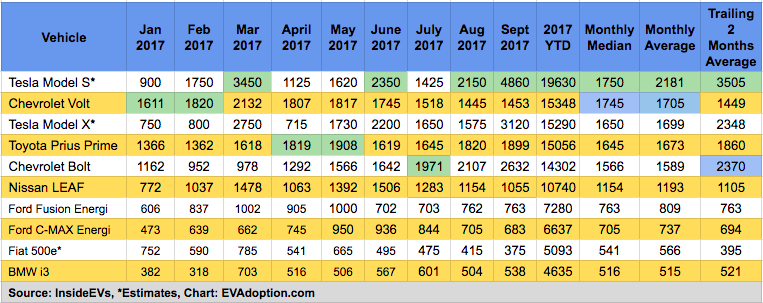

After 9 months of 2017 US electric vehicle sales, a few key trends – such as the growing sales of the Chevrolet Bolt – have come into clear focus.

Trend 1 – Chevrolet Bolt Sales Continue to Grow: The Bolt saw its best month ever in September with 2,632 units sold, a nearly 127% increase over January and a significant 25% increase over August sales.

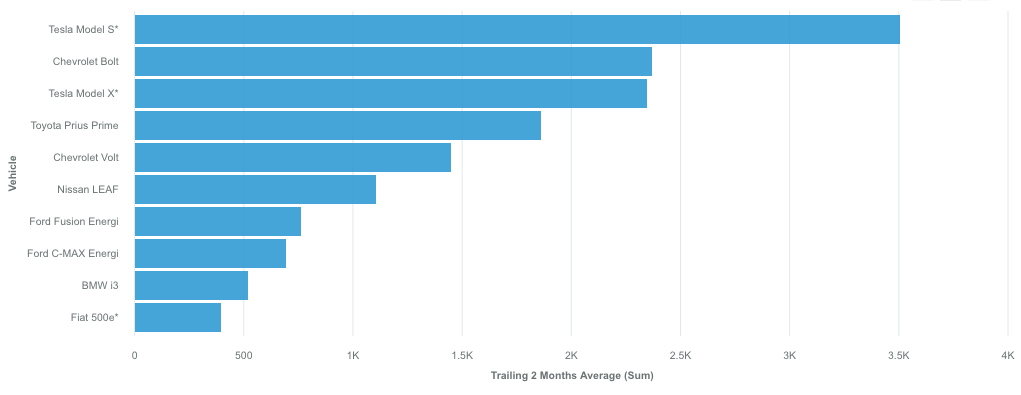

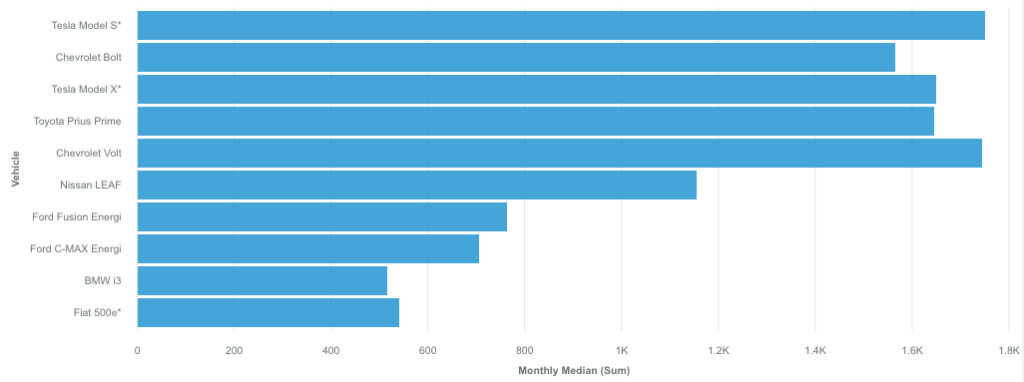

Excluding the Tesla Models S and X, the Bolt’s trailing 2 month sales average of 2,370 units put it 510 units ahead of the Toyota Prius Prime.

Trend 2 – Tesla Model S and X Sales Remain Strong: September sales for the S with 4,860 units was its second best month ever (December 2016 was highest with 5,850 units). And X sales were its 3rd highest ever with 3,120 units sold. Tesla sales generally spike in the last month of a quarter driven by aggressive sales quotas and September was no different.

Tesla’s decision to eliminate the rear wheel drive 75 kWh Model S and consumer concerns about delays in Model 3 production also may have contributed to the huge uptick in September sales. Strong showing of the Model X is harder to pinpoint, but could simply be the market’s recognition that there still is not another pure electric SUV/crossover available in the US.

Trend 3 – Chevrolet Volt Sales Continue to Fall: In the first quarter of 2017, the Volt sold well with the highest unit sales of any EV in the US for January and February, and the highest non Tesla model in March. Since the March peak at 2,132, however, Volt sales have either been flat or declining and now sit at a trailing 2 months average of only 1,449. That puts the Volt in 5th place, well behind the Toyota Prius Prime and Chevy Bolt, but 400 units ahead of the Nissan LEAF.

While currently in 2nd place for YTD sales in 2017, it is likely that in October or November the Model X, Prius Prime and Bolt will all surpass the Volt in YTD sales. It is likely that many potential Volt buyers are gravitating toward the near 240 mile range of the Bolt and its hatchback, crossover-like form factor – as well as declining fears of range anxiety.

Rumors suggest that GM will replace the sedan version of the Volt with a plug-in hybrid crossover, perhaps in 2020. The Volt has a quadruple threat working against it, however:

- Its sister EV the Bolt costs only a few thousand dollars more and if you factor in the respective Federal tax credit amounts for each, the two Chevrolet’s are basically a wash.

- The Volt’s advantage has been its combined electric/gas range of up to 410 miles on one tank and charge. That was a huge advantage when most of its BEV competitors like the Ford Focus, Fiat 500e and Nissan LEAF had a range of only around 100 miles. But the Bolt’s 238 miles of range will meet the needs of most consumers about 98% or so of the time – negating the Volt’s huge advantage.

- Sales of sedans continue to decline with consumers favoring SUVs, crossovers and pickups.

- While PHEV models will continue to play an important role in the transition to pure BEVs, consumers appear to becoming increasingly more comfortable with BEVs.

The Volt shouldn’t be discontinued, but perhaps GM should reduce its price in an attempt to increase sales and jump back ahead of the Prius Prime. The risk there would of course be that it could take away some sales from the more strategically important Bolt.

More significantly, however, GM needs to move more quickly on converting the Volt to a crossover version. The risk with that move however is that it might to too little too late. With GM apparently planning to launch a Buick-branded BEV crossover built on the Bolt platform, and with perhaps a longer-range (250-275 miles?) due to improved battery technology, there could be little demand for a Volt PHEV crossover in 2020.

Trend 4 – Have Prius Prime Sales Peaked?: September’s 1,899 units sold was only 9 short of the Prius Prime’s 2017 high of 1,908, but the PHEV seems to be stuck in a range of 1,600-1,900 units since March. Prius Prime sales volume remains strong and the PHEV will likely end the year in 3rd or 4th place in total sales. But the Prime has fallen 500 units behind the Bolt, which is seeing continuous growth.

The Bolt could be gradually replacing the regular Prius hybrid as America’s favorite affordable green car, which leads to fewer consumers opting to move up to the Prius Prime PHEV. On the positive side, however, is a clear trend away from hybrids to PHEVs and BEVs. With all of the recent press around manufacturers moving toward electrification, we could see a huge shift of Prius buyers to the Prime instead of the core hybrid. The coming months will be fun to watch in this area.

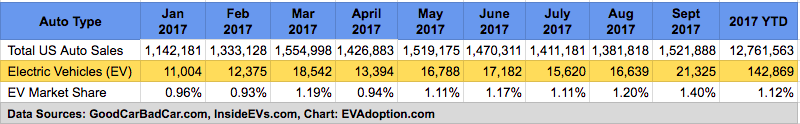

Trend 5 – EV Sales Reach Highest Percentage of Total Auto Sales: Strong EV sales in September pushed their percentage to a historical high of 1.40% of total US auto sales. While naysayers might argue accurately that this is still a tiny percentage of auto sales, it also means that we could reach 2% by the end of 2018. And then EVs are off to the races.

September’s EV sales volume of 21,325 is the second highest ever after December 2016’s 24,785. In recent years, December has far and away been the highest volume months for EV sales. As a result, we might see a decline in EV sales in October and November and then a big jump back up in December.

I estimate ending 2017 at around 203,000 EVs sold, which would be an increase of 28% over the 158,614 units sold in the US in 2016. Reaching 2% of sales in a month by the end of 2018 should be easily in reach with the Model 3 production scaling in 2018, the new Nissan LEAF and Jaguar I-PACE reaching the market as well as a possible BMW electric 3 series model and EVs from Kia, Hyundai, Suburu and others.

Note: EV sales data via InsideEVs Monthly Plug-In Sales Scorecard