesla Model X has these two luxury SUV/CUVs beat in range, technology, access to fast chargers, and performance – a certain segment of buyers may place stability, brand familiarity/loyalty, customer service, and quality over the attributes where Tesla excels.

Negative sales impact on the Model S sedan from any of these models is likely minimal. Rather the YOY decline of 33% is probably almost entirely from consumers opting instead for the smaller, but lower-priced sister sedan, the Model 3.

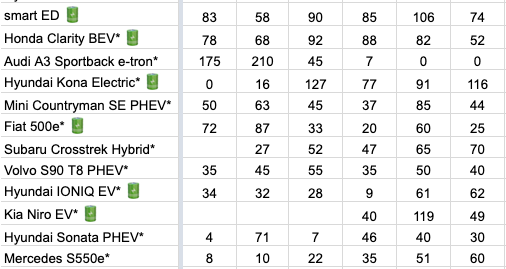

Audi e-tron Outselling Much Cheaper Hyundai and Kia BEVs

The Hyundai Kona Electric and Kia Niro EV are both averaging sales of less than 100 units per month in the US. Granted, the Kona has only been available for 5 months and the Niro for 3 months, but the much more expensive Audi e-tron is averaging 306 units per month after only 3 months and nearly 800 units for May and June.

How can the Audi e-tron, which basically costs twice as much as the Kona and Niro, be selling at about 7 times the number of units? Again, it is really too early to draw significant conclusions but assuming the current trends continue for awhile, the most obvious reasons include:

- Tesla is competition for Audi: Tesla has been carving into sales of luxury brands such as BMW, Audi and Mercedes-Benz and hence Audi and its dealers recognize that they need to get onboard the EV train and be serious about competing and selling EVs. For Hyundai and Kia, their focus remains affordable ICE vehicles so there is little urgency to build and push their EV offerings.

- Lack of Battery Supply: Both Hyundai and Kia have been battery and overall supply-constrained to date for their EVs and it doesn’t appear the situation will be rectified anytime soon. What is unclear is why the South Korean companies didn’t plan adequately to meet the volume of demand worldwide for these two highly praised EVs? On the other hand, Audi and parent Volkswagen, at least so far, seem to have planned adequately to meet demand.

- Buyer Demographics: In most markets and especially the US, electric vehicles are still in the innovator and early adopter phase meaning that the buyers are mostly upper income, tech savvy, green symbolism/status-seeking types, known as “conspicuous conservation.” But Kia/Hyundai buyers tend to be more practical, valuing value and cost above status and performance. As such, Kia/Hyundai buyers will typically not be the same buyers who would also consider a Tesla, let alone paying much more for a BEV.

