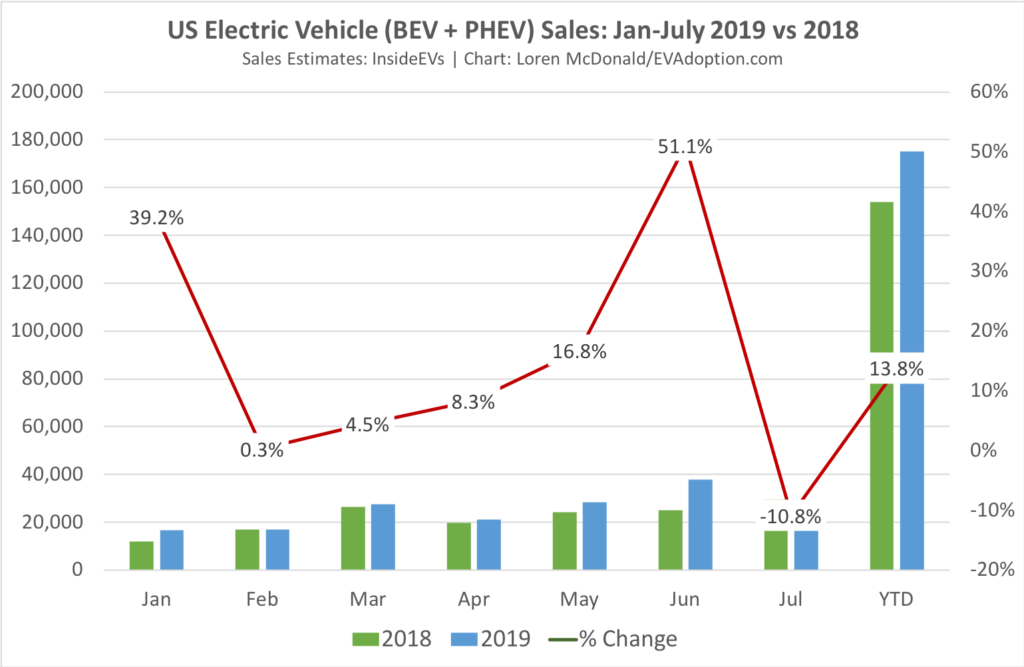

US electric vehicle sales continue to be driven primarily by the Tesla Model 3. Sales for July actually declined 10.8% in 2019 versus July 2018. Sales estimates from the InsideEVs Sales Scorecard for July were 26,395 in 2019, a decline of 3,203 units from 29,598 in 2018.

On the positive side, however, YTD, sales were up 13.8% driven by increasing sales of the Tesla Model 3. So far in 2019, monthly YOY sales have been on quite a rollercoaster ride, ranging from a June high 51.1% increase over June of 2018, to July’s decrease of 10.8%.

This up and down sales growth should likely fall into a tighter range the rest of 2019 as Model 3 sales will likely track more closely to its sales levels in the second half of 2018. Though matching the 22,000+ and 25,000+ sales volume for September and December respectively, could be a tall order.

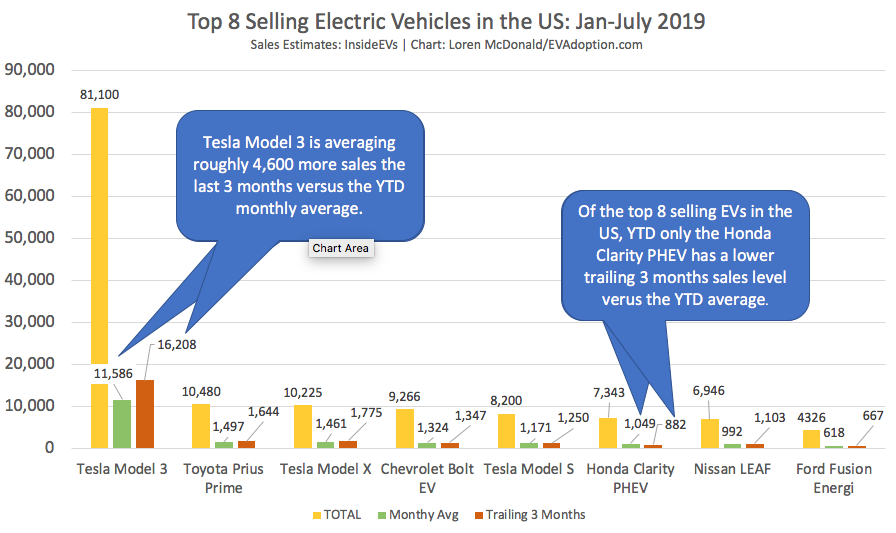

Top 8 Selling EVs in the US

Of the top 8 selling EVs in the US, YTD only the Honda Clarity PHEV has a lower trailing 3 months sales level versus the YTD average. The Tesla Model 3, however, is averaging roughly 4,600 more sales the last 3 months versus the YTD monthly average.

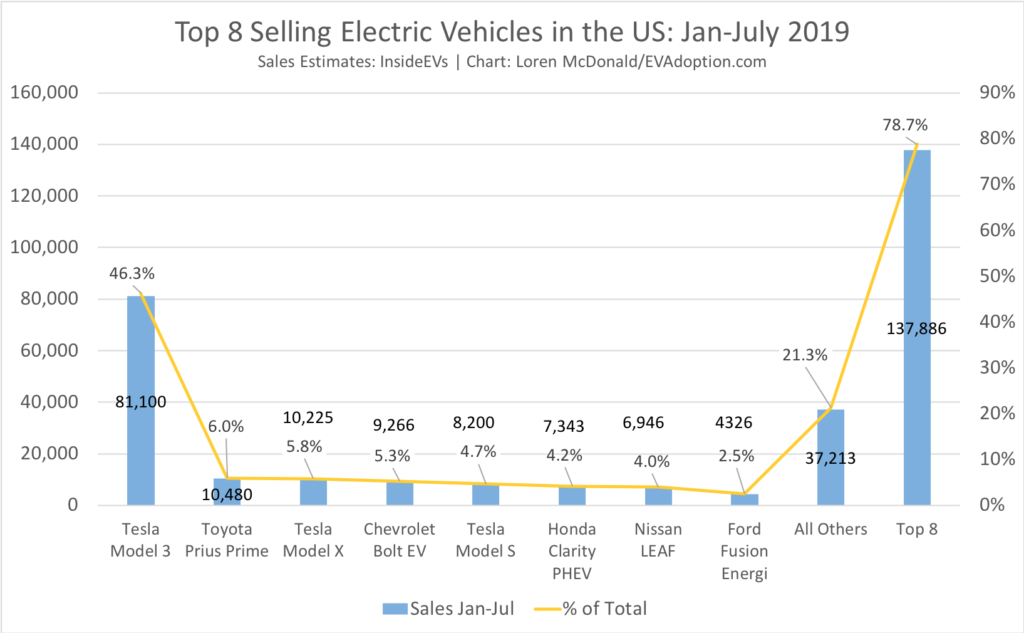

Eight vehicles, or 18.6% of the total 43 currently available EVs in the US, account for nearly than 79% of all EV sales YTD in 2019. This 80/20 trend, also known as the Pareto Principle, has been a consistent pattern for years with a few EV models accounting for the majority of EV sales.

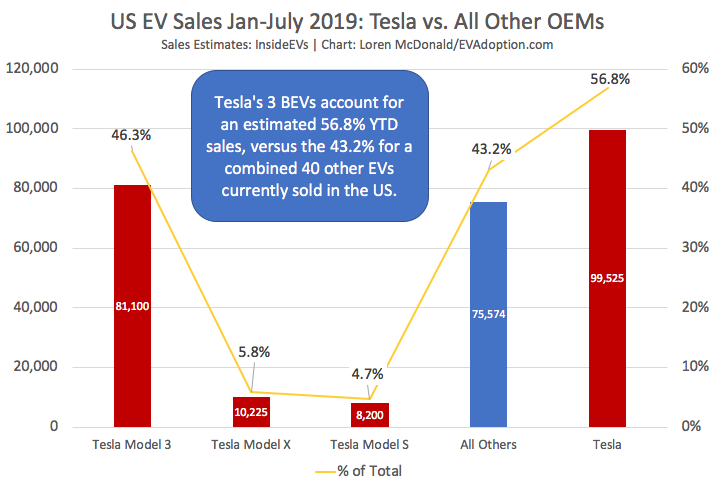

Tesla Continues Its US Dominance

Sales of Tesla models continue to dominate the electric vehicle market in the US with the company’s three BEVs accounting for nearly 57% of all EV sales. This market share dominance is pretty impressive when you consider there are 40 other EVs that comprise the other 43% of sales. This is of course due mostly to the continuing strong sales of the Model 3. However, year to date, the Model S and X have combined for an estimated 10.5% of the US market.

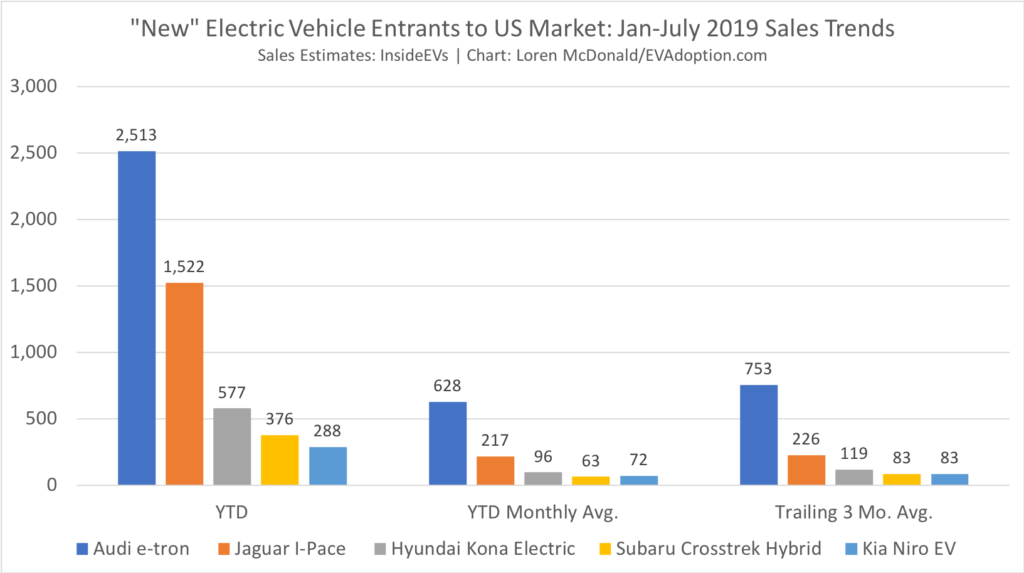

How Are the Recent EV Entrants to the US Market Selling?

While still early, only the Audi e-tron is seeing any significant sales volume averaging around 750 units per month for May through July. The Hyundai Kona and Kia Niro BEVs remain poor sellers, though likely due to lack of supply rather than weak consumer interest.

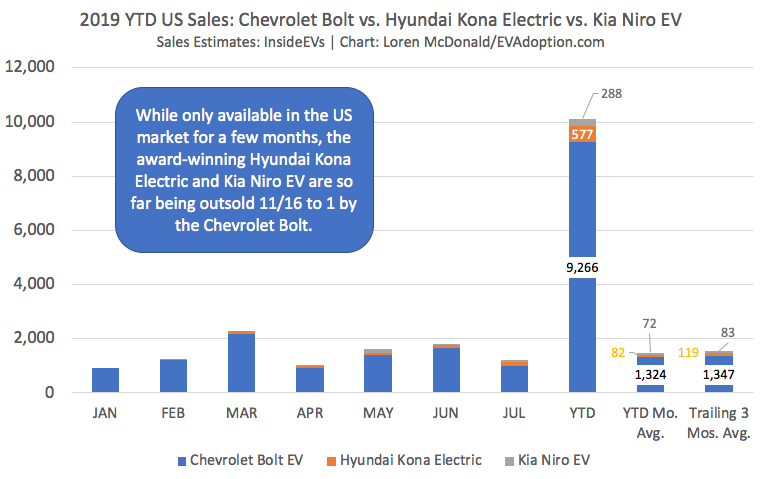

Chevrolet Bolt vs. Hyundai Kona Electric vs. Kia Niro EV

While only available in the US market for a few months, the award-winning Hyundai Kona Electric and Kia Niro EV are so far being outsold 11 and 16 (respectively) to 1 by the Chevrolet Bolt. Why? Supply. The Kona and Niro BEVs should be outselling the Bolt, but Hyundai/Kia simply have not made their BEVs widely available.

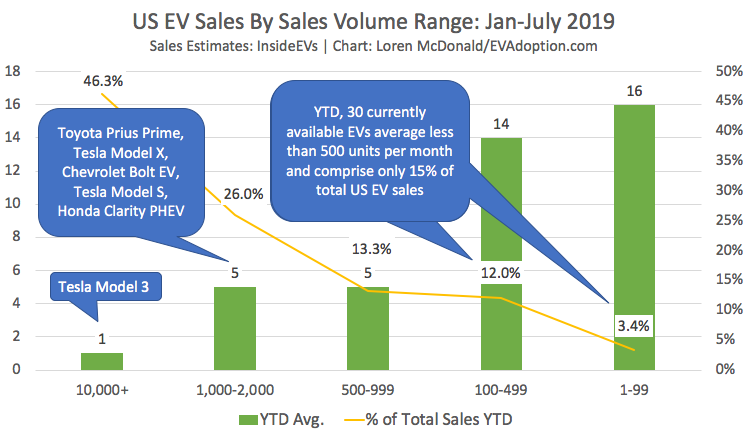

US EV Sales By Sales Volume Range: Jan-July 2019

YTD, 30 EVs currently available in the US average less than 500 units per month and comprise only 15% of total US EV sales. 16 of those average less than 100 units per month. Those numbers make you wonder why an automaker even continues to sell those vehicles, unless the primary purpose is simply to gain electric vehicle manufacturing and sales experience?

The problem in the US is not that consumers do not want electric vehicles. As the success of the Tesla Model 3 has proven, if an EV has adequate range, convenient and ample access to fast charging stations, and is priced competitively – consumers will buy an EV in significant volume.

Unfortunately for US consumers, in recent years only two automakers have been serious about selling electric vehicles – Tesla of course, and to a lesser extent General Motors. But with GM discontinuing sales of its popular and well-received Chevrolet Volt PHEV, and doing nothing to make the Bolt more competitive – it has left Tesla as the only automaker that is truly serious about trying to sell electric vehicles in the US.

We can only hope that Ford’s unnamed “Mustang-inspired” crossover and Volkswagen’s I.D. CROZZ will be competitive with the Tesla Model Y – and finally produce some serious competition in a few years and more than one high-volume selling EV in the US.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →

4 Responses

Why the weak US sales? Is the Model 3 losing its desire in the US PEV market? I have long suspected US sales would rise and fall with the Model 3. The US PEV market is, in fact, less of a PEV Market and more of a singe popular PEV model.

Zander, So I pretty much cover this in the article, but right now sales of EVs in the US rise and fall based on the Model 3. But when comparing YOY, the ups and downs are completely misleading as Tesla’s production in 2018 was quite erratic. So you can’t draw too much meaning from the YOY numbers for the Model 3 until we see can compare to a previous year’s consistent production. You also had the issue of Tesla shifting much of their production early in 2019 for international markets.

The bigger issue is looking at the Tesla Model 3 YOY sales versus all other EVs. The Model 3 is up 113% YOY, will all other EVs are down 18.8%. While it is impossible to know, much of the decline in sales of non-Model 3 EVs is likely simply due to many buyers choosing the Model 3 instead. But the bigger problem we have with EV sales in the US is as you point out – we are a one-model market at the moment.

As I wrote in this article – https://evadoption.com/new-ev-models-responsible-for-nearly-all-annual-us-ev-sales-growth-new-analysis/ – the US market is a “hit-driven” market. New EVs drive YOY growth. Without more high-volume selling EVs, the US market will see only modest growth and be driven by the Model 3 … until the Model Y, VW ID CROZZ, etc come to market.

The Model 3 has set the bar. If other automakers want to compete, they need to provide comparable price, quality, range, and fast charging. Further, as Tesla scale ramps up and the more simple manufacturing process for EVs becomes apparent, it’s ability to produce compelling price+quality options will only expand. We could be looking at a 5-10 million vehicle per year seller in less than a decade.

Thanks for the comment Robert! Tesla and the Model 3 are clearly setting the bar for BEVs and they seem to have a few year head start on battery technology over the legacy OEMs. The legacy automakers can beat Tesla on quality, service and ability to scale production – the question is how will they compete on price/range/performance? And one of Tesla’s current biggest advantages is the convenience, availability and simplicity of Supercharger and Destination Charger stations/locations. But in the US, for example, will Electrify America close the gap enough to minimize the Tesla charging advantage?

On production scale, I’m not as bullish as you that Tesla will reach 5-10 million. 5% of global share at current global sales levels would equal 4 million … which I think would be an amazing accomplishment. My assumption is that Tesla will remain a “luxury/performance” brand which by nature limits its sales volume. But if they launched a sub-brand and went down market, than they could scale much higher.