When Congress comes back in September from its August recess, members will be faced with legislation that needs to be finalized and then voted on, including the Clean Energy Act for America (CEAA). A key component of the CEAA is nine proposed changes to the Plug-In Electric Drive Vehicle Credit (IRC 30D) — more commonly known as the “federal EV tax credit.”

I’ve written extensively on the tax credit and especially its many flaws, ineffectiveness, and areas in the regulations that desperately need fixing. But while the proposed changes from the CEAA will fix some of the biggest flaws (e.g., manufacturer phaseout), the proposed revisions also skip over a foundational weak link (the underlying credit formula), and introduce new rules (e.g., elimination of the credit for non-US assembled EVs) that may prove popular in some political corners, but may or may not lead to more sales of electric vehicles.

I initially planned to write a single article about the changes, but after drafting just the first section on the eliminiation of the manufacturer phaseout, I decided to turn it into a multi-part series. This first article then will provide a brief overview of the key changes, followed by in-depth articles covering each noteworthy proposed change.

Overview of the Changes

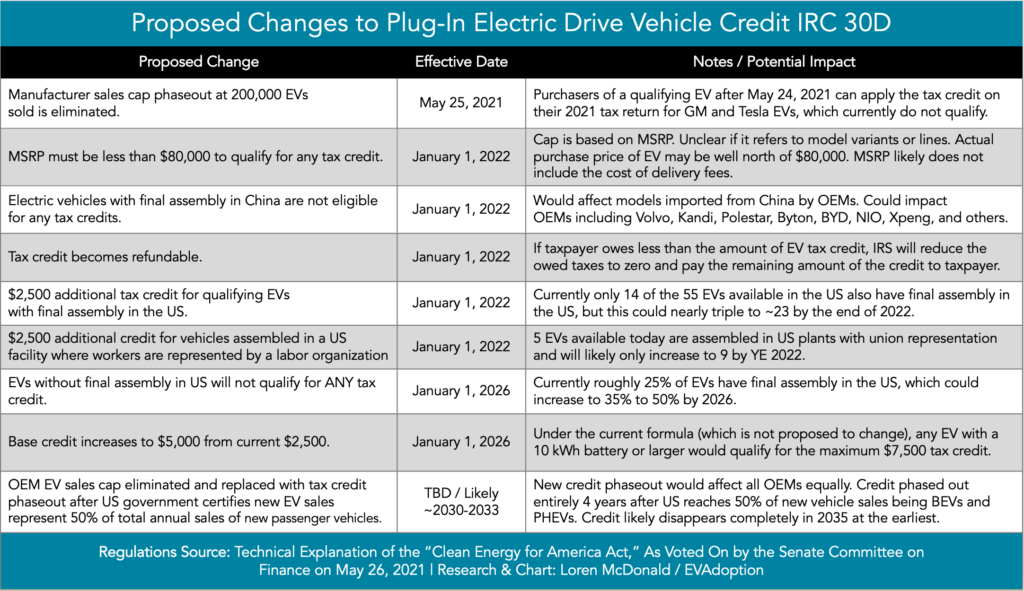

Below is a handy summary table followed by brief descriptions of the key proposed changes that will covered in more depth in upcoming articles:

- The manufacturer sales cap phaseout at 200,000 EVs sold is eliminated — effective May 24, 2021/upon passing of legislation: This would make the tax credit available again to buyers of EVs from Tesla and GM. And the OEM phaseout is retroactive to May 24, 2021 so buyers of Tesla and GM EVs purchased after May 24, 2021 could apply the credit on their 2021 tax return. It is unclear how Tesla and GM will address this retroactive credit availability for leased EVs.

- MSRP must be less than $80,000 to qualify for the tax credit — effective January 1, 2022: Details are unclear, but this may mean if the base vehicle of a model line is less than $80,000 (presumably not including delivery fees), that any higher-priced version of the vehicle would also qualify.

- Chinese-made vehicles are not eligible for any tax credits effective January 1, 2022: This not only affects future China-based brands such as Nio, BYD, Xpeng, and others, but also potentially OEMs such as Volvo, Polestar, BMW, and many others which currently produce EVs in China and export them to other countries.

- Tax credit becomes refundable — effective January 1, 2022: This is a significant change as the IRS will send you a check for the difference of the qualifying tax credit for the EV you purchase and your federal tax liability. In essence, the difference becomes a tax refund instead of credit.

- $2,500 additional tax credit for qualifying EVs with final assembly in the US — effective January 1, 2022: This rule is clearly intended to incentivize both US and non-US OEMs to assemble their EVs in the US. While foreign-based OEMs will be affected the most, US automakers will also lose out on the credit in some cases as the Ford Mustang Mach-E is currently produced in Mexico and the Chrysler Pacific Hybrid (PHEV) is assembled in Canada.

- $2,500 additional credit for vehicles assembled in a US facility where workers are represented by a labor organization — effective January 1, 2022: This is clearly a political move from the Democrats to appeal to their base and show support for America’s labor unions. This provision of the CEAA is one that could be removed or revised. If it remains, it clearly provides an advantage to Ford, GM and Stellantis — the only current automakers with union workers.

- EVs without final assembly in US will not qualify for ANY tax credit — effective January 1, 2026: One of the most political and protectionist changes would eliminate any tax credit for EVs that did not have final assembly in the US. This rule change could be hotly debated in Congress as it in essence shifts the focus from selling more EVs to reduce GHGs, to creating more factory jobs for US workers.

- Base credit increases to $5,000 from current $2,500 – effective January 1, 2026: This change is perhaps the most ill informed of all proposed changes. The way the formula works that determines the actual amount of the tax credit for a specific EV, increasing the base credit to $5,000 means that every qualifying EV (then under the $80,000 MSRP cap) with a 10 kWh or larger battery would qualify for the maximum $7,500 credit. Currently only 7 EVs (all PHEVs) have a battery less than 10 kWh and 6 of them are 9 kWh battery and all will certainly be increased to 10 kWh or larger batteries by 2026, or be discontinued.

- OEM vehicle cap eliminated and replaced with credit phaseout after US government certifies new EV sales represent 50% of total annual sales of new passenger vehicles: The phaseout rule is similar in structure to the current manufacturer phaseout, except it applies to the entire industry. By the end of 2021 the EV share of new passenger vehicle sales should reach 4% and could approach ~40% by 2030 depending on dozens of factors. If the US reached 50% EV sales share in say 2032, then the tax credit would completely phase out in 2036.

There is one other change to IRC 30D, but since it is more of an administrative change that won’t affect EV sales, I’ve not included it in the list of proposed changes. This change is listed as “Additional reporting and math error authority.” The provision requires that upon sale or lease of a new qualified plug-in electric drive motor vehicle the seller report the following information to the purchaser and IRS:

(1) purchaser’s name and taxpayer identification number;

(2) VIN of the qualified vehicle;

(3) battery capacity of the vehicle;

(4) verification that original use of the vehicle commences with the purchaser; and

(5) maximum credit purchaser is eligible to claim based on vehicle qualifications.

What’s Next?

According to tax and accounting firm KPMG, because the both the Senate and Finance Committee are equally divided between Democrats and Republicans, the CEAA may result in a tie vote and trigger a “power sharing agreement,” which generally provides that:

- The chairman of the committee (in this case, Senator Wyden) transmits a notice of the tie vote to the Secretary of the Senate.

- Either the majority leader or the minority leader may, after consultation with the chairman and ranking member of the committee, make a motion to discharge the measure to the Senate floor, with time for debate on such motion to be limited to four hours, to be equally divided between the two leaders or their designees, with no other motions, points of order or amendments in order.

In part 2 of this series: Proposed Changes to Federal EV Tax Credit – Part 2: End of the Manufacturer Sales Phaseout – we dive into the details of the potential impact from eliminating the 200,000 EVs sold threshold.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →

12 Responses

I purchased new 2021 Bolt this past April. If the billed becomes law will I receive a tax credit up to $7,500 ?

Dan, in the latest version of the proposed changes from the House Democrats, it doesn’t look like it will be retroactive. The previous proposal was retroactive to May 25, 2021 – so you would have missed out regardless.

Loren, to receive the EV tax credit, do we need hold off the purchase until January 1st, 2022?

Thanks

Ming, the answer is it depends on which vehicle you are considering. The Federal EV tax credit is currently available for all qualifying EVs except those from Tesla and General Motors. The reached the 200,000 sales cp by manufacturer a few years ago. This cap is the least controversial proposed change to the current federal EV tax credit. So if you are interested in an EV from either Tesla or GM – then yes, you may want to wait until at least January.

Because we don’t yet know what changes to the credit will be included in the final legislation that is passed, you may or may not want to put off your purchase. In some cases it is also possible that addition tax credit amounts may not take effect until 2022.

Great article Loren —

So would Tesla qualify for the additional $2,500 final assembly credit?

Thanks!

If you purchase a vehicle that qualifies for full tax credit Sept ’21 are you eligible for these changes for the 2021 tax year that isn’t due till April 15th,2022 for 2021 tax year since they’re effective Jan ’22? I’m confused by the dates.

Thank you!

Eulalia – the answer is we don’t know yet, and won’t know until after the legislation is finalized and passed by Congress. But the way things are going, my guess is that the credit changes will no longer be retroactive for an EV purchased after May 24, 2021. However, unless you are planning on buying a Tesla or Chevrolet Bolt, there is little reason to put off buying any other EV until next year.

I have to disagree with that last sentence from Loren. My understanding is that the current 2021 $7500 EV tax credit is NOT “refundable.” I understand that to mean that if I buy an EV from Volvo this week (November 2021), and I have been pre-paying my income taxes in my paychecks all year (aka withholding), at a rate that gets me no balance due on tax day, that I would NOT benefit at all from the credit because it currently only functions to reduce the additional amount you owe ON TAX DAY (not the amount you owe for the year but have already pre-paid), UNLESS the current bill states that the “refundable” stipulation will be retroactive to part of 2021. I’m not sure how to find out for sure if the current version of the bill is retroactive at all, but I’ve read a few places that it probably will NOT be retroactive, and will be effective for purchases made on or after Januray 1, 2022. So, for me, assuming that my understanding is sound and that I would still be able to order the car and receive it in a timely fashion, it makes much more sense to buy my Volvo EV on or after January 1, 2022. Someone please tell me I’m wrong because I would really like to buy the car I already have on order….

Amy, the current tax credit is NOT refundable. But the proposed changes include making it refundable.

It doesn’t matter whether you owe taxes when you file or not for the current EV credit.

What matters is your TAX LIABILITY. Please do a quick google search and become informed. I would assume someone who plans on purchasing a PHEV/EV from Volvo makes enough money to have at least $7500 in tax liability.

Hi Loren,

Thanks for your feedback. Also I saw an updated EV credit change summary dated 9/10/2021 from you on youtube.

Is that possible that you could post a link for that summary table – similar one as in this article ?

Thanks,

Ming Ye

Great article.

How might PHEVs be affected. I’m looking at buying a Toyota PHEV with an 18kWh battery so under the current plan it would get the full $7,500. Does that change in the new plan? I read elsewhere that for batteries <40kWh will be reduced to a $4,000 credit.

If the purchase is made in 2021 but the law passes this year as well, will the purchase still be eligible for the older larger credit?