Should expensive electric vehicles be excluded from the federal electric vehicle tax credit (IRC 30D)?

While this question is often hotly debated on social media, the proposed changes to IRC 30D would draw a line in the sand and establish an $80,000 MSRP cap on the credit. To date there has not been either a cap on MSRP of the EV nor income/AGI of the taxpayer.

The provision requires that a new qualified plug-in electric drive motor vehicle purchased by the taxpayer has a manufacturer’s suggested retail price (MSRP) of $80,000 or less. That is, the credit amount is reduced to $0 if the MSRP for the vehicle is more than $80,000.

– Clean Energy Act for America

While not specified in the Senate technical explanation document, it is a reasonable assumption that the MSRP cap does not include destination charges. But it also means that if the base MSRP of an EV is say $78,500 — that after various upgrades, add-ons, and destination charges — an EV costing $90,000 out the door, would still qualify for the tax credit.

But what also isn’t clear, as veteran EV journalist John Voelcker pointed out to me, is whether the MSRP cap applies to vehicle lines or versions? If the regulation refers to vehicle “lines” — then as long as any version of a model, for example, Lucid Air, Tesla Model S, GMC Hummer EV, etc., has at least one version that starts at less than $80,000, then all versions would qualify for the credit.

For example, buyers of the Lucid Air Grand Touring, which has an MSRP of $131,500, would still get to apply the tax credit because Lucid Motors offers the base Air Pure model at $69,900. But the Air Pure is not expected to be available until some time in 2023, and presumably the IRS would require the under $80,000 version to actually be available to purchase in order for the more expensive variants to qualify for the credit.

An additional unknown is if like Canada’s iZEV incentive (see below), the final legislation will include a cap on other trims of the vehicle. We will continue to investigate this language in the regulations in hopes of getting some clarity around vehicle “lines” or vehicle “versions” and “subsequent trims.”

> Impact: Without clarity on the MSRP rule, it is hard to predict what the actual impact might be on buyers and automakers. So we’ll look at two (among several possible) different scenarios:

Scenario 1 – Cap applies to a model “line”: In this scenario, an EV model variant that has an MSRP above $80,000 would still qualify for the tax credit if another variant of the model had an MSRP below $80,000.

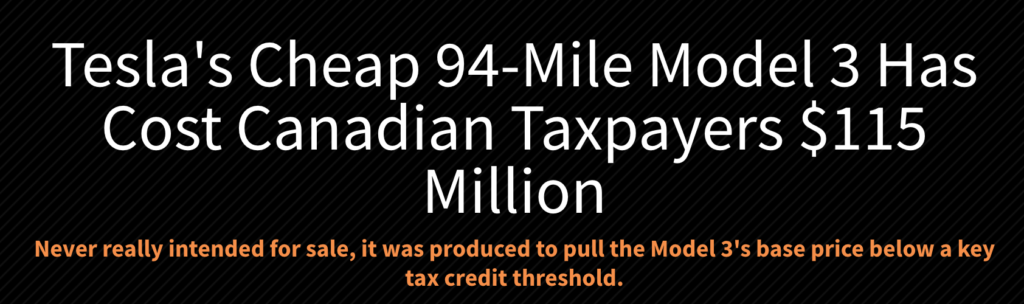

We saw an example of how this scenario can play out with the Tesla Model 3 in Canada. As documented in an article in The Drive — “Tesla’s Cheap 94-Mile Model 3 Has Cost Canadian Taxpayers $115 Million” — Tesla produced an even lower-priced version of its popular Model 3 to come in under Canada’s iZEV program threshold.

The car’s base trim must be priced under $45,000 ($37,211 USD), but subsequent trims of the same vehicle must not exceed $55,000 ($45,481). This threshold means any trim of the same vehicle model can be considered for the credit as long as it’s under that price cap.

– The Drive

To qualify for Canada’s $5,000 iZEV incentive that can be applied at the time of purchase, the car’s base trim must be priced under $45,000 ($37,211 USD). To enable residents of Canada who wanted to purchase a Model 3 and take advantage of the iZEV incentive, Tesla produced a low-cost version with just 94 miles (151 kilometers) of range and no Autopilot, which normally comes standard on all Tesla models. According to The Drive, at the time the lowest cost Model 3 was the Standard Range Plus, which cost $52,990 (Canada).

Also according to The Drive article, “from May 2019 until April 2021, Tesla sold just 151 units of the Standard Range Model 3, meaning that buyers received $755,000 in subsidies to use towards the lower-range EV. Meanwhile, it amassed a sale of 22,938 units of the Standard Range Plus.” Clearly Tesla gamed the Canadian system and we may see something similar happen in the US unless the final legislation is designed to limit or prohibit these end around approaches.

>> Implications: While I don’t expect other automakers — especially luxury brands — to offer “stripped down versions” of EV models, we very likely could see them remove certain higher-end standard features such as advanced driver assistance systems, special tires and wheels, and free fast charging with partner charging networks on EVs with a base price of say $85,000-$90,000. We could also see some OEMs software limit battery range as Tesla did with its Model S 60, which had a 75 kWh battery pack, but was priced thousands less than the Model S 75.

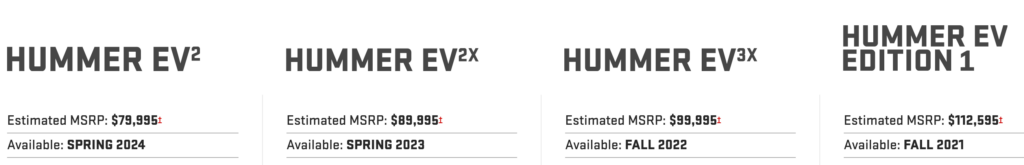

The second possibility is that automakers speed up or change the launch priority of lower-priced variants. The GMC Hummer EV is expected to launch by the end of 2021 with its Edition 1 variant at an estimated MSRP of $112,595. However the Hummer EV2 priced at $79,995 will not be available until spring of 2024. To qualify for the tax credit, GM could produce a small volume of the EV2 at or near launch of the Edition 1. Similarly, Lucid Motors could make a limited number of its Air Pure variant (priced at $69,900 and not expected until 2023) available in early 2022.

Scenario 2 – Cap applies to a model “versions”: In this scenario, everything mentioned in scenario 1 gets thrown out the window as each specific version of the EV model would have to have an MSRP below $80,000. While this creates the potential for some confusion among buyers on which version of a model does and does not qualify for the tax credit, it is actually a much more equitable approach and use of taxpayer funds.

>> Implications: For OEMs and dealers, it would mean when marketing and advertising higher-end EV models they would just have to be specific on which variants do and do not qualify for the tax credit. I personally prefer this approach as it should lead to fewer instances of OEMs producing under $80,000 versions in limited quantities just so the more expensive versions qualify for the tax credit.

That said, for those EVs with the lowest-price variant being in the $80,000-$90,000 range, I would expect to see various standard features now become optional to get the variant under $80,000 MSRP.

Lastly, on August 10 the Senate passed a non-binding vote on a resolution to limit the tax credit to an MSRP of $40,000 and single taxpayer income of $100,000. This vote was just a political and non-binding resolution created so that some senators would have a public record that they don’t want EV tax credits “going to the wealthy.” But, this vote and sentiment will certainly come up when the legislation is debated and could ultimately lead to some type of compromise with the MSRP cap ending up in the middle at $60,000 or something similar.

For consumers, an MSRP cap I believe is a good thing as it forces the automakers to produce lower-priced versions of their EVs, making them more approachable to more people. But a cap at $80,000 doesn’t really help achieve this goal but really will likely just end up making $90,000 and $100,000 EVs more affordable to those who can afford them.

Where I sit, the primary goal of an MSRP cap should be to incentivize OEMs to produce more affordable EVs — and $80,000 is simply too high. While somewhat arbitrary amounts of $40,000 and $60,000 are most often tossed around, I’ve suggested in the past a declining amount added to either the US average or median price of new cars and trucks. According to JD Power, the recent ATP (average transaction price) was $40,206. Perhaps the cap is $50,000, in essence $40,000 for the average vehicle cost plus $10,000 for the EV price differential which the tax credit then neutralizes with the maximum credit amount of from $7,500 to $12,500.

The second aspect is the political optics. The Senate non-biding vote was a simple example of how electric vehicles are turned into political divisiveness and the idea that only the rich buy and can afford EVs. So why should lower-income households have to in essence help underwrite upper income households’ purchase of expensive EVs? And while many EV advocates disagree with me on this, I think this is correct. Upper income households do not need the tax credit to afford an $80,000-$100,00 EV.

The broader question then should focus on finding the right combination of caps on both MSRP and household adjusted gross income (AGI). But that is a debate for another article.

Stay tuned and check back for updates and follow EVAdoption on social media at @EVAdoptionTweet and LinkedIn.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →

One Response