In parts 1 and 2 of this 3-part series I outlined the first 16 of 24 factors that I believe will (or could) impact sales of electric vehicles. These 16 factors included everything from range, model availability, gas prices, charging infrastructure, to economic conditions and government incentives and regulations.

In this final part-3 article, I outline 8 more factors that are focused around clean energy, the cost of electricity, vehicle to grid adoption, consumer awareness, the fate of Tesla and more:

17. Growth in Green Energy: Early adopters and buyers of EVs believe that going electric is simply the right thing to do for the planet. In the US a high percentage of early EV buyers live in states that have a greater than average level of clean energy sources or may have solar panels on their home.

But many late adopters, including those living in areas that still rely heavily on coal and natural gas, will question whether EVs are actually better for the planet than ICE vehicles. As sources of energy become greener, especially in areas that have been heavily reliant on coal, late adopters will have one less reason to cite for not wanting to go electric.

18. Declining Cost of Electricity: As the cost of clean energy, especially from solar and wind power, continues to decline, many skeptics will be more open to considering an EV especially when they realize the cost to “fuel” their EV is significantly less than their ICE vehicle. If gas prices decline, however, this advantage is reduced. But as the cost of solar panels continues to decline and products like Tesla’s solar roof tiles become mainstream, more homeowners will choose to combine an EV with their rooftop solar.

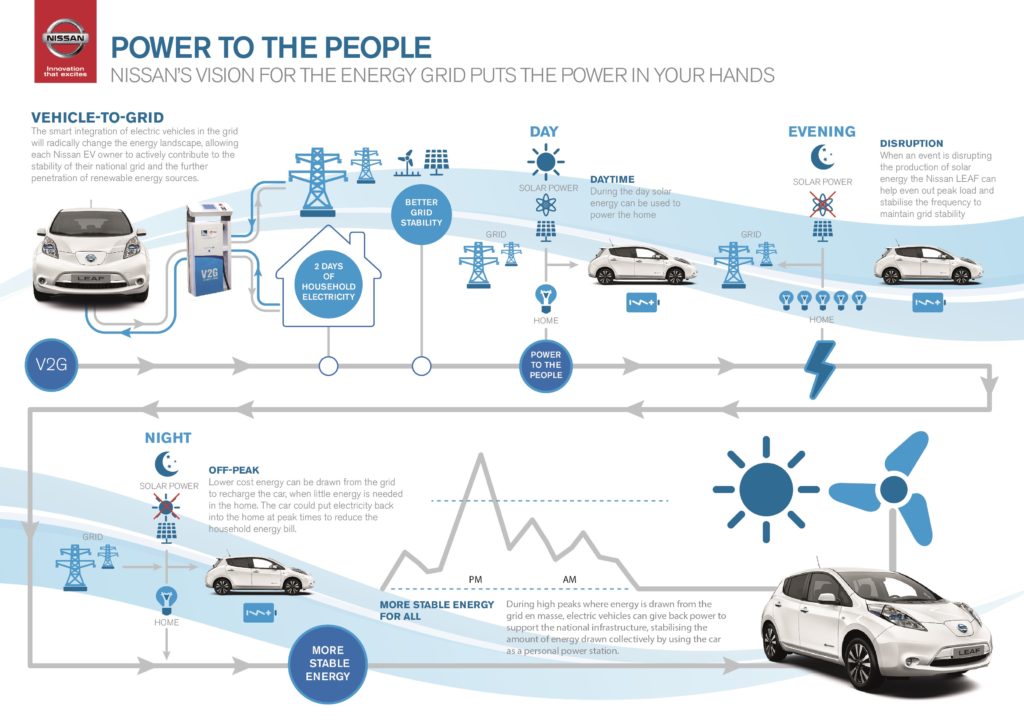

19. Vehicle to Grid Adoption/Battery Storage: EVs need a breakthrough advantage over ICE to truly grab the attention and mindshare of mass consumers. I expect that to be vehicle-to-grid capabilities and using an EV as a mobile energy storage vehicle as I wrote about recently. When consumers realize they can get paid by their local utility to store electricity in their EV’s battery for use during peak demand hours, more people will see the additional advantages of EVs over ICE vehicles.

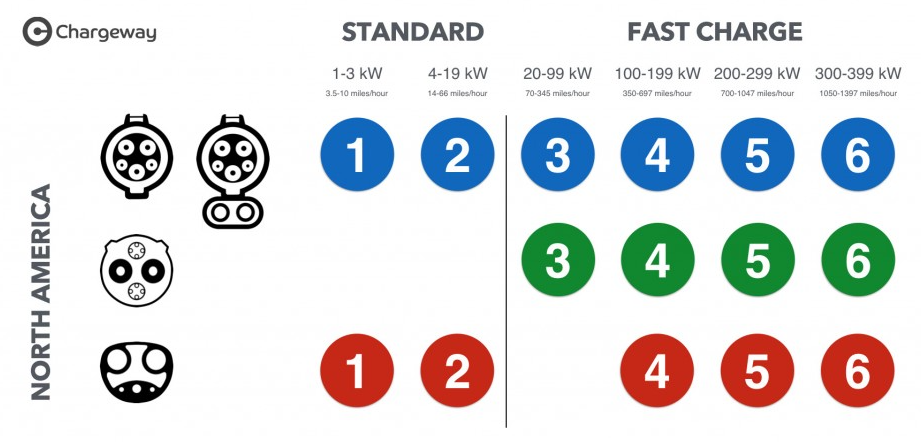

20. EV Charging Standards, Terminology, and Convenience: What the hell is a J1772? What the “f” is CCS? Oh geez, what engineers thought of these terms? Tesla got this part right with the name “Superchargers” but the industry overall is a confusing mess when it comes to charging terminology and compatibility.

When the industry can simplify terminology and have greater compatibility across brands it will reduce one less hurdle for consumers to switch from ICE vehicles. I have high hopes that Matt Teske’s Chargeway initiative that simplifies charging through the use of a color and numbering system is widely adopted in the future.

Additionally as wireless charging becomes an option and then standard on many EVs, some fence sitters might be attracted to the simplicity of wireless charging. It could become especially popular for buyers of PHEVs that currently only need 20-50 miles of charge.

21. Consumer Awareness and Education: Unless you follow or are very interested in EVs, you probably know very little about them and may have many misconceptions. A co-worker of my wife recently asked her about our EV: “So it really doesn’t need any gas? Really? Where do you plug it in?”

And a relative once referred to our Tesla as a “hybrid.” But as automakers increase advertising of EVs, mainstream media covers them as commonplace and the “neighborhood effect” kicks in – they will transition from being unknown and confusing to an accepted and more understood product.

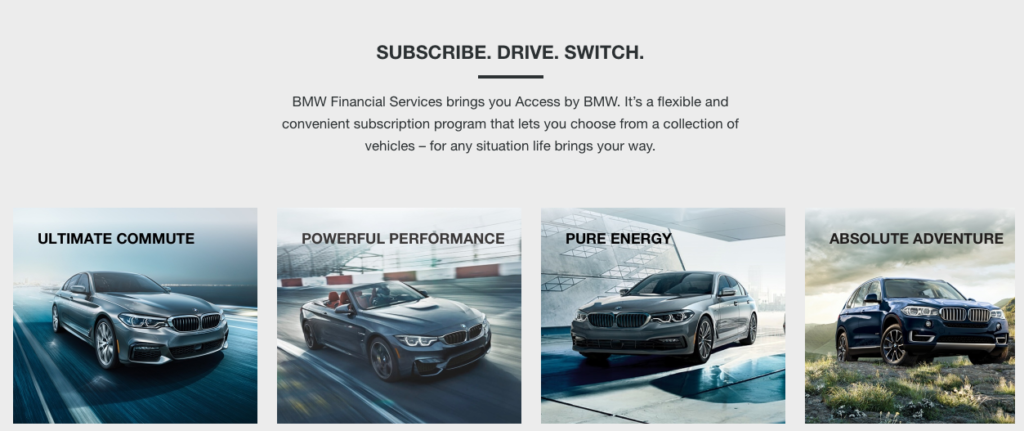

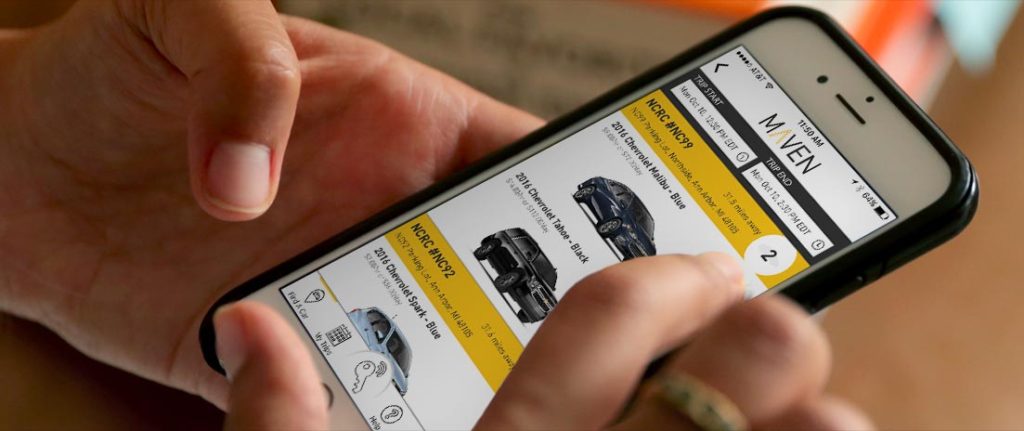

22. Purchase/Finance Models: With some consumers potentially nervous about buying a BEV and not having enough range for long-distance trips, the emerging concept of subscription-based purchases which often provides access to multiple models – could help convert some buyers, especially those considering luxury brands.

And with significant increases in battery range along with new autopilot hardware every few years (see Technology Obsolescence: The Auto Industry’s Lurking Challenge) – subscription-based “purchase” models would eliminate resale risk and obsolescence concerns and could lead to a modest increase in EV sales, again especially in the luxury market.

23. Autonomous Vehicles/Car and Ride Sharing: If autonomous vehicles and car and ride sharing services see significant adoption in the coming years, this growth should also benefit sales of EVs. Autonomous vehicles are ideally suited to be run on EV platforms and fleet operators and independent ride-sharing drivers will prefer the lower total cost of ownership once the initial purchase costs of EVs come down a bit more and a range of around 400 miles becomes the norm.

24. Tesla: Whether you love, hate or don’t really care about Tesla, the company and Elon Musk – its outspoken CEO and guiding light – continue to drive interest in and awareness of EVs. And most significantly, the company’s success in the luxury/performance category has spurred brands like Porsche, Volvo, Mercedes-Benz, BMW and Audi to speed up their development and launch of BEVs.

If Tesla runs into financial troubles or struggles to scale up production of the Model 3 and future Model Y crossover, some competitors could decide to relax their development timeline. Further, with a muted Tesla and Elon Musk PR machine, consumer interest and awareness could stagnate.

Let me know in the comments if you think I missed any key factors or disagree with any that I included.

Related:

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →

2 Responses