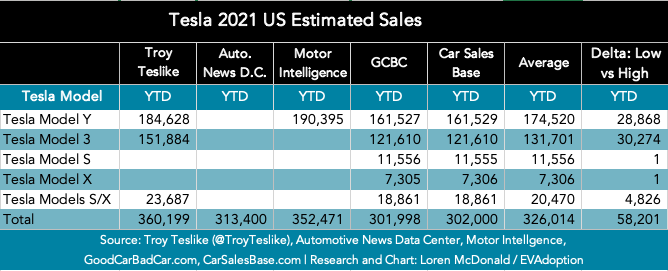

Assembling estimates from various sources of US sales for Tesla’s electric vehicle models reveals a wide range from a low of 301,998 to a high of 360,199. That difference in estimated sales amounts to a wide swath of 58,201 or 16% of the high-end estimate. The average across the five sources is 326,014.

By taking the average of the five sources, we arrive at 326,014 across all four Tesla models for 2021. Two of the sources — Troy Teslike and Motor Intelligence are reasonably close at 360,199 and 352,471 respectively. GoodCarBadCar.com and CarSalesBase.com differ by only a handful of units and seem to simply mirror each other with one of them perhaps just changing a few digits so as to appear different from the other. For the Model 3 they have the exact same number which is even more odd. And finally at 313,400 the Automotive News Data Center sits a bit by itself, but closer to low end of the estimates.

When estimating sales of the individual models, Troy Teslike breaks out sales (deliveries) for the Y and 3, but combines the S and X. Across the three sources that publish S and X (individually or combined) estimates, the average S and X 2021 sales estimate is 20,470.

For the Model Y, estimates range from a low of 161,527 from GoodCarBadCar.com to a high of 190,395 from Motor Intelligence — for a delta of 28,868. The average across the four sources with Model Y numbers was 174,520. For the Model 3, estimates range from a low of 121,610 from GoodCarBadCar.com and CarSalesBase.com to a high of 151,884 from Troy Teslike — for a delta of 30,274.

Why such a wide range of estimates?

In short, Tesla — unlike the majority (but not all) of automakers — does not report sales of their electric vehicles by either geographic market or model. With no transparency or any level of sales guidance for the US, analysts use a variety of means including registration numbers from past quarters and reports from other countries to take their best guess at the numbers. And since it takes 1-2 months for the various data firms that acquire registration numbers from state DMVs to consolidate and report their data, we won’t have a good sense of the actual numbers for another month or two.

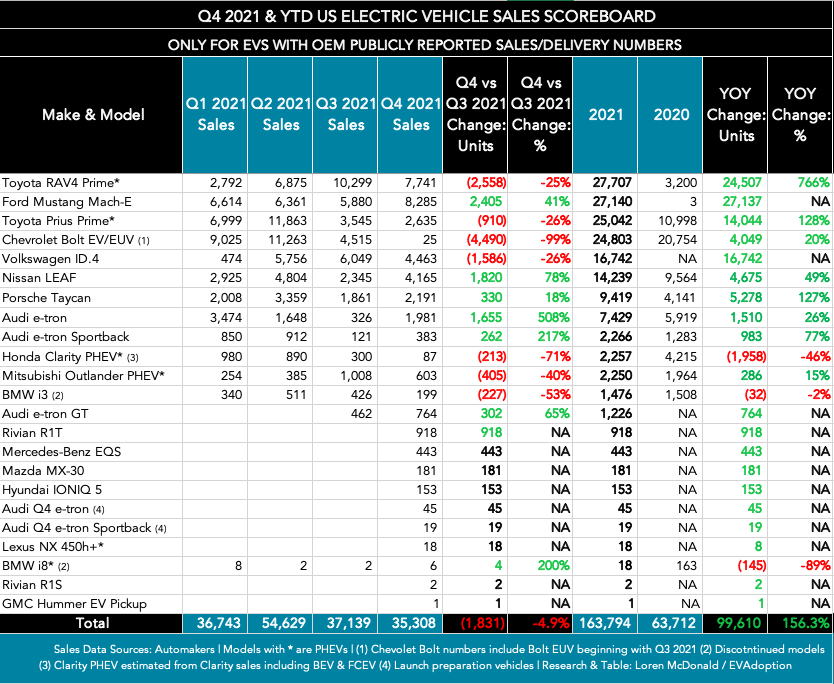

As you can see from our just published EV Sales Scoreboard and table below, most of the automakers report sales of their BEV models for the US market. The exceptions include Polestar, Volvo, Jaguar, Lucid (so far), and the Kia Niro and Hyundai Kona shared powertrain models. Also, except for Toyota and Mitsubishi, none of the automakers break out sales of just the PHEV versions of shared powertrain models.

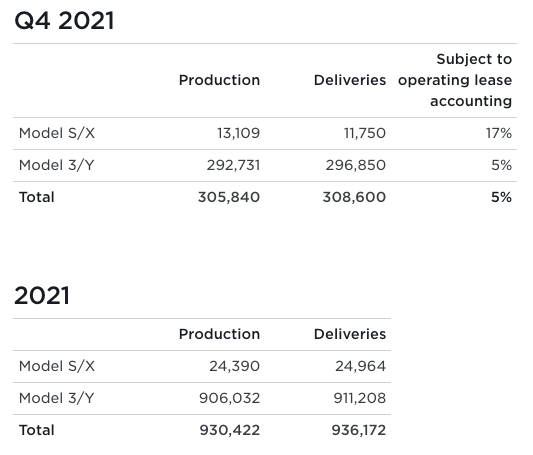

Looking at the screenshot below, you can see that the only numbers that Tesla reports are global deliveries and a combination of the Models S and X, and Y and 3. As a result, investors, journalists, financial and industry analysts have no lens into the sales of Tesla by market or individual model.

Because there are some government reports for EV sales including Tesla for both the EU and China markets, however, it is possible to back into an estimate for the US and by model by combining the EU and China numbers, estimating the rest of Asia, non-EU countries, Australia, and Canada to then arrive at US estimates. But this is still a lot of effort and guesswork — and just an estimate. It would be so much easier if Tesla just increased transparency and mirrored what most of the major automakers do and report sales by model and country on at least a quarterly basis.