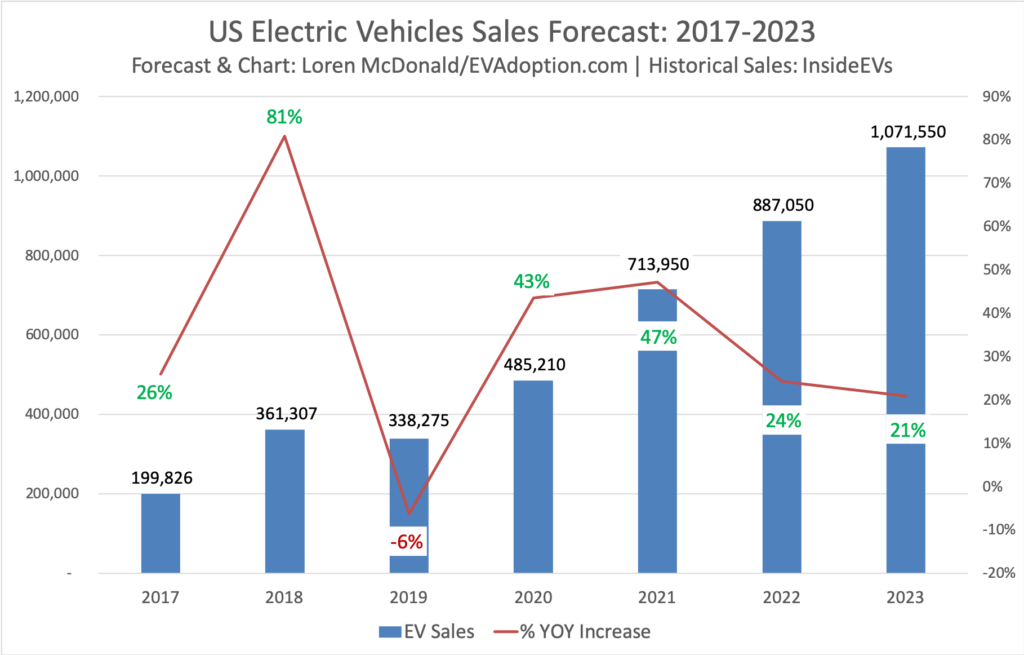

Electric vehicle sales in the US are basically flat, but are poised to regain strong year-over-year growth in the next few years. The key questions are: When?, and Which EVs will be the top sellers?

Current US EV Sales Have Hit the Doldrums

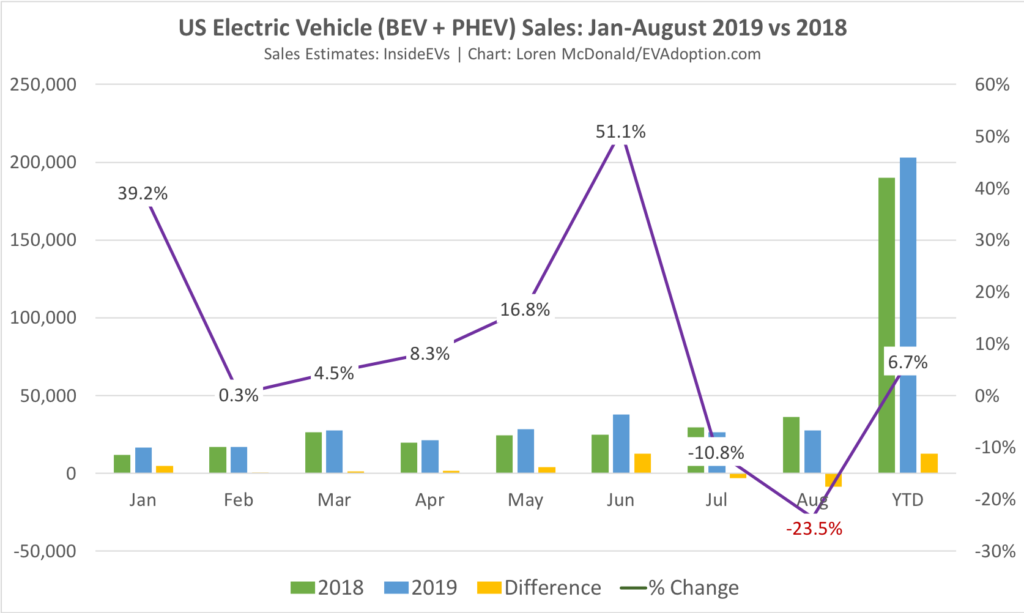

Using initial InsideEVs Sales Scorecard estimates through August, plus my own estimates, US EV sales are down ~24% YOY for August and up ~7% YTD. YOY sales are down ~8,500 units, while sales of the Tesla Model 3 are down an estimated ~4,650 units. In January I predicted 12% YOY sales increase in 2019, but unless sales of the Tesla Model 3 absolutely crush it in the remaining 3+ months, 2019 could potentially see a decline in YOY sales.

In fact, I’ve recently updated my near-term forecast for the US and now project that EV sales could decline 6% YOY, even with very strong sales of the Model 3.

Beyond the Tesla Model 3 there simply isn’t another electric vehicle that is selling in consistent high volume. No vehicle other than the Model 3 is averaging at least 2,000 units per month. YTD, the Model 3 is averaging an estimated 11,781 units per month, versus 1,757 for the Toyota Prius Prime, Tesla Model X at 1,506, Chevrolet Bolt at an estimated 1,345. The once top-selling Nissan LEAF is now averaging sales of only about 1,000 units per month.

According to GoodCarBadCar’s year end 2018 ranking, the Tesla Model 3 was the 35th best-selling vehicle in the US. The next highest standalone EVs (meaning not on a shared platform) were the Tesla Model S and X at #129 and #137 respectively. The Chevrolet Volt, which GM has discontinued, came in at #163 and the Chevrolet Bolt at #165.

To break into the top 50 in sales in 2018, an electric vehicle would have needed to sell approximately 104,000 units or an average of 8,667 units per month.

Other than the Tesla Model 3, there is currently no other EV anywhere close to this kind of volume. The US clearly needs several new high-volume, long-range, and “affordable” EVs to reinvigorate the market.

But when will they arrive?

Defining “Breakout”

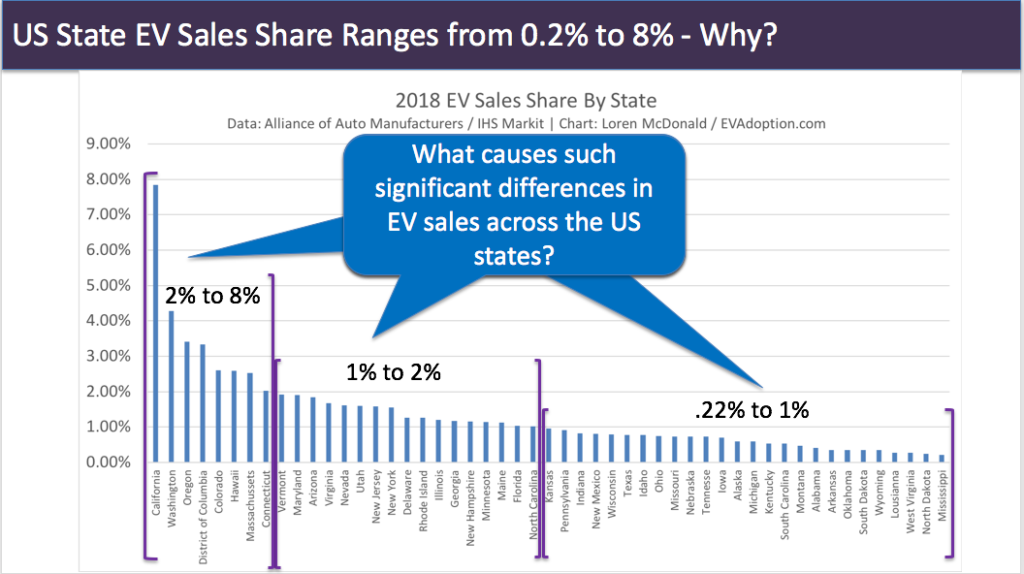

What do I actually mean by “breakout” year? To be clear, what I DON’T mean is that EV sales in the US will “cross the chasm” or reach 16% of total new vehicle sales. What I do mean is that for the first time in the US we will see several specific indicators that point to significant EV sales beginning to occur outside of California, Tesla, and upper-income ealy-adopting segments.

The following are rather arbitrary metrics, but to me they will indicate that EV sales are starting to show signs of moving towards mainstream adoption:

- A majority of states have a new EV sales share of near or above 2%: Through the first 6 months of 2019, 12 states had an EV market share of at least 2%. This is up from 8 states with more than 2% share for all of 2018. Reaching say half – roughly 25 states – at or above 2%, I believe would be a strong sign that EV sales were starting to go beyond just the early-adopting states.

- Two automakers other than Tesla have an EV with at least 30,000 in annual sales. Since 2010, only two EVs have exceeded the 30,000 mark: the Nissan LEAF in 2014 and the Tesla Model 3 in 2018 and 2019. Three different automakers achieving that milestone would show the market is clearly expanding beyond a single current “hot EV.”

- Five EVs have annual sales of at least 25,000 units and three of those exceed 50,000 units.

EV Models Likely to Drive the 2021 Breakout

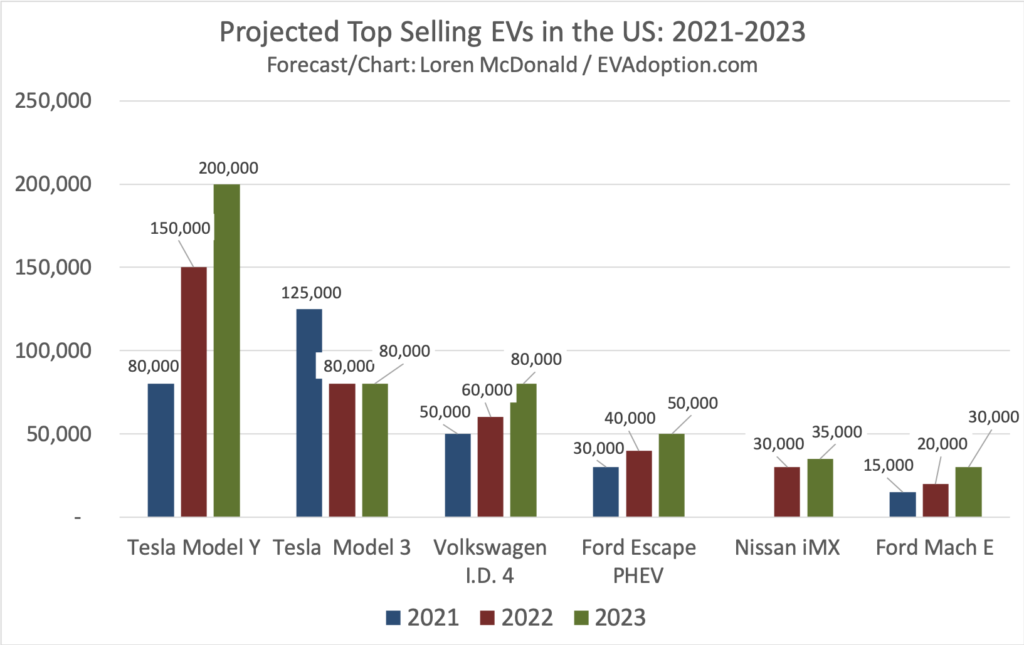

So with all of that said, which EV models will likely be the top sellers in 2021 and 2022 and drive the EV sales back to a significant rate of growth? Following are my leading candidates.:

Tesla Model Y: With the huge popularity of crossovers (CUVs), the Tesla Model Y is poised to potentially significantly outsell its sister, the Model 3 sedan. While the vehicles will be quite similar in virtually all respects, the Model Y is expected ride higher and have much more interior room than the Model 3. It is also expected to cost a bit more, but if priced within a few thousand dollars of the Model 3, the slightly higher cost should not significantly impact sales. Many EV buyers, myself included, were intrigued by the Model 3, but would rather wait for the CUV form factor of the Model Y.

- Expected Availability: Late 2020/early 2021. Knowing how Tesla usually misses promised deadlines, the Model Y might realistically become widely available in early 2021. On the positive side, the Model Y will is expected to share 76% of the same parts as the Model 3, which should help scale up volume production.

- Forecast Annual Sales Volume in:

- 2021: 80,000

- 2022: 150,000

- 2023: 200,000

Volkswagen I.D. 4: Formerly called the I.D. Crozz, the VW I.D. 4 built on the new MEB platform is expected to be a big seller in the US. The Tiguan, Volkswagen’s small SUV was its top-selling vehicle in the US in 2018, with 103,000 units sold, more than doubling its sales in 2017, according to GoodCarBadCar. This shows that there is a strong appetite for a small SUV/CUV from Volkswagen and that VW dealers know how to sell these vehicles. With VW going all in on BEVs, I expect VW dealers to be well trained and to aggressively push the I.D. 4 when it becomes available. Sales of VW’s short-range eGolf has been growing steadily and significantly (150 in January versus 689 in August) which portends that VW dealers are learning how to sell electric vehicles.

- Expected Availability: News reports suggest that the I.D. 4 might be available in the US in the fall of 2020. Assuming it takes a few months for sales to gear up it should start to see strong sales in Q1 or Q2 of 2021.

- Forecast Annual Sales Volume in:

- 2021: 50,000

- 2022: 60,000

- 2023: 80,000

Tesla Model 3: The Model 3 has been the breakthrough EV the US market has needed. In 2018, the sedan sold nearly 140,000 units (estimates by InsideEVs) – 112,000 more than the number 2 selling EV, the Toyota Prius Prime. But by 2022 and with the launch of the Model Y, I expect sales of the Model 3 to drop pretty significantly. A large percentage of sales that would have gone to the Model 3, will likely shift instead to the Model Y.

- Expected Availability: Available since 2017.

- Forecast Annual Sales Volume in:

- 2021: 125,000

- 2022: 80,000

- 2023: 80,000

Ford Escape PHEV: Several years ago the Ford Escape hybrid was a strong seller, which portends well for the newly designed Escape – and available as a PHEV. Small SUVs/CIVs are the hottest vehicle segment in the US and a competitively-priced Escape PHEV could be a very strong seller.

- Expected Availability: The latest availability via the Ford website is “spring of 2020.” This could mean anywhere from March to May.

- Forecast Annual Sales Volume in:

- 2021: 30,000

- 2022: 40,000

- 2023: 50,000

Ford “Mach E”: The upcoming “Mustang-inspired” Ford SUV/CUV has very strong sales potential with its promised 300 miles of range and high-performance capabilities. Assuming it does have at or near 300 miles of range and great performance, the key determinant of sales volume will be if Ford prices the BEV competitively and whether Ford dealers get behind it and know how to sell it.

- Expected Availability: Late 2020/Early 2021. Virtually every EV announced (except for the Chevrolet Bolt) in recent years has reached dealers at least a quarter later than planned. While rumors have the Ford CUV reaching dealers in late 2020, I expect that it may not reach wide availability until at least Q1 2021 or possibly later.

- Forecast Annual Sales Volume in:

- 2021: 15,000

- 2022: 20,000

- 2023: 30,000

Other Models That Should Sell Well, But Not In Huge Volumes

There are several new electric vehicles coming to market in the next three years that should sell fairly well by EV sales standards – in the 800-2,000 per month range. Because of their price point, model/class type or other factors. These include (but are not limited to) Tesla Model P, Rivian RT1, BMW iX3, Volvo XC40, and Mercedes-Benz EQC. For existing EVs, an updated Chevrolet Bolt should do OK as well as the Nissan LEAF. If Hyundai actually make the Kona EV available nationwide and in volume, it could move out of the category of underachievers.

Final Thoughts

Projecting which EVs will be big sellers is a huge crapshoot. I had expected both the Hyundai Kona EV and Kia Niro BEV to sell in the 1,500 per month range, but both have sold in the 100+/- range per month in 2019. It turns out that both companies did not have adequate supply of battery packs (for whatever reason) and only made the models available in a few states.

By the same token, how will US consumers respond to an electric crossover from VW. Will the Ford Mach E CUV excite consumers, or will they instead opt for a Tesla or stick with a gas model? And if Ford doesn’t price the Escape PHEV competitively, it might only sell a few hundred per month instead of a few thousand. Fingers crossed that these EVs sell well!

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →