On Twitter on a recent sunny spring Sunday afternoon someone posted a photo of a Porsche Taycan and made several points about pricing and Tesla’s lack of US Federal EV tax credits. They implied that this would potentially be of significant hurt to Tesla.

I asked: “…where are you going to charge it?”

I have no stake or interest in the Tesla battles that are prevalent on social media, my focus is on trying analyze and understand through research and data, what will drive EV sales growth – especially in the US where I live.

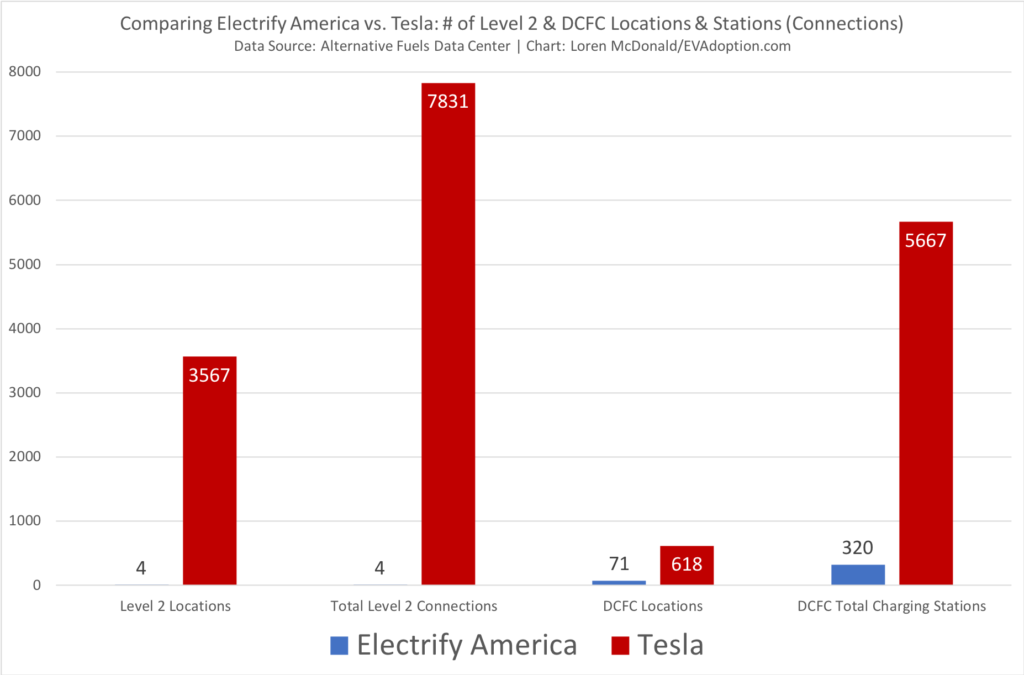

But the ‘Google “Electrify America”’ comment was the wrong thing to tweet at me as at that very moment I was diving into the latest (as of March 31, 2019) EV charging station and location data from the Alternative Fuels Data Center, to produce several charts. And so in about 15 minutes of basic Excel work, I created the chart below:

The point was not to be pro Tesla and/or anti Electrify America, as I have no skin in the game other than my wife and I being happy drivers of a Model S. But the simple point is that while Electrify America is making great progress on its network and $2 billion investment, it has a long way to go to catch up to Tesla’s network of fast chargers (not to mention Level 2 Destination Charger network). For the sake of growth of electric vehicle sales in the US, I hope that Electrify America (and all of the other charging networks) are able to add thousands of charging stations as quickly as possible.

But unless Tesla has to cut back on charging station expansion for financial belt-tightening reasons, the number of their Supercharger and Destination Charger stations will continue to increase as well – likely keeping pace with Electrify America’s expansion – and they would continue to have many more times available charging stations than the other networks.

But fundamentally, this article and question that I pose is not about Tesla versus Electrify America (and the VW brands that will access the network) – but about the role and importance of charging infrastructure to new buyers of electric vehicles.

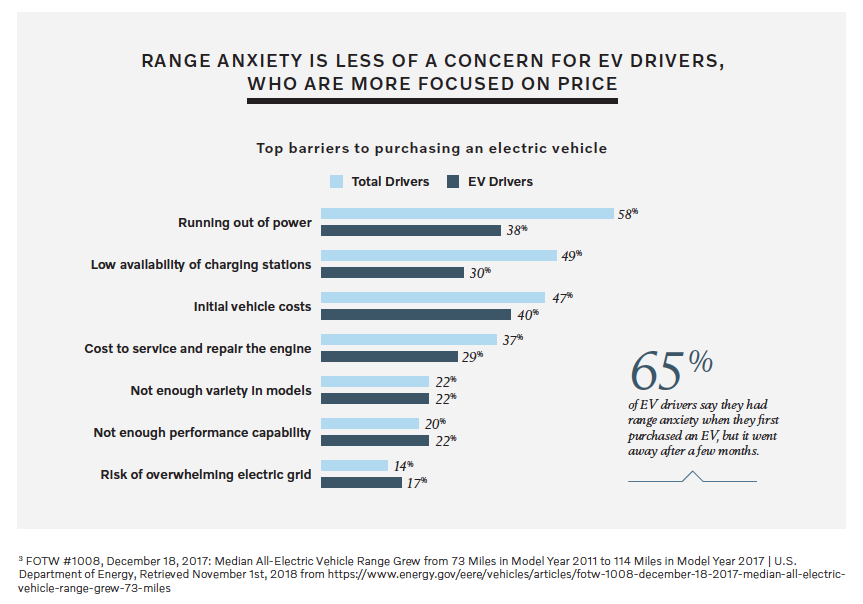

I recently wrote about research from the Volvo/Harris Poll that had similar insights to many other EV-related surveys in that range anxiety and the availability of charging stations remain key concerns for potential buyers. As battery range continues to increase, with my own analysis showing a current median of 234 miles for US BEVs, range anxiety will lessen and be replaced by an increased focus on charger availability and charging speed.

And so what this leads to is that until public EV charging infrastructure is built out and ubiquitous, automakers that wish to sell as many BEVs as possible, need to ensure that buyers have a complete and amazing customer experience with their EV – which means the charging process is part of the experience.

Tesla understood this early on and recognized that without fast charging stations (Superchargers) located along major highway routes, and Level 2 (Destination Chargers) located at resorts and hotels, that consumers would be reticent to pay $80,000 to well beyond $100,000 for a car where they would struggle to find a working Level 2 charger at the back of a hotel miles off of the interstate.

From my own personal experience the Supercharger and Destination Charger networks were key factors in our decision to buy an EV and Tesla. Before buying, I would often check the Tesla website and review the progress of the Superchargers along Interstate 5 between the Bay Area and Los Angeles. I’d see which wineries in Napa and Sonoma had destination chargers. And if we were to take a day trip to Carmel, where would we charge?

And last summer I put the Supercharger network to the test, which I wrote about in a 3-part series for CleanTechnica – Diary of an EV Road Trip: 900+ Round-Trip Miles in Our Tesla Model S 60 (Part 1), (Part 2), (Part 3). As many EV owners have articulated, would you take a 500-mile road trip today in any EV other than a Tesla? Again, this is not to tout Tesla, but simply to convey how critical charging infrastructure is to the customer experience EV owners have. It cannot be left to chance.

So am I saying that if a buyer is considering both say a Porsche Taycan and a Tesla Model S that after considering many factors – even perhaps with the Taycan beating the Model S on certain criteria, that some buyers may opt for the Tesla instead?

Possibly, but in general probably not. Porsche is a special brand and in this example, the Porsche-inclined buyer would likely still opt for the Taycan, even if there are several thousand fewer fast charging stations conveniently available.

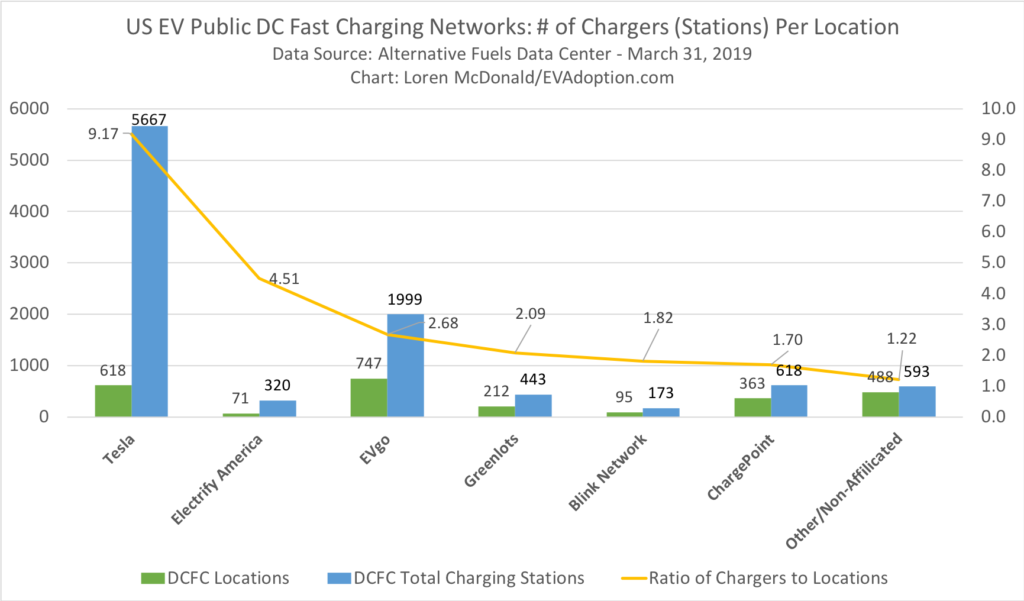

But if a buyer is considering, for example, a Hyundai Kona BEV, Chevrolet Bolt, Tesla Model 3 and a Volkswagen iCrozz – then Tesla and Volkswagen with its Electrify America relationship have distinct advantages in how they can present access to its respective convenient charging networks.

To counter this advantage I believe other automakers will need to deepen and strengthen their partnerships and relationships with networks in the US such as EVgo, ChargePoint, Blink and Greenlots. I expect to see more announcements like the recent one from GM designed to ensure a better charging experience through mobile app integrations with EVgo, Greenlots, and ChargePoint. Automakers will need to ensure that mobile apps, navigational maps, billing and other factors are as seamless as they are with the Tesla network.

In Europe of course, the IONITY charging network was formed under a joint venture of the BMW Group, Daimler AG, Ford Motor Company and the Volkswagen Group including Audi and Porsche. While Ford is somewhat of an outlier among this group, there is a clear recognition among the leadership at the German luxury brands that they have to take the lead in ensuring adequate access to fast charging and a superior complete experience for their EV customers.

Automakers will need to understand which are the most important markets where their potential EV buyers are located and consider opening co-branded charging stations dedicated to their portfolio of brands. This approach helps ensure a seamless experience and strong word-of-mouth – especially in the key early adopter customer markets.

But as charging infrastructure is built out in secondary markets the need for branded or co-branded charging stations will lessen as EVs become more mainstream. And as consumers purchase their second EV or new consumers simply become comfortable with the idea of charging – unbranded and unaffiliated charging locations similar to the gas station model will suffice, especially for the non-luxury auto makers.

What do you think? How important is it for automakers to ensure a superior charging experience for customers when they purchase a new EV?

2 Responses

Very interesting article! I have some comments/questions, would love to hear some feedback from you.

1. In Montana there’s no single Tesla Supercharger so far. In fact, their EV sales share is one of the smallest in the US as well. Do you really think that after getting new Tesla charger stations EV shares in this state will significantly rise and why? I’m not from the States, so I’m not able to make my own assumption without knowing any local context, but it seems that consumers behavior is more…”conservative” there…I guess. Louisiana, for example, having some number of Tesla Superchargers still has relatively low EV share. It would be great if you could explain it.

2. It was really interesting to see the dynamics of the U.S. EV market stimulation – from “initial cost” being the first barrier for a final decision to the “infrastructure”…However, It seems like the US and Norway are the only countries in the world who succeeded so much so far. So even though the IONITY charging network is developing, it seems like in Europe charging network development is not a #1 barrier for the final buying decision. It is getting more obvious if you come more to the East. I’m saying that as a citizen of almost the only European country not being in Tesla Supercharger development plan (Belarus, but Moldova is also not there – don’t think that I’ll see nice Tesla Supercharger in this countries for next 10 years).

Thanks a lot for the article!

Tim, Thanks for the comment and questions. So I touch on this in my latest post – https://evadoption.com/what-is-the-ideal-ratio-of-evs-to-charging-stations/ – but as you can see from this table – https://evadoption.com/ev-charging-stations-statistics/charging-stations-by-state/ – many states with very low levels of EV sales have a relative large number (ratio) of charging stations in comparison to high adoption states. Which clearly points to that while we are in the early adopter stage for EVs, access to charging stations is a secondary concern.

Current EV buyers are much more likely to live in a single family home and have access to charging at their house, perhaps take few long trips per year or have an ICE vehicle as back up for longer trips. Montana is a heavy pickup truck state, has very cold weather in the winter and has mostly rural and not urban. Any state like that is not going to buy EVs in any significant level until electric pickups are mainstream and affordable. We are 7-10 years from that point.