We are excited to announce the launch of the new EVAdoption Quarterly US Electric Vehicle Sales Scoreboard, beginning with sales data from Q3 of 2021. The Scoreboard will have its own dedicated page and be updated within a few weeks after the end of each quarter.

At launch, the Sales Scoreboard will only track sales of the 13 EVs for which sales are publicly reported by the OEMs. (More on sales reporting challenges at the end of this article.) But with more than 30 additional new EVs (both BEV and PHEV) likely to be available between now and the end of 2022, we anticipate that the OEMs will report sales publicly on at least 20 of these, bringing the total tracked in the Sales Scorecard to about 30.

With OEMs only reporting sales on so few EV models, we have to build models and estimate the sales numbers for nearly 85% of the EVs currently available in the US. To this end, we are excited to announce that we have recently released our first public EV sales report. This initial report covers Q1, Q2, and the combined H1 (first half) sales for 2021 — learn more about the report. However, we have also decided to launch this new quarterly EV sales scoreboard using data for the current EVs for which public data exists. As the automakers begin reporting sales for more new EV models publicly, we will add them to the EVAdoption Sales Scoreboard.

We recognize that this scoreboard has limited value today due to the small number and randomness of the these 9 EVs currently included, but part of our goal is to shine a light on the general lack of transparency in the auto industry when it comes to US EV sales data. Secondly, however, as limited as this scoreboard is, as more new EVs are added and reported on, the value will also increase and provide a small indicator of EV sales trends.

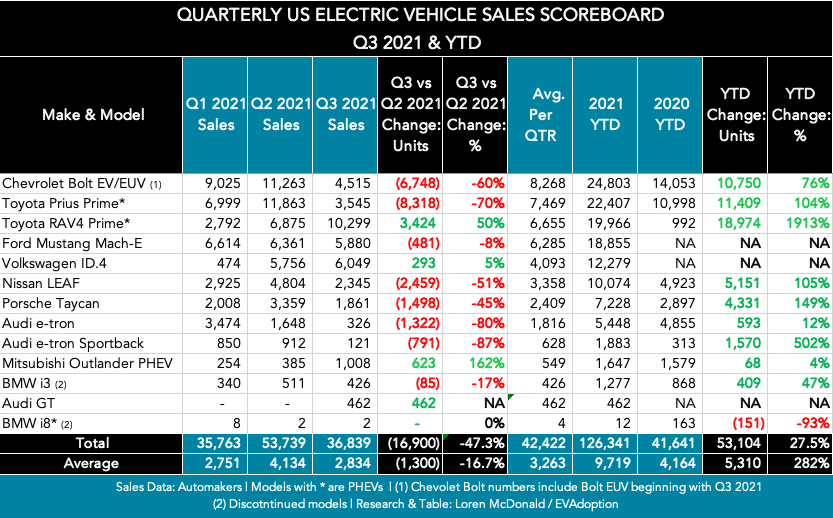

Below are two scoreboards — the most recent sales for Q3 2021, followed by the combined sales for Q1 and Q2 2021.

Q3 2021 US EV Sales Scoreboard – The Numbers

In Q3 2021, only 3 out of 12 EVs tracked which had sales in Q2 saw a positive increase in sales QOQ. The three EVs with positive sales growth in Q3 were:

- Mitsubishi Outlander PHEV at 162%

- Toyota RAV4 Prime at 50%

- Volkswagen ID.4 at 5%

The 50% QOQ sales for the RAV4 Prime — one of the most in-demand EVs on the market today — was impressive and it will be keen to monitor if Toyota is able to to keep up this pace of supply for the US market in coming quarters. The huge 162% increase in the Mitsubishi Outlander PHEV sales were surprising and may be from increased supply and dealer awareness and incentives. The Outlander has for the last few years been one of the top selling PHEVs in many European countries, but has never found its footing with customers in the US.

Of models available all or most of 2020, the following have the highest YOY sales growth through 3 quarters:

- Porsche Taycan at 149%

- Nissan LEAF at 105%

- Toyota Prius Prime at 104%

- Chevrolet Bolt EV/EUV at 76%

New to the scoreboard in Q3 was the Audi e-tron GT. At a starting MSRP of $103,500, the e-tron GT has solid sales of 462 units in Q3.

The biggest decliners in Q3 versus Q2 included:

- Audi e-tron Sportback at -88%

- Audi e-tron at -80%

- Toyota Prius Prime at -70%

- Chevrolet Bolt EV/EUV at -60%

- Nissan LEAF at -51%

- Porsche Taycan at -45%

- Ford Mustang Mach-E at -8%

While both the BMW i3 and i8 have both been discontinued by BMW, we will include them in the scoreboard for as long as the German automaker reports sales for these models.

