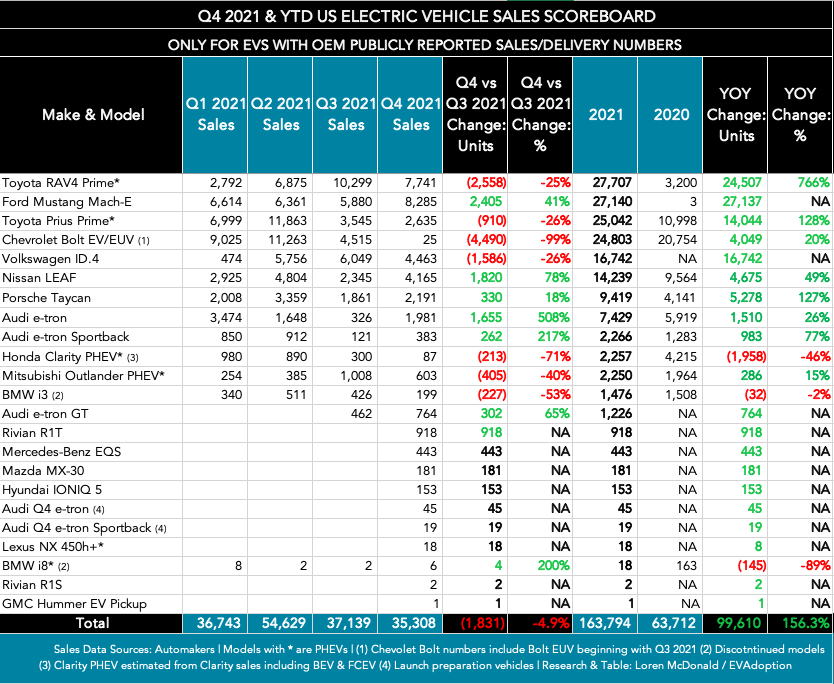

Among the 23 electric vehicles from automakers that publicly report specific sales numbers for their EV models, the Toyota RAV4 Prime PHEV was tops in the US in 2021 with 27,707 units sold. Ford’s Mustang Mach-E in its first year on the market (Ford delivered 3 Mach-E units in December 2020), was the number one-selling BEV among legacy automakers at 27,140 units in 2021.

The Tesla Model Y and Model 3 of course far outsold any other EV models in the US, however since Tesla neither breaks out deliveries by market or individual model (the company reports global deliveries each for the combined Model 3/Y and S/X models – see article on Tesla sales estimates for 2021) we can only estimate their sales. In the coming weeks, EVAdoption will release our (for purchase) Q4 and full-year 2021 US EV Sales Report which will include estimated and reported sales for all BEVs and PHEVs with sales in the US in 2021 (including Tesla). However, our current (but likely to be revised) estimates for the Model Y and Model 3 are 180,000 and 145,000 deliveries respectively.

Another top-selling EV beyond Tesla models that is not included is the Jeep Wrangler 4xe PHEV, which saw 2021 estimated sales of around 26,000. If you include the Tesla Model Y and Model 3 in the rankings, the Wrangler 4xe would likely be the number 5 selling EV in the US for 2021.

Trends Among the 2021 Top-Selling (Reported) EVs

Perhaps at the top of the list of trends from our Scoreboard is how well the two PHEVs from Toyota sold. The 27,707 from the RAV4 Prime was not a surprise as we believe that the popular PHEV version of the number four selling vehicle in the US (407,739 total) could easily sell 40,000-50,000 units of the RAV4 Prime if Toyota imported that many. What is a surprise to us was the rebound in sales of the Prius Prime, which was up 128% YOY. And as you can see from the chart below, the the Prius is heading toward 60% of its sales being for the Prime PHEV version.

