California reached an impressive 7.83% EV market share of new vehicle registrations for the month of April 2018. Could California reach 10% by the end of 2018? In short, yes.

The new numbers for April are just in from the Alliance of Auto Manufacturers Advanced Technology Sales Dashboard and portend that 2018 could see nearly a doubling of EV market share in California from 2017. What is particularly impressive in the new numbers is the jump in sales to 12,153 (7.83%) in April from 9,390 (5.56%) in March. That is a very significant one month increase in EV registrations of 29.4%.

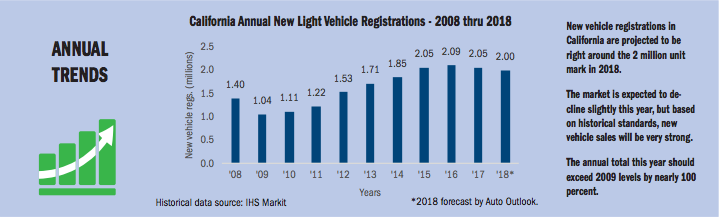

According to the California New Car Dealers Association, auto sales in California are expected to reach right around 2 million for the full-year 2018. By our estimates, this would mean that December EV sales in the state would likely have to be around 18,000 – 10% of an estimated 180,000 for the final month of the year. For the full year 2018, this would likely put the EV market share at around 9.5%.

Source: California Auto Outlook, California New Car Dealers Association – Q1 2018

What’s Fueling the Growth in California EV Sales?

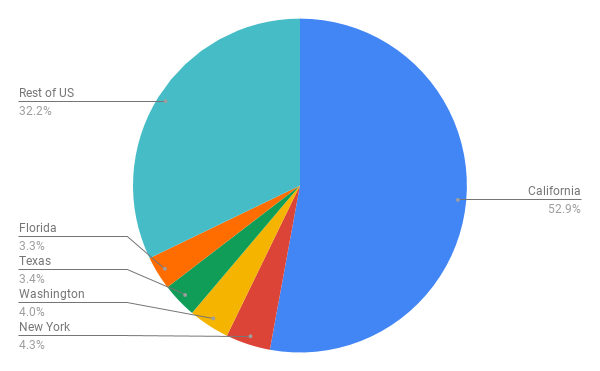

California has long been the pacesetter in the US for EV sales with roughly 50% of all US EV sales coming from the Golden State. During April however, California increased its share of US EV sales to 52.9% What’s causing this latest bump in sales?

Here are 5 likely drivers of current California EV sales and what could continue the strong pace for the rest of the year:

1. Tesla Model 3. Tesla appears to not be completely out of Model 3 “production hell” but does seem to be on pace to reach 5,000 units produced weekly sometime in Q3 2018. A sizable percentage of these Model 3s will end up in the hands of California reservation holders and so will be the sales volume key to reaching the overall 10% market share level.

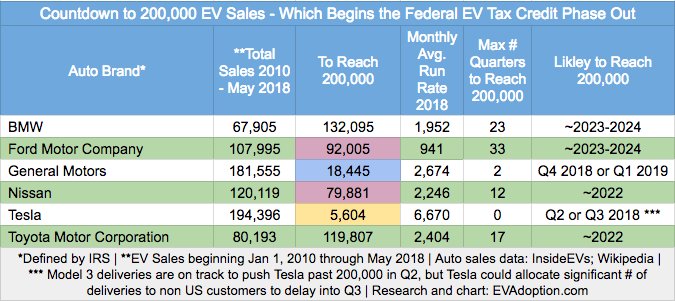

2. Federal Tax Credit Phase Out Fears. There is much confusion among consumers about the details of how the Federal EV tax credit actually works, but what many hear is that the credit may soon be going away for some manufacturers including Tesla and GM. With both Tesla and GM hitting the 200,000 milestone that kicks off the beginning of the phase out in the next few quarters, we could see many consumers decide to pull the trigger on a Tesla or GM EV late in 2018 to take advantage of the tax credit and apply it toward their 2018 taxes.

