One of the biggest hurdles in the transition to electric vehicles is the lack of foresight among “electrification” executives at legacy automakers.

You’ve certainly seen or read about what I’m describing. The head of some division or function at a legacy automaker is quoted in an interview or states while speaking on a panel at an automotive conference that “consumers don’t want electric vehicles.” Or “EVs will only sell where there are significant incentives.”

A recent example of this was from Klaus Frölich, BMW’s director of development:

“There are no customer requests for BEVs. None. There are regulator requests for BEVs, but no customer requests.” – Klaus Frölich, via Forbes

What always amazes me is that leadership at legacy automakers often put people into “electrification” roles who either have no EV experience or who do not truly believe in electric vehicles. Because electric vehicles are relatively new, I understand transferring an ICE executive with no electrification experience into an EV role, but if they are not all in on EVs, what is the point? How does an automaker expect to be a leader in EVs if the people in charge of EV-related programs don’t actually believe in them?

This is not an uncommon approach at large or old companies where longevity, political savvy and the ability to move around the organization is rewarded. I’ve personally observed “old-world thinking” from executives at automakers including the following four examples:

- A powertrain executive at one of the US Big 3 told me 3 years ago at CES that they didn’t expect 300 miles of range in an EV would be common for many, many years. This was at the same time his own employer announced a 300-mile BEV would be available in 2020/2021. Huh?

- This same executive then bristled when I told him that in a few years we would see fast charging capabilities that would add 150-200 miles of range in ~20 minutes. His response: “We don’t see that happening and we are first and foremost concerned about our customer’s safety. We aren’t comfortable putting that much electricity in the hands of our customers.”

- On a panel at a recent automotive conference a market research executive from one of the world’s largest automakers shared that they were quite shocked and surprised at how quickly the cost of battery packs had declined. He admitted their own research was nothing close to what actually occurred. When I was listening I wondered if he and his research team simply ignored the work of Bloomberg New Energy Finance, McKinsey, and many others who had forecast significant declines in battery costs? Clearly it was yet another case of confirmation bias driven by not actually believing in a future of EVs. And in this case, a preference toward regular hybrids and fuel cell vehicles.

- Finally, another speaker who leads the EV charging infrastructure program at a Big 3 automaker, told me that they were “not going to compete with Electrify America.” That is a little bit like Alphabet’s Google Android division saying they would not compete with the Apple App store. In fairness, I subsequently learned that this automaker is actually planning to partner with Electrify America for charging. But in a conversation with this executive, it was clear that he had never actually taken an EV on a road trip and didn’t truly understand the importance of automakers creating a strong total customer experience for their future EV owners.

8 Requirements for Auto Executives

If an executive has any responsibility related to electrification, powertrains, EV charging infrastructure, V2G, etc, – then the leadership of the company should require the following from each executive:

1. They must own and drive an electric vehicle. If you are going to lead some aspect of an automaker’s electrification program, you must drive an EV. Period. It can be one your company produces or one from a competitor if the automaker doesn’t offer an EV. In fact, automakers should purchase a pool of EVs from competitors and require that executives each drive them for several weeks to gain deeper insight into what their competition is doing both well and poorly.

2. They must take one or two road trips of at least 400-500 miles each way. Driving an electric vehicle to work each day, or on short weekend excursions does not give you the full experience – both positives and challenges – of driving an EV. Long road trips are where you might first experience the affects of terrain, weather, and wind conditions on range. Executives might have to research and plan out where they will stop and charge (and eat at or near the charging location).

They might experience the convenience of charging stations at their hotel or other destinations, or frustration if charging stations are not working or they find an ICE vehicle parked in the charging space. Ideally, these road trips might involve a long-range Tesla so the executive could experience charging at one or more Supercharger locations and as well with one of the company’s own EVs, or competitor’s EVs if the company doesn’t offer one.

3. They must go through the process of having an EV charging station installed at their home. I know of one automaker that bought a Tesla Model 3 and let several people each drive it as their own car for a few days. But most of the employees did not have home charging stations and so were reliant on Tesla Superchargers for their normal charging, but they were not that prevalent in their local area.

So many of them complained about the inconvenience of charging, but they didn’t actually replicate the experience of a typical EV driver with access to home charging, or where charging infrastructure matches EV ownership. Just as importantly, executives need to understand and experience the process of finding an electrician or experienced EV charging station installer and learn first hand what this process is like. Ultimately, however, they will experience the convenience of regular charging at home and never having to go to a gas station (perhaps ever again).

4. Drive a Tesla. They must drive a Tesla and not just around the block but for an extended period. And as mentioned earlier, this should include driving a Tesla on a road trip that includes charging at a Supercharger and Destination Charger. With Tesla dominating EV sales in many markets around the world, and especially in the US and California, legacy automakers must have first-hand knowledge of both the strengths and weaknesses of Tesla’s electric vehicles.

5. Read electric vehicle reports and forecasts from Bloomberg New Energy Finance, ICCT, and other “non-inside auto” sources. The auto industry, like all industries, tends to be a bit of an echo chamber. The publications that are read, the consultants used, the research reports that everyone refers to tend to be from long-time sources within the industry. The problem is that most of those organizations supplying research, content and advice suffer from the same industry confirmation bias as the automakers.