Jaguar I-Pace Sales Disappoint in the US

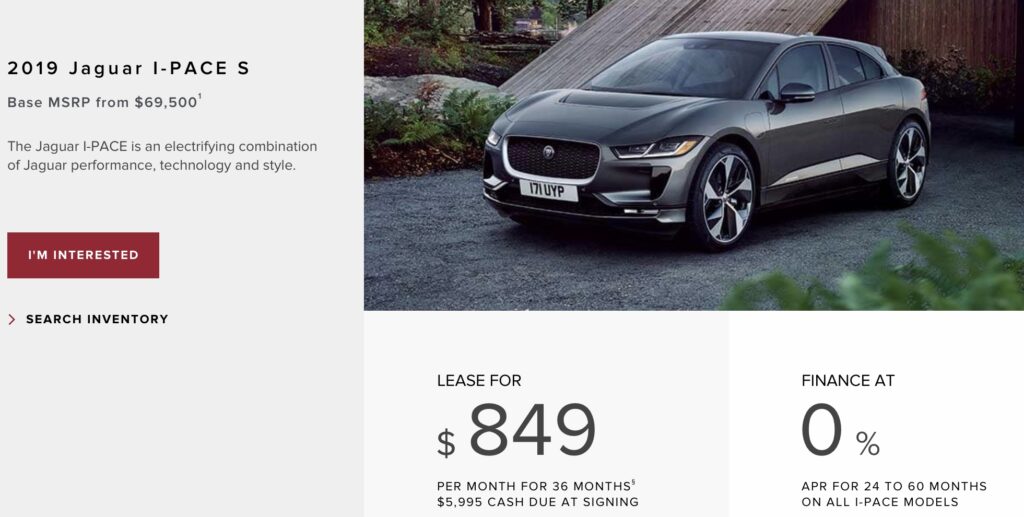

Jaguar launched its fully electric I-Pace in October of 2018 and in 2019 through June, the award-winning BEV has averaged 218 sales per month in the US. The more expensive Audi e-tron, which also has a lower EPA range of only 204 miles versus the 234 of the I-Pace, has averaged sales of nearly 800 in May and June.

Why is the I-Pace selling so many fewer units than the Tesla Model X and at least so far, the Audi e-tron? While it is unclear if sales of the e-tron will continue at their current level or even increase, but it has already sold more units in 3 months than the I-Pace has in 9 months.

Four possible reasons come to mind:

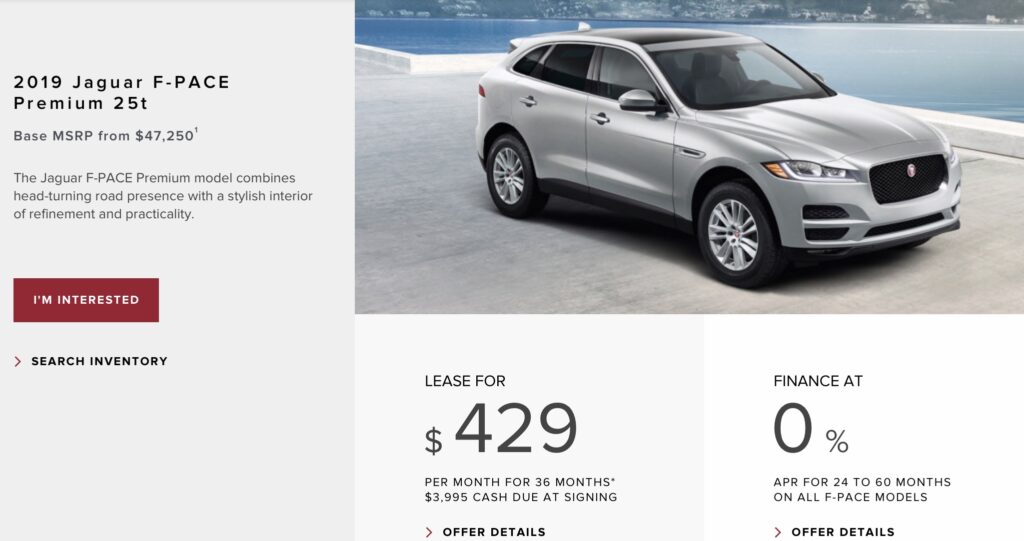

- Price Differential With the F-Pace: If you have your heart set on an SUV or CUV from Jaguar, the monthly lease payment for the I-Pace is almost double that of the F-Pace ICE model. The ~$400 a month higher lease payment is a pretty significant price differential that would be hard to justify for most buyers.

- Jaguar’s Older Buyer Demographic: While the data is fairly old, in 2014 Jaguar had one of the oldest buyer demographics at 56.6 year of age. More recent data from CarMax, that did not include Jaguar, pegged the average age of Audi buyers at 40.7 years. While the data is not really comparable, it is widely known that Jaguar attracts a much older, and less tech savvy and less early-adopter type buyer than Audi. With EVs in essence being a new technology product, Jaguar’s older buyer demographic may not be the best fit at this stage of the EV market.

- Lack of Dedicated Charging Network: Tesla has its Supercharger and Destination Charger networks and while not exclusive to Volkswagen-owned brands, the Electrify America subsidiary of VW has an added marketing benefit and comfort to Audi EV buyers.

- Confusing Branding: It is almost as if Jaguar intentionally wanted to confuse buyers with their SUV/CUV model names. Most buyers would probably assume that a model with “E” in the name as in the E-Pace, is likely electric. But no, Jaguar went with an “I” for its electric CUV and also uses “F” for its full-size ICE SUV. And all 3 use the same X-Pace branding which further adds to the confusion because the I-Pace does not have its own unique EV branding. Early adopter EV buyers want to be recognized as driving an EV, and Jaguar simply failed to understand this simple fact of behavioral economics.

There don’t seem to be any “Tesla Killer” models on the near-term horizon, but the following future EVs (see SlideShare above) could provide some decent competition for specific Tesla models, but also might just expand the size of the EV market:

- Model X: Mercedes-Benz EQC SUV, Volvo XC40 Electric, Rivian RS-1, Ford Unnamed BEV CUV, and BMW iX3.

- Model S: Porsche Taycan, Polestar 2, Audi e-tron Sportsback, Aston Martin RapidE Electric.

- Model 3: Volkswagen I.D. Crozz, Ford Unnamed CUV, Tesla Model Y.

The reality is Tesla is its own biggest competitor. The future Model Y is likely to crush sales of the Model 3. But since there likely won’t be any model from other OEMs with similar range, performance and access to charging – the Model Y should do just fine.

Tesla killers may or may not ever arrive, but the better question is: When will electric models provide serious competition to Tesla?

4 Responses

Good article. Two comments:

1. When comparing the Audi e-tron and Jaguar I-PACE, realize that the former is, or was before dieselgate, the largest automaker in the world and the latter is much smaller and thus, cannot absorb as much of the cost of R&D, but must instead pass it along, as evidenced by the large price increase versus the F-PACE.

2. At 155 units projected, the Aston Martin RapidE is neither competition nor an expansion of the size of the EV market.

Thanks Mark, good calls. Yes, dieselgate has been transformational to VW. And agreed on the Aston Martin, it isn’t really competition for Tesla Model S from a volume perspective, but someone considering the high-end Performance S could opt for the RapidE instead.

I’m a Tesla owner (two weeks now) and a huge fan. But also an economist by training, and have to take issue with the way the media has understood the EV market, in part by addressing the idea that EVs have their own market. But EV isn’t function, and the market is driven by function. There is a market for 2-seaters, a market for full size SUVs, and a market for pick-up trucks and vans. EVs, at the moment, require a larger up-front cost in exchange for lower operating costs, and depending on the availability of overnight charging, some shorter term inconvenience in recharging. Based on what’s being traded in, it looks like the Model 3 competes with with sedans and small wagons ranging from the Nissan Leaf to the BMW 5 series. When the Roadster comes out, it wont compete with the Model 3 as much as it will everything for people who want to go really fast and not carry more than 1 passenger and some golf clubs….and that includes the Maclaren, but it will be priced to earn market share from the Mustang, Corvette, VW Golf GTI, Nissan 300, etc. In conclusion, the “Tesla Killers” idea that EV is its own distinct market where the competition is among other EVs is bunk. People wont buy an EV if its the wrong function for them.

Thanks for the comment Gabe! I agree and disagree. At this stage of the market with a limited number of EV model types, many consumers are buying an EV first, model type second. We got a Model S sedan even though we didn’t want a sedan, my wife wanted another SUV – but we didn’t want to spend the extra money for a Model X.

The fact that people who are trading in Prius and Honda Accords for a Tesla Model 3 shows that EVs are in fact a unique market today. People at this stage of the market are in fact first and foremost buying an EV. How many people bought a Chevrolet Bolt who said they would NEVER by a GM product or Chevrolet? A lot – they bought it because is had 238 miles of range and was in their price range.

As for EVs competing with each other – today there is a little of that – but not much with the Model 3 accounting for 50% of EV sales in the US. But this will change.