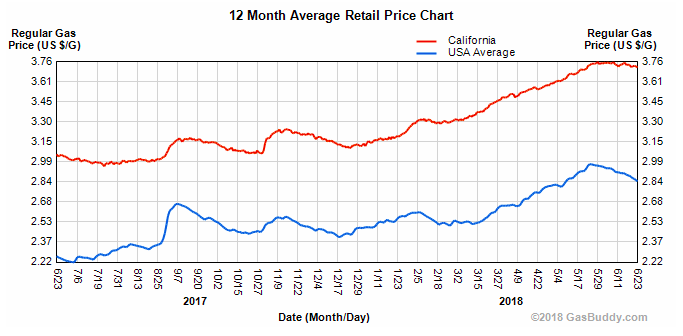

3. Gas Prices. The average price of a gallon of gasoline has long been higher in California due to high gas taxes and the state’s special blending requirements. Various experts, according to USA Today, predict that summer gas prices in California may reach $4.00 a gallon. As of June 23, the average price of a gallon of gas is roughly $3.70 in California and $2.85 nationally. The $4 a gallon level could spur a psychological consumer trigger among many consumers to finally buy an EV after waiting for EVs to become more affordable and have longer ranges.

In 2017 I ran a regression analysis across multiple factors using data for all 50 US states to try and determine correlations with high and low EV sales states. In running the analysis using more than 100 different combinations of factors, in every single analysis gas prices had the highest correlation with state EV sales. Expect the high summer gas prices (highest in 4 years) to be a significant factor in EV sales in the second half of 2018.

Source: Gas Buddy

Subscribe to our email alerts now!

You’ll also receive our exclusive special report: Analyzing US Sales Trends of EVs Versus ICE Powertrains Across Shared Models.

4. Neighborhood Effect. Drive around the more affluent or green-inclined cities in California and you will see Teslas, Chevrolet Bolts, Nissan LEAFs and other EVs everywhere. This concentrated level of EV sales within a geographic region has a neighborhood effect of heightening awareness and making EVs seem more desirable and acceptable. As deliveries of the Tesla Model 3 increase in California, combined with a potential strong rebound in sales of the Chevrolet Bolt and the revised Nissan LEAF (among other EVs), this awareness is driving a growing number of California consumers to consider an EV for their next vehicle purchase.

5. EV Awareness. While EVs are still being purchased primarily by “green” and early-adopting consumers, media coverage continues to grow and is generally shifting from a “If?” EVs will go mainstream to “When?” There is the constant buzz around Tesla (both positive and negative), growing awareness of the new programs from the state’s utilities, retailers such as Target and Walmart adding charging stations to their parking lots and general increase in media coverage on EVs. Combine the growing media coverage around EVs and the neighborhood effect referenced above and 2H of 2018 should see a growing interest and sales of EVs among California car buyers.

What Would Get in the Way of Reaching or Coming Close to 10% Market Share?

A lot has to go right in California for the EV market share to reach or come close to 10% from the April level of just under 8%. Here are 3 things that could get in the way:

Tesla Model 3 Deliveries: While Tesla has yet to reach its stated target of producing 5,000 Model 3s per week, it appears to be on track toward reaching that target in the next few months. Tesla has yet to comment specifically on this, but it appears that the company is currently optimizing deliveries of the Model 3 to Canadian reservation holders so that the company reaches the 200,000 EV sales milestone in Q3 instead of Q2. If Tesla has production issues with the Model 3 in the second half and/or delivers a high percentage of them outside of California, the current state sales growth could remain fairly flat.

Gas Prices Decline: While highly unlikely, if gas prices in the state retreated to the low $3 a gallon range, the $4 a gallon psychological effect would disappear, reducing interest in EVs among the non-green/non-early adopting demographics.

EV Supply Issues Among Several Automakers: While the media focus on Tesla issues, several OEMs have admitted to not being able to keep up with demand for their EVs or they simply have decided to limit the number produced. This includes the Chevrolet Bolt, and Hyundai IONIQ. Several other EVs are considered compliance cars and available only in California and a few other states. If demand increases for these cars, there may not be enough supply to continue fueling sales growth.

What do you think? Will California reach or come close to the magic 10% EV market share target by the end of 2018? Let me know in the comments below (comments require approval before they will post).

3 Responses

No. The growth rate just isn’t going to be that fast.

However, I think California will hit the 10% market share (nothing magic about it) in 2019.