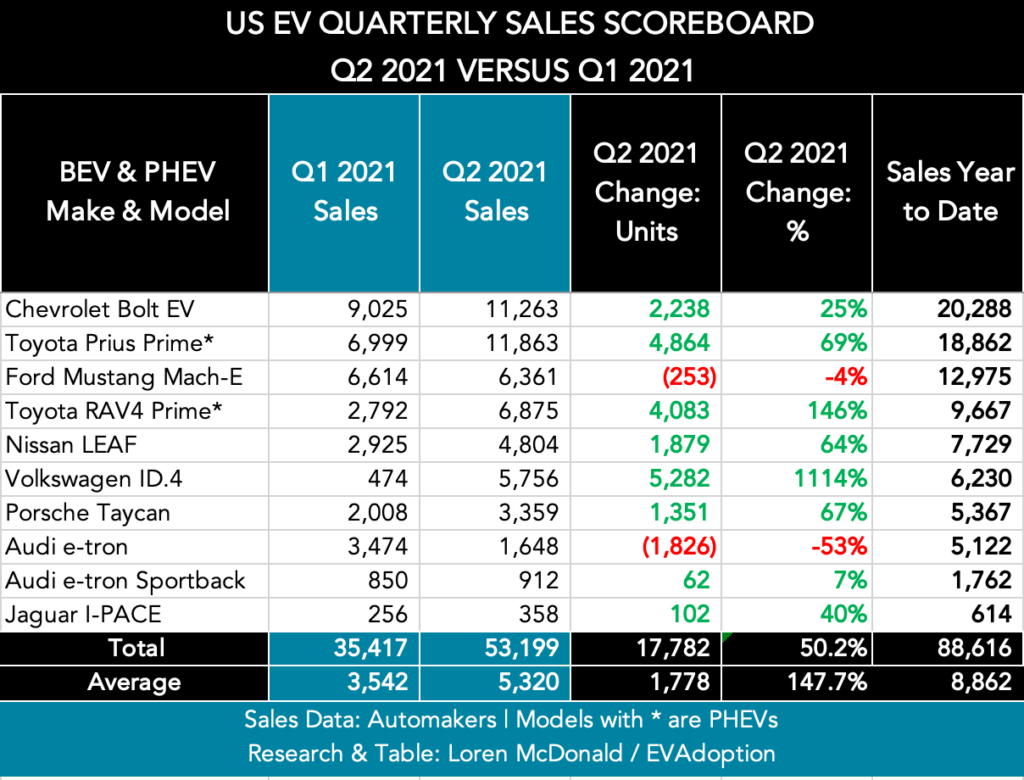

Q1 and Q2 2021 US EV Sales Scoreboard – The Numbers

As you can see in the table below, 7 out of the 10 tracked EVs saw an increase in sales in Q2 versus Q1, with the Volkswagen ID.4 having “off-the-chart” growth due to deliveries beginning in earnest in Q2. The two PHEVs from Toyota also saw strong QOQ increases with the Prius Prime PHEV jumping 69% and the RAV4 Prime popping 146%.

The Porsche Taycan saw a small unit increase, but it still amounted to 67% growth in Q2 over Q1. The Nissan LEAF, now in its 11th year of availability in the US, is seeing a rebound in sales with a Q2 increase of 64%. GM’s Chevrolet Bolt saw a respectable increase of 25% due to discounting (especially with leasing) in advance of the updated Bolt EV and new Bolt EUV becoming available. With the Bolt battery fires and recall, however, Bolt sales for the rest of 2021 are likely to drop like a rock.

The highly acclaimed Ford Mustang Mach-E saw a small decline in Q2 due to deliveries being front loaded in Q1 and deliveries for Europe prioritized in Q2. Additionally, the Mach-E may have also been somewhat affected in Q2 by the continuing global chip shortage. The Jaguar I-PACE has never been a particularly strong seller as it failed to capture a compelling competitive position among available BEV SUVs/crossovers. But while on a very small base of 256 units, it did see a respectable Q2 increase of 40%.

While hard to be certain, the 53% decrease in Audi e-tron sales may be partially attributable to the growing number of electric SUVs and crossovers becoming available, including the Mustang Mach-E, VW ID.4, and Tesla Model Y. And while these latter three EVs are smaller and less luxurious than the Audi e-tron, at this stage of the EV market consumers will often buy the “best available” EV until the one they want becomes available. (We are a perfect example in that while we are driving our second Tesla Model S, what I always wanted was an EV like the Model Y, Mach-E, upcoming Audi Q4 e-tron, or Volvo XC40 Recharge — and so we went with the Model S as it was the best option for us at the time.)

The Audi e-tron Sportback was launched in the US in Q3 2020, and has seemingly settled in at a consistent level of +/- 900 units sold per quarter.

In terms of total sales for the first half of 2021 for these nine EVs, the Chevrolet Bolt (20,288) and Toyota Prius Prime (18,862) were well out front of the pack, followed by the Mustang Mach-E at 12,975. No other EV broke 10,000 for the H1 and the Jaguar I-PACE did not reach 1,000 units sold. The average increase for the H1 was 8,862 and average increase was 147.7%, while combined increase was up 50.2%.

Please visit the new EV Sales Scoreboard page for additional Scoreboard charts, including:

- Q2 2021 sales versus Q2 2020

- Q1 2021 sales versus Q1 2020

- Total sales by year

US Electric Vehicle Sales Reporting Challenges

There are four major challenges to reporting on sales of US electric vehicles:

- Currently the automakers only publicly report sales for ten EVs, though with the arrival of more than 30 new EVs (with an estimated roughly 20 of them having sales data published for the OEMs) in the US by the end of 2022, so the number with public sales data could rise to about 30.

- While a few automakers (such as Ford) report sales on a monthly basis, most now only report quarterly sales numbers — which means there is generally no transparency to sales trends within the 3 months that make up a quarter. Meaning, while you can compare quarter to quarter, you can’t see if sales are flat, or trending up or down within the quarter.

- Tesla, which sells more EVs than any other automaker by a long shot with an EVAdoption estimated 43.2% share of new EVs sales in Q2 2021, does not report sales of individual models at all and additionally does not break out sales for the US. Hence you have to use several indicators and sources to attempt to produce a solid estimate of Tesla US sales.

- And finally, of the current 36 PHEVs available in the US, only Toyota reports sales on their two PHEV models — the Prius Prime and RAV4 Prime. All other PHEV sales numbers are intermixed with their shared platform sister models (ICE, regular hybrid and/or BEV) and must be estimated.

Despite these challenges, we at EVAdoption believe our just launched EV Sales Report will prove to be very accurate over time. Please visit our report page for more information.

Announcing the acquisition of EVAdoption by Paren →

Announcing the acquisition of EVAdoption by Paren →