Legacy automakers need to seek out ideas, data, and insights from new sources that have a very different view of the world than traditional industry sources. While the truth may lay somewhere in between the old and new sources, it is critical that automaker executives use these sources to drive change and question the status quo within their organizations.

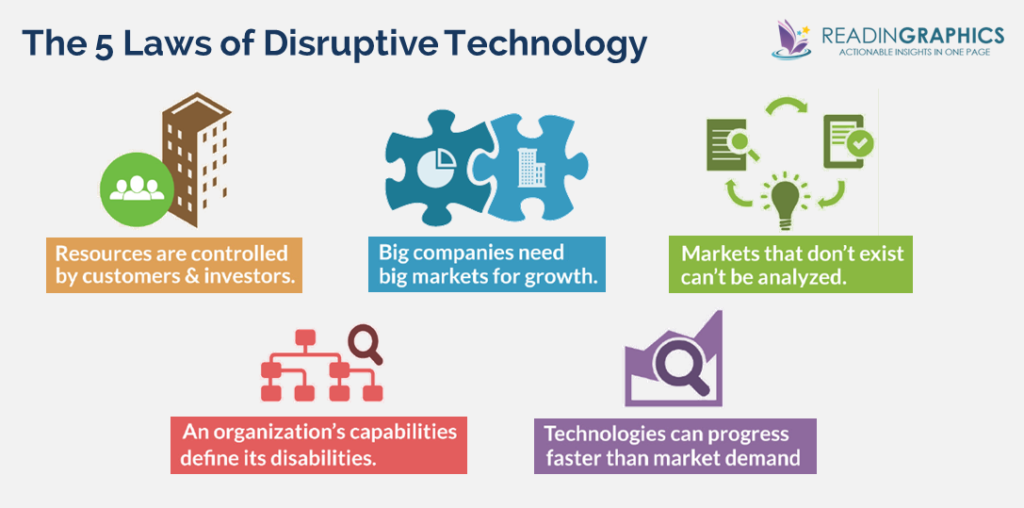

6. Read the “Innovator’s Dilemma” and “Crossing the Chasm.” Among other things, executives at legacy automakers need to understand how to compete in two markets in parallel – the mature one for gas- and diesel-powered vehicles, and the fast-growing and emerging market for electric vehicles. Clayton Chrstensen’s The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail (Management of Innovation and Change) uses examples in the disk drive industry to show how new entrants often dominate in emerging markets and explains how mature companies must organize and respond to new technologies and markets. While the disk-drive industry examples feel rather dated today, the underlying lessons are still relevant.

Geoffrey Moore’s “Crossing the Chasm” is a great primer on how new markets evolve from innovator and early adopter buyers to “cross the chasm” to early majority and mainstream consumers. This is a required foundation for auto executives to understand how the market for EVs will progress.

In Crossing the Chasm, Geoffrey A. Moore shows that in the Technology Adoption Life Cycle—which begins with innovators and moves to early adopters, early majority, late majority, and laggards—there is a vast chasm between the early adopters and the early majority. While early adopters are willing to sacrifice for the advantage of being first, the early majority waits until they know that the technology actually offers improvements in productivity. The challenge for innovators and marketers is to narrow this chasm and ultimately accelerate adoption across every segment. – Source: Amazon

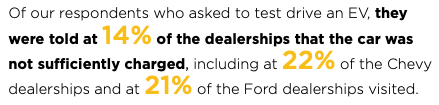

7. Try buying an EV from one of their own brand’s dealers. Someone recently commented to me on Twitter that when he went to buy a Kia Niro BEV, the dealer sales associate tried to sell him oil changes with the car. I went to test drive a Chevrolet Bolt when it first came to market, and while the salesperson was fairly knowledgeable about EVs (he actually drove a Chevrolet Spark), the Bolt only had 12 miles of range and the power was limited, resulting in a short and disappointing test drive experience.

The Sierra Club and others have conducted secret shopper programs that have uncovered less than stellar EV shopping experiences at many legacy brand dealerships. Executives from the legacy automakers need to visit multiple dealerships and experience first hand how EVs are sold by their dealers.

8. Then Visit a Tesla showroom. While Tesla seems to be faltering recently in customer service and often flip flopping on its retail strategy, its galleries located in upscale retail locations and showrooms offer quite a different experience than that of a typical auto dealer. Legacy automakers could learn from Tesla’s showroom/gallery model and work with their dealers to establish EV experience and education centers within their dealer showrooms.

Say what you want about Elon Musk and Tesla’s challenges and weaknesses, one of its biggest advantages is its singular focus on batteries and electric vehicles. There is no internal debate about if or when EVs will go mainstream – driving the industry in that direction is one of Elon’s long-stated goals.

Electric vehicles are clearly the future of the automobile industry – the only question is how quickly EVs are adopted by mainstream consumers. Those automaker executives who don’t actively seek to understand and immerse themselves in the coming wave of EVs risk eventually working for an automaker that experiences a slow death.

One Response

This is a very interesting topic. Thank you for sharing.