Ford executive Jim Farley recently announced some somewhat vague electrification plans for the company’s iconic F-150 pickup, with most people interpreting the statements as to include both some form of a regular hybrid or perhaps plug-in hybrid and a pure electric BEV version.

Ford has said the hybrid will reach market in 2020, but did not announce specific timeline for a BEV version. My assumption is that the earliest a BEV F-150 could reach market would be in 2022 or 2023.

Ford global marketing chief Jim Farley told investors at the Deutsche Bank Global Automotive Conference in Detroit that plans are in the works to electrify the best-selling F-series truck.

“We’re going to be electrifying the F-Series—battery electric and hybrid,” Farley said, according to the Detroit Free Press. (Source: Motor Trend)

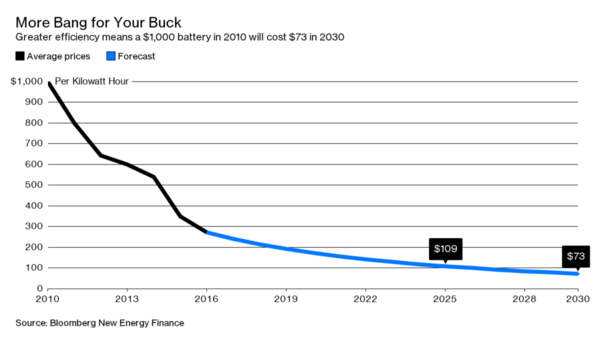

While many battery analysts predict that by around 2025 or so, the price of battery packs will reach an average of roughly $100 per kWh and the widely believed magic point of cost parity to that of the cost of an internal combustion engine. But would cost competitiveness be enough to move buyers to an electric F-150?

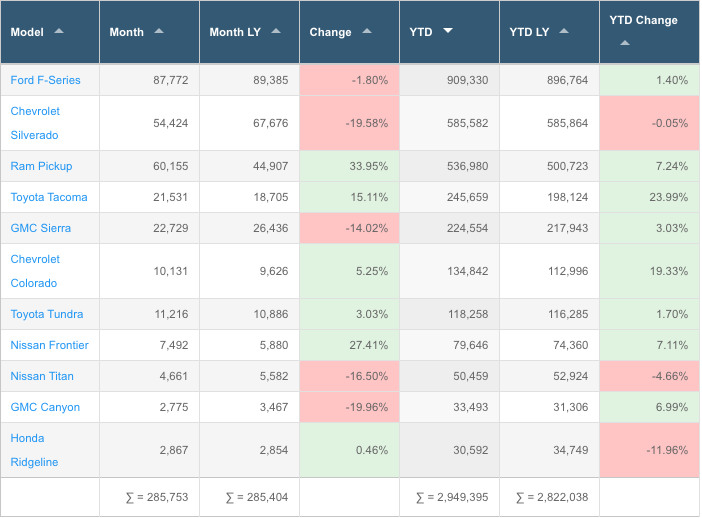

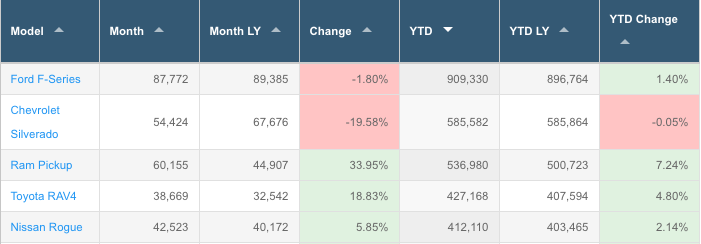

Along with the Mustang, the F-150 is the engine and franchise that drives the Ford brand and sales and revenue. In 2018, the F-150 accounted for sales of 909,000 units in the US, or 38% of vehicle sales for the company in the US.

With the iconic nature of the Ford F-150 and the demographics and psychographics of their typical buyers, even if the cost of an electric Ford F-150 was within a few thousand dollars of a comparable gas version – would buyers ready to make that switch?

I don’t believe most American pickup buyers will be ready go all electric in the next 4-5 years.

Over the next several years it doesn’t appear that Ford has any serious threats of competition for an electric pickup from GM (Chevrolet, GMC), FCA (Ram), Toyota or Nissan. New entrants including Tesla, Rivian, Bollinger, and Workhorse are all working on electric trucks, which are expected to reach US market beginning in 2020 to 2022.

But I don’t expect these trucks to seriously compete with Ford, GM and Ram. Tesla and Rivian will be attractive to high-income early adopters located in urban areas, but not mainstream truck buyers. The Rivian R1T for example has a base price of $69,000 and goes up to $100,000.

Both the Bollinger and Workhorse pickups are more specialty vehicles that will initially be of interest to contractors, fleet managers and ranchers/farmers.

Outside of the above niche markets, pickups are simply one of American consumers favorite utility vehicles, with nearly 3 million sold in the US in 2018.

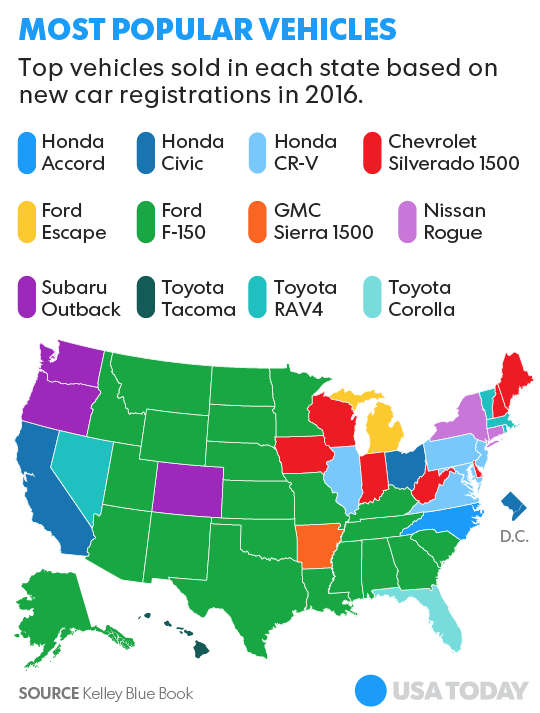

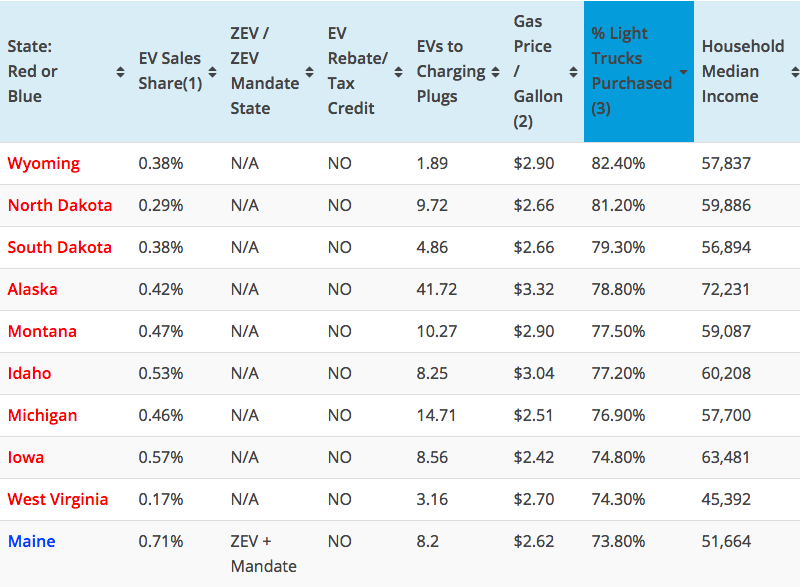

Further, at least to date, auto buyers in the states with the highest light truck purchase rate also have some of the lowest EV purchase rates. Now that is obviously partially because no electric pickups are yet available. But it also portends that markets that favor pickups will likely be some of the last ones to adopt EVs, let alone electric pickups.

Who Will Buy An Electric Pickup?

So who are the likely buyers of a BEV pickup in the US?

- Fleet managers at companies such as utilities who are looking at total cost of ownership and their company’s sustainability image.

- High-income weekend warriors located primarily on the West and East coasts. These are people who need to tow their boats or trailers loaded with personal water craft or dirt bikes and who can afford to pay a premium cost over a similar ICE truck or SUV. Driving an electric truck also sends a strong conspicuous conservation message to neighbors.

- Small business owners in construction, ranching and related industries that can take advantage of various Federal, state and utility incentives and who are attracted to lower total cost of ownership. Electric trucks that can power equipment from its battery pack will also be attractive to this group.

- Suburban households who aren’t necessarily traditional truck buyers, but like the idea of the uniqueness and utility of en electric pickup.

Who won’t be a likely initial buyer? Until electric vehicles in general are widely adopted in the high truck-buying markets in middle America, electric pickups will simply be a tough sell due to their green-leaning perception

So What Should Ford Do?

As with my recent articles (EVAdoption, CleanTechnica) offering advice to Toyota executives on what to do with the Prius, I don’t expect Ford to seriously consider my recommendations, but here are a few thoughts anyway:

Launch a Commercial Work Truck With a New Brand: Ford has several models of commercial work trucks and vans and should consider either a sub brand, similar to the Ford Transit brand for small delivery vans, or an entirely new truck brand similar to FCA’s Ram truck brand that was launched in 2010.

A new work truck brand that also had electric versions would appeal to fleet managers and other buyers who are focused on total cost of ownership. This approach also does not dilute the F-150 brand and allows Ford the opportunity to lead in a new market of electric work trucks and benefit from the platform development and learnings.

Launch a Lincoln Pickup: Secondly, Ford might leverage the above EV pickup platform for commercial trucks and create a new electric luxury Lincoln pickup. A Lincoln model would directly compete with the Tesla and Rivian trucks for the high-end luxury performance truck buyer. This would enable Ford to test and learn with higher-income, early adopters located on the coasts before eventually rolling out an electric truck for consumers under the Ford brand.

Ford last sold a Lincoln pickup, the Mark LT, in 2008 which sold 12,000 units in 2016, according to AutoTrader. And while 12,000 units today sounds unimpressive, if electric that volume could make it the 9th highest selling EV. A Lincoln electric pickup could be a failure, but it wouldn’t hurt the Lincoln brand, whereas a misstep with an electric F-150 could create opportunities for competitors such as Ram.

Launch an Electric Ford Ranger: Ford re-introduced the Ranger in 2019, its mid-sized pickup that was previously sold in the US and Canada until 2011. Ford should consider first launching a BEV version of the Ranger as the mid-sized pickup market is currently a fast growing segment and these pickups likely appeal more to the urban/suburban buyers than the larger F-150. An electric version would also provide some further differentiation against competitors like the Toyota Tacoma and Chevrolet Colorado/GMC Canyon. Finally, with Ram trucks growing in popularity and perhaps stealing some of the F-150’s “toughest truck” brand image perception, first launching a BEV Ranger instead of the F-150 reduces the risk of damaging the F-150 brand franchise.

Launch a PHEV version of the F-150: Before delivering an all electric BEV F-150, Ford might consider first launching a PHEV version. With a PHEV version, Ford could appeal to the typical pickup owner who uses a pickup as a utility vehicle and in this case benefit from the onboard electrical power.

With a large enough battery pack powering an onboard generator, owners could power and charge tools, camping equipment, and TVs at tailgate parties. A PHEV could enable normal driving around town or short trips on electric-only power but then enable drivers to use the gas engine for long 300-400 mile trips with the comfort of knowing they can refill in remote areas that lack charging stations.

This combination could help maintain the F-150’s rugged, tough truck image but also expand its functionality with a dual-purpose battery pack. And then once battery prices are low enough and EV‘s are more widely adopted in middle America, Ford can launch a BEV F-150 or create an entirely new electric pick up model.

What do you think? Let me know in the comments.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →

2 Responses

Why not a 50-75 mile range PHEV. Gets the tax credit, will handle all the day to day running around in EV mode. Has the ICE muscle to pull the boat, travel trailer, etc. on weekends, vacations, etc.

I would save a bunch by being rid of one vehicle and the extra acquisition cost of the PHEV would soon be mitigated by less per mile cost and not having to pay for a commuter BEV.

Completely agree. I think 50-75 mile PHEVs could be a great compromise, especially for the often conservative truck-buying market.