One of the biggest complaints about the federal electric vehicle (EV) tax credit (IRC 30D) is that its structure of using a non-refundable tax credit is clearly more beneficial to higher-income households. But Congress may actually get something right (well mostly) as among the nine key proposed changes to the tax credit contained in the Clean Energy for America Act (CEAA) is changing the current non-refundable credit into one that is refundable.

Before explaining the difference between a refundable and non-refundable tax credit, let’s first look at the core design of the tax credit.

How the Current Tax Credit Works For EV Buyers

To take advantage of the federal EV tax credit a taxpayer applies the qualifying amount of the tax credit for their vehicle on their tax return for the year in which the vehicle was registered. If you purchase an EV in March of 2021 you would apply the tax credit on your 2021 federal tax return when you file your taxes in (presumably) early 2022. So you may not actually benefit from the tax credit for from as few as a couple of months to as many as 16 months.

If you lease the EV, however, the qualifying amount of the tax credit goes to the lessor — usually the finance division of the automaker. In theory, but there is no requirement by the IRS to do so, the OEM finance company applies the tax credit to the purchase price of the EV and reduces the amount of the monthly lease payment. While it is unclear how many automakers actually do this, for consumers with little or no federal tax liability, the lease option has at least in theory been a way to still take advantage of the tax credit.

The amount of the tax credit for a qualifying electric vehicle is based on a rather arcane and outdated formula. The way it is structured is such that any EV (either BEV or PHEV) with a battery of 16 kWh (which translates typically to 20-40 miles of EV range) or larger, qualifies for the full maximum tax credit of $7,500. In the chart below you can see the math of the formula and the resulting credit amounts for 9 sample EVs.

Because of this flaw in the design of the tax credit, every BEV qualifies for the full $7,500 and in addition six plug-in hybrid vehicles (PHEVs) currently also qualify for the $7,500. And another 7 PHEVs qualify for credits of between $6,670 and $7,500. In total, 29 of the 54 EVs currently available in the US qualify for a tax credit of between $5,000 to $7,500.

But these significant levels of EV incentives are of little use to many US taxpayers simply because they do not have any — or a large enough — tax liability to apply against the amount of the qualifying credit amount for the EV purchased. And that is because the current credit is what’s known as a “non-refundable tax credit.”

A non-refundable tax credit is a tax credit that can only reduce a taxpayer’s liability to zero. Any amount that remains from the credit is automatically forfeited by the taxpayer. – Investopedia

So What Then Is A Refundable Tax Credit?

Even though more than 25 years ago I worked in marketing for the world’s largest accounting and tax firm, I had to research what exactly is a refundable tax credit — perhaps like many of you. Below is a definition from Investopedia and then one from Intuit/TurboTax:

A refundable credit is a tax credit that is refunded to the taxpayer no matter how much the taxpayer’s liability is. Typically, a tax credit is non-refundable, which means that the credit offsets any tax liability the taxpayer owes, but if the credit takes this liability amount down to zero, no actual money is refunded to the taxpayer. In contrast, refundable credits can take the tax liability down below zero and this amount is refunded in cash to the taxpayer. — Investopedia

Refundable tax credits are called “refundable” because if you qualify for a refundable credit and the amount of the credit is larger than the tax you owe, you will receive a refund for the difference. For example, if you owe $800 in taxes and qualify for a $1,000 refundable credit, you would receive a $200 refund. — Intuit/TurboTax

How The Current Non-refundable Tax Credit Works: Four Sample Scenarios

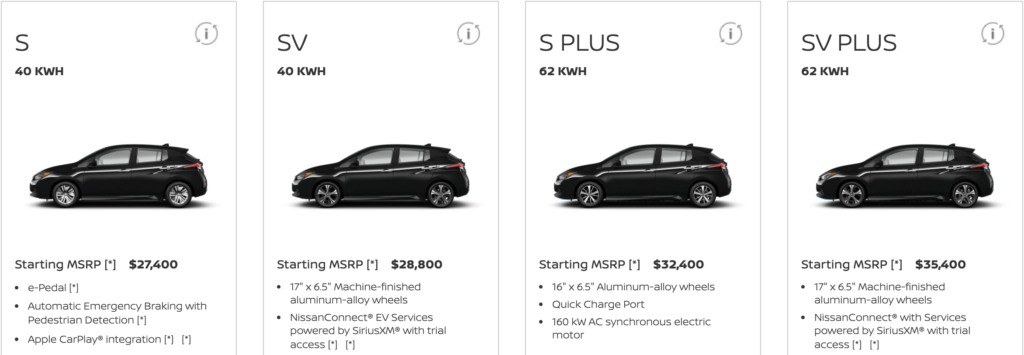

Under the current non-refundable tax credit, buyers of EVs may benefit from 100% of the qualifying tax credit amount for the EV they purchase — or nothing at all. Let’s look at four scenarios under the existing non-refundable tax credit based on the purchase of a Nissan LEAF which qualifies for the maximum $7,500 amount of the credit:

- You owe the IRS $10,000: You would apply the $7,500 tax credit to your $10,000 tax liability and then owe the IRS $2,500.

- You owe the IRS $4,000: You would apply the $7,500 tax credit to your $4,000 tax liability and now have a tax liability of $0.

- You owe the IRS $0: You would apply the $7,500 tax credit to your $0 tax liability, but would not benefit in any way from the tax credit. You would still owe $0 and not receive a refund or future credit.

- You are due a refund of $2,000: You would apply the $7,500 tax credit to your $2,000 tax refund, but would not benefit in any way from the tax credit. You would only receive your $2,000 refund.

How A Refundable Tax Credit Affects the Four Sample Scenarios

So let’s go back to my Nissan LEAF, $7,500 tax credit example and the same four scenarios:

- You owe the IRS $10,000: You would apply the $7,500 tax credit to your $10,000 tax liability and still owe the IRS $2,500. (no change)

- You owe the IRS $4,000: You would apply the $7,500 tax credit to your $4,000 tax liability and the IRS would then give you a refund of $3,500. (change)

- You owe the IRS $0: You would apply the $7,500 tax credit to your $0 tax liability and the IRS would then give you a refund of $7,500. (change)

- You are due a refund of $2,000: You would apply the $7,500 tax credit to your $2,000 tax refund, and then receive a total refund from the IRS of $9,500. (change)

How A Refundable Tax Credit Might Affect Car Buyers and US EV Sales

A couple of the net effects of the change to a refundable tax credit may include:

1. For those who have a very small or no tax liability — often people in lower and modest-income levels — the tax credit now becomes a full or partial tax rebate. People of lower or moderate incomes — assuming they become aware of the change to a refundable tax credit — might be more likely to purchase an EV knowing they will receive a refund after filing their taxes. However, a large percentage of lower- and moderate-income households typically purchase used vehicles rather than new ones. Secondly, while the tax credit may become refundable, these buyers still need to purchase the EV without the credit and if they buy in January and file their taxes in April of the following year, they would have to wait more than 15 months for their refund to arrive from the IRS.

>> Look for some lenders to give EV buyers the amount of their estimated IRS refund in cash at the time of vehicle purchase in return for a high interest rate.

>> Net sales impact: Because tax credits are not very well understand in general, and EV tax credits specifically, I expect the tax credit becoming refundable will increase EV sales only small amount on their own — perhaps 5%-10% increase above the non-refundable credit.

2. Secondly, what it might mean is as people begin to understand this change they may decide to purchase their EV in the fourth quarter or especially in the month of December to take advantage of both year/quarter-end sales and discounts combined with knowing that they can get their tax refund within a few months (depending of course on when they file their tax return).

>> While car buyers can’t always delay when they buy a new car (lease end, car breaking down, child going to college, etc.) for those on a tight budget and who truly need the tax credit dollars, we could see an additional increase in EV sales at year end.

>> Net sales impact: Little to none. The switch to a refundable tax credit in this case may mostly just switch when people buy an EV.

3. In some cases buyers may decide to spend the refundable amount of the tax credit on a more expensive EV. For example, they may opt for the Nissan LEAF Plus S with a 62kWh battery, 226 miles of range and which costs $5,000 more than the LEAF S with a 40 kWh battery, but only 150 miles of range. Or they might opt for the Chevrolet Bolt EUV instead of the Bolt EV, or the Tesla Model Y Performance instead of the Model Y Long Range (assuming for Tesla that the manufacturer cap of 200,000 EVs sold is eliminated).

>> In essence, some buyers may look at a refundable tax credit as a way to get more car for roughly the same cost as what they had originally planned to spend.

>> Net sales impact: If some EV buyers simply upgrade or buy a more expensive EV because of the refundable credit, then there would be no net increase in actual sales, but just a shift to different models or versions.

The switch to a refundable tax credit will be long overdue (assuming it stays in the final CEAA legislation), but Congress really should have moved to a rebate — preferably an instant rebate that is applied at purchase. But an application-based rebate would still be better than either a non-refundable or refundable credit because of its simplicity and more immediate benefit to buyers.

While the move to a refundable credit would be a much needed change, in the end — don’t expect it to actually increase EV sales at any significant level.

In part 6 of our article series on the proposed changes to the tax credit we’ll dive into one of the most controversial, which is to add an additional $2,500 credit amount for qualifying EVs that have final assembly in the US. Below are links to all of the articles in the series published to date:

- Proposed Changes to Federal EV Tax Credit – Part 4: Chinese-Assembled Vehicles Will Not Be Eligible for Tax Credit

- Proposed Changes to Federal EV Tax Credit – Part 3: MSRP Must Be Less Than $80,000

- Proposed Changes to Federal EV Tax Credit – Part 2: End of the Manufacturer Sales Phaseout

- Impact of Proposed Changes to the Federal EV Tax Credit – Part 1: Summary Chart

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →

12 Responses

For the current proposal if a EV was purchased in December 2021 would they qualify for the refundable tax credit? or just the tax credit towards any tax liability? I am wondering because I am suppose to take delivery of my vehicle on 12/18 and would want to be able to benefit.

Timothy – so the proposed revisions to the tax credit have changed since I wrote this article, see the updated article – https://evadoption.com/proposed-changes-to-the-federal-ev-tax-credit-passed-by-the-house-of-representatives/

In the updated draft bill, the retroactive aspect was eliminated. So as of now, any EV purchased in 2021 would be subject to the current EV tax credit rules. But lots of things could change once the Senate revises the BBBA – or it may not even pass.

Last year, after filing tax return, I had to pay $500 federal tax (did not get a refund). If it still remains the same and I am getting $8000 tax credit, how much will I get back?

And if I get $500 refund back after filing tax return, what do I get?

Paul, everything is up to the Senate and what they do with the latest proposed revisions. That said, if you have a tax liability of $500 for the tax year 2021, the current tax credit that has a maximum amount (varies depending on the EV) is $7,500 – but you would only get to offset your $500 tax liability as the refundable credit will not take effect until January 1, 2022. The revised and latest language in the House bill eliminated the retroactive aspect. So if you don’t need to buy or lease on EV in 2021, you may want to wait until 2022. Please see my latest article: https://evadoption.com/proposed-changes-to-the-federal-ev-tax-credit-passed-by-the-house-of-representatives/

I did that, I am holding my Tesla order till February, 2022. The way I can see my tax return for 2021, I probably have to pay around $500 in federal tax. Because I am delaying my Tesla order till February, 2022, and if refundable deal also passes through Senate, should I be getting $7000?

If the revised bill passes as currently structured and you are purchasing a Tesla Model 3 or Y, the tax credit amount would be $8,000 and you would receive a check from the IRS for $7,500. Of there will be the option to apply that amount as in essences a rebate at the time of purchase – assuming Tesla is a licensed to sell cars in the state you purchase the Tesla.

I just purchased an EV and am about to file my taxes but I know I will not get the full $7,500. Could I hold off submitting the tax credit form for this year’s taxes and submit it with next year’s? That way I can modify my withholdings from my paycheck to increase my tax liability for next year and get more of the credit? Thank you.

Patrick, here are links to the tax credit form and instructions:

– https://www.irs.gov/pub/irs-pdf/f8936.pdf

– https://www.irs.gov/instructions/i8936

I am not a tax advisor and the language is not entirely clear at a quick glance, but I believe that you have to claim the credit for the tax year in which you purchased the EV. So I don’t think you can simply delay apply the credit in a later year’s return to maximize the credit. But check with a tax professional.

Why these politicians are not agreeing to help people of our country? If they keep old phaseout people who buy car after car company sold 200000 cars are the only one lose getting tax credit, right?

Correct. Sort of. There is a phase out of 6 quarters, so you have basically 18+ months to qualify for claiming at least some percentage of the tax credit.

Loren — thanks for the clear explanation. Seems a little counter intuitive, right? If I’m owed a tax refund, it is because I overpaid taxes throughout the year. So, come tax time, the only people that receive benefit are those who underpaid, right? Does that mean I’m better off decreasing exemptions to maximize my take home pay biweekly, in turn making me eligible for the credit? Or am I over-simplifying?