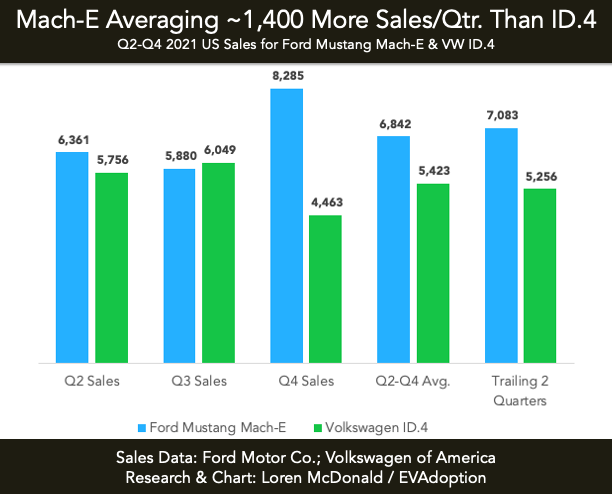

The second key trend is the solid first-year sales of both the Ford Mustang Mach-E (27,140) and Volkswagen ID.4 (16,742) BEVs. For the year the Mach-E outsold the ID.4 by 10,398 units. But the Mach-E — which had 3 deliveries in December 2020 — had its second best sales quarter in Q1 when the ID.4 was only just beginning to reach US dealers. When looking at only Q2-Q4 sales, the Mach-E outsold the ID.4 by an average of 1,419 units per quarter. Ford has announced plans to increase production of the Mach-E at its Mexico plant 3X over the next two years which suggests sales could reach at least 40,000 in 2022.

A third key trend is of course the drop in sales to nearly zero (25) in Q4 for GM’s Chevrolet Bolt, which suffered from both a battery recall due to fires and a stopping of production. The Bolt, which is expected to resume production in early March, was on pace until the recall to sell 40,000 units in 2021. Especially if Congress removes the OEM cap which would mean at least a $7,500 tax credit and as much as $12,500, the Bolt has the potential to be the top selling EV in the US in 2022 other than models from Tesla. However, by likely losing all or most of Q1 production, the Bolt would likely have to average sales of 12,000-13,000 in Q2-Q4 plus a few thousand in March.

A fourth trend or finding is that YOY sales increased 155% for these 21 EVs with publicly reported numbers. However, about half of the 98,690 increase was from new EVs that were not available either all or part of 2020. In fact two models, the Mach-E and ID.4, accounted for 43,879 units of the YOY increase.

Other positive sales trends from 2021 include:

- Nissan LEAF: First launched in the US in December 2010, the iconic LEAF saw a 49% increase in sales versus 2020, and 78% in Q4 versus Q3 of 2021. With the Ariya BEV expected in late 2022, it will be interesting to watch how aggressive Nissan and its dealers are with incentives to move the increasingly less competitive LEAF.

- Porsche Taycan: Ranging in price from $83,000 to $188,000, the Taycan had a YOY sales increase of 127%, perhaps partially due to the addition of the Cross Turismo station wagon variant.

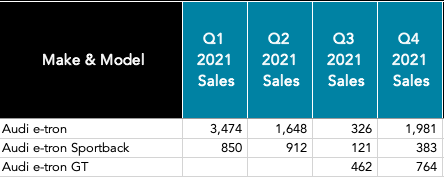

- Audi e-tron: Perhaps partially because of the launch of the Sportback version and growing competition, the e-tron SUV had solid but unspectacular YOY growth in sales of 26%. Its sales varied widely by quarter from a high of 3,474 to a low of 326 in Q2. It is unclear if the down Q3 for all three Audi e-tron models were due to supply chain issues or other factors.

- Audi e-tron Sportback: The e-tron Sportback had YOY sales increase of 77%, but sales in quarters 3 and 4 were significantly below that of Q1 and Q2.

- Audi e-tron GT: A competitor to the Tesla Model S, the e-tron GT had a 65% increase in Q4 over Q3, its first quarter for sale in the US. A gorgeous sedan, it will be interesting to see if the e-tron GT can approach sales of 10,000 units in 2022 – which would make it a huge success.

- Mitsubishi Outlander PHEV: While very popular in Europe, the Outlander PHEV has never caught on in the US but it did have slight YOY growth of 15%. Mitsubishi will bring an updated version of the Outlander PHEV to the US likely in Q3 with an increase in range and optional 3rd-row seating.

- Honda Clarity PHEV: Honda ended production of the Clarity PHEV and FCV (fuel cell vehicle) in August 2021, but has stated that both would be available for lease from dealers in 2022.

- New Models: Five new models Mazda MX-30, Hyundai IONIQ 5, Lexus NX 450h+, Mercedes-Benz EQS, GMC Hummer EV pickup, and Rivian R1T and R1S all began deliveries in Q4. The Mazda MX-30 is a limited production compliance EV and is expected to be replaced by a PHEV/Range extender version. The IONIQ 5, NX 450h+, EQS, R1T, R1S, and Hummer EV only began deliveries in November or December and so it is too early to determine any sales trends. And while Audi reported sales of its Q4 e-tron and Q4 e-tron Sportback, the new BEVs won’t arrive at US dealerships until perhaps Q2, though Audi has yet to confirm specific timing.

In the coming weeks EVAdoption will release its 2021 EV Sales Report for sale which includes sales figures and estimates plus dozens of charts on all 70 BEVs and PHEVs that had sales in the US in 2021.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →