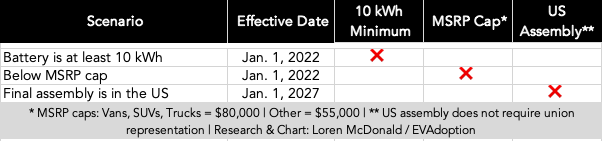

In my previous article, Proposed Changes to the Federal EV Tax Credit Passed by the House of Representatives, I outlined and analyzed 13 proposed changes to IRC 30D (federal EV tax credit). Because of the multiple and nuanced variables included in the House bill legislation, you need to have deep knowledge on everything from the price of the EV, where it is assembled, whether it is assembled in a union factory, battery size, and where the battery cells are made to determine what the future tax credit amount might actually be.

In fact, there are potentially nine different tax credit amounts from $0 to $12,500 under the proposed tax credit changes in the bill passed by the US House of Representatives on November 20. In this brief article I will share the 3 scenarios that lead to an EV being completely disqualified from any available tax credit amount.

1. Battery is under 10kWh: Currently only five PHEVs would not meet the proposed 10 kWh threshold:

- Toyota Prius Prime (8.8 kWh)

- Subaru Crosstrek Hybrid (8.8 kWh)

- Hyundai IONIQ PHEV (8.9 kWh)

- Kia Niro PHEV (8.9 kWh)

- Ferrari SF90 Stradale (8.8 kWh – but which exceeds the MRSP cap and would not qualify anyway).

Of these five, the Toyota Prius Prime is the only one that sells in any significant volume. With Chevrolet Bolt production halted, the Prius Prime is likely to finish 2021 in third (after the Tesla Models Y and 3) or 4th after the Toyota RAV4 Prime. But all of these PHEVs have batteries of around 9 kWh and so they could easily be upgraded to 10 kWh to qualify for the tax credit.

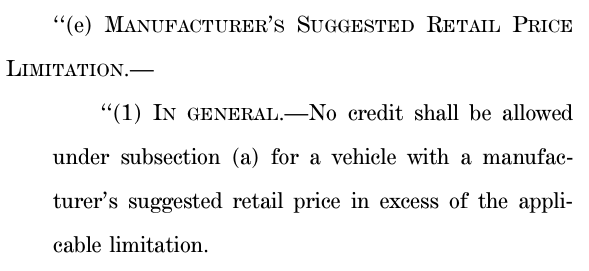

2. Exceeds the Manufacturers Suggested Retail Price (MSRP) Cap: The House proposed changes institute price caps based on MSRP of $80,000 and $55,000. What isn’t entirely clear are the details behind how to apply the MSRP cap. Is it applied to the base trim of an EV model, and so that all other model trims and variants that exceed the MSRP cap still qualifies? Or does the cap apply to each model trim?

So for example, the base MSRP on the Ford F-150 Lightning Pro is $39,974. But there will also be a Ford F-150 Lightning Platinum trip with a starting MSRP of $90,474. What the bill does not clarify is if the Platinum version still qualifies because there is the Pro base trim that falls under the $80,000 MSRP cap. Most industry observers I’ve spoken with believe that the bill provision is dictated by the EV model’s base trim — meaning any other trim would still qualify even if it exceeded the applicable MSRP cap. Of course we presume that the base trim model must actually be available to purchase, and not just planned for the future.

The MSRP price caps by vehicle body type are:

- Vans: $80,000.

- Sport Utility Vehicles (SUVs): $80,000.

- Pickup Trucks: $80,000.

- Other (Any other vehicle type): $55,000.

A second variable is the lower $55,000 MSRP cap for vehicles classified as “Other.” While the “Other” classification isn’t actually defined in the bill, it clearly includes sedans, hatchback, sports cars, station wagons, roadsters, and coupes. But isn’t clear is if some crossovers will fall under the “Other” category and not the SUV classification? The Ford Mustang Mach-E, for example, is classified by the EPA as a station wagon – so it falls under “Other” and the $55,000 cap — but the Mach-E is not affected due to its base MSRP of $42,895. However, the Mustang Mach-E GT has a starting MSRP of $59,995. So depending upon the definition of how the MSRP is applied, the Mach-E GT either will or will not be eligible for the federal EV tax credit.

And if the Cadillac LYRIQ, which currently has a base MSRP of $58,795, is classified as a station wagon (very possible), it would fall under the “Other” category and exceed the $55,000 MSRP cap and thus would be disqualified completely from eligibility. If categorized as an SUV, however, the LYRIQ would qualify for the maximum $12,500 tax credit.

