On February 14, Rivian, the electric pickup and SUV startup, announced a $700 million investment round that was led by ecommerce and cloud services giant Amazon. The amount of Amazon’s investment was not made public, but Rivian confirmed to Green Car Reports that Amazon “is a significant majority of this round.”

Earlier in the week Reuters reported that GM was also a potential investor in Rivian, but the company has been vague in their public statements that seem to confirm that it did not participate in the investment.

“We’re inspired by Rivian’s vision for the future of electric transportation,” Jeff Wilke, CEO of Amazon’s worldwide consumer division, said in a statement. “RJ has built an impressive organization, with a product portfolio and technology to match. We’re thrilled to invest in such an innovative company.”

So why would Amazon invest in an EV startup? The above statement from Amazon didn’t shed much light, so we can only speculate.

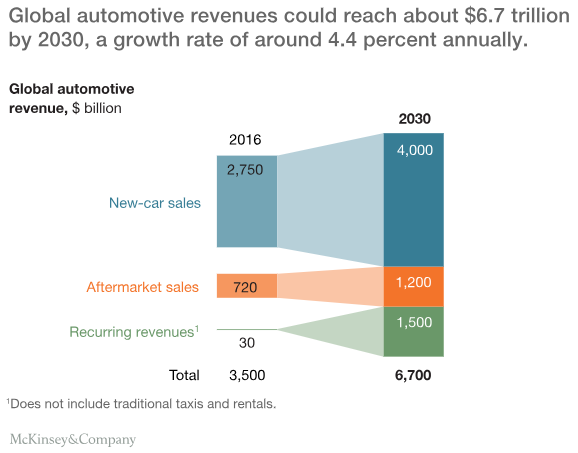

Several analysts have suggested that Amazon’s interest in Rivian is to build an electric delivery vehicle using the EV startups powertrain as a platform. While I think that is part of the benefit of Amazon’s investment, I think the company has much grander plans. Amazon is already one of the world’s largest companies and is dominating retail, ecommerce and web services. How does it continue to achieve huge growth rates? The automotive industry is one of the most logical remaining industries ripe for Amazon to disrupt and dominate.

Overall my belief is that Amazon, the world’s largest retailer and ecommerce company, will use the Rivian investment as a means to enter the global automative sales and service business to test, learn and eventually reinvent and dominate this massive industry. Sales of automotive parts and new and used cars, white-glove delivery, and mobile repair services present trillion dollar business opportunities for Amazon.

Following are my thoughts on the possible benefits to both companies as a result of Amazon’s huge investment in Rivian:

1. Online and Physical Showroom/Sales Centers: Amazon’s Consumer division is all about ecommerce and increasingly physical store commerce through stores such as Whole Foods and Amazon Go. Rivian, like Tesla, is planning a direct sales model but to also partner in markets which require vehicles be sold through a dealer.

Rivian will likely open showrooms in several key markets, but to keep costs down it could heavily rely on selling direct via an online store and Amazon’s expertise and technology. With a combination of an online store and a physical presence in key markets, Amazon may be looking at Rivian as a test case to reinvent automobile sales.

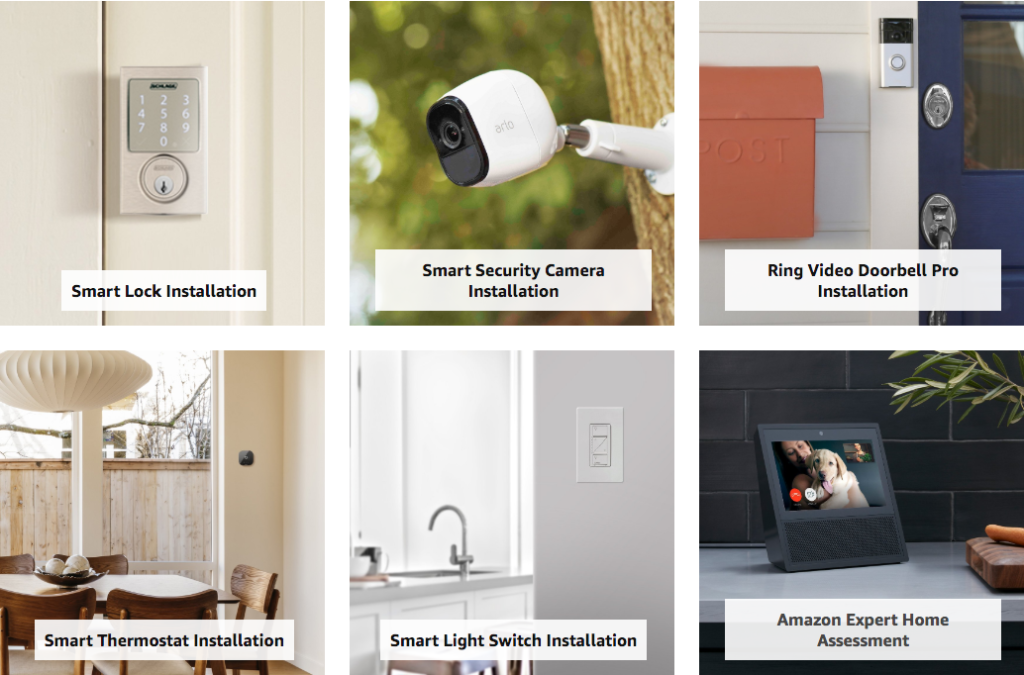

2. White-Glove Delivery: As I wrote in How Google, Apple and Amazon May Participate in the EV Charging Market Opportunity, Amazon has already entered the home technology services market though its Amazon Home Services offering and has partnered with Audi for EV charging installation services.

Rivian could leverage Amazon’s Home Services team to deliver new models to buyer’s homes, finish paperwork, educate owners on features and charging, set up devices and garage openers, and install EV charging stations if needed. This approach combined with relying heavily on an online store and purchase process would save Rivian significant capital and expenses that stores and delivery centers would require.

3. Deeper Alexa Integration: Amazon has been working with several automakers, including Audi, Ford, Lexus, Lincoln, Seat and Toyota, the last few years to incorporate the Alexa voice assistant capabilities into their vehicle’s navigation, media, entertainment and climate control systems.

While Alexa Auto has already built some impressive functionality into vehicles, with Amazon’s investment in Rivian they can likely work even closer with that companies engineering team to design and integrate capabilities more deeply into the R1T and R1S. Those learnings could then be leveraged and sold to other OEMs.

4. Custom Electric Delivery Vans: Much of the press coverage around Amazon’s investment has focused on the idea that Rivian wants to leverage the company’s R1T pickup as a delivery truck. I don’t really see it, at least with its current design. The truck is too expensive and not designed for cargo and easy driver access to packages. There are also several better electric delivery van options available currently or in the next year or so, including from Chanje, Workhorse and Mercedes-Benz.

Additionally, Amazon placed an order in 2018 for 20,000 gas-powered Mercedes-Benz Sprinter delivery vans. Unless, Amazon cancels that order or modifies it to be for electric versions, they would appear to be pretty set. With those factors in mind, four options seem possible:

- Rivian supplies the powertrains to Mercedes-Benz for an electric version of the Sprinter, and Amazon and M-B modify the order.

- Rivian produces their own custom delivery van, starting with orders from Amazon. Rivian might build their own van body, or partner with a company like Morgan Corporation or US Truck Body to produce the for the Rivian powertrain and chassis.

- Rivian could produce a stripped down version of its R1T pickup and add its own or third party cargo body, such as the one below from Supreme.

- A bit further adrift, Amazon has partnered with Toyota on a self-driving delivery and passenger-carrying van called e-Palette. Unlikely perhaps, but Amazon could broker the relationship to have Rivian provide Toyota the powertrain for the e-Palette.

5. Mobile Auto Service: Tesla is already beginning to reinvent auto service with its mobile repair/service and portends a future shift toward more of a Geek Squad approach to home repair for the entire auto industry. This makes growing sense as cars increasingly become technology products and combinations of hardware and software. As mentioned earlier, Amazon has already launched its Home Services division that will install EV charging stations in addition to televisions, home security, energy management and other smart home products.

Rivian will need to establish a way to service its vehicles and a mobile service approach deployed via Amazon would be a win win. Amazon could use the partnership with Rivian to build out the mobile repair and service business on a small scale, figure out the model and perfect it before rolling it out to other manufacturers and disrupting the non-dealer auto repair market.

6. Autonomous Trucks: Drones deployed from roving delivery vehicles and autonomous trucks portend to be a huge opportunity to reduce delivery costs for Amazon in the future. According to this CNBC article, Amazon’s delivery costs exceeded $27 billion in 2018.

Amazon was recently part of a $530 million investment round (Amazon’s share was undisclosed) in Aurora, a self-driving technology start-up. With significant ownership stakes in both Aurora and Rivian it makes sense for Rivian to leverage Aurora’s technology in its vehicles in the future. Secondly, it then makes even greater sense for Amazon to have Rivian produce custom delivery vans which over time leverage Aurora’s self-driving technology.

7. Ride-Hailing/Car-Sharing/Delivery Services: Perhaps a huge wildcard, but I would not be shocked to see Amazon enter the ride-hailing and car-sharing business. Amazon is fundamentally a logistics and delivery company that now also has physical locations with Whole Foods and Amazon Go. The company is also in the food delivery business with Amazon Fresh and Amazon Restaurants.

If Rivian was able to produce a lower-cost version of its pickup or SUV, these could be part of an Amazon ride-hailing, food and package delivery services model. Drivers could rent or lease an electric truck or van from Amazon (this would require having to be licensed commercial drivers and not freelance gig workers) or through a financing partner and deliver people, food, restaurant meals and packages based on routes and schedules optimized by Amazon’s logistics software across the different businesses.

Amazon wouldn’t need Rivian vehicles to enable this concept of course, but specially-designed Rivian vehicles optimized for carrying people, food and packages driven by gig workers could help Amazon reduce its high delivery costs.

Final Thoughts

Amazon and Rivian have not hinted at the rationale and strategy behind the investment, but I believe the two companies saw multiple potential synergies in working together. Fundamentally, Rivian provides Amazon with a laboratory test environment to reinvent auto sales and service, voice-based auto interactivity and controls, ride-hailing, car-sharing and delivery services, and more. And besides a significant investment to scale the company, Rivian gets a partner that can open new market opportunities and reduce the need for costly sales and service centers.

Based on estimated future sales, by 2022 Rivian could see sales of as much as $3 billion. If the company was to subsequently file an IPO, it could be valued at tens of billions, providing a great return for Amazon’s investment. On the other hand, the investment is highly risky as Tesla, Ford, GM and others will all soon enter the electric pickup segment and many electric SUVs exist or are reaching market in the next few years.

What do you think? What did I miss or what do you think is Amazon’s most strategic intent in investing in Rivian?

Related Articles/Information:h

- Rivian Announces $700M Investment Round Led By Amazon – Rivian Press release, February 15, 2019

- Musk-Like or Not, This 36-Year-Old CEO Has Amazon Riding Shotgun – Bloomberg, February 15, 2019

- Amazon invests in startup building electric pickup trucks and SUVs – The Verge, February 15, 2019

- Two ways GM and Amazon can make money on Rivian’s electric pickup – CNBC, February 13, 2019

- Prime time: Amazon invests in electric-truck hopeful Rivian – Green Car Reports, February 15, 2019

- How Google, Apple and Amazon May Participate in the EV Charging Market Opportunity – EVAdoption, December 29, 201

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →