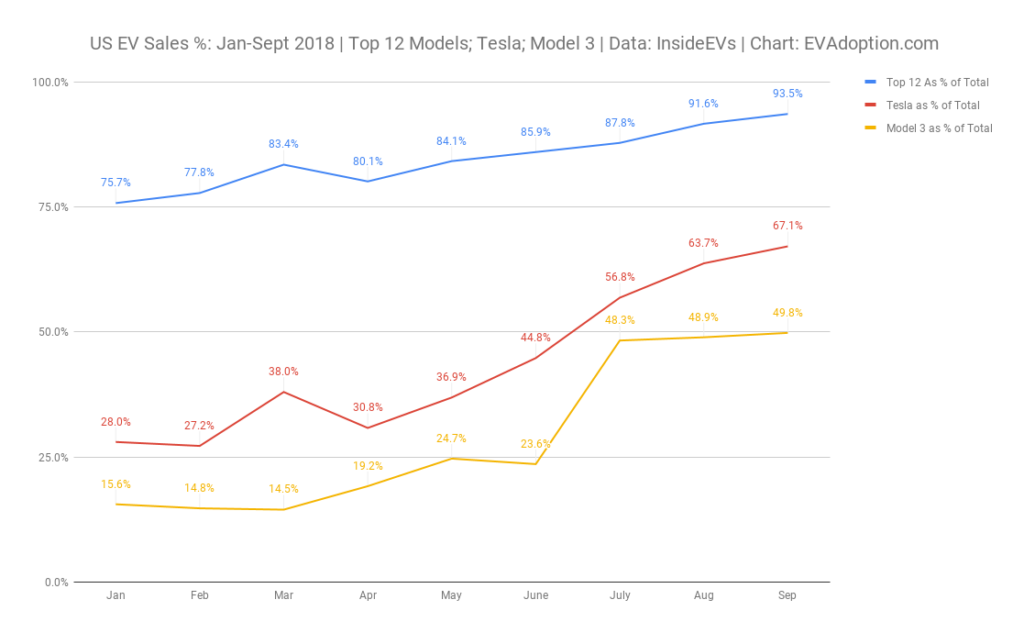

The Pareto principle, commonly referred to as the “80/20 rule,” is alive and well with the US EV sales numbers.

The Pareto principle says that “for many events, roughly 80% of the effects come from 20% of the causes.” More broadly, the principle simply means that a minority of causes lead to the majority of the outcomes.

For sales of EVs, this means that a small number of models are responsible for a majority of the sales volume. In the US, this has long been the true and continues to be the case with 93% of all EV sales coming from just 12 out of 42 EV‘s, using data from the InsideEVs Monthly Plug-In Sales Scorecard.

For the next few years both Tesla and it’s Model 3 will likely dominate the sale charts accounting for the majority of the EV sales in the US. The picture may be very different in other parts of the world, but Tesla’s aspirational brand, available Superchargers and destination chargers, and longer battery range have made it the dominant seller of EV‘s in the US.

For the next few years both Tesla and it’s Model 3 will likely dominate the sale charts accounting for the majority of the EV sales in the US. The picture may be very different in other parts of the world, but Tesla’s aspirational brand, available Superchargers and destination chargers, and longer battery range have made it the dominant seller of EV‘s in the US.

And while the result of the Pareto principle is great for Tesla, we fundamentally need many more high-selling affordable EV models from other automakers to fuel grow in the market and achieve mass consumer awareness and adoption.

And while the result of the Pareto principle is great for Tesla, we fundamentally need many more high-selling affordable EV models from other automakers to fuel grow in the market and achieve mass consumer awareness and adoption.

Currently and for the next few years in the US, EV sales will likely be dominated by a combination of luxury brands including Tesla, Jaguar, Audi, BMW and Mercedes-Benz on the high-end. As I wrote in The Next High-Volume Selling EVs: Ford Escape PHEV and Tesla Model Y, unfortunately there aren’t very many high-volume selling and affordable EVs anywhere on the horizon for the US market – unless you include the infamous $35,000 version of the model three expected to be available in Q2 or Q3 of 2019.

Supply, Not Demand is the Issue

Of the 42 EVs currently available in the US only 8 models consistently average sales of more than 1,000 units each month. And only 4 models are averaging more than 2,000, the Tesla Models 3, S and X and Toyota Prius Prime PHEV.

The issue in the US is more one of demand rather supply. Battery production is causing supply constraints for GM, Hyundai and Kia. And in particular of course the cost of battery packs still puts EVs at a price premium compared to similar ice models.

The plane reality is currently and for the next few years Tesla is the only auto manufacturer that is truly serious about selling high volumes of EV‘s. And while executives at Volkswagen, Volvo, BMW, Mercedes-Benz and others talk about their electrification plans, each of them are only bringing a few new EVs to market in next 3 years. Most will be luxury model‘s priced above $70,000, hence limiting sales volume potential.

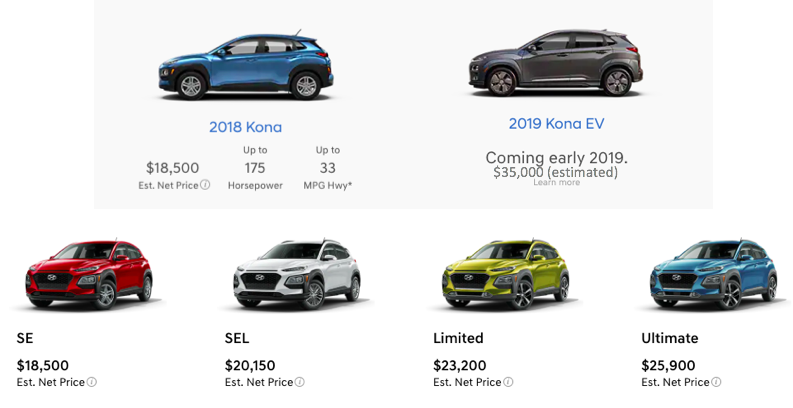

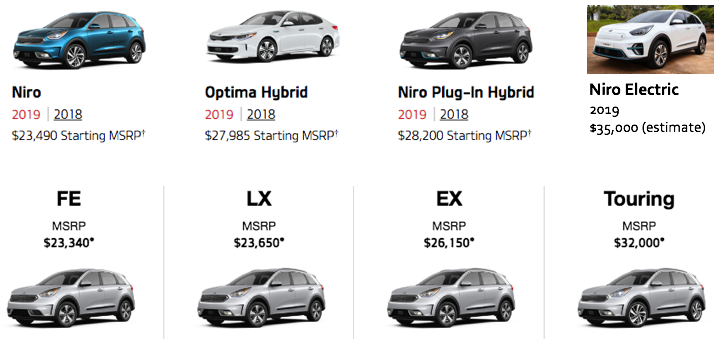

Many industry observers have high hopes for the new Hyundai Kona BEV and Kia Niro BEV models expected to arrive in the US sometime in 2019. The problem I foresee with both of these models – which will each have an EPA range of around 250 miles, look good and are solid vehicles -is the cost differential and customer demographic.

Pricing for both the Kia Niro BEV and Hyundai Kona BEV have not been released for the US, but both are expected to have an MSRP of around $35,000-$39,000. At the low end of that pricing estimate, the Niro BEV would be priced about $7,500 more than the Niro PHEV and perhaps $12,000 more than the Niro hybrid. The Hyundai Kona BEV would cost about $15,000 more than the regular Kona.

While Federal, state and utility incentives can help close those price gaps, buyers still have to qualify for the full sales price and be able to/want to make the full loan or lease payment each month.

Secondly the Hyundai and Kia brands are not luxury or aspirational brands, but rather known for being affordable and of great value. The typical buyers of these brands are not looking to make a statement but get more for their money. Most of the current buyers of these brands will not likely be willing to pay a significant premium for the benefit of driving a BEV.

As a result, Kia and Hyundai will have to be smart about how they market these cars to higher-income, early-adopting EV buyers who are attracted to the 250 miles of range and crossover styling. This buyer segment may not want to wait for the Tesla Model Y, not want the Model 3 sedan or want to pay 2-3 times the cost of the Hyundai/Kia for one of the luxury crossover/SUVs available now or in the next year.

Combining all of those factors, plus limited availability, both of these models from Hyundai and Kia should crack the top 10 list of EVs, but may only sell in the 1,500-2,000 range each month once the cars are distributed to dealers in a reasonable supply.

The good news is that Tesla, unless the company was to somehow implode, will continue to drive awareness, excitement and sales volume of EVs in the US. The company is also increasingly putting pressure on luxury brands including BMW, Audi Mercedes-Benz, Lexus, Infiniti, Porsche, Jaguar and Acura to up their game on the EV front.

But EV sales will not truly take off and have a broader distribution in the US until someone starts causing pain in the boardrooms of Toyota, GM, Volkswagen, Nissan and FCA Chrysler (especially the Jeep and Dodge truck brands).

Currently in the US the Pareto principle is at work with 2 categories of vehicles driving a high percentage of vehicle sales – pickups and SUVs, with small SUVs and crossovers being perhaps the hottest segment. But there are no electric pickups or small SUVs on the horizon from the legacy automakers. Until we see some new models in those segments, Tesla may continue to dominate the US EV sales charts.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →

3 Responses

What about the Mitsubishi Outlander PHEV?

Bruce, the Mitsubishi Outlander PHEV does really well in Europe, but as of now it is only #14 in sales in the US for EVs – https://insideevs.com/monthly-plug-in-sales-scorecard/