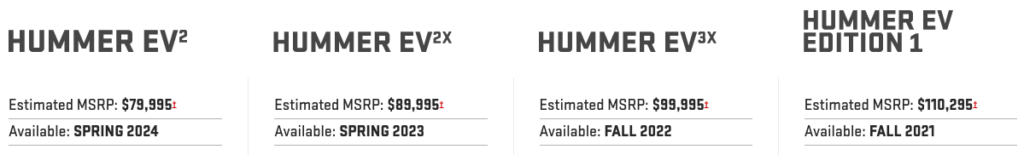

As such, until we know the specifics of how the MSRP rule is applied along with definitions of the vehicle type classifications, it is difficult to be precise on how many EVs would be disqualified due to exceeding the MSRP cap. That said, the EVs below are pretty certain to be disqualified unless those that are on the bubble like the BMW i4 eDrive40 ($55,400), BMW 530e ($55,500), and BMW iX xDrive50 ($83,200) have their MSRP reduced to come under the cap. And some of these EVs like the GMC Hummer EV will see lower-priced trims (Hummer EV2 at $79,995) in the coming years that would be under the MSRP cap.

- Audi e-tron GT Premium Plus quottro

- Bentley Bentagya Hybrid

- BMW i4 eDrive40 (MSRP is $55,400 and will likely be reduced)

- BMW iX xDrive50 (MSRP is $83,200 and will likely be reduced)

- BMW 745e xDrive

- BMW 530e (MSRP is $55,500 and would likely be reduced under the cap by BMW)

- GMC Hummer EV (EV2 expected in 2024 would be under the cap)

- Genesis eG80

- Karma Revero GT

- Kia EV6 First Edition (Assuming it is classified as “Other”; later based trims would qualify)

- Lucid Air

- Mercedes-Benz EQE

- Mercedes-Benz EQS

- Porsche Panamera E-Hybrid

- Porsche Taycan 4 Cross Tourismo

- Porsche Taycan

- Range Rover Sport PHEV

- Range Rover PHEV

- Tesla Model S

- Tesla Model X

- Volvo S90 T8 PHEV

- Volvo V60 Recharge

One interesting affect of the MSRP cap is that some OEMs may move up launch dates of their lower-priced trims if that brings the model underneath the applicable MSRP cap. The GMC Hummer is one example with its lowest price trim, the Hummer EV2 at $79,995 currently slated for 2024. Depending upon how the MSRP caps are applied, availability of the Hummer EV2 at under the $80,000 SUV cap could make the more expensive trims also eligible. But this is a key aspect of the text of the bill that still lacks clarity.

3. Final Assembly is Not in the US (Jan 1, 2027): “Final assembly” in this case does not include the “Domestic Content” requirement of being assembled in a factory with a collective bargaining agreement (union). EVs assembled in a foreign country — whether Canada, Mexico, Japan, Germany, South Korea or elsewhere — would not be eligible for any level of tax credit. However, EVs assembled in the US but not in a union factory, would still be eligible for the tax credit, but not the $4,500 bonus amount covered in the previous article.

Since many foreign-headquartered automakers have announced plans to produce EVs in the US in the coming years, this provision is most likely to affect the following types of EVs:

- Low-volume, luxury/premium vehicles: In theory these would include some models from Porsche, Bentley, Range Rover, Jaguar, Mercedes-Benz, BMW, and others — but many of the EV models from these brands would likely exceed the MSRP caps anyway. So the US requirement may have minimal impact on the luxury OEMs, unless they don’t move production of their higher-volume selling EVs to the US. An example could be an EV such as the BMW i4.

- EVs from Asian start ups: This may include OEMs such as BYD, Xpeng, Nio, and others looking to enter the US market but waiting to establish a manufacturing base in the US once they’ve reached a critical mass in sales the US.

- US importers: These would apply to models from companies such as Kandi America which import EVs from China and then put through a homologation process to make the vehicles legal in the US.

It remains to be seen what changes the US Senate will make to the proposed tax credit changes, or if the BBBA will even achieve the necessary 50 votes once the text of the bill is finalized. However, if it does pass basically as is, we will probably see many MSRP and model standard feature changes as well as more foreign-based OEMs assembling EVs in the US later this decade. I would also expect Toyota and Subaru to increase the size of the battery packs just over 1 kWh to reach the proposed 10 kWh battery minimum.

Related Articles on the Federal EV Tax Credit

- Proposed Changes to the Federal EV Tax Credit Passed by the House of Representatives

- Proposed Changes to Federal EV Tax Credit – Part 5: Making the Credit Refundable

- Proposed Changes to Federal EV Tax Credit – Part 3: MSRP Must Be Less Than $80,000

- Proposed Changes to Federal EV Tax Credit – Part 2: End of the Manufacturer Sales Phaseout

- Fixing the Federal EV Tax Credit Flaws: Redesigning the Vehicle Credit Formula

- Overview of Biden Administration Plans to Help Increase EV Adoption in the US

- Why Only 3 Auto Manufacturer’s EV Sales Data Is Being Reported Publicly By the IRS

- Huge Flaws in Federal EV Tax Credit Will Hurt US Automakers Beginning in 2020

- Instructions for Form 8936

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →